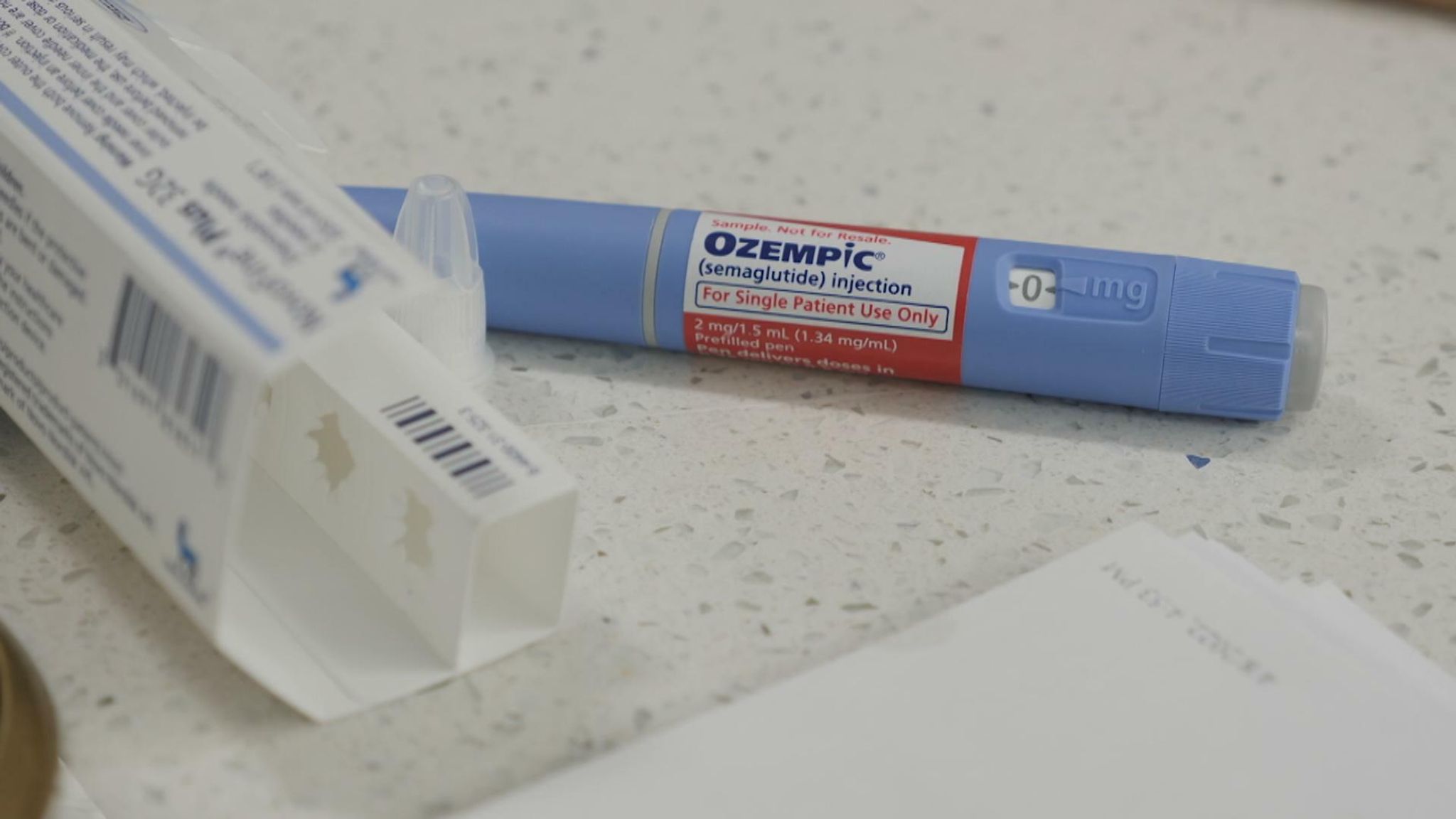

Novo Nordisk's Ozempic: Why It Lagged In The Weight-Loss Market

Table of Contents

Marketing and Brand Positioning

Novo Nordisk's initial marketing strategy significantly impacted Ozempic's early performance in the weight-loss sector.

Initial Focus on Diabetes Treatment

Initially, Novo Nordisk prioritized positioning Ozempic as a leading treatment for type 2 diabetes. Marketing campaigns heavily emphasized its efficacy in managing blood glucose levels.

- Early advertisements primarily focused on glycemic control and diabetes-related complications.

- Limited initial messaging directly targeted weight loss as a key benefit.

- Physician education materials primarily highlighted the diabetic indications.

Competition from Later Entrants

Later entrants in the weight-loss market adopted aggressive marketing strategies specifically targeting weight loss, gaining a significant head start.

- Competitors launched targeted campaigns emphasizing weight loss as the primary benefit, often utilizing social media influencers and celebrity endorsements.

- Marketing budgets allocated to weight-loss promotion were substantially higher for some competitors than those initially dedicated to promoting Ozempic for weight loss by Novo Nordisk.

