Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist: What You Need To Know

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. It's a fundamental metric reflecting the underlying value of the ETF's holdings. Think of it as the true worth of each share. The calculation is relatively straightforward:

-

Definition of NAV: The net asset value is the total market value of all the assets in the ETF's portfolio minus its liabilities (expenses, debts).

-

Formula for NAV calculation (simplified): NAV = (Total Asset Value - Total Liabilities) / Number of Outstanding Shares

-

Frequency of NAV calculation: The NAV is typically calculated daily, at the close of the market.

-

Factors affecting NAV: Several factors influence the daily NAV, most significantly market fluctuations in the underlying assets and, in the case of internationally-focused ETFs, currency exchange rates.

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist and its NAV

The Amundi MSCI World II UCITS ETF USD Hedged Dist is designed to track the performance of the MSCI World Index, offering broad exposure to global equities. Crucially, it incorporates a USD hedging strategy. This means the ETF aims to minimize the impact of currency fluctuations between the base currency of the underlying assets and the US dollar. Let's delve deeper:

-

ETF investment objective: To track the performance of the MSCI World Index, while mitigating currency risk for USD-based investors.

-

Underlying index tracked (MSCI World Index): This broad market index provides exposure to a large and diverse range of global companies.

-

Currency hedging mechanism (explain USD hedging): The USD hedging strategy aims to reduce the impact of exchange rate movements between the currencies of the companies held within the MSCI World Index and the US dollar. This minimizes volatility for investors whose base currency is the USD.

-

Target investor profile: This ETF is suitable for investors seeking diversified exposure to the global equity market and who prefer to minimize currency risk related to their investment in non-USD assets.

-

Expense ratio and its impact on NAV: The expense ratio, a small annual fee, is deducted from the fund's assets and therefore impacts the NAV, albeit usually marginally. Always check the current expense ratio.

How to Find the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Finding the NAV of your Amundi MSCI World II UCITS ETF USD Hedged Dist investment is straightforward. Several reliable sources provide this crucial information:

-

Amundi's official website: The fund manager's website is the primary and most reliable source for accurate, up-to-date NAV information.

-

Reputable financial data providers (Bloomberg, Yahoo Finance, etc.): Many financial websites and data providers list real-time and end-of-day NAV data for various ETFs, including this one.

-

Brokerage platforms: If you hold the ETF through a brokerage account, the platform will usually display the current NAV.

-

Understanding the difference between real-time and end-of-day NAV: Real-time NAV fluctuates constantly throughout the trading day. End-of-day NAV reflects the final calculation at market close.

Using NAV to Evaluate Investment Performance

The NAV is an essential tool for monitoring your investment’s performance. By tracking changes in the NAV over time, you can gain insight into your returns.

-

Calculating percentage change in NAV: Simply compare the current NAV with the NAV at a previous date to calculate the percentage change, representing your investment growth (or loss).

-

Comparing NAV performance to benchmark index: By comparing the NAV changes to the performance of the MSCI World Index, you can gauge how effectively the ETF is tracking its benchmark.

-

Impact of expense ratio on overall returns: Remember to factor in the expense ratio when calculating your overall return. The expense ratio slightly reduces your net gains.

-

Long-term investment perspective: It's important to consider the NAV in the context of a long-term investment strategy. Short-term fluctuations are normal; focus on the overall trend.

Conclusion

Understanding the Net Asset Value (NAV) is paramount for investors in the Amundi MSCI World II UCITS ETF USD Hedged Dist. By understanding its calculation, accessing reliable data sources, and using the NAV to track your investment performance against the benchmark index, you can make more informed investment decisions. Stay informed about your Net Asset Value, track your Amundi MSCI World II UCITS ETF USD Hedged Dist NAV, and understand your ETF’s NAV to confidently manage your global equity investments.

