Nigel Farage And NatWest Settle De-banking Dispute

Table of Contents

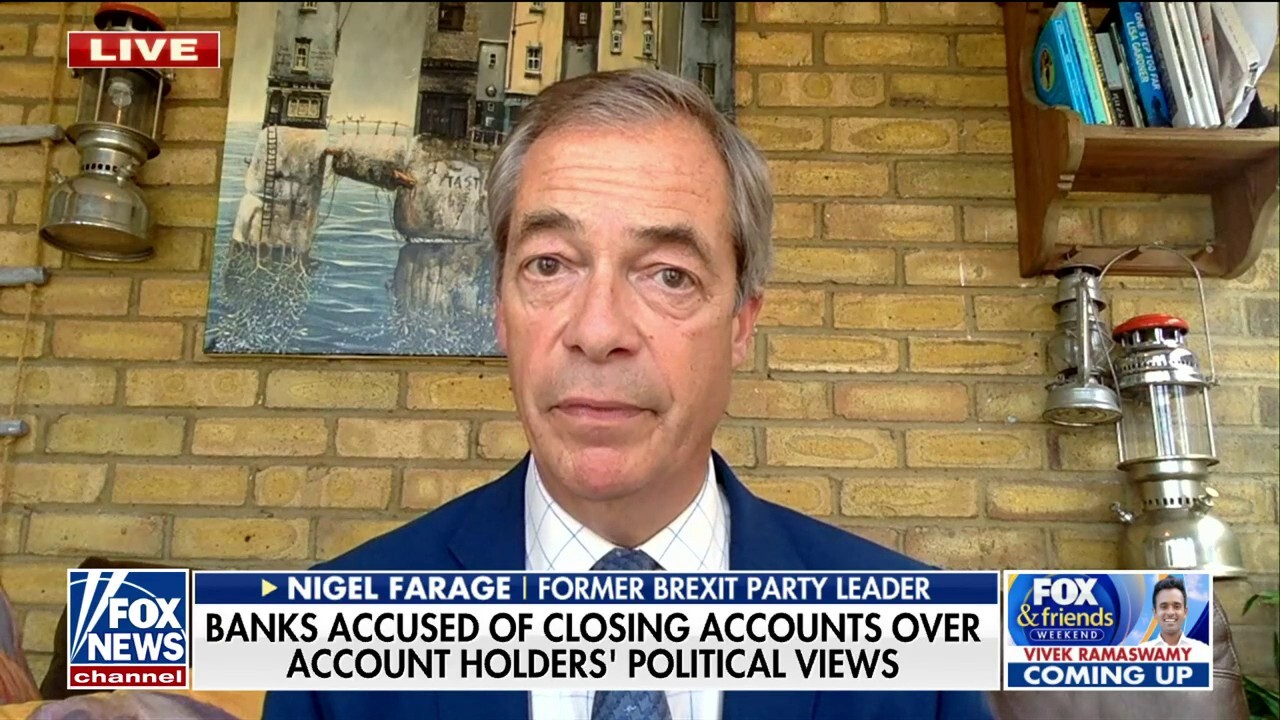

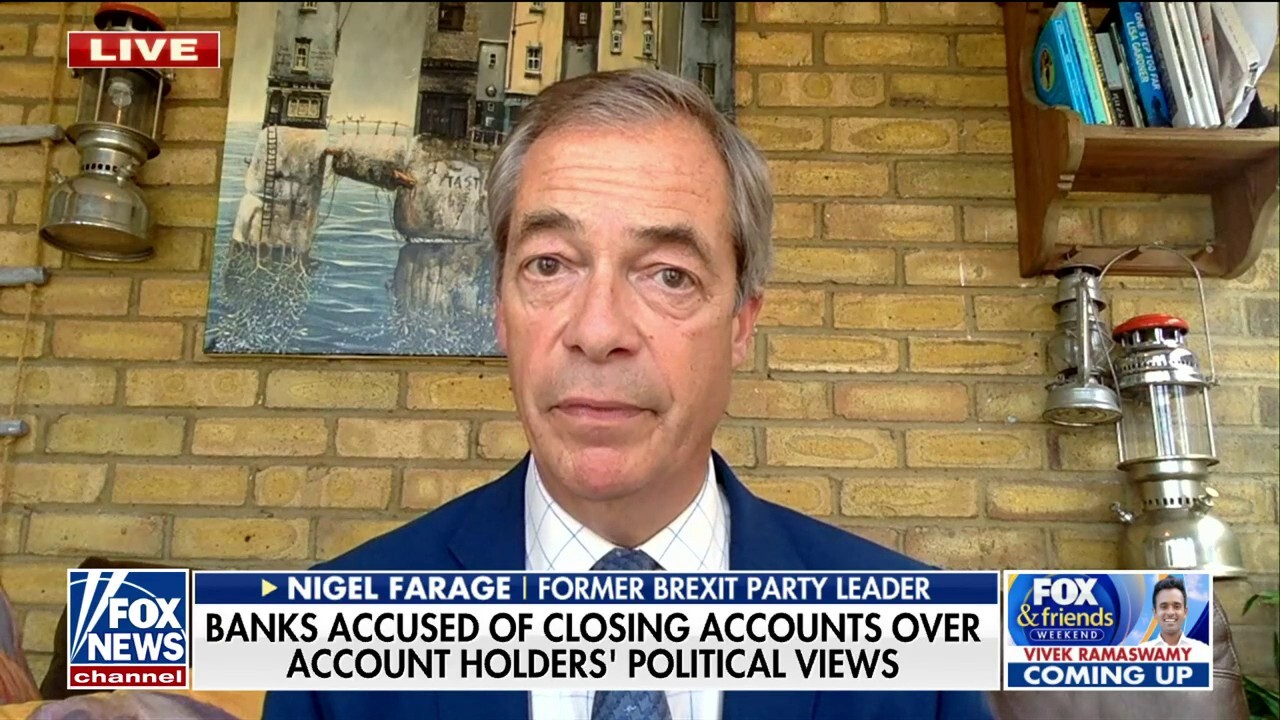

The Nature of the Dispute

The dispute began when NatWest, one of the UK's largest banks, closed several of Nigel Farage's personal and business accounts. NatWest's initial justification centered around concerns related to their de-banking policies and risk assessment processes. However, Farage and many others viewed the closure as politically motivated, citing his outspoken views and controversial political stances as the primary reason. The de-banking immediately ignited a firestorm of public outcry and intense political reaction. The controversy quickly escalated into a major debate about freedom of expression and the potential for banks to unfairly target individuals based on their political beliefs.

- Allegations of political bias: Many criticized NatWest for appearing to discriminate against Farage due to his political views, arguing it sets a dangerous precedent for suppressing dissenting opinions.

- Concerns about freedom of expression and due process: The lack of transparency regarding the decision-making process fuelled concerns about due process and the potential for arbitrary de-banking actions.

- The role of regulatory bodies: The incident prompted calls for greater scrutiny of regulatory bodies' oversight of banks' de-banking policies and practices. Questions were raised about whether current regulations adequately protect individuals from politically motivated de-banking.

Details of the Settlement

While the exact terms of the settlement between Farage and NatWest remain partially confidential, reports indicate that NatWest offered a significant financial settlement to Farage. Although the precise amount hasn't been publicly disclosed, it's understood to represent compensation for the reputational damage and inconvenience caused by the closure of his accounts. NatWest also issued a statement acknowledging the distress caused to Mr. Farage, although it stopped short of a full apology for the de-banking decision itself.

- Specific details of the agreement: The specific details of the agreement remain largely undisclosed due to confidentiality clauses, however, the financial compensation is a central element.

- Changes in NatWest's de-banking policies: The settlement doesn't appear to have led to any publicly announced changes in NatWest's de-banking policies, raising concerns that similar incidents could occur in the future.

- Impact on similar ongoing cases: The outcome of this settlement will likely influence other ongoing de-banking disputes, providing a precedent, positive or negative, for similar cases involving high-profile figures or controversial organizations.

Implications and Wider Context

The settlement between Nigel Farage and NatWest has significant implications for freedom of speech, political debate, and the relationship between financial institutions and the public. The case raises crucial questions about the potential for abuse of power by financial institutions and the need for greater transparency in their de-banking processes. The legal and regulatory aspects of de-banking practices in the UK are now under renewed scrutiny.