- Competitor strategies often involved direct-to-consumer advertising, increasing brand awareness in the weight-loss community more rapidly.

Slower Expansion into Weight-Loss Channels

Novo Nordisk's slower expansion into weight-loss specific channels also contributed to the initial lag.

- Access to specialized weight-loss clinics and practitioners was initially limited compared to competitors.

- Distribution strategies focused more on traditional diabetes care channels, delaying penetration into the weight-loss market.

- The company's approach to partnerships with weight-loss specialists was slower than those of some competitors.

Accessibility and Pricing

The cost of Ozempic and accessibility barriers played a considerable role in its initial market performance in the weight-loss space.

High Cost and Insurance Coverage

Ozempic's price point and insurance coverage limitations created access barriers, particularly when compared to other weight-loss options.

- The cost of Ozempic is considerably higher than many other weight-loss treatments, leading to out-of-pocket expenses for many patients.

- Insurance reimbursement rates varied significantly, with some plans providing limited or no coverage, making it financially inaccessible for numerous individuals.

- The high cost created a pricing barrier, limiting adoption and hindering market penetration compared to lower-cost alternatives.

Prescription Requirements and Access Barriers

Prescription requirements and related hurdles further limited access to Ozempic.

- Patients required doctor visits and consultations, creating time and logistical barriers for some.

- Wait times for appointments with healthcare professionals capable of prescribing Ozempic could be significant.

- Geographic limitations in access to prescribing physicians added to the challenges.

Public Perception and Brand Awareness (Specific to Weight Loss)

Public perception and brand awareness within the weight-loss community were critical factors impacting Ozempic's initial market share.

Lack of Early Awareness in the Weight-Loss Community

Early adoption of Ozempic for weight loss was slow due to a lack of awareness within this specific target audience.

- Brand awareness among the weight-loss community lagged behind that of competitors who had established a strong presence in this niche.

- Social media and word-of-mouth marketing played a significant role for competitors, contributing to their faster uptake.

- Novo Nordisk's initial focus on diabetes limited its organic reach within online weight-loss communities.

Negative Press and Misinformation

Negative press and misinformation surrounding Ozempic and its potential side effects also impacted consumer perception.

- Negative news coverage, often exaggerating or misrepresenting risks, impacted consumer confidence.

- Online discussions and social media posts sometimes spread inaccurate information, creating confusion and concerns.

- Addressing these concerns and improving transparency were crucial in building consumer trust and mitigating negative perceptions.

Conclusion: Understanding Ozempic's Weight-Loss Journey

Ozempic's initial lag in the weight-loss market stemmed from a confluence of factors: a marketing strategy initially focused on diabetes, pricing and accessibility challenges, and fluctuating public perception. Despite these initial hurdles, the effectiveness of Ozempic for weight loss remains undeniable. Learn more about Ozempic weight loss and explore Ozempic for weight management by visiting the Novo Nordisk website. Understanding the market dynamics surrounding Ozempic and similar medications is crucial for navigating the evolving landscape of weight management treatments.

Featured Posts

-

Gorillaz Celebrate 25 Years A Retrospective Exhibition And Special Performances

May 30, 2025

Gorillaz Celebrate 25 Years A Retrospective Exhibition And Special Performances

May 30, 2025 -

The Impact Of Vivian Jenna Wilsons Modeling Debut

May 30, 2025

The Impact Of Vivian Jenna Wilsons Modeling Debut

May 30, 2025 -

Popeye And Robin Williams A Look At The Alleged Drug Fueled Filming

May 30, 2025

Popeye And Robin Williams A Look At The Alleged Drug Fueled Filming

May 30, 2025 -

Second Straight Day Of School Closures Due To Winter Storm

May 30, 2025

Second Straight Day Of School Closures Due To Winter Storm

May 30, 2025 -

Army Rejoices Jin Promises Bts Comeback After Coldplay Seoul Appearance

May 30, 2025

Army Rejoices Jin Promises Bts Comeback After Coldplay Seoul Appearance

May 30, 2025

Latest Posts

-

Zverevs Road To The Semifinals At The Bmw Open

May 31, 2025

Zverevs Road To The Semifinals At The Bmw Open

May 31, 2025 -

New Covid 19 Cases In India Analysis Of The Recent Rise And Xbb 1 5 Variant

May 31, 2025

New Covid 19 Cases In India Analysis Of The Recent Rise And Xbb 1 5 Variant

May 31, 2025 -

Italian International Tennis Alcaraz Advances Passaro Upsets Dimitrov

May 31, 2025

Italian International Tennis Alcaraz Advances Passaro Upsets Dimitrov

May 31, 2025 -

Covid 19 In India A Moderate Increase Amidst The Global Xbb 1 5 Variant Wave

May 31, 2025

Covid 19 In India A Moderate Increase Amidst The Global Xbb 1 5 Variant Wave

May 31, 2025 -

Covid 19 Jn 1 Variant In India Staying Safe Amidst The Outbreak

May 31, 2025

Covid 19 Jn 1 Variant In India Staying Safe Amidst The Outbreak

May 31, 2025