Featured Posts

-

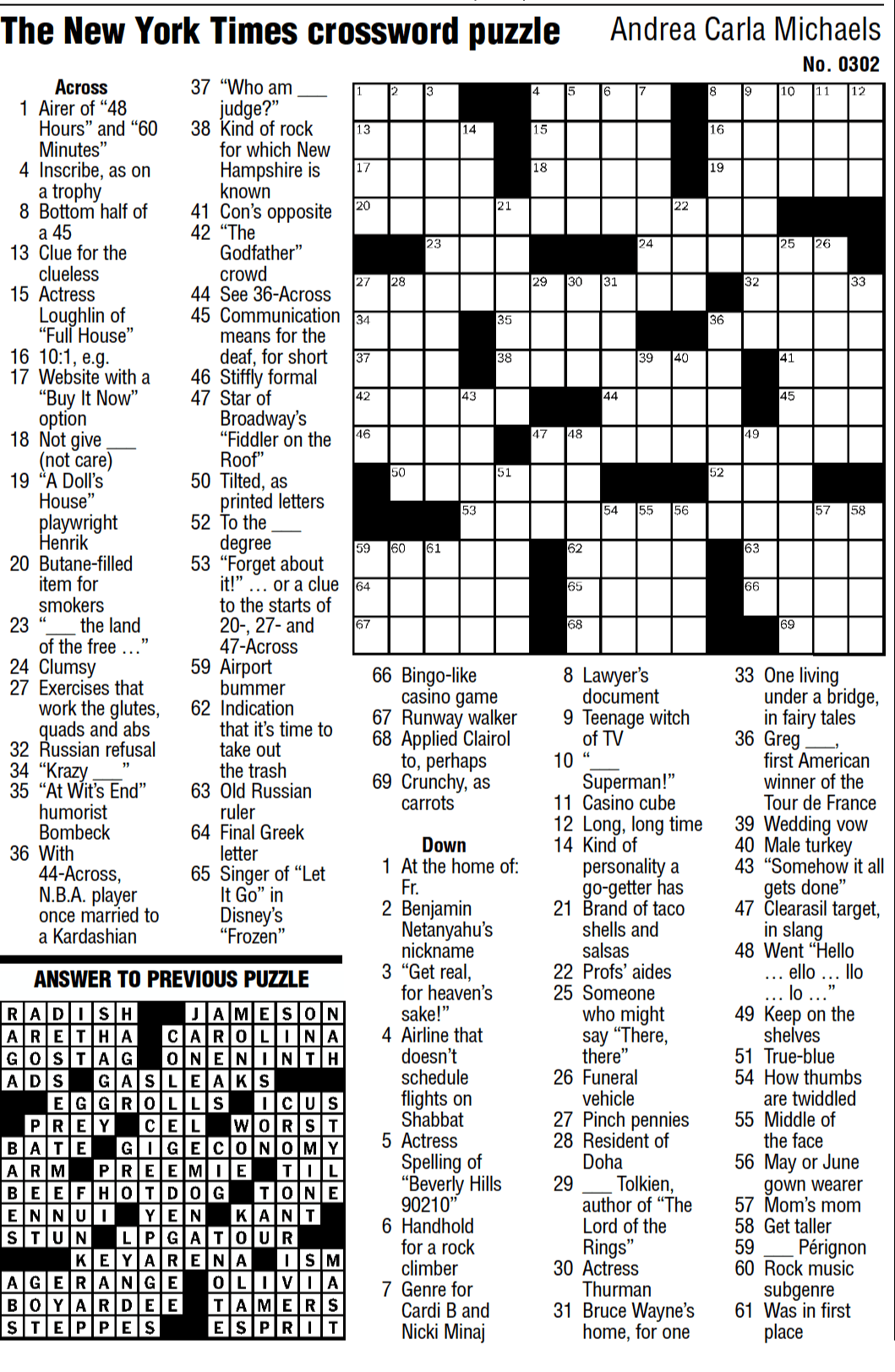

Nyt Mini Crossword Answers March 26 2025 Clues And Solutions

May 24, 2025

Nyt Mini Crossword Answers March 26 2025 Clues And Solutions

May 24, 2025 -

80 Millioert Felvertezett Porsche 911 Az Extrak Szemleje

May 24, 2025

80 Millioert Felvertezett Porsche 911 Az Extrak Szemleje

May 24, 2025 -

My Experience Waiting By The Phone

May 24, 2025

My Experience Waiting By The Phone

May 24, 2025 -

Escape To The Country Finding Your Perfect Rural Home

May 24, 2025

Escape To The Country Finding Your Perfect Rural Home

May 24, 2025 -

The Phones Silent Ring A Reflection On Waiting

May 24, 2025

The Phones Silent Ring A Reflection On Waiting

May 24, 2025

Latest Posts

-

Macrons Policies Faced Internal Opposition Former French Pm Speaks Out

May 24, 2025

Macrons Policies Faced Internal Opposition Former French Pm Speaks Out

May 24, 2025 -

France New Proposals For Punishing Underage Criminals

May 24, 2025

France New Proposals For Punishing Underage Criminals

May 24, 2025 -

Proposed Changes To Juvenile Sentencing In France

May 24, 2025

Proposed Changes To Juvenile Sentencing In France

May 24, 2025 -

Gaga And Polansky Couples Arrival At Snl Afterparty

May 24, 2025

Gaga And Polansky Couples Arrival At Snl Afterparty

May 24, 2025 -

French Pms Past Disagreements With Macron Revealed

May 24, 2025

French Pms Past Disagreements With Macron Revealed

May 24, 2025