Network18 Media & Investments Share Price Today (April 21, 2025): Live NSE/BSE Rates, Technical Analysis & Forecasts

Table of Contents

Live NSE/BSE Network18 Media & Investments Share Price

Current Market Price:

(This section needs to be dynamically updated with real-time data from NSE and BSE. Placeholder below.)

- NSE: ₹XXX.XX

- BSE: ₹XXX.XX

Day's High/Low:

(This section needs to be dynamically updated with real-time data from NSE and BSE. Placeholder below.)

- Day's High (NSE): ₹XXX.XX

- Day's Low (NSE): ₹XXX.XX

- Day's High (BSE): ₹XXX.XX

- Day's Low (BSE): ₹XXX.XX

Volume Traded:

(This section needs to be dynamically updated with real-time data from NSE and BSE. Placeholder below.)

-

NSE Volume: XXX,XXX shares

-

BSE Volume: XXX,XXX shares

-

Significant Price Changes: (e.g., "Compared to yesterday's closing price of ₹YYY.YY, the share price is currently up/down by X%.").

-

Unusual Trading Volume: (e.g., "Today's trading volume is significantly higher/lower than the average daily volume, potentially indicating increased investor interest/lack of interest.")

-

Disclaimer: Please note that real-time data is subject to change and may not be completely accurate.

Technical Analysis of Network18 Media & Investments Stock

Chart Patterns:

(This section requires the inclusion of relevant charts. Placeholders for descriptions below.)

- Support Levels: Analysis of recent support levels (e.g., "The ₹XXX level has acted as a strong support in the past.")

- Resistance Levels: Analysis of recent resistance levels (e.g., "The ₹XXX level has proven to be a significant resistance level.")

- Trends: Identification of the current trend (e.g., "The stock appears to be in a short-term uptrend/downtrend.")

Technical Indicators:

-

RSI (Relative Strength Index): Explanation of the RSI value and its implications (e.g., "The RSI is currently at XX, suggesting the stock is/is not overbought/oversold.")

-

MACD (Moving Average Convergence Divergence): Explanation of the MACD lines and their crossover (e.g., "A bullish/bearish crossover is observed, indicating a potential price movement.")

-

Moving Averages (e.g., 50-day, 200-day): Analysis of the relationship between the share price and moving averages (e.g., "The share price is currently above/below the 50-day moving average, suggesting bullish/bearish momentum.")

-

Indicator Explanations: Each indicator should be explained in simple terms, suitable for a broad audience.

-

Further Learning: Links to reputable resources for learning more about technical analysis should be provided.

-

Disclaimer: Technical analysis is not a foolproof method and should be used in conjunction with fundamental analysis and other investment strategies.

Network18 Media & Investments Share Price Forecast

Short-Term Forecast (Next 1-3 Months):

(e.g., "Based on current market conditions and technical analysis, a price range of ₹XXX to ₹XXX is anticipated within the next 1-3 months. This prediction is supported by the recent bullish trend and positive RSI readings.")

Long-Term Forecast (Next 6-12 Months):

(e.g., "Considering long-term industry growth prospects and the company's performance, a potential price range of ₹XXX to ₹XXX is foreseen over the next 6-12 months. This forecast considers factors such as potential advertising revenue growth and the expansion of digital platforms.")

Factors Influencing the Forecast:

-

Company Performance: Analysis of the company's financial performance, including revenue growth, profitability, and debt levels.

-

Economic Indicators: Consideration of relevant economic indicators that could affect the company's performance (e.g., GDP growth, inflation rates).

-

Industry News: Discussion of significant industry news and trends that may impact the share price.

-

Assumptions: Clear statement of the assumptions underlying the forecast.

-

Disclaimer: Emphasis on the inherent uncertainty in any price prediction.

-

Risks and Opportunities: Identification of potential risks and opportunities for Network18 Media & Investments.

Conclusion

This analysis has provided a snapshot of the current Network18 Media & Investments share price, incorporating live NSE/BSE data, technical analysis using key indicators like RSI and MACD, and short-term and long-term price forecasts. Key takeaways include the identification of potential support and resistance levels, the interpretation of current technical indicators, and a prediction of future price movement based on multiple factors. Remember, however, that these predictions are based on current market conditions and are subject to change.

Key Takeaways:

- Monitor key technical indicators (RSI, MACD, moving averages) for insights into short-term price movements.

- Consider both short-term and long-term market trends when making investment decisions.

- Stay updated on company performance, economic conditions, and industry news for a comprehensive investment approach.

