Nvidia's Global Challenges: A Broader Perspective Than China

Table of Contents

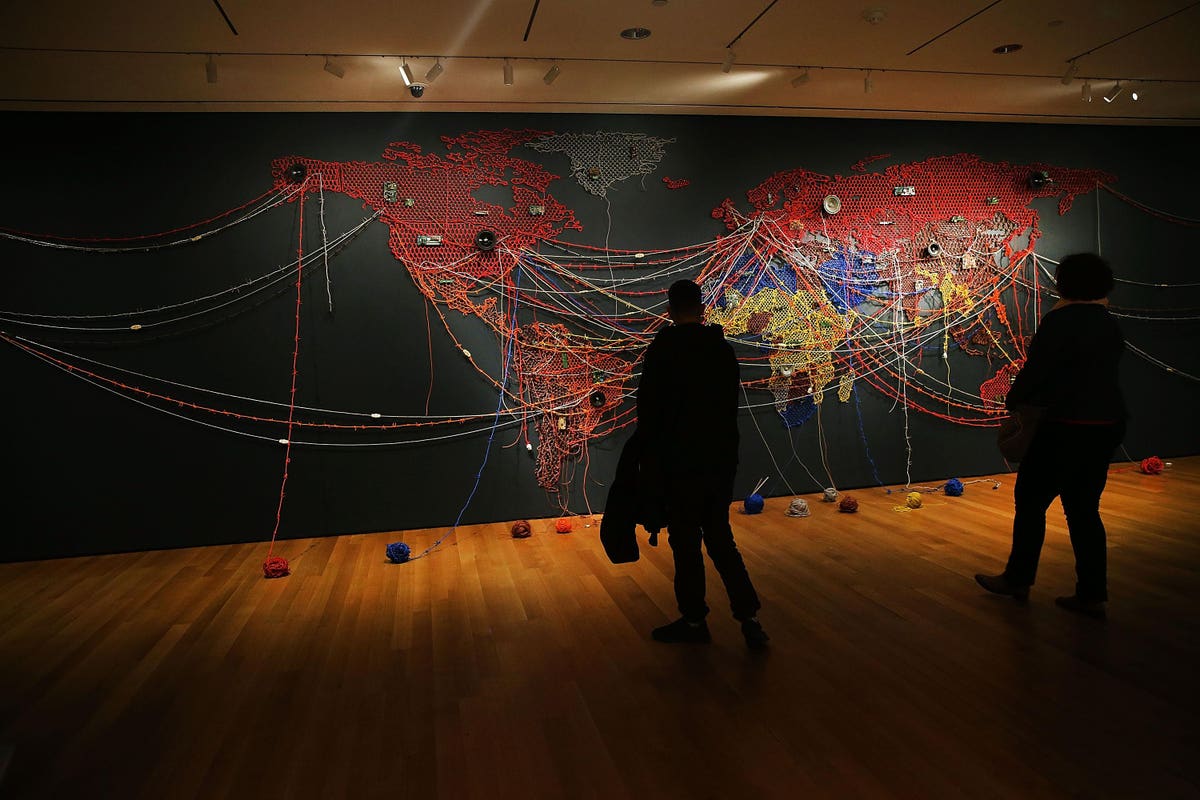

Geopolitical Risks and International Trade Tensions

Escalating geopolitical tensions between major global powers, particularly the US-China relationship, significantly impact Nvidia's operations and supply chains. The semiconductor industry is inherently global, making it vulnerable to trade wars, export controls, and sanctions. These factors introduce significant uncertainty and risk to Nvidia's business model.

- Impact of export controls and sanctions on sales to specific regions: Restrictions on the sale of high-performance computing chips to certain countries directly affect Nvidia's revenue streams and market reach. This necessitates careful navigation of complex international regulations.

- Risks associated with relying on global manufacturing and supply chains: Nvidia's reliance on a global network of suppliers and manufacturers exposes it to disruptions caused by geopolitical instability, natural disasters, and pandemics. The global chip shortage of recent years highlighted this vulnerability acutely.

- Diversification strategies to mitigate geopolitical risks: To mitigate these risks, Nvidia is likely exploring strategies like diversifying its manufacturing base and securing alternative supply chains. This involves substantial investment and long-term planning.

- Potential for future trade restrictions impacting component sourcing or finished product sales: The ongoing evolution of international relations means the potential for future trade restrictions remains a constant concern for Nvidia and the entire semiconductor sector. This necessitates ongoing monitoring and adaptation.

Intense Competition in the AI Chip Market

Nvidia currently dominates the AI chip market, but its leadership position is not guaranteed. The competitive landscape is intensifying with key players like AMD, Intel, and Qualcomm aggressively pursuing market share with their own AI accelerators and GPUs.

- Market share analysis of Nvidia versus key competitors: While Nvidia currently holds a significant lead, competitors are rapidly developing and launching competitive products, challenging Nvidia's dominance. Close monitoring of market share data is crucial.

- Analysis of competitors' technological advancements and their potential impact on Nvidia's dominance: AMD's MI series GPUs and Intel's Ponte Vecchio are examples of advancements that are directly challenging Nvidia’s technological leadership in the high-performance computing space.

