One Compelling Reason To Invest In AI Quantum Computing Stocks

Table of Contents

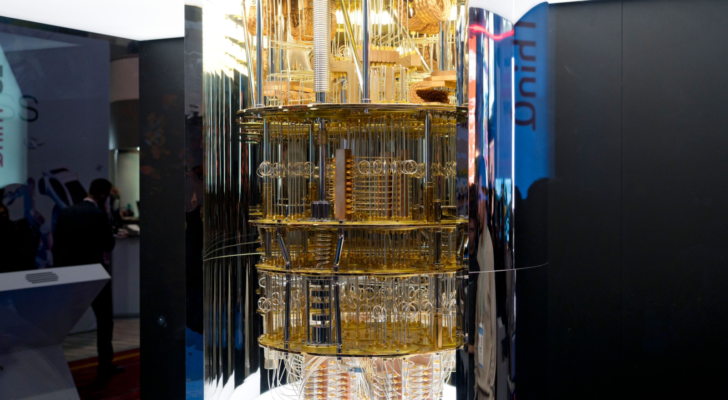

Exponential Computational Power: The Core Advantage

Quantum computing surpasses classical computing in processing power by leveraging the principles of quantum mechanics. This allows it to handle complex calculations that are simply intractable for even the most powerful classical computers, a massive advantage especially relevant for sophisticated AI algorithms. This "quantum computing power" translates directly into faster development cycles and the potential for groundbreaking discoveries.

- AI applications benefiting from this exponential growth:

- Drug discovery and development: Quantum computing accelerates the simulation of molecular interactions, drastically reducing the time and cost of bringing new drugs to market.

- Materials science breakthroughs: Designing new materials with specific properties (e.g., superconductors, high-strength alloys) becomes significantly faster and more efficient.

- Financial modeling and risk assessment: Quantum algorithms can optimize portfolios, manage risk more effectively, and predict market trends with greater accuracy.

- Advanced machine learning algorithms: Quantum computing enables the development of more powerful and efficient machine learning models capable of processing vast datasets and solving complex optimization problems.

The speed and efficiency gains offered by quantum computing lead to faster problem-solving and unlock entirely new possibilities for AI, fueling the growth of AI quantum computing stocks. This computational advantage is a primary reason for the increasing interest in quantum computing investment.

Addressing the Limitations of Classical AI

Current AI technologies face significant limitations, particularly when dealing with increasingly complex data sets and computationally intensive tasks. These limitations hinder progress and stifle innovation. AI quantum computing offers a pathway to overcome these roadblocks.

- How AI quantum computing overcomes classical AI limitations:

- Complex, high-dimensional data sets: Classical AI struggles with the sheer volume and complexity of data encountered in many fields. Quantum computing can efficiently process and analyze such datasets.

- Inefficient algorithms: Classical algorithms are often inefficient for solving certain optimization problems, such as those found in logistics and supply chain management. Quantum algorithms offer significant improvements in efficiency.

- Intractable problems: Many problems currently considered intractable by classical computers become solvable using quantum algorithms. This opens up new horizons in fields like materials science and drug discovery.

By addressing these "classical AI limitations," quantum computing unlocks unprecedented potential, making AI quantum computing stocks an attractive investment opportunity in this rapidly evolving field. The "quantum advantage" is driving considerable interest in quantum computing investment.

Early Mover Advantage in a Nascent Market

The AI quantum computing market is still in its nascent stages, presenting a unique opportunity for early investors. The potential for high growth is substantial, offering significant returns for those who enter the market early. However, it's crucial to understand both the risks and rewards.

- Risks and rewards of investing in a nascent market:

- High potential for growth: Early investment in this emerging technology can lead to disproportionate returns as the market matures.

- Inherent risks: The technology is still developing, and not all companies will succeed. Thorough due diligence is critical.

- Disproportionate returns: Early investment carries the potential for exceptionally high returns, making it a compelling opportunity for risk-tolerant investors.

- Due diligence is crucial: Carefully research and select promising companies with strong technology, a skilled team, and a clear path to market.

The "early adopter advantage" in this "high-growth market" makes investing in AI quantum computing stocks a potentially lucrative, albeit risky, endeavor. Understanding the "emerging technology investment" landscape is key to making informed decisions.

Conclusion: Investing in the Quantum Future of AI

Investing in AI quantum computing stocks presents a compelling opportunity driven by three key factors: exponential computational power, the ability to overcome classical AI limitations, and the significant early mover advantage in a rapidly expanding market. The potential for groundbreaking advancements and substantial financial returns makes this a sector worth serious consideration for forward-thinking investors. Don't miss out on the quantum revolution. Begin your research into AI quantum computing stocks today and secure your place in the future of AI. The "future of AI" is quantum, and strategic "AI quantum computing investment" could significantly benefit your portfolio.

