Oil Production Outlook: OPEC+ To Decide On July Output Levels

Table of Contents

H2: Current Global Oil Market Dynamics

The current global oil market is a complex interplay of supply, demand, and geopolitical factors. Understanding these dynamics is crucial to predicting the OPEC+ decision.

-

Global Oil Demand: Global oil demand shows signs of robust growth for the remainder of 2024, fueled by a recovering global economy, particularly in Asia. However, seasonal factors and potential economic slowdowns in certain regions could temper this growth. The International Energy Agency (IEA) and OPEC itself will release updated demand forecasts in the coming weeks, providing crucial data points for the OPEC+ decision.

-

Oil Supply: Current oil supply levels are a mixture of stability and uncertainty. While OPEC+ members are producing at agreed-upon levels, production challenges and disruptions in non-OPEC producing nations, such as those experiencing political instability or facing maintenance issues, are impacting overall supply. This puts pressure on the cartel to address potential shortfalls.

-

Oil Inventories: Oil inventory levels in key storage hubs like Cushing, Oklahoma, and Rotterdam are being closely monitored. High inventory levels generally indicate a surplus, potentially leading to lower prices, while low inventories can signal tighter markets and upward pressure on prices. These levels directly influence OPEC+'s assessment of market balance.

-

Geopolitical Risks: Geopolitical instability, especially the ongoing conflict in Ukraine, remains a major wildcard. Sanctions on Russian oil and potential disruptions to crucial oil transportation routes through the Black Sea and other regions create considerable uncertainty and contribute to price volatility.

-

Global Economic Outlook: The global economic outlook plays a significant role in shaping oil demand forecasts. A robust economic recovery typically boosts oil consumption, while a potential slowdown or recession could significantly dampen demand, impacting OPEC+'s production strategy.

H2: OPEC+'s Recent Decisions and Trends

OPEC+'s recent actions and history provide valuable clues about their likely July decision.

-

OPEC+ Production Cuts: OPEC+ has implemented several production cuts in recent months, primarily aimed at stabilizing oil prices and preventing a significant price drop. The effectiveness of these cuts in supporting prices will be a key factor in their upcoming decision.

-

Compliance Rates: Monitoring the compliance rates of OPEC+ members with agreed-upon production quotas is essential. Consistent compliance demonstrates the cartel's commitment to its strategy, while low compliance raises concerns about its effectiveness and potential internal discord.

-

Strategic Goals: OPEC+'s strategic goals typically revolve around maintaining market share and ensuring price stability. They seek to avoid both excessive price volatility and prolonged periods of low prices that could hurt their member states' economies.

-

Internal Dynamics: Disagreements among OPEC+ members, particularly between Saudi Arabia and other nations, are not uncommon. Navigating these internal tensions and forging a consensus on production levels is a crucial aspect of the decision-making process.

H2: Factors Influencing the July Decision

Several crucial factors will likely influence the OPEC+ decision in July.

-

Oil Price Forecasts: Oil price forecasts from various organizations and analysts will be closely studied. Predictions of sustained price increases or significant drops will heavily influence the cartel's decision to increase, maintain, or further cut production.

-

Inflation and Economic Slowdown: High inflation and the risk of a global economic slowdown could significantly impact future oil demand. OPEC+ will need to factor in potential demand reductions when deciding on July output levels.

-

Renewable Energy and the Energy Transition: The growing adoption of renewable energy sources and the global energy transition pose a long-term challenge to oil demand. While not the immediate focus, OPEC+ must consider the long-term implications of this shift on its production strategies.

-

Energy Transition: The shift toward cleaner energy sources is gradually reducing reliance on fossil fuels. This long-term trend impacts OPEC+'s overall planning and influences its short-term decisions, although its effects may not be felt immediately.

H3: Potential Scenarios and Their Implications

Several scenarios could emerge from the OPEC+ meeting.

-

Maintaining Current Production Levels: Maintaining current production levels would signal relative confidence in the market’s balance. This could lead to modest price stability but may not address potential supply shortages.

-

Increasing Production: Increasing production would aim to address potential supply tightness and lower prices, but it could also lead to lower revenues for OPEC+ members.

-

Implementing Further Production Cuts: Further cuts would aim to bolster prices but could exacerbate supply concerns and potentially lead to increased price volatility.

Each scenario carries different implications for global oil prices, market stability, and the various stakeholders involved – consumers, producers, and investors. The choice will significantly influence the broader oil production outlook.

3. Conclusion

The OPEC+ decision on July oil production levels is a critical factor that will significantly impact the global oil production outlook. Numerous interconnected factors, including global demand, geopolitical instability, and internal OPEC+ dynamics, will shape this pivotal decision. The potential outcomes – maintaining current production, increasing output, or implementing further cuts – will have far-reaching consequences for oil prices and market stability. The upcoming decision will shape the future oil production outlook and demands careful monitoring. Stay tuned for updates on the upcoming OPEC+ meeting and its impact on the global oil market. Continue to monitor the oil production outlook for insights into the future of crude oil prices. Follow our blog for more in-depth analyses on the oil production outlook and OPEC+ decisions.