- Discussion of pricing strategies and potential price wars: Competitive pressures may lead to price wars, impacting Nvidia's profitability margins and requiring strategic responses to maintain competitiveness.

- Nvidia's strategies to maintain its competitive edge: Nvidia will need to continue investing heavily in research and development, focusing on innovation, and expanding its product portfolio to stay ahead of the competition.

Supply Chain Vulnerabilities and Manufacturing Challenges

Nvidia's manufacturing process relies heavily on external partners, notably Taiwan Semiconductor Manufacturing Company (TSMC), which introduces significant vulnerabilities. Securing raw materials and ensuring sufficient production capacity are also major challenges.

- Dependence on Taiwan Semiconductor Manufacturing Company (TSMC) and potential risks: TSMC's concentration in Taiwan creates geopolitical and logistical risks for Nvidia, emphasizing the need for diversification.

- Challenges related to securing raw materials and components: The semiconductor industry's reliance on specific rare earth minerals and other materials creates supply chain fragility, which can be exacerbated by geopolitical events or natural disasters.

- Strategies to diversify manufacturing and reduce reliance on single suppliers: Nvidia is likely exploring options to diversify its manufacturing base, reducing its reliance on any single entity. This is a complex and costly undertaking.

- The impact of global chip shortages on Nvidia's production capabilities: Past chip shortages have demonstrated the fragility of the semiconductor supply chain and the need for proactive risk management strategies within Nvidia’s operations.

Talent Acquisition and Retention in a Competitive Market

Attracting and retaining top talent in the highly competitive AI and semiconductor industries is crucial for Nvidia's continued success. The demand for skilled engineers and researchers far exceeds supply.

- Competition for skilled engineers and researchers: Nvidia faces fierce competition from other tech giants and startups for the best AI engineers and researchers.

- Strategies to attract and retain talent (e.g., compensation packages, benefits, company culture): Attractive compensation, benefits packages, and a strong company culture are crucial for recruiting and retaining top talent in this competitive environment.

- The impact of a talent shortage on innovation and growth: A shortage of skilled workers can hamper innovation and slow down the development of new products and technologies, impacting Nvidia's future growth trajectory.

Conclusion

Nvidia's success is not solely dependent on its performance in any single market, including China. The company faces a complex web of global challenges, including geopolitical risks, intense competition from players like AMD and Intel, and supply chain vulnerabilities. Understanding these broader issues is crucial for accurately assessing Nvidia's long-term prospects within the ever-evolving AI chip market and the wider semiconductor industry. To stay informed on the ever-evolving landscape of Nvidia's global challenges and its strategies to overcome them, continue to follow our analysis and insights on the Nvidia challenges and the wider semiconductor industry.

Featured Posts

-

Glissieres De Securite Routiere Impact Sur La Mortalite Et L Amenagement Des Routes

Apr 30, 2025

Glissieres De Securite Routiere Impact Sur La Mortalite Et L Amenagement Des Routes

Apr 30, 2025 -

Top 5 Cruise Lines For Families In 2024

Apr 30, 2025

Top 5 Cruise Lines For Families In 2024

Apr 30, 2025 -

Document Amf Edenred 2025 E1029244 Guide De Lecture

Apr 30, 2025

Document Amf Edenred 2025 E1029244 Guide De Lecture

Apr 30, 2025 -

The Diverging Paths Of Altman And Nadella Implications For The Future Of Ai

Apr 30, 2025

The Diverging Paths Of Altman And Nadella Implications For The Future Of Ai

Apr 30, 2025 -

6 Doi Thu Thua Cuoc Tam Hop Vuon Len Trung Thau Du An Cap Nuoc Gia Dinh

Apr 30, 2025

6 Doi Thu Thua Cuoc Tam Hop Vuon Len Trung Thau Du An Cap Nuoc Gia Dinh

Apr 30, 2025

Latest Posts

-

Alex Ovechkin Ties Wayne Gretzkys Nhl Goal Record

Apr 30, 2025

Alex Ovechkin Ties Wayne Gretzkys Nhl Goal Record

Apr 30, 2025 -

Analyzing The Celtics Cavaliers Game 4 Takeaways Featuring Derrick Whites Performance

Apr 30, 2025

Analyzing The Celtics Cavaliers Game 4 Takeaways Featuring Derrick Whites Performance

Apr 30, 2025 -

Ovechkins 894th Goal Nhl Record Tied With Wayne Gretzky

Apr 30, 2025

Ovechkins 894th Goal Nhl Record Tied With Wayne Gretzky

Apr 30, 2025 -

Derrick Whites Heroics Power Celtics Past Cavaliers 4 Crucial Takeaways

Apr 30, 2025

Derrick Whites Heroics Power Celtics Past Cavaliers 4 Crucial Takeaways

Apr 30, 2025 -

Alex Ovechkin Ties Gretzkys Nhl Goal Record With 894th Goal

Apr 30, 2025

Alex Ovechkin Ties Gretzkys Nhl Goal Record With 894th Goal

Apr 30, 2025