One Cryptocurrency Standing Strong Despite The Trade War

Table of Contents

The Decentralized Nature of Bitcoin as a Safe Haven

Bitcoin's inherent decentralization is a key factor in its resilience against geopolitical risks. Unlike traditional financial systems controlled by central banks and governments, Bitcoin operates on a peer-to-peer network using blockchain technology. This inherent design offers several significant advantages:

- Reduced reliance on centralized institutions vulnerable to trade war impacts: Trade wars often target specific nations or industries, impacting centralized financial institutions. Bitcoin, being decentralized, circumvents this vulnerability. Its network is globally distributed, making it less susceptible to the effects of localized political or economic turmoil.

- Increased resistance to government regulations and sanctions: Governments often implement sanctions and regulations during trade disputes. Bitcoin's decentralized structure makes it inherently resistant to such measures, providing a degree of censorship resistance that traditional assets lack. This is a key aspect of decentralized finance (DeFi).

- Improved security and transparency due to blockchain technology: The transparent and immutable nature of the Bitcoin blockchain enhances security and builds trust. Every transaction is recorded publicly and cryptographically secured, making it difficult to manipulate or censor.

Growing Adoption and Institutional Investment Fueling Bitcoin's Resilience

The increasing adoption of Bitcoin by both individuals and institutions is a significant driver of its strength during periods of trade uncertainty. This growing acceptance reflects a growing confidence in Bitcoin as a store of value and a medium of exchange.

- Growing number of businesses accepting Bitcoin as payment: More and more businesses, from small online retailers to large corporations, are beginning to accept Bitcoin as payment, broadening its utility and driving demand.

- Increased institutional investment in Bitcoin despite market fluctuations: Despite the inherent volatility of the cryptocurrency market, large institutional investors are increasingly allocating a portion of their portfolios to Bitcoin. This influx of capital provides stability and contributes to Bitcoin's market capitalization.

- Development of new use cases for Bitcoin (e.g., NFTs, DeFi applications): The emergence of new applications like non-fungible tokens (NFTs) and decentralized finance (DeFi) protocols is expanding Bitcoin’s utility and driving further adoption.

Technological Advancements Enhancing the Bitcoin Ecosystem

Continuous technological advancements are strengthening the Bitcoin ecosystem and contributing to its resilience. These improvements address scalability challenges and enhance security:

- Improved scalability solutions (e.g., layer-2 scaling): Layer-2 scaling solutions such as the Lightning Network are improving Bitcoin's transaction speed and reducing fees, making it more efficient for everyday use.

- Enhanced security features (e.g., improved consensus mechanisms): Bitcoin's security is constantly being refined and improved through advancements in its consensus mechanisms, making it increasingly resistant to attacks.

- Development of new tools and infrastructure (e.g., improved wallets, exchanges): The development of user-friendly wallets and secure exchanges is making it easier for individuals and institutions to interact with the Bitcoin network.

Bitcoin's Performance Compared to Traditional Assets During Trade Wars

Analyzing Bitcoin's performance relative to traditional assets during periods of trade tension reveals its potential as a hedge against market volatility. While historical data is limited, initial observations suggest a less pronounced negative correlation with traditional assets during such periods, indicating a degree of diversification benefit. (Charts and graphs comparing Bitcoin's performance to stocks and bonds during specific trade war periods would be inserted here). This relative strength is likely due to Bitcoin’s decentralized nature and its position as a global, non-sovereign asset. Further research and correlation analysis are needed to fully understand the relationship between Bitcoin and traditional assets during periods of global instability. This is crucial for effective asset diversification and risk management.

Navigating Trade Wars with the Strength of Bitcoin

In conclusion, Bitcoin's resilience during times of global trade uncertainty is underpinned by its decentralized nature, growing adoption, and continuous technological improvements. Its resistance to centralized control and its increasing integration into the global financial landscape highlight its potential as a valuable asset in a diversified portfolio. Decentralized finance (DeFi) and other technological innovations further solidify this position. Learn more about the benefits of Bitcoin and discover how it can strengthen your investment portfolio against the uncertainties of global trade conflicts. Explore resources like [link to Bitcoin's official website] and [link to a reputable cryptocurrency news source] to delve deeper into this fascinating asset class.

