NYSE Parent Company ICE Reports Higher-Than-Expected First-Quarter Profits

Table of Contents

Strong Performance Across ICE's Diverse Business Units

ICE's impressive Q1 results stemmed from robust performance across its diverse business units. Revenue growth was driven by increased trading volumes, higher demand for data and analytics services, and strong performance in clearing and settlement operations. This demonstrates the effectiveness of ICE's diversified business model in generating consistent profitability, even amidst market fluctuations.

- Significant growth in futures trading volume: ICE reported a substantial increase in futures trading volume across various asset classes, including energy, agricultural products, and interest rates. This surge is likely attributed to increased market volatility and investor activity. Specific figures released by ICE should be included here when available (e.g., "Futures trading volume increased by X% compared to Q1 2022").

- Increased demand for data and analytics services: ICE's data and analytics offerings, crucial for market participants, experienced significant growth. This reflects the rising need for sophisticated tools and insights in navigating complex market conditions. The expansion of ICE's data products and partnerships likely contributed to this positive trend.

- Strong performance in clearing and settlement operations: ICE's clearing houses processed a high volume of transactions efficiently and effectively. The seamless execution of these critical processes contributes significantly to market stability and trust, further solidifying ICE's position within the financial ecosystem.

- Successful integration of recent acquisitions (if applicable): If ICE made any significant acquisitions recently, their successful integration into the broader business model would be a key factor contributing to increased profitability. This should be discussed with specific examples and quantifiable results.

Impact of Increased Market Volatility on ICE's Profitability

While market volatility can present risks, it can also drive increased trading activity. ICE's Q1 performance suggests that the increased volatility observed in the market translated into higher trading volumes across its platforms. The company’s robust risk management strategies played a crucial role in mitigating potential negative impacts, allowing ICE to capitalize on increased trading activity without substantial losses.

- Higher trading volumes due to increased market uncertainty: Periods of uncertainty often lead to heightened investor activity, resulting in larger trading volumes. ICE's position as a major player in various financial markets allowed it to benefit from this increased activity.

- Effective risk management strategies mitigating potential losses: ICE’s proactive risk management practices were vital in ensuring the company could successfully navigate market volatility. This expertise minimizes potential losses and maximizes returns during periods of heightened uncertainty.

- Increased demand for ICE's risk management solutions: Market volatility often leads to increased demand for robust risk management solutions. ICE’s offerings in this area are likely to have experienced increased demand, contributing positively to overall profitability.

Future Outlook and Implications for Investors

ICE's strong Q1 earnings provide a positive outlook for the company's future performance. The sustained growth across its diverse business segments suggests resilience and adaptability. Analysts will likely revise their financial projections for ICE upward, potentially impacting the stock price positively. However, investors should also consider potential risks and uncertainties before making investment decisions.

- Potential impact on ICE's stock price: The strong Q1 earnings are expected to positively influence ICE's stock price. However, the actual impact will depend on various market factors and investor sentiment.

- Analysts' revised forecasts for ICE's performance: Following the Q1 results, financial analysts are expected to revise their forecasts for ICE's full-year performance, likely upward.

- Investment opportunities and risks associated with ICE stock: ICE stock presents both investment opportunities and risks. Investors should thoroughly analyze the company's financial statements and market conditions before making investment decisions.

- Comparison of ICE's performance to competitors: A comparative analysis with competitors in the financial market will offer a more comprehensive view of ICE’s success and provide context for future predictions.

Conclusion

Intercontinental Exchange's better-than-anticipated first-quarter earnings highlight the company's resilience and adaptability within a dynamic financial market. Strong performance across multiple business units, coupled with effective risk management, contributed to this significant profit increase. The implications for investors are substantial, potentially impacting future investment strategies. Stay informed about the latest developments regarding NYSE parent company ICE and its financial performance. Keep an eye on future earnings reports to understand the long-term growth trajectory of this key player in the global financial markets. Learn more about investing in ICE and other leading financial companies by [link to relevant resource/investment platform].

