Net Asset Value (NAV) Explained: Amundi MSCI All Country World UCITS ETF USD Acc

Table of Contents

How NAV is Calculated for the Amundi MSCI All Country World UCITS ETF USD Acc

The Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc, like all ETFs, represents the net value of its underlying assets per share. It's calculated daily, providing a snapshot of the ETF's worth. The calculation process involves several key steps:

- Asset Valuation: The ETF holds a diversified portfolio of stocks and bonds across the global market. The value of each holding is determined using its closing market price. While market prices are the primary determinant, certain adjustments might be made for illiquid assets or unusual market conditions.

- Liability Deduction: From the total market value of all assets, the ETF's expenses, including management fees and other liabilities, are subtracted. This crucial step ensures that the NAV reflects the actual net value available to shareholders.

- Per-Share Calculation: Finally, the total net asset value (after deducting liabilities) is divided by the total number of outstanding ETF shares. This results in the NAV per share, which is the figure you see reported daily.

Example Calculation:

Let's assume the ETF holds $100 million in assets and has liabilities of $1 million. If there are 10 million shares outstanding, the NAV per share would be: ($100 million - $1 million) / 10 million shares = $9.90 per share.

- In short: The NAV calculation is a straightforward process: Total Asset Value - Total Liabilities = Net Asset Value; Net Asset Value / Number of Outstanding Shares = NAV per Share.

Factors Affecting the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc

Several factors can influence the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc:

-

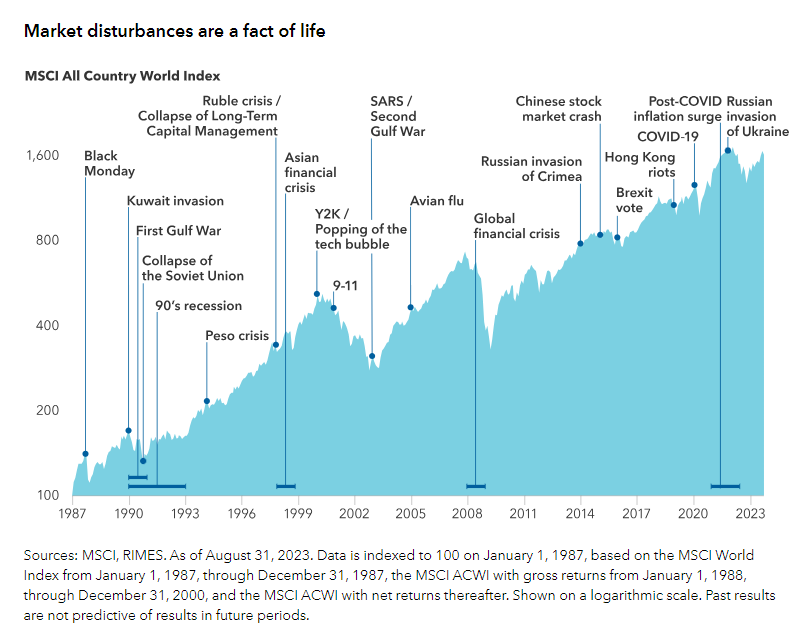

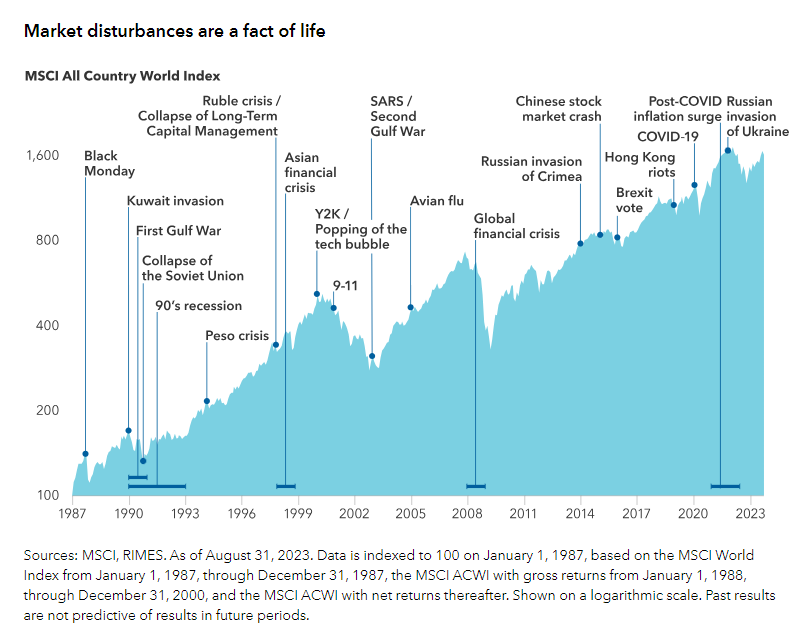

Market Fluctuations: Changes in the prices of the underlying assets (stocks and bonds) directly impact the ETF's NAV. A rising market generally leads to a higher NAV, while a falling market results in a lower NAV.

