Nestlé's (NESN) Higher Prices Boost Coffee And Cocoa Product Sales

Table of Contents

Increased Pricing Strategies and Their Impact on Revenue

Nestlé's decision to increase prices wasn't arbitrary; it was a strategic response to a challenging economic environment.

Strategic Price Adjustments

The rationale behind Nestlé's price increases is multifaceted. Rising input costs across the board played a significant role.

- Soaring Commodity Prices: The cost of coffee beans, cocoa beans, and other raw materials has increased substantially in recent years due to factors such as unfavorable weather patterns, geopolitical instability, and increased global demand.

- Supply Chain Disruptions: The ongoing impact of the global pandemic and the war in Ukraine continues to disrupt supply chains, leading to higher transportation costs and longer lead times.

- Inflationary Pressures: General inflation has impacted the cost of packaging, labor, and other operational expenses, necessitating price adjustments to maintain profitability.

- Specific Examples: While Nestlé doesn't publicly detail price increases for every product line, reports suggest across-the-board adjustments to reflect these rising costs affecting their coffee and cocoa products. This includes brands like Nescafé, Nesquik, and KitKat.

Consumer Response to Higher Prices

Contrary to expectations, Nestlé's price increases haven't resulted in a significant drop in sales. Several factors contribute to this resilience:

- Strong Brand Loyalty: Decades of marketing and consistent product quality have fostered strong brand loyalty among consumers. They are willing to pay a premium for familiar and trusted brands like Nescafé and KitKat.

- Perceived Value: Nestlé's products are often perceived as offering high quality and value, justifying the higher price point for many consumers.

- Limited Substitutes: Many consumers lack readily available and equally appealing substitutes for popular Nestlé products, particularly in the premium segment.

- Data Points: While precise sales figures before and after the price increases are not publicly available, financial reports indicate a continued strong performance in the coffee and cocoa divisions despite the pricing changes.

Strong Demand for Nestlé's Coffee and Cocoa Brands

The success of Nestlé's pricing strategy is further underpinned by the inherent strength of its coffee and cocoa brands.

Brand Recognition and Loyalty

Nestlé boasts a portfolio of iconic brands with exceptional brand recognition and consumer loyalty.

- Key Brands: Nescafé, Nesquik, KitKat, and other Nestlé brands enjoy decades of brand heritage and widespread global recognition.

- Established Reputation: These brands have cultivated a strong reputation for quality, taste, and consistency, making them preferred choices for millions of consumers worldwide.

- Marketing and Advertising: Continuous marketing and advertising campaigns have played a key role in maintaining brand awareness and loyalty, reinforcing the premium image and justifying price increases.

Product Innovation and Premiumization

Nestlé's commitment to product innovation and premiumization further contributes to sales growth.

- New Product Launches: Nestlé regularly introduces new products and variations within its coffee and cocoa portfolios, catering to evolving consumer preferences and trends. This includes organic, fair trade, and single-origin options.

- Premiumization Strategy: Offering premium products at a higher price point has been a successful strategy. Consumers are willing to pay more for specialized, higher-quality products, such as organic or sustainably sourced cocoa and coffee.

Implications for Investors and the Future of Nestlé (NESN)

The success of Nestlé's pricing strategy has significant implications for investors and the company's future.

Financial Performance and Stock Implications

The price increases have demonstrably boosted Nestlé's profitability.

- Increased Revenue and Profit Margins: The higher prices have translated into increased revenue and improved profit margins within the coffee and cocoa segments.

- Analyst Reports and Forecasts: Many analysts view this as a positive sign for Nestlé's future performance, leading to positive sentiment and potentially influencing the Nestle stock price positively.

- Investor Confidence: The ability to successfully navigate rising costs while maintaining revenue growth strengthens investor confidence in Nestlé's long-term sustainability.

Long-Term Sustainability and Growth Strategy

Nestlé's long-term strategy emphasizes sustainability and continued innovation.

- Sustainability Initiatives: Nestlé's commitment to sustainable sourcing and environmentally friendly practices is resonating with increasingly conscious consumers, further strengthening brand loyalty and justifying premium pricing.

