Net Asset Value (NAV) Explained: Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Investing in ETFs like the Amundi Dow Jones Industrial Average UCITS ETF requires understanding a key metric: Net Asset Value (NAV). Knowing how NAV is calculated and its significance is crucial for making informed investment decisions. This article will guide you through understanding Net Asset Value, its calculation, and its importance in relation to your Amundi Dow Jones Industrial Average UCITS ETF investment. We'll also show you where to find this crucial data.

<p>Net Asset Value (NAV) represents the net value of an ETF's underlying assets, per share. For the Amundi Dow Jones Industrial Average UCITS ETF, this reflects the collective value of its holdings in the 30 Dow Jones Industrial Average companies. Understanding the NAV calculation is fundamental to assessing the ETF's performance and making sound investment choices. Let's delve deeper into this essential aspect of ETF investing.</p>

<h2>How is the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Calculated?</h2>

The NAV calculation for the Amundi Dow Jones Industrial Average UCITS ETF, like other ETFs, is a daily process that involves several steps. Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV calculation helps you grasp how the ETF's value is determined.

-

Daily Calculation: The NAV is typically calculated at the close of each trading day, reflecting the market value of the underlying assets at that specific time. This means the Amundi Dow Jones Industrial Average UCITS ETF NAV you see represents the end-of-day value.

-

Market Value of Holdings: The primary component of the NAV calculation is the total market value of the 30 Dow Jones Industrial Average stocks held within the ETF's portfolio. Each stock's closing price is multiplied by the number of shares the ETF owns to arrive at its contribution to the overall value.

-

Expenses Deduction: The ETF's total expenses, which include management fees and other operational costs (represented by the ETF expense ratio), are deducted from the total asset value before the NAV is calculated. This ensures that the NAV accurately reflects the net value available to investors.

-

Formula Illustration: A simplified formula for understanding NAV calculation can be expressed as:

NAV = (Total Market Value of Holdings - Total Expenses) / Number of Outstanding Shares

<h2>The Importance of Monitoring NAV in Your Amundi Dow Jones Industrial Average UCITS ETF Investment</h2>

Monitoring the NAV of your Amundi Dow Jones Industrial Average UCITS ETF investment is essential for several reasons. Active NAV tracking provides valuable insights into your investment's performance and helps you make strategic decisions.

-

Performance Tracking: By regularly tracking the NAV, you can monitor the ETF's growth or decline over time, assessing its performance relative to your investment goals. This allows for efficient NAV tracking of your investment progress.

-

Investment Decisions: NAV trends and valuation can inform your buying and selling decisions. A rising NAV may indicate a positive trend, while a declining NAV could warrant further investigation or adjustment of your investment strategy.

-

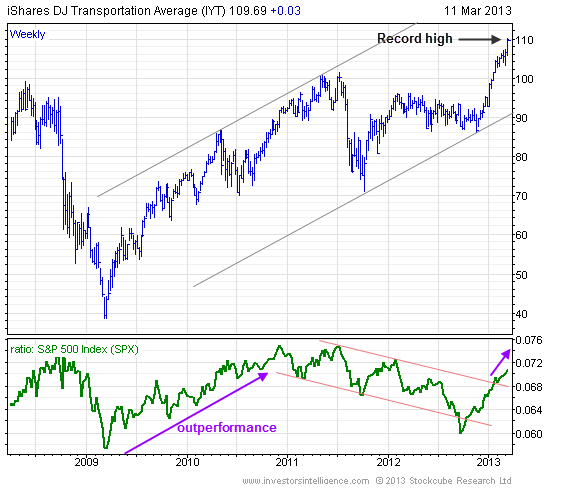

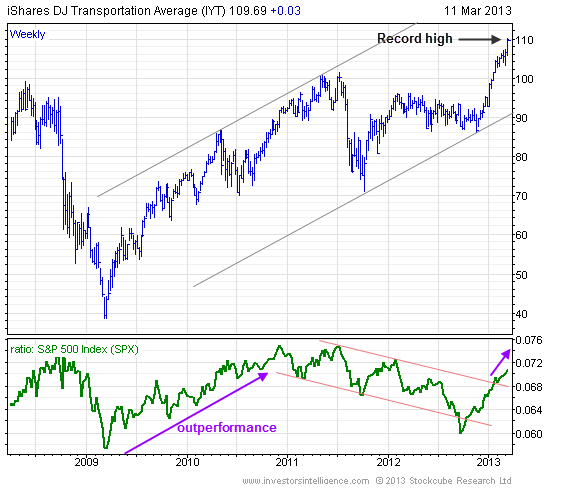

Benchmark Comparison: Comparing the ETF's NAV performance to the Dow Jones Industrial Average itself allows you to gauge the ETF's effectiveness in tracking its benchmark index. This comparison is key for evaluating the ETF's performance against the market.

