Nine Sub-Saharan African Countries Affected By PwC's Departure

Table of Contents

The Nine Affected Countries: A Detailed Overview

PwC's departure significantly impacts nine Sub-Saharan African nations. The scale of impact varies depending on the extent of PwC's previous operations in each country. Understanding the individual contexts is crucial to grasping the overall implications of this PwC Sub-Saharan Africa withdrawal.

-

Angola: PwC audit services Angola were substantial, playing a key role in the nation's oil and gas sector. The withdrawal could impact foreign investment and regulatory compliance.

- Level of PwC Involvement: Extensive in audit, tax, and consulting for major corporations.

- Size of Operations: One of PwC's largest offices in the region.

- Potential Economic Impact: Uncertainty for businesses relying on PwC's expertise; potential delays in projects.

- Alternative Firms: Deloitte, Ernst & Young (EY), KPMG are potential replacements.

-

Botswana: PwC consulting Botswana provided services to the diamond mining industry and other key sectors. Its absence creates a gap in expertise and capacity.

- Level of PwC Involvement: Significant in audit and consulting for both public and private sectors.

- Size of Operations: A sizeable office with a strong local team.

- Potential Economic Impact: Increased costs for businesses seeking alternative auditing services.

- Alternative Firms: Deloitte, KPMG, BDO are potential alternatives.

-

Ghana: PwC's withdrawal from Ghana impacts its robust financial sector and burgeoning tech industry. The absence of PwC audit services Ghana creates a void.

- Level of PwC Involvement: Extensive across various sectors, including banking and telecommunications.

- Size of Operations: A large and established office.

- Potential Economic Impact: Potential challenges for attracting foreign direct investment.

- Alternative Firms: Deloitte, EY, KPMG are well-established competitors.

-

Kenya: The impact of the PwC Sub-Saharan Africa withdrawal in Kenya is considerable, given the country's position as a regional economic hub.

- Level of PwC Involvement: Extensive across many sectors, including financial services and tourism.

- Size of Operations: One of PwC's largest African offices.

- Potential Economic Impact: Potential ripple effects across the Kenyan economy.

- Alternative Firms: Deloitte, EY, and KPMG are well-positioned to absorb some of the demand.

-

Mozambique: PwC provided vital services to Mozambique's developing infrastructure sector. This withdrawal leaves a noticeable gap.

- Level of PwC Involvement: Significant in infrastructure projects and natural resource management.

- Size of Operations: A medium-sized office with a focus on specialized sectors.

- Potential Economic Impact: Potential delays in major infrastructure projects.

- Alternative Firms: Deloitte, EY, and KPMG are potential successors.

-

Namibia: PwC’s presence in Namibia was substantial, particularly within the mining and financial sectors.

- Level of PwC Involvement: Strong presence in the mining and financial sectors.

- Size of Operations: A medium-sized office serving a range of clients.

- Potential Economic Impact: Potential increased costs for businesses and delays in project completion.

- Alternative Firms: Deloitte, KPMG, and BDO could fill the gap.

-

Rwanda: PwC’s role in Rwanda’s economic development initiatives will be missed following its withdrawal.

- Level of PwC Involvement: Significant in supporting government initiatives and private sector growth.

- Size of Operations: A steadily growing office supporting various industries.

- Potential Economic Impact: Potential impact on government transparency and private sector confidence.

- Alternative Firms: Deloitte, EY, and other firms will need to increase their resources to fill the gap.

-

South Africa: While a large market, the PwC Sub-Saharan Africa withdrawal from South Africa still has considerable ramifications for the region.

- Level of PwC Involvement: Extensive operations across all sectors.

- Size of Operations: One of PwC’s largest global offices.

- Potential Economic Impact: While South Africa has a robust market, the withdrawal will still impact investor confidence.

- Alternative Firms: Deloitte, EY, and KPMG are already significant players in the market.

-

Zambia: PwC played a crucial role in Zambia’s copper mining and related sectors.

- Level of PwC Involvement: Significant involvement in mining and related industries.

- Size of Operations: A sizable office with expertise in the mining sector.

- Potential Economic Impact: Potential challenges in attracting foreign investment.

- Alternative Firms: Deloitte, EY, and KPMG are potential alternatives, although resources may be stretched.

Reasons Behind PwC's Withdrawal: Unpacking the Decision

PwC's decision to withdraw is multifaceted, driven by a confluence of factors:

- Changing Regulatory Landscape: Increasing regulatory scrutiny and compliance burdens in some of these countries might have increased operational costs.

- Economic Instability and Risks: Economic volatility and political risks in certain regions posed significant challenges.

- Internal Restructuring within PwC: The firm might be streamlining its global operations, focusing resources on higher-growth markets.

- Competitive Pressures from Other Firms: Increased competition from other large accounting firms could have contributed to the decision.

Impact on Businesses and the Economy

The PwC Sub-Saharan Africa withdrawal carries substantial implications:

- Loss of Expertise and Auditing Credibility: Businesses lose access to established expertise, potentially impacting the quality of audit reports and financial advice.