Featured Posts

-

Everything Going To Be Great Trailer First Look

May 29, 2025

Everything Going To Be Great Trailer First Look

May 29, 2025 -

Karl Weinbar Neueroeffnung An Der Venloer Strasse Weine Atmosphaere And Mehr

May 29, 2025

Karl Weinbar Neueroeffnung An Der Venloer Strasse Weine Atmosphaere And Mehr

May 29, 2025 -

Inter Rent Reit Receives Takeover Bid Analysis Of The Offer

May 29, 2025

Inter Rent Reit Receives Takeover Bid Analysis Of The Offer

May 29, 2025 -

Legal Developments In The Live Nation Antitrust Case Under Trump

May 29, 2025

Legal Developments In The Live Nation Antitrust Case Under Trump

May 29, 2025 -

Netflix Exec Teases Emotional Stranger Things Season 5

May 29, 2025

Netflix Exec Teases Emotional Stranger Things Season 5

May 29, 2025

Latest Posts

-

How To Achieve The Good Life Steps To Happiness And Fulfillment

May 31, 2025

How To Achieve The Good Life Steps To Happiness And Fulfillment

May 31, 2025 -

75 Year Old Duncan Bannatyne And Wife Nigora Witness Impact Of Operation Smile

May 31, 2025

75 Year Old Duncan Bannatyne And Wife Nigora Witness Impact Of Operation Smile

May 31, 2025 -

Behind The Scenes Of Dragons Den Fact And Fiction

May 31, 2025

Behind The Scenes Of Dragons Den Fact And Fiction

May 31, 2025 -

Cocina Historica Aragonesa Receta Facil Con 3 Ingredientes

May 31, 2025

Cocina Historica Aragonesa Receta Facil Con 3 Ingredientes

May 31, 2025 -

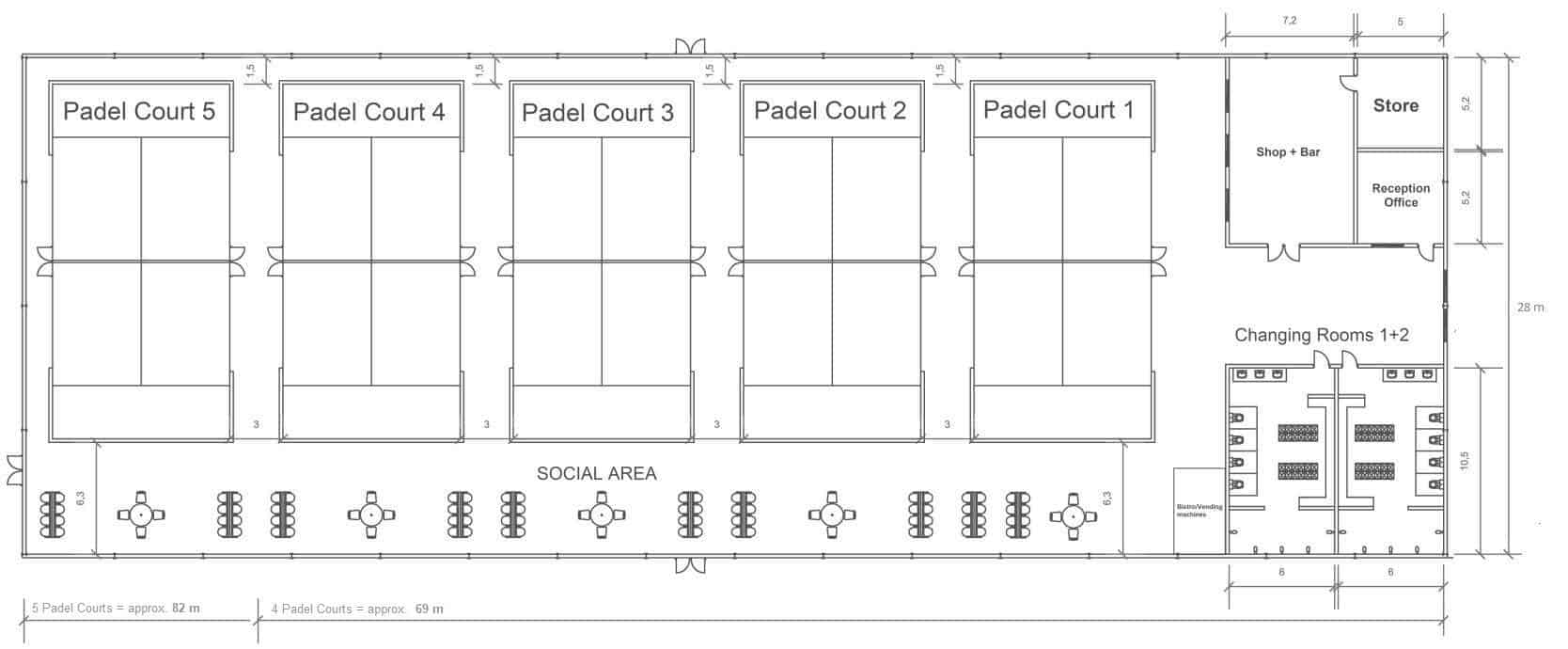

Essex Bannatynes Padel Court Plans A Detailed Proposal

May 31, 2025

Essex Bannatynes Padel Court Plans A Detailed Proposal

May 31, 2025