Norwegian Cruise Line (NCLH) Stock: Is It A Good Buy According To Hedge Funds?

Table of Contents

Hedge Fund Sentiment Towards NCLH Stock: A Deep Dive

Analyzing hedge fund activity offers valuable insight into market sentiment and potential investment strategies. By examining their holdings and trading patterns, we can gain a better understanding of the perceived value of NCLH stock.

Recent Hedge Fund Investments and Holdings

Scrutinizing recent 13F filings – quarterly reports disclosing large institutional investors' equity holdings – reveals significant shifts in NCLH ownership. While specific holdings change frequently, a pattern of increased or decreased investment can point to a collective bullish or bearish outlook. For instance, an increase in holdings by several prominent funds might indicate growing confidence in NCLH's future performance. Conversely, a widespread reduction in holdings could signal caution. [Link to SEC EDGAR database for 13F filings could be inserted here]. We need to analyze data from multiple quarters to identify trends rather than isolated incidents. For example, if several funds known for their expertise in the leisure and travel sectors, like [insert example fund name if possible], increase their NCLH positions, this would be a strong bullish signal.

Analyzing Hedge Fund Trading Strategies

Hedge funds employ diverse strategies, from long-term value investing to short-term speculation. Understanding these strategies is crucial. A long-term investor might see NCLH as undervalued, believing its stock price will appreciate significantly over time due to factors like fleet expansion or improved profitability. Conversely, a short-term trader might focus on short-term market fluctuations, buying and selling NCLH stock based on anticipated price movements. Identifying the dominant strategy among hedge funds regarding NCLH offers valuable insight into their expectations for the stock's price trajectory.

Considering Overall Market Conditions and Their Impact on NCLH

Macroeconomic factors significantly influence the cruise industry and NCLH's stock price. Inflation, recessionary fears, and fluctuating fuel costs directly impact operational expenses and consumer spending on leisure travel. A period of high inflation, for example, might lead to decreased discretionary spending and impact NCLH's bookings, potentially influencing hedge fund decisions to reduce their positions. Conversely, a period of economic growth could lead to an increase in investment. Understanding the interplay between these macroeconomic factors and hedge fund activity is crucial for accurate assessment.

Fundamental Analysis of NCLH: Beyond Hedge Fund Activity

While hedge fund activity provides valuable insight, a thorough assessment of NCLH requires a fundamental analysis of the company itself.

NCLH Financial Performance and Future Projections

Examining NCLH's financial reports – including revenue, earnings per share (EPS), and debt levels – reveals its financial health and growth trajectory. Are revenues increasing year-over-year? Is the company profitable? What is its debt-to-equity ratio? Analyzing these metrics alongside industry trends and NCLH's strategic initiatives (e.g., fleet modernization, new itinerary development) helps to project future performance. Potential risks and challenges, such as increased competition, regulatory changes, or geopolitical instability impacting travel, need careful consideration.

NCLH's Competitive Landscape and Market Position

NCLH competes with other major cruise lines like Carnival Corporation & plc (CCL) and Royal Caribbean Group (RCL). Analyzing NCLH's market share, brand recognition, pricing strategies, and fleet modernization efforts helps gauge its competitive advantages or disadvantages. Does NCLH offer unique experiences or target a specific niche market that differentiates it from competitors? A strong competitive position should enhance its future prospects.

Is NCLH Stock a Smart Investment? Weighing the Evidence

Synthesizing the insights from both hedge fund analysis and fundamental analysis provides a balanced perspective on NCLH's investment potential. While hedge fund activity might suggest a bullish or bearish sentiment, the company's financial performance and market position ultimately determine its long-term viability. A strong financial position and a compelling competitive strategy would mitigate the risks associated with the inherent volatility of the cruise industry, making NCLH stock a more attractive prospect. However, factors like high debt levels or intense competition could indicate higher risks.

Conclusion: Making Informed Decisions about Norwegian Cruise Line (NCLH) Stock

In conclusion, determining whether Norwegian Cruise Line (NCLH) stock is a good buy requires a careful evaluation of both hedge fund sentiment and the company's fundamental performance. While hedge fund activity can offer valuable clues, it's not the sole determinant. Understanding the macroeconomic environment, NCLH's financial health, and its competitive positioning are crucial. This analysis offers a framework, but investors should conduct their own thorough research, considering their individual risk tolerance and financial goals before making any investment decisions. Remember to stay informed about developments in the cruise industry and NCLH's performance for continued success.

