Nippon Steel-U.S. Steel Merger Receives Trump Administration Approval

Table of Contents

Key Terms of the Nippon Steel-U.S. Steel Merger Approval

The merger, structured as an acquisition of U.S. Steel by Nippon Steel, is not simply a corporate consolidation; it’s a strategic move with far-reaching implications. The Trump administration's approval, however, came with specific conditions designed to mitigate potential negative consequences and ensure benefits for the American economy. These conditions are crucial to understanding the true nature of the deal.

-

Commitment to Maintain U.S. Steel Manufacturing Jobs: Nippon Steel pledged to maintain a specific number of U.S. steel manufacturing jobs for a defined period, ensuring job security for a significant workforce within the American steel industry. This commitment directly addresses concerns about potential job losses following the merger.

-

Investment in Modernization of U.S. Steel Production Facilities: A substantial investment in upgrading and modernizing U.S. steel production facilities was mandated. This modernization will enhance efficiency, competitiveness, and the overall quality of American steel production. This element is vital for boosting the long-term competitiveness of the U.S. steel sector.

-

Agreements Regarding Fair Trade Practices and Import/Export Regulations: The approved merger includes stipulations ensuring adherence to fair trade practices and compliance with existing import/export regulations. This aspect aims to prevent any potential anti-competitive behavior and safeguard the interests of other players within the global steel market.

Economic Implications of the Nippon Steel-U.S. Steel Merger

The Nippon Steel-U.S. Steel merger has significant potential economic impacts, both domestically and internationally. The effects on steel prices are a key concern. While some analysts predict a short-term price increase due to reduced competition, others believe that increased efficiency and economies of scale could lead to long-term price stability or even decreases. The merger’s impact on the American steel industry’s global competitiveness is equally important. Increased efficiency and modernized facilities could bolster the U.S.'s position in the global steel market.

-

Steel Prices: The immediate impact on steel prices remains uncertain. However, long-term effects will depend on factors like global demand, production capacity, and the competitive landscape.

-

American Jobs: While job security was a key condition of approval, the long-term impact on American jobs requires further analysis. Some analysts suggest potential job losses in certain sectors, offset by job creation in others due to increased investment and modernization. The net effect on employment in the steel industry and related sectors remains a subject of ongoing debate.

-

Global Competitiveness: By combining the strengths of both companies, the merged entity could improve efficiency and innovation. This has the potential to improve the global competitiveness of the U.S. steel industry, enabling it to better compete with international rivals. Data from the World Steel Association will be crucial in tracking these changes in the global steel market. Increased investment in R&D is also crucial for maintaining long-term competitiveness.

Political and Geopolitical Ramifications

The Trump administration’s approval stemmed from a belief that the merger would ultimately benefit the U.S. economy through job creation, modernization, and enhanced global competitiveness. However, the decision carries significant geopolitical implications.

-

Rationale for Approval: The administration likely weighed the potential benefits of a more competitive U.S. steel industry against concerns about reduced competition. The conditions imposed were designed to mitigate the risks while securing the economic upsides.

-

U.S. Trade Relations: The merger could influence U.S. trade relations with other steel-producing nations, potentially leading to trade negotiations or disputes. Countries with significant steel exports to the U.S. may see this as a challenge to their market share.

-

National Security: The steady supply of steel for critical infrastructure projects is a key aspect of national security. The merger's impact on this supply chain will need close monitoring.

-

Stakeholder Perspectives: The merger's reception has been mixed. Unions may view job security guarantees favorably, while competitors may express concern about reduced competition. Consumers will be impacted by price fluctuations, and their interests must also be considered.

Concerns and Criticisms

Critics express concern about the potential for the merger to create a monopoly or significantly reduce competition within the steel industry. This could lead to higher prices for consumers and reduced choices. Smaller steel companies may face increased pressure, possibly leading to consolidation or even bankruptcies within the steel industry. However, proponents argue that the increased efficiency and investment resulting from the merger will outweigh these risks, leading to a stronger, more competitive U.S. steel industry.

Conclusion

The Trump administration's approval of the Nippon Steel-U.S. Steel merger represents a pivotal moment in the global steel industry. This decision has far-reaching economic, political, and geopolitical implications. While the merger offers potential benefits such as job creation and enhanced competitiveness, concerns about monopolies and reduced competition remain. Careful monitoring of its long-term effects is crucial.