Call to Action: Stay informed on the latest Network18 Media & Investments share price fluctuations and market trends by regularly checking our website for updates and in-depth analysis. Monitor the Network18 Media & Investments share price for optimal investment decisions.

Featured Posts

-

La Lakers News Scores And Analysis Vavel United States

May 17, 2025

La Lakers News Scores And Analysis Vavel United States

May 17, 2025 -

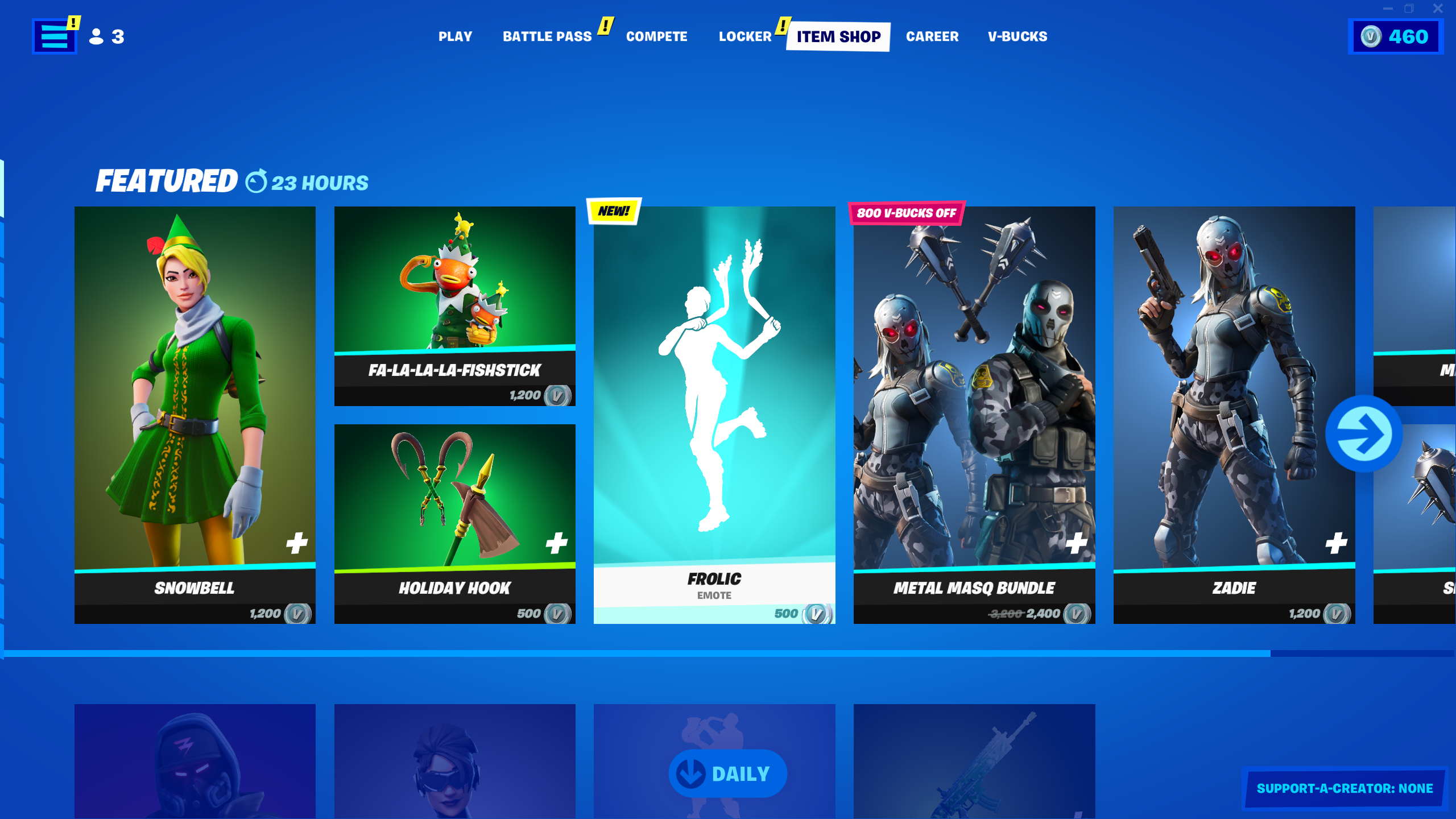

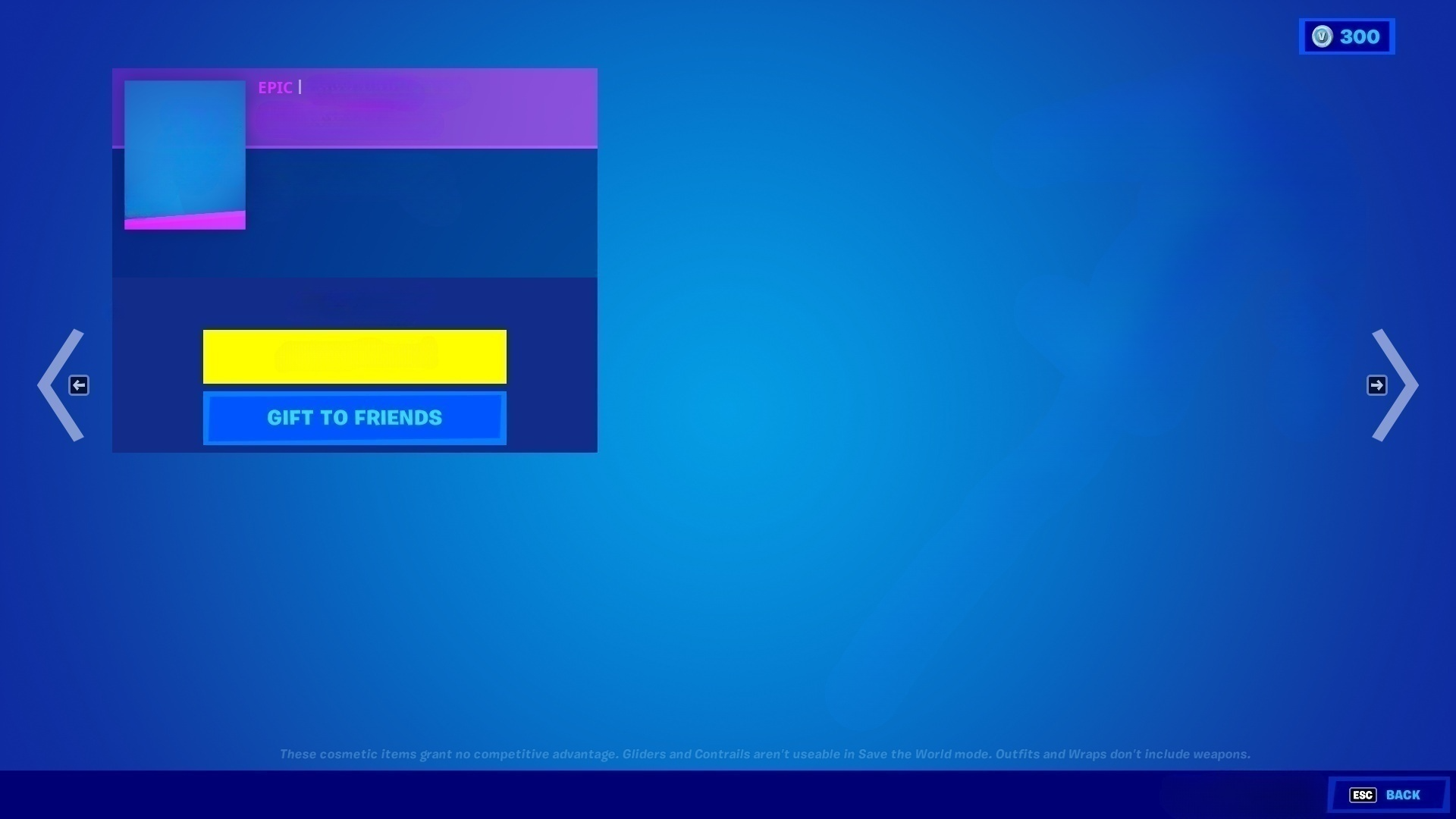

New Fortnite Item Shop Feature Easier Navigation And Purchases

May 17, 2025

New Fortnite Item Shop Feature Easier Navigation And Purchases

May 17, 2025 -

Enhanced Fortnite Item Shop A New Feature For Streamlined Shopping

May 17, 2025

Enhanced Fortnite Item Shop A New Feature For Streamlined Shopping

May 17, 2025 -

Fortnites Controversial Music Update Players Speak Out

May 17, 2025

Fortnites Controversial Music Update Players Speak Out

May 17, 2025 -

Resultado Palmeiras Bolivar 2 0 Goles Y Reporte Del Partido

May 17, 2025

Resultado Palmeiras Bolivar 2 0 Goles Y Reporte Del Partido

May 17, 2025