<h2>Factors Affecting the NAV of the Amundi Dow Jones Industrial Average UCITS ETF</h2>

Several factors influence the NAV fluctuations of the Amundi Dow Jones Industrial Average UCITS ETF. Understanding these factors provides context for interpreting NAV changes and managing your investment risks.

-

Market Volatility: Market downturns or upturns directly impact the NAV. A general market decline will typically lead to a decrease in the NAV, while a market upswing is likely to result in a NAV increase. This highlights the inherent market risk associated with ETF investments.

-

Economic Indicators: Macroeconomic factors such as interest rates and inflation significantly influence the performance of companies within the Dow Jones Industrial Average and consequently affect the ETF's NAV. Economic factors can influence overall market sentiment and investor behaviour.

-

Company Performance: The individual performance of companies within the Dow Jones Industrial Average directly impacts the ETF's NAV. Strong performance by constituent companies generally leads to an increase in the ETF's NAV, while underperformance negatively affects it. This demonstrates the importance of understanding the underlying holdings of the ETF.

<h2>Where to Find the NAV for the Amundi Dow Jones Industrial Average UCITS ETF</h2>

Accessing daily NAV data for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Several reliable sources provide this information. Finding real-time NAV is easy with these resources.

-

Amundi Website: The most reliable source is usually the official Amundi website. [Insert a placeholder link here – replace with the actual link to the relevant Amundi ETF page].

-

Financial News Sources: Reputable financial news websites and data providers such as Bloomberg, Yahoo Finance, and Google Finance typically offer real-time or end-of-day NAV data for various ETFs, including the Amundi Dow Jones Industrial Average UCITS ETF.

-

Brokerage Platforms: Most brokerage platforms where you hold the ETF will display the current NAV, often in real-time, on your account statements or portfolio overview.

<h2>Conclusion: Understanding Net Asset Value for Informed Amundi Dow Jones Industrial Average UCITS ETF Investing</h2>

Understanding Net Asset Value (NAV) is fundamental to successful investing in the Amundi Dow Jones Industrial Average UCITS ETF. By comprehending how the NAV is calculated, the factors affecting it, and where to find the data, you can actively monitor your investment's performance and make informed decisions. Regularly tracking the NAV allows you to effectively assess your investment's progress against your goals and react appropriately to market changes.

By understanding Net Asset Value and its implications for the Amundi Dow Jones Industrial Average UCITS ETF, you can make more strategic and successful investment decisions. Start tracking the NAV today and build a strong investment portfolio!

Featured Posts

-

Leeds Uniteds Interest In Kyle Walker Peters Intensifies

May 24, 2025

Leeds Uniteds Interest In Kyle Walker Peters Intensifies

May 24, 2025 -

Nyt Mini Crossword Sunday April 19th Complete Clue Solutions

May 24, 2025

Nyt Mini Crossword Sunday April 19th Complete Clue Solutions

May 24, 2025 -

Major Road Closed After Serious Accident Person Hospitalized

May 24, 2025

Major Road Closed After Serious Accident Person Hospitalized

May 24, 2025 -

Protecting Your Investment Essential Gear For Ferrari Owners

May 24, 2025

Protecting Your Investment Essential Gear For Ferrari Owners

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Factors Affecting Net Asset Value

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Factors Affecting Net Asset Value

May 24, 2025

Latest Posts

-

1 08 Euro Live Markt Analyse Kapitaalmarktrente Ontwikkeling

May 24, 2025

1 08 Euro Live Markt Analyse Kapitaalmarktrente Ontwikkeling

May 24, 2025 -

Live Update Euro Boven 1 08 Kapitaalmarktrentes Blijven Stijgen

May 24, 2025

Live Update Euro Boven 1 08 Kapitaalmarktrentes Blijven Stijgen

May 24, 2025 -

Philips Announces 2025 Annual General Meeting Of Shareholders Agenda

May 24, 2025

Philips Announces 2025 Annual General Meeting Of Shareholders Agenda

May 24, 2025 -

Kapitaalmarktrentes Stijgen Verder Euro Klimt Boven 1 08 Live Update

May 24, 2025

Kapitaalmarktrentes Stijgen Verder Euro Klimt Boven 1 08 Live Update

May 24, 2025 -

Understanding The Philips 2025 Annual General Meeting Agenda

May 24, 2025

Understanding The Philips 2025 Annual General Meeting Agenda

May 24, 2025