Featured Posts

-

Understanding The Papal Conclave Choosing The Next Leader Of The Catholic Church

May 08, 2025

Understanding The Papal Conclave Choosing The Next Leader Of The Catholic Church

May 08, 2025 -

Westbrook Leads Nuggets In Birthday Song For Jokic

May 08, 2025

Westbrook Leads Nuggets In Birthday Song For Jokic

May 08, 2025 -

Dwp Announces Universal Credit Refund Programme Following Budget Cuts

May 08, 2025

Dwp Announces Universal Credit Refund Programme Following Budget Cuts

May 08, 2025 -

Pnjab Pwlys 29 Afsran Ke Tqrr W Tbadle Ka Nwtyfkyshn

May 08, 2025

Pnjab Pwlys 29 Afsran Ke Tqrr W Tbadle Ka Nwtyfkyshn

May 08, 2025 -

Psl 10 Ticket Sales Starting Today

May 08, 2025

Psl 10 Ticket Sales Starting Today

May 08, 2025

Latest Posts

-

The Planet Star Wars Has Kept Hidden For 48 Years Is The Wait Finally Over

May 08, 2025

The Planet Star Wars Has Kept Hidden For 48 Years Is The Wait Finally Over

May 08, 2025 -

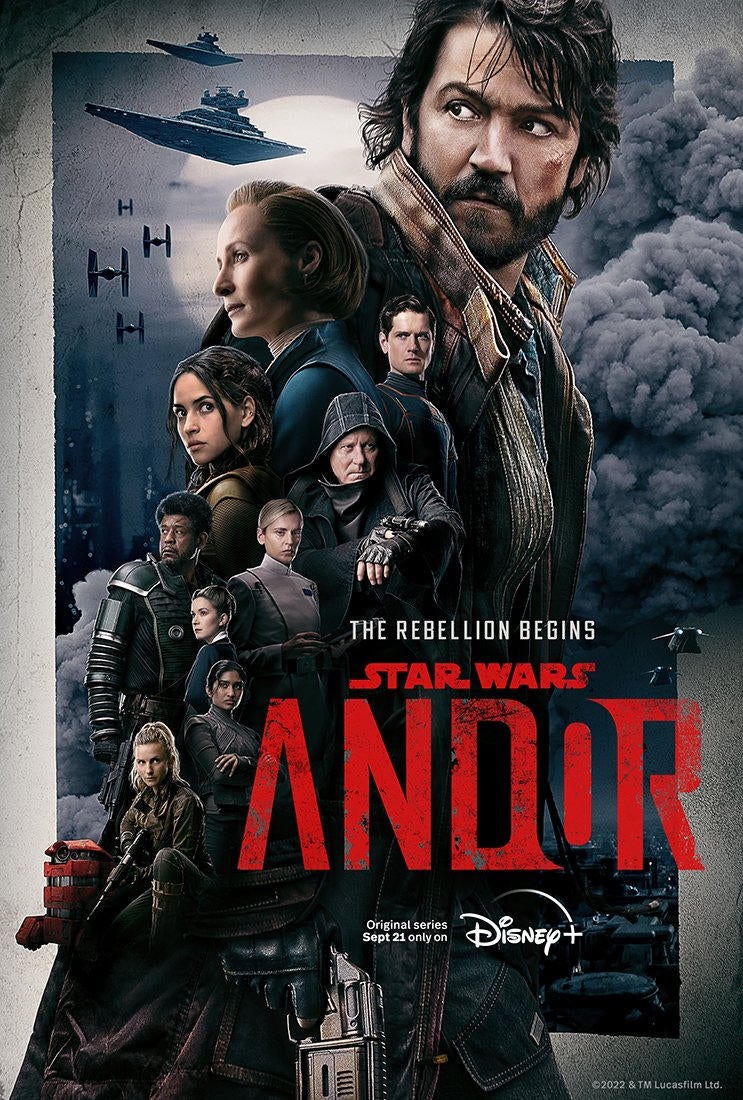

Star Wars The Andor Story Book Project Cancelled Amidst Ai Debate

May 08, 2025

Star Wars The Andor Story Book Project Cancelled Amidst Ai Debate

May 08, 2025 -

Andor Novel Axed Publishers Ai Related Concerns

May 08, 2025

Andor Novel Axed Publishers Ai Related Concerns

May 08, 2025 -

Star Wars Andor Book Cancelled The Ai Controversy

May 08, 2025

Star Wars Andor Book Cancelled The Ai Controversy

May 08, 2025 -

Reaction Kuzma Addresses Tatums Trending Instagram Picture

May 08, 2025

Reaction Kuzma Addresses Tatums Trending Instagram Picture

May 08, 2025