New Saudi Regulation To Revolutionize The ABS Market: Size And Scope

Table of Contents

The Size of the Saudi ABS Market Before the New Regulation

Prior to the new regulation, the Saudi ABS market, while growing, faced considerable limitations. Its size was relatively small compared to more established markets globally, hindering its full potential. Key players were primarily limited to a few major banks, with ABS predominantly focused on traditional sectors like real estate and auto loans.

- Market Size: The pre-regulation market was estimated at [Insert approximate market size in Saudi Riyals and USD equivalent].

- Growth Rate: Annual growth hovered around [Insert percentage] in recent years, constrained by regulatory complexities and a lack of standardization.

- Major Sectors: Real estate and auto loan securitizations dominated, leaving significant untapped potential in other sectors.

- Key Challenges: Regulatory hurdles, including complex approval processes and a lack of clear guidelines, significantly hampered market growth. Standardization of ABS structures was also lacking, creating inefficiencies and deterring potential investors.

Key Provisions of the New Saudi Regulation

The new Saudi regulation introduces sweeping changes designed to unlock the full potential of the ABS market. These provisions directly address the pre-existing limitations, paving the way for exponential growth. Key changes include:

- Streamlined Regulatory Processes: The new regulation simplifies the approval process for ABS issuances, reducing bureaucratic hurdles and accelerating time to market.

- Innovative ABS Structures: The introduction of new and more flexible ABS structures allows for a wider range of underlying assets to be securitized, expanding the market's scope considerably.

- Enhanced Investor Protections: Robust investor protection mechanisms are implemented, increasing confidence and attracting both domestic and international investors.

- Clearer Securitization Guidelines: Comprehensive and transparent guidelines for securitization are provided, promoting standardization and transparency across the market.

- Revised Capital Requirements: Adjusted capital requirements for issuers are designed to encourage greater participation and facilitate a more vibrant and competitive market.

Projected Impact of the Regulation on Market Size and Scope

The new regulation is expected to propel the Saudi ABS market into a new era of growth and diversification. The projected impact is significant:

- Projected Market Size: Industry analysts predict the market size could reach [Insert projected market size in Saudi Riyals and USD equivalent] within [ timeframe] of the regulation's implementation.

- Expected Growth Rate: A substantial increase in the annual growth rate is anticipated, potentially reaching [Insert projected percentage] or higher.

- New Sectors: The broader range of permissible underlying assets will open doors for sectors like infrastructure, consumer finance, and renewable energy to leverage ABS financing.

- Increased Market Liquidity: The improved regulatory framework and enhanced investor protections will significantly increase market liquidity, making it easier for issuers to raise capital and for investors to trade ABS.

- Diversification of Issuers: The simplified regulatory environment will attract a wider range of issuers, including smaller and medium-sized enterprises (SMEs), fostering a more dynamic and competitive market.

Opportunities and Challenges for Market Participants

The new Saudi regulation presents both significant opportunities and challenges for market participants:

- Opportunities for Banks: Banks will see expanded lending opportunities as they can securitize a broader range of assets, improving their balance sheet management and freeing up capital for further lending activities.

- Investment Opportunities: Both local and international investors will benefit from a wider array of investment options and potentially higher returns.

- Challenges in Compliance: Meeting the new compliance requirements will necessitate significant investments in technology, training, and internal processes.

- Skilled Professionals: A demand for skilled professionals in ABS structuring, management, and compliance will emerge, requiring targeted training and development initiatives.

- Increased Competition: The expanded market will lead to increased competition among issuers and investors, necessitating a focus on efficiency, innovation, and competitive pricing strategies.

Conclusion: New Saudi Regulation to Revolutionize the ABS Market: Size and Scope

The new Saudi regulation promises to fundamentally reshape the Kingdom's ABS market. By streamlining regulations, promoting innovation, and enhancing investor protections, it paves the way for substantial market expansion and increased participation from diverse stakeholders. The potential for growth is immense, creating numerous opportunities for banks, investors, and other market participants. However, successfully navigating the changes will require proactive adaptation and strategic planning. Stay ahead of the curve and explore the opportunities presented by the new Saudi regulation to revolutionize the ABS market. Contact us to learn more about leveraging this dynamic market.