Call to Action: Stay informed about the developments surrounding the Nippon Steel-U.S. Steel merger and its impact on the global steel market. Continuous analysis and monitoring of this significant corporate event are crucial to understanding its long-term implications for the steel industry and the broader global economy. Follow our updates for the latest news on the Nippon Steel-U.S. Steel merger and its effects on the steel industry.

Featured Posts

-

Louisiana Horror Film Sinners Release Date Announced

May 26, 2025

Louisiana Horror Film Sinners Release Date Announced

May 26, 2025 -

A Corruption Scandal Shakes Monaco Investigating The Princes Finances

May 26, 2025

A Corruption Scandal Shakes Monaco Investigating The Princes Finances

May 26, 2025 -

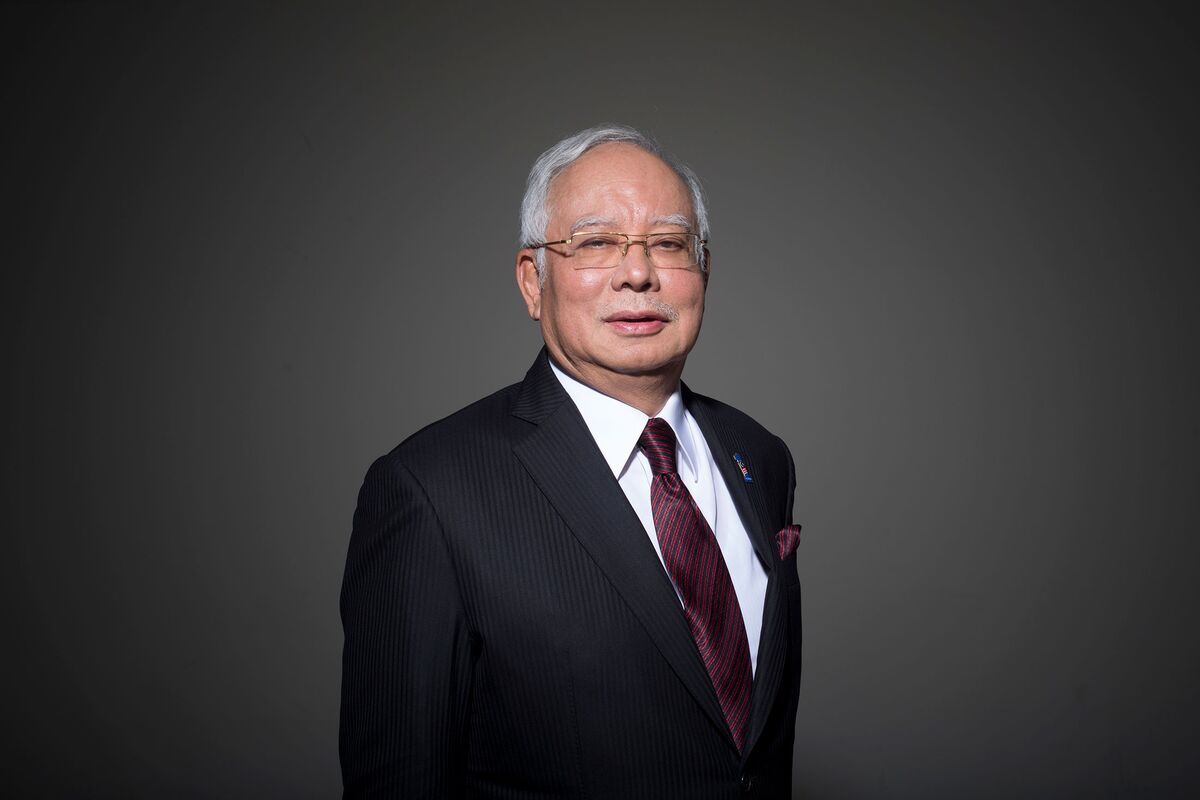

Submarine Bribery Allegations French Investigation Targets Malaysias Najib Razak

May 26, 2025

Submarine Bribery Allegations French Investigation Targets Malaysias Najib Razak

May 26, 2025 -

Marc Marquez Juara Sprint Race Argentina 2025 Dampak Pada Klasemen

May 26, 2025

Marc Marquez Juara Sprint Race Argentina 2025 Dampak Pada Klasemen

May 26, 2025 -

Addressing Oem Concerns Sg Wireless Expands Manufacturing Partnerships

May 26, 2025

Addressing Oem Concerns Sg Wireless Expands Manufacturing Partnerships

May 26, 2025