Featured Posts

-

Banned Candles In Canada Etsy Walmart Amazon Sales

May 14, 2025

Banned Candles In Canada Etsy Walmart Amazon Sales

May 14, 2025 -

The Unfading Influence Of A Giants Legend

May 14, 2025

The Unfading Influence Of A Giants Legend

May 14, 2025 -

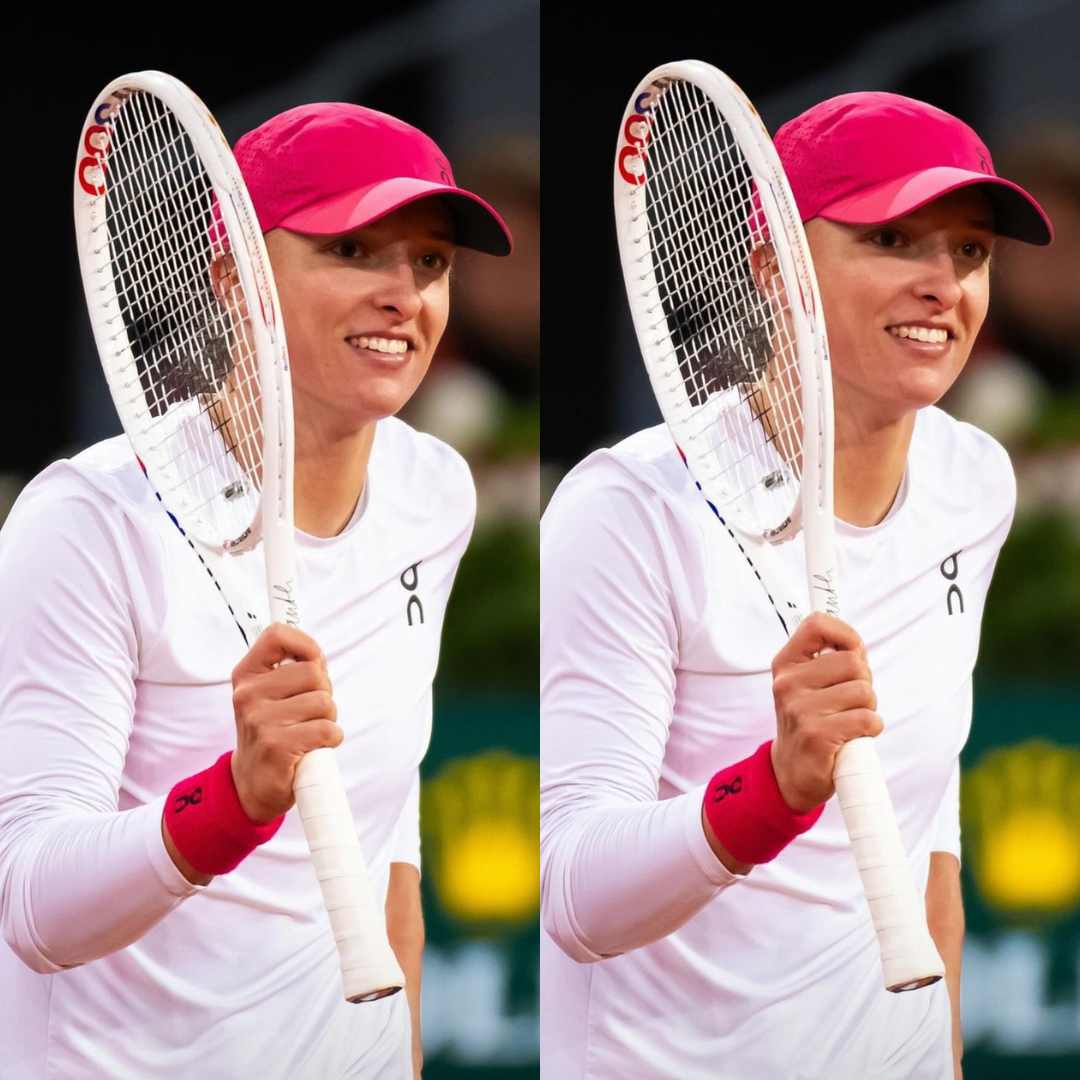

Swiateks Rome Defeat Drop From World No 2 Confirmed

May 14, 2025

Swiateks Rome Defeat Drop From World No 2 Confirmed

May 14, 2025 -

Tommy Fury And Jake Pauls Feud Analyzing The Daddy Remark

May 14, 2025

Tommy Fury And Jake Pauls Feud Analyzing The Daddy Remark

May 14, 2025 -

Amorims Transfer Wishlist 7 Potential Manchester United Signings This Summer

May 14, 2025

Amorims Transfer Wishlist 7 Potential Manchester United Signings This Summer

May 14, 2025

Latest Posts

-

Mirka I Rodzer Federer Dva Para Blizanaca Fotografije I Detalji

May 14, 2025

Mirka I Rodzer Federer Dva Para Blizanaca Fotografije I Detalji

May 14, 2025 -

Bad Gottleuba Berggiesshuebel Ermittlungen Nach Toedlichem Wohnungsbrand

May 14, 2025

Bad Gottleuba Berggiesshuebel Ermittlungen Nach Toedlichem Wohnungsbrand

May 14, 2025 -

Wohnungsbrand Mit Todesopfern In Bad Gottleuba Berggiesshuebel

May 14, 2025

Wohnungsbrand Mit Todesopfern In Bad Gottleuba Berggiesshuebel

May 14, 2025 -

Leichenfund Nach Wohnungsbrand In Bad Gottleuba Berggiesshuebel

May 14, 2025

Leichenfund Nach Wohnungsbrand In Bad Gottleuba Berggiesshuebel

May 14, 2025 -

Tragoedie In Bad Gottleuba Berggiesshuebel Brandopfer Gefunden

May 14, 2025

Tragoedie In Bad Gottleuba Berggiesshuebel Brandopfer Gefunden

May 14, 2025