New X Financials: Debt Sale Impacts And Company Transformation

Table of Contents

Analyzing the Immediate Financial Impacts of the Debt Sale on New X Financials

The immediate impact of New X Financials' debt sale can be viewed through two key lenses: short-term financial health and the alteration of investor sentiment.

Short-Term Debt Reduction and Liquidity Improvement

The sale has undeniably improved New X Financials' short-term financial standing.

- Improved Cash Flow: The influx of capital from the debt sale has significantly boosted New X Financials’ cash reserves, enabling them to meet immediate obligations and invest in growth opportunities. Preliminary estimates suggest an increase in cash flow of [insert percentage or specific number if available].

- Reduced Interest Expense: By refinancing existing high-interest debt, New X Financials has lowered its overall interest expense, freeing up capital for other strategic initiatives. This could translate to [insert projected savings percentage or amount].

- Lowered Debt-to-Equity Ratio: The debt sale has likely improved New X Financials’ debt-to-equity ratio, a key indicator of financial leverage. This enhanced ratio signals a healthier financial position to potential investors and lenders.

However, some negative short-term impacts are worth considering:

- Higher Interest Rates on New Debt: Securing new debt might have involved accepting higher interest rates compared to the previous debt, potentially offsetting some of the initial savings. Further analysis of the terms of the new debt is crucial to understand the full impact.

- Potential Dilution of Existing Shareholder Equity: Depending on the structure of the debt sale, existing shareholders might experience some dilution of their equity. This would need to be weighed against the potential long-term benefits of the transformation strategy.

Impact on Credit Ratings and Investor Confidence

The debt sale's effect on New X Financials' credit rating is a crucial factor. Agencies like Moody's and S&P will assess the financial implications and adjust the company's credit rating accordingly. A positive rating change could attract more investors and lower borrowing costs in the future. Conversely, a negative change could hinder future funding opportunities.

Investor reaction has been mixed. Initial stock price fluctuations reflected the uncertainty surrounding the sale. Analyst reports have varied, with some praising the strategic move and others expressing concerns about the increased debt burden. Monitoring ongoing market sentiment and investor confidence is essential for a comprehensive assessment of the debt sale's success.

The Debt Sale's Role in New X Financials' Strategic Transformation

The debt sale is not merely a financial maneuver; it's a cornerstone of New X Financials' broader strategic transformation.

Funding for Growth Initiatives and Acquisitions

The proceeds from the debt sale are primarily earmarked for several key initiatives:

- Investment in R&D: A significant portion of the funds will be allocated to research and development, aiming to enhance New X Financials’ product offerings and strengthen its competitive edge. Specifically, the company plans to invest in [mention specific technologies or projects].

- Expansion into New Markets: New X Financials intends to leverage the capital to expand into new geographical markets, increasing its market reach and revenue streams. The target markets include [list specific regions or countries].

- Strategic Acquisitions: The debt sale provides the financial muscle to pursue strategic acquisitions, potentially accelerating growth through the integration of complementary businesses. [Mention any potential acquisition targets or types of companies being considered]. Details can be found in [link to relevant press releases or company announcements].

Restructuring and Operational Efficiency Improvements

Alongside the debt sale, New X Financials is implementing restructuring initiatives aimed at enhancing operational efficiency.

- Streamlining Operations: The company is streamlining its operations to reduce redundancies and improve productivity. This might include [mention any specific measures, e.g., process automation, workforce restructuring].

- Cost Optimization: Cost-cutting measures, justified by the need to improve profitability and manage the increased debt, are being implemented across various departments. These measures are designed to ensure the long-term sustainability of the debt.

- Technology Upgrades: Investment in new technologies is being used to streamline workflows, improve customer service and enhance operational efficiency. This will contribute to New X Financials’ long-term competitiveness.

Long-Term Implications and Potential Risks for New X Financials

The long-term success of this debt-fueled transformation hinges on several key factors.

Debt Repayment Strategies and Sustainability

New X Financials' plan for debt repayment is critical. The feasibility of this plan depends on several factors:

- Revenue Growth: The company’s ability to generate sufficient revenue to cover debt service is paramount. Projected revenue growth needs to be realistic and account for potential market fluctuations.

- Interest Rate Hikes: Potential interest rate increases by central banks could significantly impact the cost of servicing the debt. This risk needs to be carefully managed.

- Economic Downturns: A broader economic downturn could negatively affect revenue and profitability, making debt repayment more challenging. Contingency plans for economic uncertainty are crucial.