Featured Posts

-

Drones Attack Aid Ship Bound For Gaza Ngo Reports

May 03, 2025

Drones Attack Aid Ship Bound For Gaza Ngo Reports

May 03, 2025 -

15 April 2025 Daily Lotto Results

May 03, 2025

15 April 2025 Daily Lotto Results

May 03, 2025 -

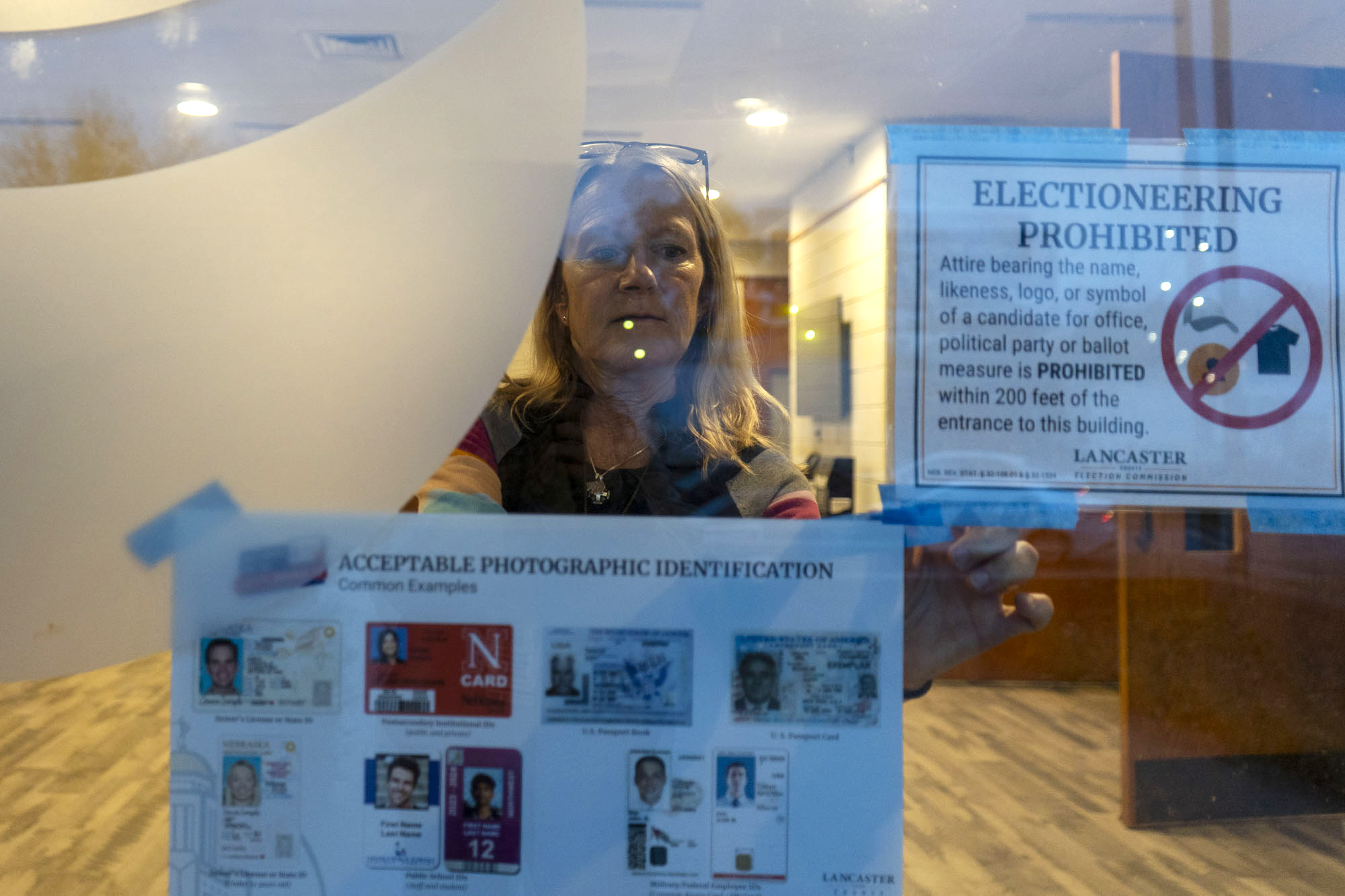

National Award Honors Nebraskas Voter Id Campaign

May 03, 2025

National Award Honors Nebraskas Voter Id Campaign

May 03, 2025 -

Play Station 6 Twqeat W Melwmat Hsryt

May 03, 2025

Play Station 6 Twqeat W Melwmat Hsryt

May 03, 2025 -

La Matinale De Mathieu Spinosi Le Violon En Direct

May 03, 2025

La Matinale De Mathieu Spinosi Le Violon En Direct

May 03, 2025

Latest Posts

-

Latest Liverpool Fc News Frimpong And Elliott Situation

May 03, 2025

Latest Liverpool Fc News Frimpong And Elliott Situation

May 03, 2025 -

Frimpong Transfer Update And Elliotts Liverpool Stance

May 03, 2025

Frimpong Transfer Update And Elliotts Liverpool Stance

May 03, 2025 -

Liverpool News Frimpong Talks And Elliotts Future

May 03, 2025

Liverpool News Frimpong Talks And Elliotts Future

May 03, 2025 -

Why Graeme Souness Loves Lewis Skelly Its All About Attitude

May 03, 2025

Why Graeme Souness Loves Lewis Skelly Its All About Attitude

May 03, 2025 -

Jw 24 Yndhr Slah Tjnb Almkhatrt Wdek Dqyq

May 03, 2025

Jw 24 Yndhr Slah Tjnb Almkhatrt Wdek Dqyq

May 03, 2025