- Potential for legal challenges: The settlement might not deter future legal challenges to de-banking decisions, particularly in cases where evidence of political bias can be presented.

- Calls for greater transparency: The case has reinforced calls for greater transparency in the criteria used by banks to make de-banking decisions, demanding clearer guidelines and more robust oversight.

- Balancing financial crime prevention and freedom of expression: The central issue remains finding a fair balance between preventing financial crime and protecting freedom of expression – a challenge for regulators and financial institutions alike.

The Role of Financial Institutions in a Democratic Society

Financial institutions play a vital role in a democratic society, but their actions must align with fundamental principles of fairness and due process. The power of banks to essentially exclude individuals from the financial system needs careful consideration and oversight. The potential for abuse of this power, particularly in targeting individuals with controversial viewpoints, demands robust regulatory frameworks and strict accountability mechanisms.

- Best practices for de-banking procedures: Clear, transparent, and consistently applied procedures are crucial to prevent arbitrary de-banking.

- Role of independent regulatory oversight: Independent regulatory bodies must play a more active role in monitoring banks' de-banking practices and ensuring compliance with regulations designed to protect both financial integrity and fundamental rights.

- Need for clear guidelines and accountability mechanisms: Clearer guidelines and strong accountability mechanisms are necessary to ensure fairness and transparency in banking practices, including a well-defined appeals process for individuals affected by de-banking decisions.

Conclusion

The Nigel Farage and NatWest de-banking dispute settlement marks a significant moment in the ongoing debate surrounding de-banking practices. The settlement highlights the complexities of balancing financial regulation with the protection of fundamental rights, specifically freedom of speech, and emphasizes the need for greater transparency and accountability within the financial services sector. The case has raised serious questions about the potential for abuse of power by large financial institutions and the need for strong regulatory oversight to prevent similar disputes in the future. Further investigation into banking practices and regulatory oversight is crucial. Stay informed about future developments in this crucial area concerning freedom of speech and the future of de-banking disputes. Continue to follow our coverage for updates on this and other significant financial and political controversies.

Featured Posts

-

Christina Aguilera Did Photoshopping Ruin Her Latest Photoshoot

May 03, 2025

Christina Aguilera Did Photoshopping Ruin Her Latest Photoshoot

May 03, 2025 -

Riot Platforms Stock Riot Whats Happening Now

May 03, 2025

Riot Platforms Stock Riot Whats Happening Now

May 03, 2025 -

Fortnite Cowboy Bebop Themed Freebies Timed Event

May 03, 2025

Fortnite Cowboy Bebop Themed Freebies Timed Event

May 03, 2025 -

Nigel Farages Reform Uk Faces Rift Ex Deputy Hints At Split

May 03, 2025

Nigel Farages Reform Uk Faces Rift Ex Deputy Hints At Split

May 03, 2025 -

Farages New Reform Slogan A Controversial Jimmy Savile Reference

May 03, 2025

Farages New Reform Slogan A Controversial Jimmy Savile Reference

May 03, 2025

Latest Posts

-

President Of Switzerland Issues Strong Statement Against Russian Invasion Of Ukraine

May 03, 2025

President Of Switzerland Issues Strong Statement Against Russian Invasion Of Ukraine

May 03, 2025 -

Ukraine Conflict Swiss Presidents Condemnation Of Russian Aggression

May 03, 2025

Ukraine Conflict Swiss Presidents Condemnation Of Russian Aggression

May 03, 2025 -

Fotos Laura Keller De Biquini Em Retiro De Tantra Yoga

May 03, 2025

Fotos Laura Keller De Biquini Em Retiro De Tantra Yoga

May 03, 2025 -

Laura Keller Biquini E Tantra Yoga Em Retiro Espiritual

May 03, 2025

Laura Keller Biquini E Tantra Yoga Em Retiro Espiritual

May 03, 2025 -

Retiro De Tantra Yoga Laura Keller Mostra O Corpo Em Biquini

May 03, 2025

Retiro De Tantra Yoga Laura Keller Mostra O Corpo Em Biquini

May 03, 2025