Maintaining Investor Relations and Communication Transparency

Effective communication is essential for maintaining investor trust and confidence throughout the transformation.

- Regular Updates: New X Financials must provide regular updates to investors on its progress in achieving its transformation goals and debt repayment plan.

- Open Dialogue: Maintaining an open dialogue with stakeholders helps to address concerns and fosters trust, which is key for sustaining long-term investor support.

- Transparency in Reporting: Transparent and accurate financial reporting is crucial to build and maintain investor confidence.

Conclusion: Assessing the Future of New X Financials Post-Debt Sale

The debt sale undertaken by New X Financials is a significant event with far-reaching implications. While the short-term financial benefits are apparent, the long-term success of the company's transformation hinges on its ability to execute its growth strategies, manage its debt effectively, and maintain open communication with investors. The strategic use of debt to fund growth initiatives, improve efficiency, and potentially facilitate acquisitions presents both significant opportunities and substantial risks. A careful monitoring of its financial performance and strategic execution will be critical in determining the long-term outcome. Stay updated on the evolving story of New X Financials: Debt Sale Impacts and Company Transformation by following the company's news and financial reports.

Featured Posts

-

Hudsons Bay Closing Sale Deep Discounts On Remaining Inventory

Apr 28, 2025

Hudsons Bay Closing Sale Deep Discounts On Remaining Inventory

Apr 28, 2025 -

Ray Epps Defamation Lawsuit Against Fox News January 6th Falsehoods

Apr 28, 2025

Ray Epps Defamation Lawsuit Against Fox News January 6th Falsehoods

Apr 28, 2025 -

Jarren Duran 2 0 This Red Sox Outfielders Potential For A Breakout Season

Apr 28, 2025

Jarren Duran 2 0 This Red Sox Outfielders Potential For A Breakout Season

Apr 28, 2025 -

Yankees Stave Off Sweep Rodons Pitching Early Offense Key To Victory

Apr 28, 2025

Yankees Stave Off Sweep Rodons Pitching Early Offense Key To Victory

Apr 28, 2025 -

Alberta Economy Suffers Dow Megaproject Delay Amid Tariff Disputes

Apr 28, 2025

Alberta Economy Suffers Dow Megaproject Delay Amid Tariff Disputes

Apr 28, 2025

Latest Posts

-

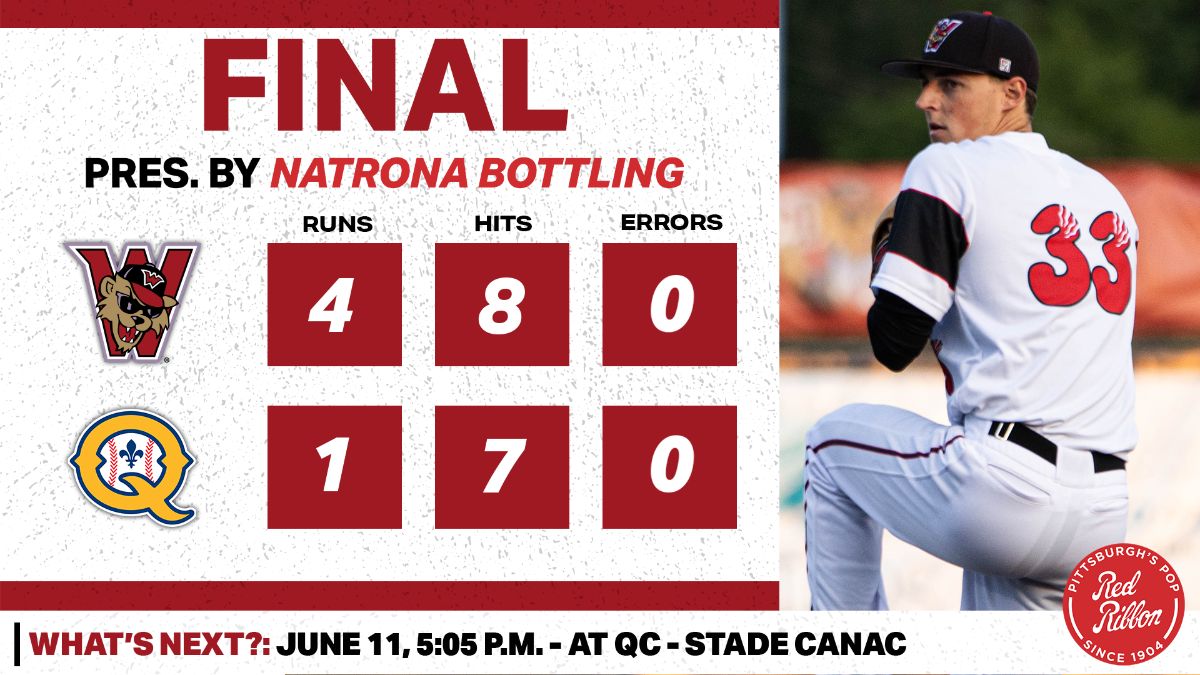

75

Apr 28, 2025

75

Apr 28, 2025 -

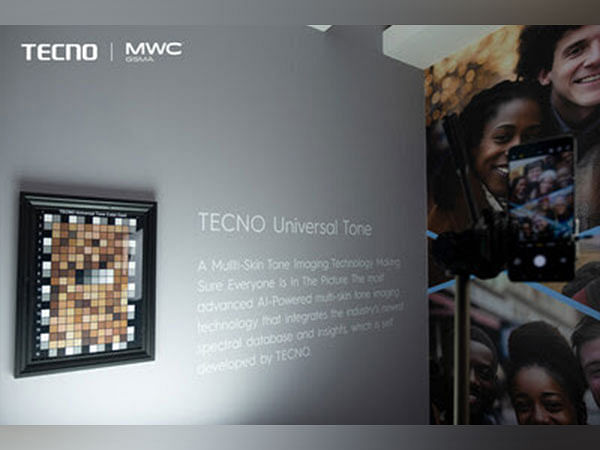

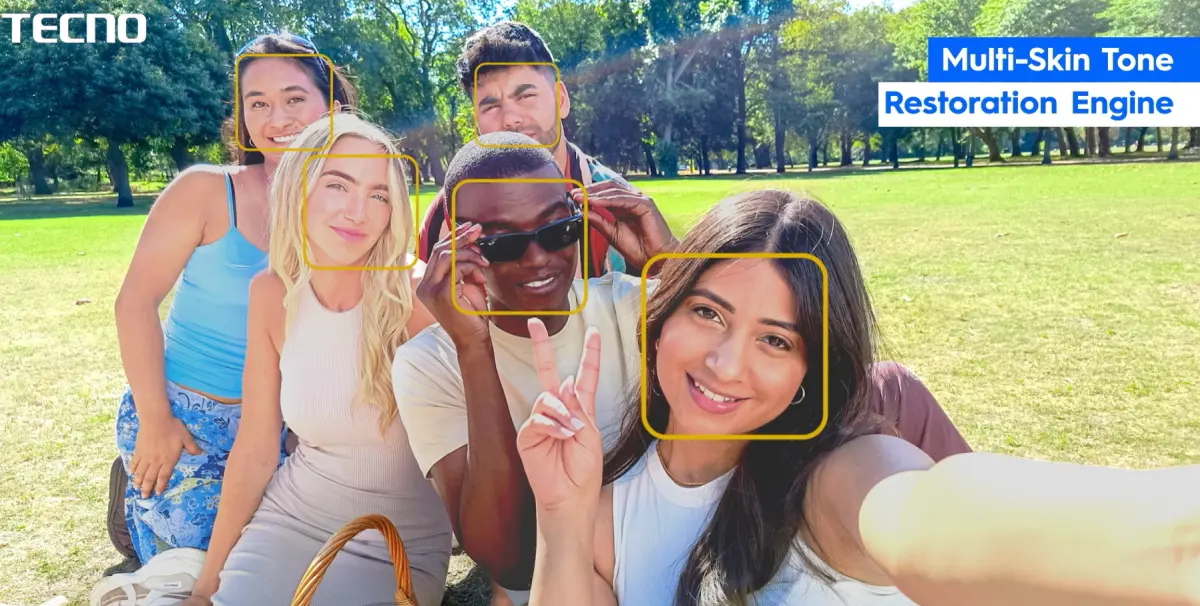

Universal Tone Tecno

Apr 28, 2025

Universal Tone Tecno

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Doubleheader Game 1 Alex Coras Red Sox Lineup Strategy

Apr 28, 2025

Doubleheader Game 1 Alex Coras Red Sox Lineup Strategy

Apr 28, 2025 -

Boston Red Sox Cora Alters Lineup Slightly For Doubleheader

Apr 28, 2025

Boston Red Sox Cora Alters Lineup Slightly For Doubleheader

Apr 28, 2025