Oil Supply Shocks: How The Airline Industry Is Feeling The Heat

Table of Contents

Soaring Fuel Costs: The Biggest Headache

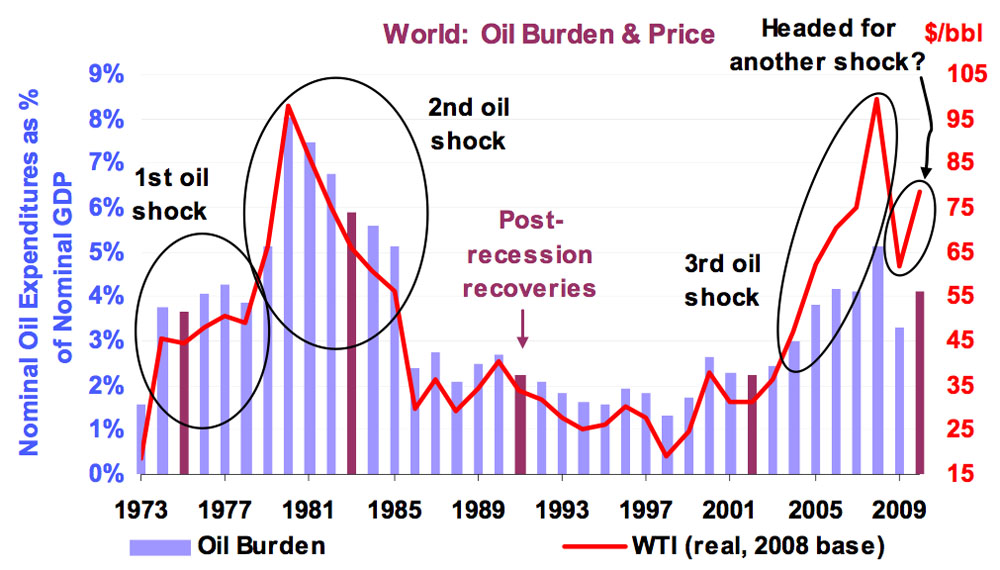

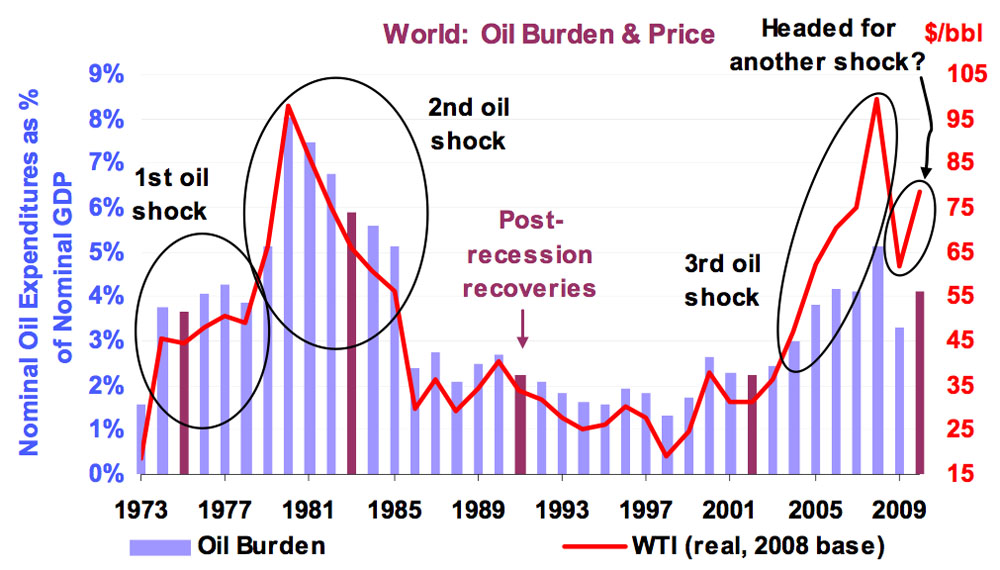

The most immediate and significant impact of oil supply shocks on the airline industry is the dramatic increase in fuel costs. Jet fuel, a crucial operational expense, is directly tied to the price of crude oil. Any surge in oil prices translates almost immediately into higher fuel bills for airlines, severely impacting their profitability.

- Percentage increase in fuel costs: Over the past year, the cost of jet fuel has increased by an estimated 40-60% in many regions, depending on the specific location and airline. This dramatic increase puts immense pressure on already tight operating margins.

- Impact on operating margins and profitability: Airlines, already battling post-pandemic recovery challenges, are now grappling with significantly reduced operating margins. Many are experiencing substantial losses or are only barely profitable, with fuel costs eating into a significant portion of their revenue.

- Examples of airlines announcing fuel surcharges: Several major airlines have already announced or implemented fuel surcharges to pass on some of these increased costs to consumers. This is a controversial tactic, as it can further deter passengers already facing higher fares.

- Hedging strategies: Many airlines utilize hedging strategies to mitigate the impact of fluctuating fuel prices. These strategies involve locking in future fuel prices at a predetermined rate. However, the effectiveness of hedging depends heavily on the accuracy of price predictions and the complexity of the hedging instruments. Recent volatility has proved challenging for even sophisticated hedging strategies.

Fuel Efficiency Strategies and Technological Advancements

Airlines are actively pursuing fuel efficiency improvements to counter the impact of soaring fuel costs. This involves a multi-pronged approach:

- Newer aircraft: Modern aircraft are significantly more fuel-efficient than older models. Airlines are investing in newer fleets to reduce their fuel consumption per passenger mile.