Featured Posts

-

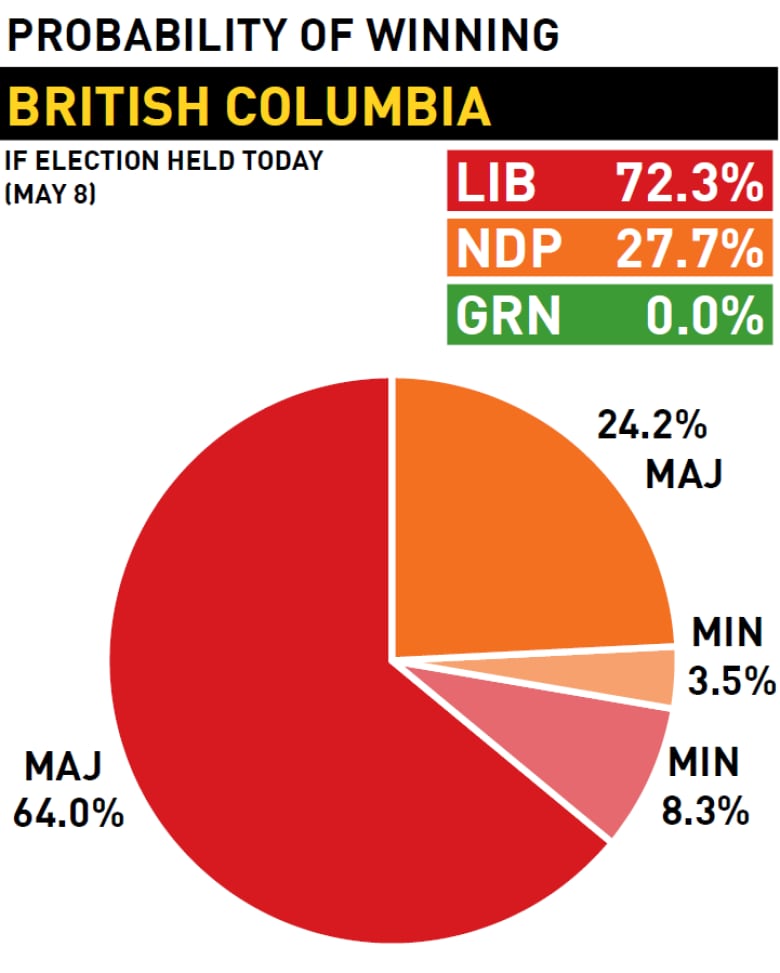

Minority Government Election Implications For The Canadian Dollar

Apr 30, 2025

Minority Government Election Implications For The Canadian Dollar

Apr 30, 2025 -

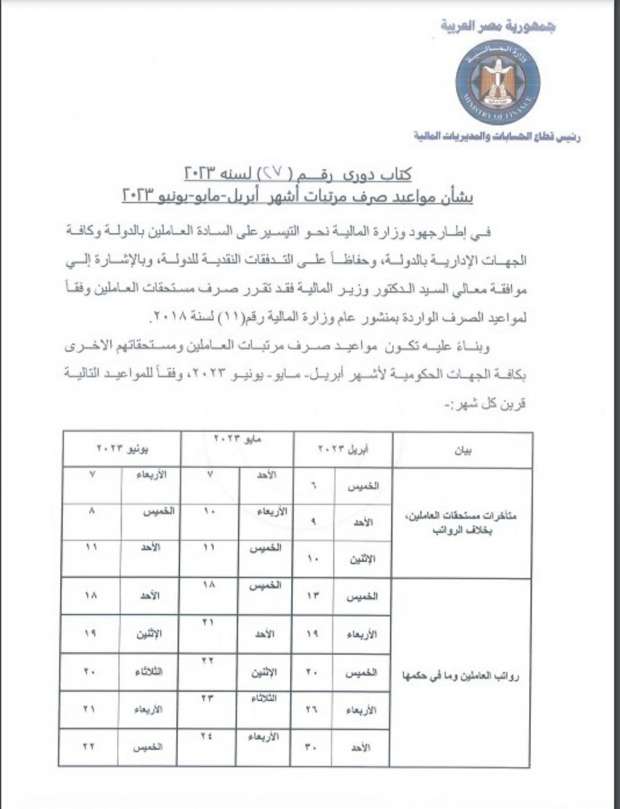

Tarykh Srf Rwatb Shhr Abryl 2025 Dlyl Shaml Llmstfydyn

Apr 30, 2025

Tarykh Srf Rwatb Shhr Abryl 2025 Dlyl Shaml Llmstfydyn

Apr 30, 2025 -

Cruising In 2025 A Comprehensive Guide To The Newest Ships

Apr 30, 2025

Cruising In 2025 A Comprehensive Guide To The Newest Ships

Apr 30, 2025 -

Amanda And Clive Owen A Look At Their Ongoing Relationship On Our Yorkshire Farm

Apr 30, 2025

Amanda And Clive Owen A Look At Their Ongoing Relationship On Our Yorkshire Farm

Apr 30, 2025 -

Supermodelja Beyonce Ne Fushaten E Re Te Levis

Apr 30, 2025

Supermodelja Beyonce Ne Fushaten E Re Te Levis

Apr 30, 2025

Latest Posts

-

Bowen Yangs Plea To Lorne Michaels A Different Snl Jd Vance

Apr 30, 2025

Bowen Yangs Plea To Lorne Michaels A Different Snl Jd Vance

Apr 30, 2025 -

Trumps Dismissal Of Doug Emhoff From Holocaust Memorial Council Jta Report

Apr 30, 2025

Trumps Dismissal Of Doug Emhoff From Holocaust Memorial Council Jta Report

Apr 30, 2025 -

Bowen Yang Asked Lorne Michaels To Replace Him As Jd Vance On Snl

Apr 30, 2025

Bowen Yang Asked Lorne Michaels To Replace Him As Jd Vance On Snl

Apr 30, 2025 -

Post Election Silence Raises Concerns About Kamala Harris Leadership

Apr 30, 2025

Post Election Silence Raises Concerns About Kamala Harris Leadership

Apr 30, 2025 -

Democratic Insiders Criticize Kamala Harris Post Election Absence

Apr 30, 2025

Democratic Insiders Criticize Kamala Harris Post Election Absence

Apr 30, 2025