- Increased Costs for Businesses: Finding alternative services may be more expensive, adding financial strain.

- Potential Disruption to Ongoing Projects: Projects dependent on PwC's services might face delays or disruptions.

- Impact on Foreign Investment and Economic Growth: Uncertainty could deter foreign investment, potentially hindering economic growth.

Government Response and Future Outlook

Governments in affected countries will likely respond in various ways:

- Government Statements and Reactions: Official statements will likely address the situation and reassure businesses.

- Measures to Attract Alternative Firms: Incentives may be offered to attract other major accounting firms.

- Development of Local Auditing and Consulting Capabilities: Investing in local talent and expertise will be crucial.

- Potential Regulatory Changes: Regulatory changes might be implemented to mitigate the impact of PwC's withdrawal.

Opportunities for Competing Firms

PwC's departure creates significant opportunities for competitors:

- Increased Market Share: Rival firms can gain a substantial increase in market share.

- Potential for Expansion and New Client Acquisition: This presents a chance to expand operations and attract new clients.

- Need for Rapid Scaling: Firms will need to expand their resources and personnel to handle increased demand.

Conclusion

The PwC Sub-Saharan Africa withdrawal represents a significant development with wide-ranging economic and business consequences. The reasons behind the withdrawal – encompassing regulatory changes, economic risks, internal restructuring, and competitive pressures – underscore the complex challenges faced by businesses operating in the region. While the immediate impact is considerable, the long-term effects will depend on the responses of governments and the strategies of competing firms. This significant development in the Sub-Saharan African business landscape necessitates further analysis and discussion. Stay informed about the evolving situation regarding the PwC Sub-Saharan Africa withdrawal and its long-term effects. Continue to monitor developments in the region to understand how this change shapes the future of auditing and consulting services.

Featured Posts

-

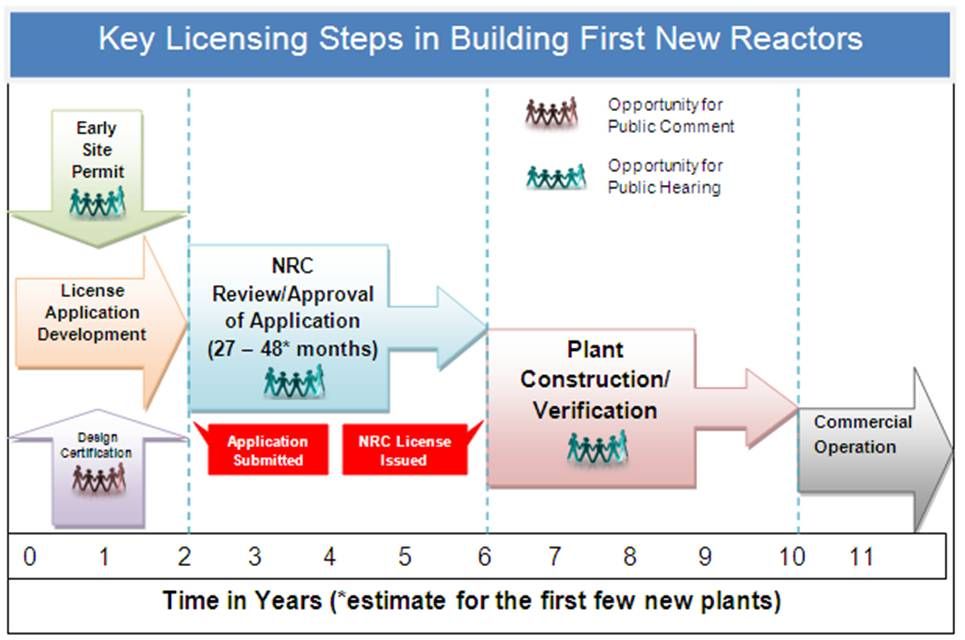

China Approves 10 New Nuclear Reactors A Boost To Energy Production

Apr 29, 2025

China Approves 10 New Nuclear Reactors A Boost To Energy Production

Apr 29, 2025 -

Fhi Rapport Medisinsk Behandling Av Adhd Og Utfordringer I Skolen

Apr 29, 2025

Fhi Rapport Medisinsk Behandling Av Adhd Og Utfordringer I Skolen

Apr 29, 2025 -

Ce Modificari Fiscale Se Pregatesc In 2025 Informatii Esentiale De La Conferinta Pw C

Apr 29, 2025

Ce Modificari Fiscale Se Pregatesc In 2025 Informatii Esentiale De La Conferinta Pw C