- Optimized flight paths: Implementing more efficient flight paths, utilizing advanced air traffic management systems, and reducing unnecessary taxiing time can contribute to fuel savings.

- Weight reduction: Reducing the weight of aircraft through lighter materials and efficient cargo loading also improves fuel efficiency.

- Sustainable Aviation Fuels (SAFs): The increasing adoption of SAFs, produced from renewable sources, offers a pathway towards reducing reliance on traditional jet fuel and lowering carbon emissions. However, SAF production is currently limited, and scaling up production to meet industry demand presents a significant challenge.

- Advancements in aircraft technology: Ongoing advancements in aircraft design and engine technology promise further improvements in fuel economy in the coming years.

Ticket Prices and Consumer Demand: A Delicate Balance

The surge in fuel costs inevitably leads to increased ticket prices. Airlines face a challenging balancing act: passing on some of the increased costs to consumers to maintain profitability while remaining competitive in a price-sensitive market.

- Elasticity of demand: The demand for air travel is not entirely inelastic; consumers are sensitive to price increases, especially leisure travelers. Business travelers often have less price sensitivity, but even this segment can be affected by significant fare hikes.

- Impact on travel frequency and passenger numbers: Higher ticket prices can lead to a decrease in overall passenger numbers, particularly impacting leisure travel. This reduction in demand can further strain airline profitability.

- Market segment sensitivity: Business travelers are generally less sensitive to price increases than leisure travelers. Airlines will need to develop tailored pricing strategies to balance the needs of these different market segments.

- Absorbing costs: Airlines might strategically absorb some of the increased costs to maintain market share, especially in competitive routes. However, this approach can significantly impact profitability.

The Ripple Effect: Impacts Beyond Fuel Costs

The effects of oil supply shocks extend beyond simply higher fuel costs. The industry faces a cascade of indirect impacts:

- Increased maintenance costs: Inflation driven by rising energy prices impacts the cost of spare parts and maintenance services, adding further strain on airline budgets.

- Supply chain disruptions: The same supply chain bottlenecks affecting many sectors are impacting the availability and cost of aircraft parts, ground support equipment, and other necessary materials.

- Impact on expansion plans: The economic uncertainty caused by high energy costs can lead airlines to postpone or cancel expansion plans and investment in new aircraft or routes.

- Securing financing: The increased financial risk associated with high fuel prices makes it more challenging for airlines to secure financing for future investments.

Government Intervention and Support Measures

Governments may intervene to mitigate the impact of oil supply shocks on the airline industry. Potential measures include:

- Fuel tax reductions or subsidies: Lowering fuel taxes or providing direct subsidies can offer some relief to airlines. However, this can be costly for governments and may have broader economic implications.

- Financial aid packages: Governments might offer financial aid packages to help airlines weather the storm. However, this approach often requires careful consideration of market distortions and potential bailouts.

- Regulatory relief: Easing regulations or streamlining approval processes can help airlines to adapt more quickly to changing conditions.

- Effectiveness and downsides: The effectiveness of government intervention varies depending on the scale of the shock and the design of the support measures. Potential downsides include market distortion, moral hazard, and budgetary pressures.

Conclusion

Oil supply shocks present significant challenges for the airline industry. Soaring fuel costs are directly impacting profitability, forcing airlines to increase ticket prices and explore cost-cutting measures. The ripple effects extend to maintenance, supply chains, and investment decisions. While airlines are implementing fuel efficiency strategies and hedging techniques, government intervention might also play a crucial role in mitigating the impact. Staying informed about the ongoing developments in oil prices and their impact on the airline industry is critical. Understanding oil supply shocks' effect on air travel requires continuous monitoring of fuel prices, airline announcements, and governmental responses. Further research into the effectiveness of various mitigation strategies and the potential for long-term solutions like sustainable aviation fuels will be essential in navigating this complex and evolving situation.

Featured Posts

-

Improved Play Station Experience Sony Launches New Beta Program

May 03, 2025

Improved Play Station Experience Sony Launches New Beta Program

May 03, 2025 -

Sonys Play Station Beta Program A Closer Look At The Latest Update

May 03, 2025

Sonys Play Station Beta Program A Closer Look At The Latest Update

May 03, 2025 -

Photoshop Controversy Christina Aguileras Latest Look

May 03, 2025

Photoshop Controversy Christina Aguileras Latest Look

May 03, 2025 -

La Fire Aftermath Price Gouging Claims And The Selling Sunset Stars Response

May 03, 2025

La Fire Aftermath Price Gouging Claims And The Selling Sunset Stars Response

May 03, 2025 -

Joseph Tf 1 Analyse De La Serie La Creme De La Crim

May 03, 2025

Joseph Tf 1 Analyse De La Serie La Creme De La Crim

May 03, 2025

Latest Posts

-

Glastonbury Festival Scheduling Conflicts Spark Fan Outrage

May 03, 2025

Glastonbury Festival Scheduling Conflicts Spark Fan Outrage

May 03, 2025 -

Glastonbury Stage Times 2024 A Scheduling Nightmare For Fans

May 03, 2025

Glastonbury Stage Times 2024 A Scheduling Nightmare For Fans

May 03, 2025 -

Loyle Carners 3 Arena Show All The Details

May 03, 2025

Loyle Carners 3 Arena Show All The Details

May 03, 2025 -

Dublin Concert Loyle Carner Plays 3 Arena

May 03, 2025

Dublin Concert Loyle Carner Plays 3 Arena

May 03, 2025 -

Loyle Carner 3 Arena Gig Date Tickets And More

May 03, 2025

Loyle Carner 3 Arena Gig Date Tickets And More

May 03, 2025