Omada Health: Andreessen Horowitz-Backed Company Files For US IPO

Table of Contents

Omada Health's Business Model and Target Market

Omada Health employs a sophisticated digital therapeutics approach to chronic disease management. Their platform utilizes telehealth technology to deliver personalized, scalable solutions for individuals battling chronic conditions. This innovative model addresses a critical need in healthcare: providing accessible, affordable, and effective care for patients suffering from conditions like type 2 diabetes and hypertension.

Their target market is multifaceted, encompassing:

- Employers: Offering corporate wellness programs that improve employee health and reduce healthcare costs.

- Health Plans: Providing a cost-effective method for managing chronic conditions within their enrolled populations.

- Individuals: Directly offering access to personalized programs and support.

Omada Health's key programs include:

- Diabetes Prevention Program (DPP): A proven program aimed at preventing type 2 diabetes.

- Weight Management Program: A comprehensive program designed to support healthy weight loss and maintenance.

- Hypertension Management Program: A program focused on controlling blood pressure.

The platform's success stems from its key features:

- Remote Patient Monitoring: Continuous tracking of vital health metrics.

- Personalized Coaching: One-on-one support from certified health coaches.

- Medication Management Tools: Support for adherence to prescribed medications.

- Interactive Educational Materials: Empowering patients with knowledge and self-management skills.

- Seamless Integration with Existing Healthcare Systems: Ensuring ease of use and data sharing.

These features highlight Omada Health's commitment to providing comprehensive, patient-centered virtual care solutions, making them a key player in the digital therapeutics and telehealth markets.

The Role of Andreessen Horowitz and Investor Interest

Andreessen Horowitz, a renowned venture capital firm, has played a crucial role in Omada Health's journey. Their significant investment, spanning multiple funding rounds, underscores their belief in the company's innovative approach and market potential. This backing has provided Omada Health with not only the financial resources but also the credibility and strategic guidance needed to scale their operations and achieve market leadership.

Beyond Andreessen Horowitz, Omada Health has attracted investment from several other prominent investors, demonstrating significant confidence in the digital health sector and Omada's unique position within it. This influx of venture capital and Series funding signifies the broader industry's recognition of the potential for growth in the digital health investment space, particularly in companies focused on providing effective solutions for chronic disease management.

Potential Impact of the Omada Health IPO on the Digital Health Market

A successful Omada Health IPO will likely have profound implications for the digital health market:

- Increased Investment: It could trigger a wave of increased investment in digital therapeutics companies, accelerating innovation and expansion in the sector.

- Wider Adoption: The IPO may lead to increased adoption of virtual care solutions by employers and health plans seeking cost-effective and scalable solutions for chronic disease management. This increased adoption will further accelerate the shift towards telehealth and remote patient monitoring.

- Market Consolidation: It could potentially lead to market consolidation, with larger players acquiring smaller companies to gain a competitive edge.

However, challenges and risks remain:

- Competition: The digital health space is becoming increasingly competitive, requiring Omada Health to maintain its innovative edge and market leadership.

- Regulatory Hurdles: Navigating regulatory landscapes for digital therapeutics can be complex and requires ongoing attention.

- Market Volatility: The success of the IPO will ultimately depend on market conditions and investor sentiment.

Analyzing these factors provides a complete picture of the potential impact of the Omada Health IPO on the broader digital health trends and the IPO market.

Key Financial Projections and Omada Health's Future Outlook

While specific financial projections from the IPO filing are yet to be fully disclosed, analysts expect robust revenue growth and a positive outlook for the company. Omada Health plans to continue expanding its program offerings, enhancing its platform's capabilities, and forging new partnerships to further penetrate its target markets. The company's future success hinges on its ability to maintain its competitive edge, expand its market share, and effectively manage operating costs while driving revenue growth and achieving sustained profitability. This will ensure Omada Health continues to thrive in the increasingly competitive landscape of the digital health market, solidifying its position and future outlook.

Conclusion: Investing in the Future of Digital Health with the Omada Health IPO

The Omada Health IPO represents a pivotal moment for the digital health sector. It showcases the growing acceptance and demand for innovative, technology-driven approaches to chronic disease management. Omada Health's success, facilitated by strategic investments like those from Andreessen Horowitz, holds immense potential for both investors seeking returns in a high-growth sector and patients seeking accessible, effective healthcare. The Omada Health IPO offers a unique opportunity to participate in the future of healthcare. Stay informed about the Omada Health IPO and its impact on the future of digital health. Learn more about investing in the burgeoning digital therapeutics market with the Omada Health IPO and the potential for significant returns.

Featured Posts

-

High Potential Finale A Surprise Reunion After 7 Years

May 10, 2025

High Potential Finale A Surprise Reunion After 7 Years

May 10, 2025 -

Brutal Racist Murder A Familys Unbearable Loss

May 10, 2025

Brutal Racist Murder A Familys Unbearable Loss

May 10, 2025 -

Macron Announces Planned Signing Of France Poland Friendship Treaty

May 10, 2025

Macron Announces Planned Signing Of France Poland Friendship Treaty

May 10, 2025 -

Vegas Golden Nayts Pobeda Nad Minnesotoy V Overtayme Pley Off

May 10, 2025

Vegas Golden Nayts Pobeda Nad Minnesotoy V Overtayme Pley Off

May 10, 2025 -

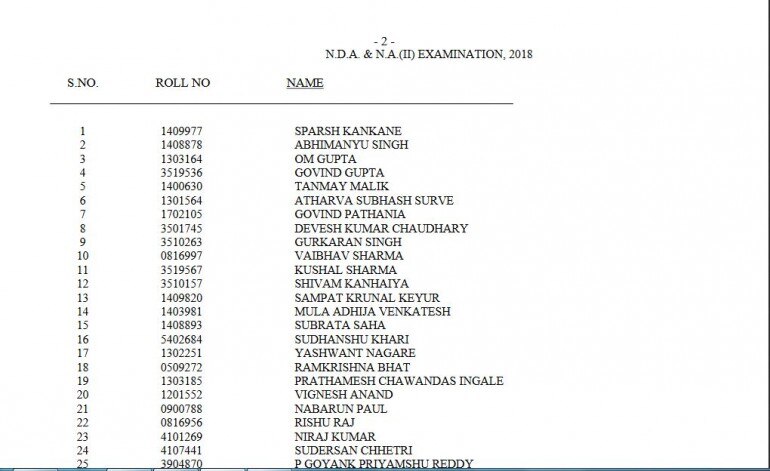

Madhyamik Pariksha Result 2025 Check Merit List Online

May 10, 2025

Madhyamik Pariksha Result 2025 Check Merit List Online

May 10, 2025