-

Currency Exchange Rates: Since this is a USD Acc (Accumulating) ETF, fluctuations in exchange rates between the USD and the currencies of the underlying assets can significantly affect the NAV. For example, a strengthening dollar could decrease the NAV if a substantial portion of the holdings are in other currencies.

-

Dividend Income and Reinvestment: Dividends received from the underlying assets are typically reinvested back into the ETF, increasing the total asset value and thereby impacting the NAV positively.

-

Expense Ratio: The ETF's expense ratio, representing the annual cost of managing the fund, slightly erodes the NAV over time. This is because the expense ratio is deducted from the asset value.

-

Key Factors Summary:

- Market Performance (Bull or Bear Market)

- Currency Exchange Rate Volatility

- Dividend Income & Reinvestment Policy

- ETF Expense Ratio

Using NAV to Track Performance of the Amundi MSCI All Country World UCITS ETF USD Acc

Monitoring the NAV is key to tracking the Amundi MSCI All Country World UCITS ETF USD Acc's performance:

-

NAV as a Performance Indicator: Daily NAV changes provide a clear indication of the ETF's short-term performance. Comparing the NAV over time reveals the overall growth or decline in value.

-

Comparing NAV to Share Price: While the NAV should closely track the ETF's share price, minor discrepancies can occur due to the bid-ask spread (the difference between the buying and selling price of the ETF shares).

-

Long-Term NAV Growth Analysis: Analyzing the long-term NAV trend is crucial for evaluating the ETF's overall investment strategy and its success in meeting its investment objectives. This provides a perspective beyond short-term market fluctuations.

-

Practical Applications of NAV:

- Evaluate short-term performance

- Identify long-term investment growth potential

- Compare against benchmark indices

Where to Find the NAV for the Amundi MSCI All Country World UCITS ETF USD Acc

Accessing the daily NAV for your Amundi MSCI All Country World UCITS ETF USD Acc is straightforward:

-

Official ETF Provider Website: Amundi's official website is the most reliable source for the up-to-date NAV.

-

Financial News Websites and Data Providers: Major financial news sources like Bloomberg, Yahoo Finance, and Google Finance typically provide real-time or delayed NAV data for ETFs.

-

Brokerage Platforms: Your brokerage account will display the current NAV of the ETFs held in your portfolio.

-

Key Data Sources Summary:

- Amundi's Official Website

- Major Financial News Outlets (Bloomberg, Yahoo Finance, etc.)

- Your Brokerage Account

Conclusion: The Importance of Understanding Net Asset Value (NAV) for the Amundi MSCI All Country World UCITS ETF USD Acc

Understanding the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is vital for informed investment decisions. By grasping how NAV is calculated, the factors affecting it, and how to track its changes, you gain valuable insight into your investment's performance. Regularly monitor your ETF's NAV and use this knowledge to make strategic investment choices. Maximize your investment with NAV analysis and understanding your ETF's Net Asset Value. Start tracking your Amundi MSCI All Country World UCITS ETF USD Acc's NAV today!

Featured Posts

-

Ferraris Fastest Production Cars A Fiorano Track Comparison

May 25, 2025

Ferraris Fastest Production Cars A Fiorano Track Comparison

May 25, 2025 -

Dow Jones Climbs On Positive Pmi Report A Cautious Ascent

May 25, 2025

Dow Jones Climbs On Positive Pmi Report A Cautious Ascent

May 25, 2025 -

The Bury M62 Relief Road A Forgotten Plan

May 25, 2025

The Bury M62 Relief Road A Forgotten Plan

May 25, 2025 -

Walker Peters To Leeds Latest Transfer News And Updates

May 25, 2025

Walker Peters To Leeds Latest Transfer News And Updates

May 25, 2025 -

Bardellas Path To The French Presidency A Contender Emerges

May 25, 2025

Bardellas Path To The French Presidency A Contender Emerges

May 25, 2025

Latest Posts

-

French Elections 2027 Bardellas Challengers And Prospects

May 25, 2025

French Elections 2027 Bardellas Challengers And Prospects

May 25, 2025 -

Bardellas Path To The French Presidency A Contender Emerges

May 25, 2025

Bardellas Path To The French Presidency A Contender Emerges

May 25, 2025 -

French Pms Dissenting Voice On Macrons Leadership

May 25, 2025

French Pms Dissenting Voice On Macrons Leadership

May 25, 2025 -

Ex French Prime Minister Disagrees With Macrons Policies

May 25, 2025

Ex French Prime Minister Disagrees With Macrons Policies

May 25, 2025 -

Former French Pm Critiques Macrons Decisions

May 25, 2025

Former French Pm Critiques Macrons Decisions

May 25, 2025