Featured Posts

-

Moysiki Bradia Synaylia Kathigiton Dimotikoy Odeioy Rodoy Stin Dimokratiki

May 20, 2025

Moysiki Bradia Synaylia Kathigiton Dimotikoy Odeioy Rodoy Stin Dimokratiki

May 20, 2025 -

Schumacher Bunic Prima Fotografie Cu Nepoata Nepotul

May 20, 2025

Schumacher Bunic Prima Fotografie Cu Nepoata Nepotul

May 20, 2025 -

Andelka Milivojevic Tadic Detalji Sahrane I Prisustvo Milice Milse

May 20, 2025

Andelka Milivojevic Tadic Detalji Sahrane I Prisustvo Milice Milse

May 20, 2025 -

Space Based Supercomputing Chinas Ambitious Project Takes Shape

May 20, 2025

Space Based Supercomputing Chinas Ambitious Project Takes Shape

May 20, 2025 -

Was Michael Schumachers Comeback A Waste Red Bulls Counsel And The F1 Reality

May 20, 2025

Was Michael Schumachers Comeback A Waste Red Bulls Counsel And The F1 Reality

May 20, 2025

Latest Posts

-

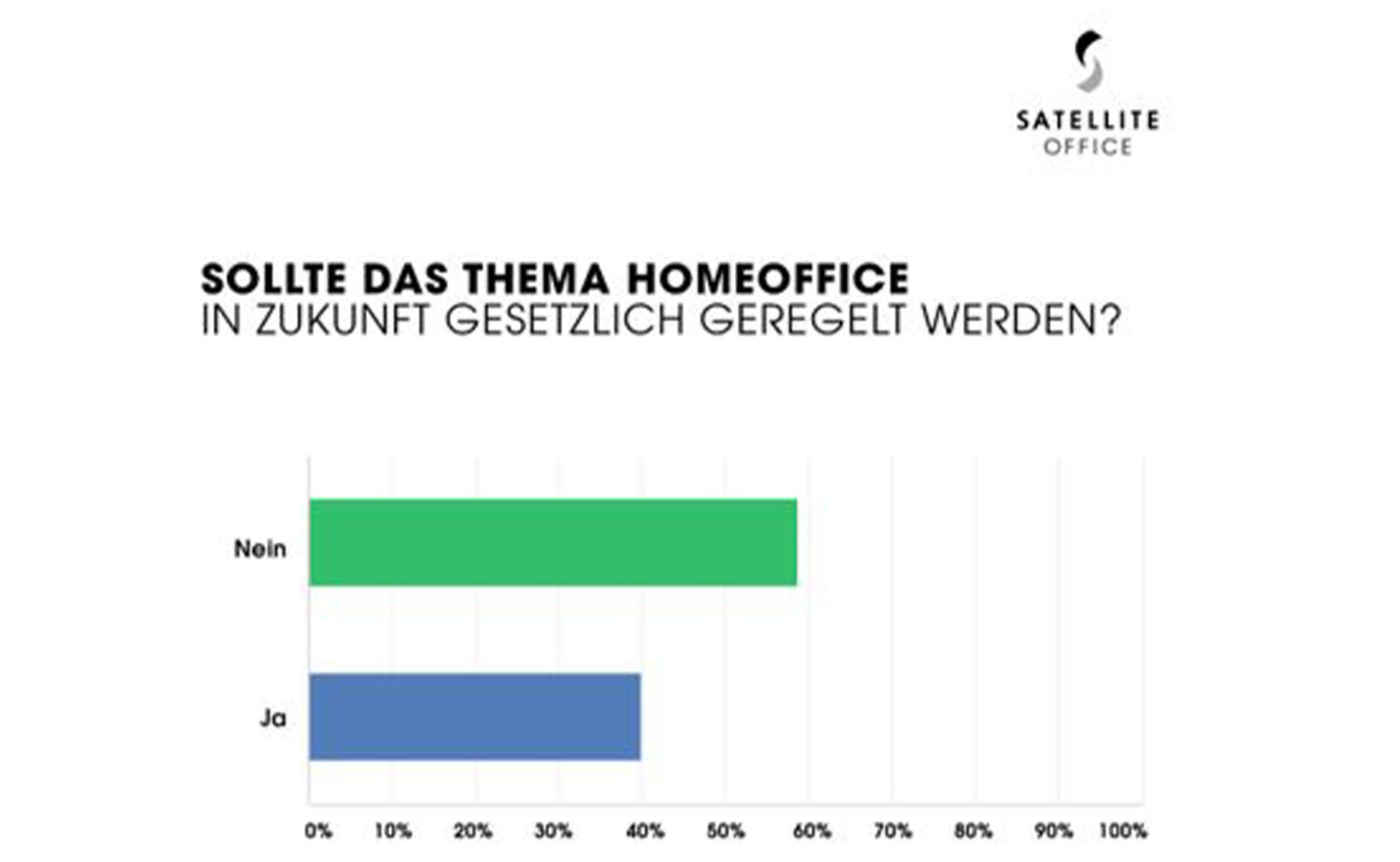

Kancelaria Alebo Home Office Rozhodovanie Na Zaklade Statistik A Potrieb

May 21, 2025

Kancelaria Alebo Home Office Rozhodovanie Na Zaklade Statistik A Potrieb

May 21, 2025 -

Mia Wasikowska Cast In Taika Waititis Next Family Movie

May 21, 2025

Mia Wasikowska Cast In Taika Waititis Next Family Movie

May 21, 2025 -

Home Office Vs Klasicka Kancelaria Pre Koho Je Co Vhodne

May 21, 2025

Home Office Vs Klasicka Kancelaria Pre Koho Je Co Vhodne

May 21, 2025 -

Mia Wasikowska Joins Taika Waititis New Family Film

May 21, 2025

Mia Wasikowska Joins Taika Waititis New Family Film

May 21, 2025 -

Blog Home Office Alebo Kancelaria Vyhody A Nevyhody Oboch Rieseni

May 21, 2025

Blog Home Office Alebo Kancelaria Vyhody A Nevyhody Oboch Rieseni

May 21, 2025