Apr 29, 2025 -

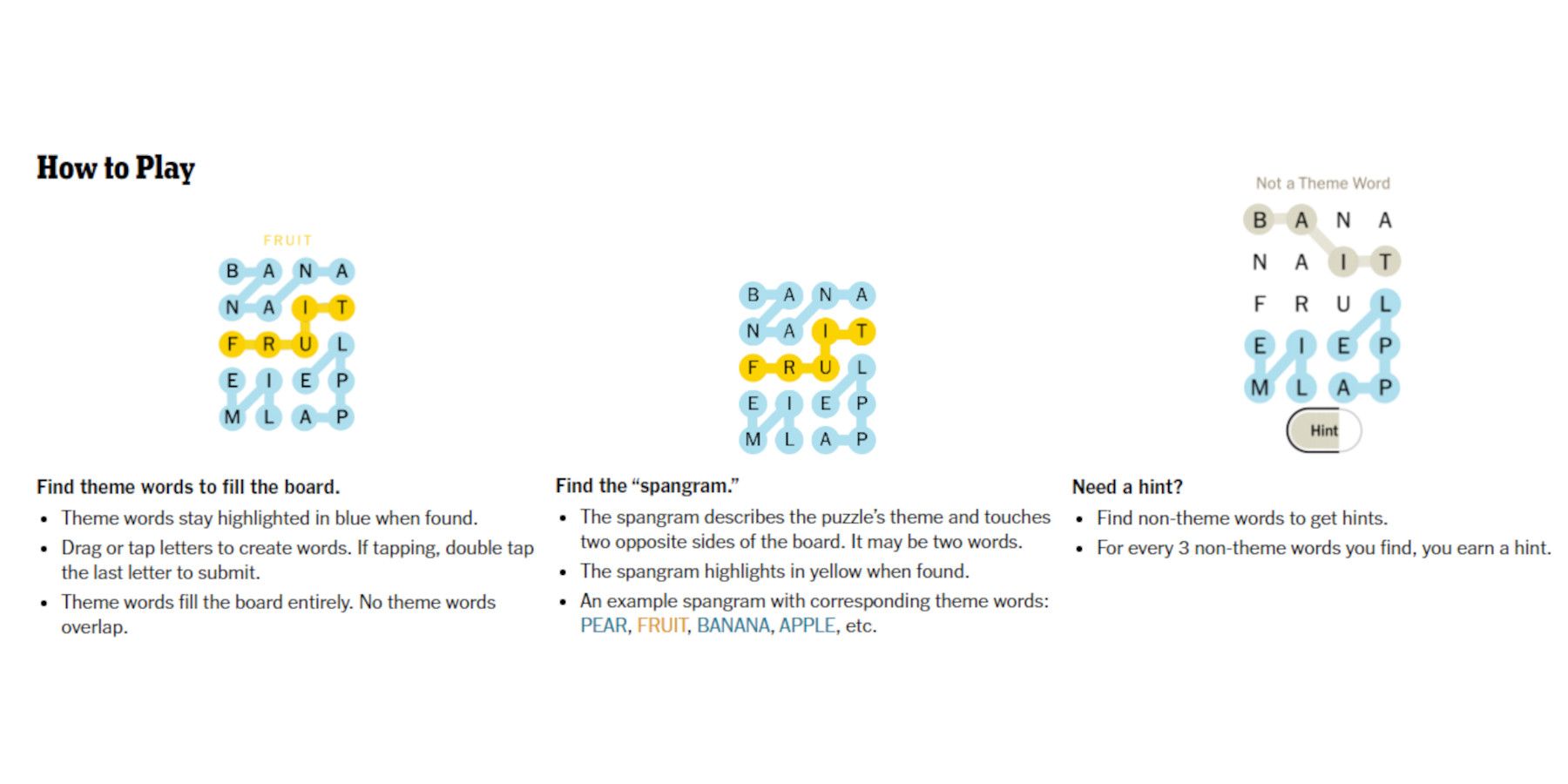

Nyt Strands Puzzle February 27 2025 Answers And Clues

Apr 29, 2025

Nyt Strands Puzzle February 27 2025 Answers And Clues

Apr 29, 2025 -

Bangkok Post Pw Cs Withdrawals And The Implications For Global Accounting

Apr 29, 2025

Bangkok Post Pw Cs Withdrawals And The Implications For Global Accounting

Apr 29, 2025

Latest Posts

-

Stream Ru Pauls Drag Race Season 17 Episode 6 Without Cable Free Options

Apr 30, 2025

Stream Ru Pauls Drag Race Season 17 Episode 6 Without Cable Free Options

Apr 30, 2025 -

Find Ru Pauls Drag Race Season 17 Episode 9 Free Online Streaming

Apr 30, 2025

Find Ru Pauls Drag Race Season 17 Episode 9 Free Online Streaming

Apr 30, 2025 -

Free And Legal Ways To Watch Ru Pauls Drag Race Season 17 Episode 9

Apr 30, 2025

Free And Legal Ways To Watch Ru Pauls Drag Race Season 17 Episode 9

Apr 30, 2025 -

How To Stream Ru Pauls Drag Race Season 17 Episode 9 For Free Legally

Apr 30, 2025

How To Stream Ru Pauls Drag Race Season 17 Episode 9 For Free Legally

Apr 30, 2025 -

New Controversy Our Yorkshire Farm And The Latest Complaints Against Amanda Owen

Apr 30, 2025

New Controversy Our Yorkshire Farm And The Latest Complaints Against Amanda Owen

Apr 30, 2025