- Innovation and Diversification: Continuous investment in research and development is crucial for developing new products and expanding into new market segments to drive future growth.

Conclusion

This article has demonstrated that Nestlé's (NESN) strategic price increases for its coffee and cocoa products have surprisingly boosted sales. This success is attributable to a powerful combination of strong brand loyalty, successful premiumization strategies, and the resilient consumer demand for these essential products. The company's ability to navigate rising costs while maintaining revenue growth signifies a robust business model and signals a positive outlook for the future.

Call to Action: Stay informed on Nestlé's (NESN) performance and the impact of pricing strategies on the coffee and cocoa market. Monitoring this crucial aspect of Nestlé’s business is essential for assessing future investment opportunities and understanding the ongoing growth trajectory of these key product lines. Understanding the interplay between higher prices and sales growth for Nestlé (NESN) coffee and cocoa products is crucial for investors and market analysts alike.

Featured Posts

-

2025 Nfl Draft Prospect Scouting Report On Texas Wr Matthew Golden

Apr 25, 2025

2025 Nfl Draft Prospect Scouting Report On Texas Wr Matthew Golden

Apr 25, 2025 -

New Business Hotspots A Map Of The Countrys Fastest Growing Areas

Apr 25, 2025

New Business Hotspots A Map Of The Countrys Fastest Growing Areas

Apr 25, 2025 -

Mercer International Q4 2024 Financial Report Dividend Increase To 0 075

Apr 25, 2025

Mercer International Q4 2024 Financial Report Dividend Increase To 0 075

Apr 25, 2025 -

The Countrys Hottest New Business Locations A Geographic Analysis

Apr 25, 2025

The Countrys Hottest New Business Locations A Geographic Analysis

Apr 25, 2025 -

T Mobile To Pay 16 Million For Data Breaches Spanning Three Years

Apr 25, 2025

T Mobile To Pay 16 Million For Data Breaches Spanning Three Years

Apr 25, 2025

Latest Posts

-

Addio A Mario Nanni La Sua Eredita Nel Giornalismo Parlamentare

Apr 30, 2025

Addio A Mario Nanni La Sua Eredita Nel Giornalismo Parlamentare

Apr 30, 2025 -

Mario Nanni Omaggio A Un Grande Del Giornalismo Parlamentare Italiano

Apr 30, 2025

Mario Nanni Omaggio A Un Grande Del Giornalismo Parlamentare Italiano

Apr 30, 2025 -

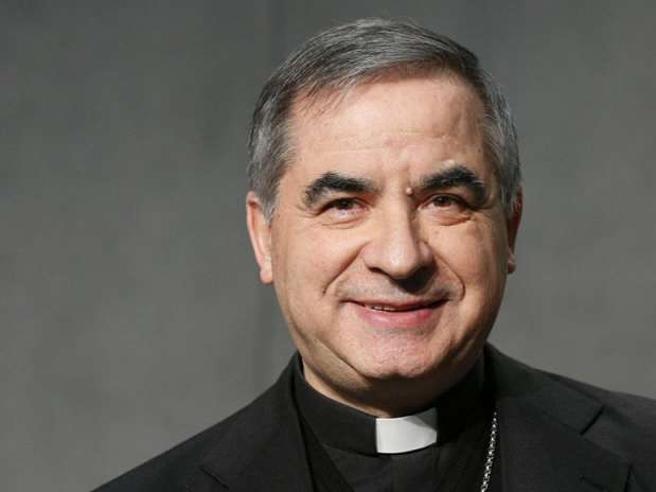

Il Complotto Becciu Cosa Rivelano Le Chat Pubblicate Da Domani

Apr 30, 2025

Il Complotto Becciu Cosa Rivelano Le Chat Pubblicate Da Domani

Apr 30, 2025 -

Cardinal Trial Evidence Of Prosecutorial Misconduct Prompts New Investigation

Apr 30, 2025

Cardinal Trial Evidence Of Prosecutorial Misconduct Prompts New Investigation

Apr 30, 2025 -

Lutto Nel Giornalismo Parlamentare Ricordando Mario Nanni

Apr 30, 2025

Lutto Nel Giornalismo Parlamentare Ricordando Mario Nanni

Apr 30, 2025