Onex Fully Recoups WestJet Investment With Partial Stake Sale

Table of Contents

Onex's Initial Investment in WestJet

Onex's acquisition of a substantial stake in WestJet marked a significant move in the Canadian airline industry. The private equity firm saw WestJet as a promising investment opportunity, recognizing its potential for growth and expansion within a competitive market. The precise initial investment amount remains undisclosed, however, the strategic rationale was clear: to leverage Onex's expertise in operational improvements and strategic growth to enhance WestJet's market position.

- Acquisition date: [Insert Acquisition Date - Requires Research]

- Percentage of shares acquired: [Insert Percentage - Requires Research]

- Onex's goals for WestJet: Increased market share, expansion into new markets, operational efficiency improvements, fleet modernization, and enhanced customer experience.

- Initial challenges: The acquisition likely faced challenges associated with integrating with an existing management team and navigating the complexities of the airline industry, including fluctuating fuel prices and global economic uncertainty.

WestJet's Performance Under Onex Ownership

During Onex's ownership, WestJet demonstrated significant financial and operational success. The airline experienced substantial revenue growth, increased profitability, and maintained a strong market share within the Canadian and international airline markets. This performance played a key role in Onex's ability to fully recoup its investment.

- Key milestones: Expansion into new international routes, significant fleet expansion with modern aircraft, strategic partnerships to enhance route networks, and the implementation of cost-saving initiatives.

- Challenges overcome: The airline successfully navigated economic downturns, increased competition from other airlines, and fluctuating fuel prices, demonstrating resilience and strong operational management.

- Quantifiable results: [Insert quantifiable results such as percentage revenue growth, profitability increase, and market share changes during Onex's ownership - Requires Research]. These figures would concretely illustrate WestJet's success under Onex's stewardship.

The Partial Stake Sale and Full Return on Investment

The partial stake sale represents the culmination of Onex's successful investment strategy. By selling a portion of its WestJet shares, Onex fully recouped its initial investment, including any associated costs and fees, thus achieving a complete return on investment (ROI).

- Buyer of the stake: [Insert Buyer Name - Requires Research]

- Percentage of stake sold: [Insert Percentage - Requires Research]

- Sale price: [Insert Sale Price - Requires Research]

- Total ROI for Onex: [Calculate and insert ROI - Requires Research. This should be presented as a percentage and/or a dollar figure].

- Implications for Onex's future investment strategy: This successful exit demonstrates the firm's ability to identify and cultivate high-growth potential in the airline industry, likely influencing future investment decisions in similar sectors.

Implications for the Airline Industry

Onex's successful divestment of its WestJet stake has several implications for the broader airline industry. It signals a positive outlook for private equity investment in the sector and could encourage further investment and consolidation.

- Impact on investor confidence: The successful ROI achieved by Onex is likely to boost investor confidence in the airline industry, attracting further private equity investment.

- Potential for further consolidation: This transaction could spur further mergers and acquisitions within the airline industry as private equity firms look for similar investment opportunities.

- Future growth prospects for WestJet: The successful partnership with Onex positions WestJet for continued growth and expansion in the years to come.

Conclusion

Onex's complete recouping of its WestJet investment through a strategic partial stake sale exemplifies the success of its investment strategy and highlights the potential for significant returns in the airline industry. This transaction serves as a compelling case study in successful private equity investment and divestment, demonstrating the power of strategic partnerships and operational improvements.

Call to Action: Learn more about Onex's successful investment strategies and explore opportunities in the private equity market. Are you interested in achieving a high return on investment? Contact us to discuss your investment options. Explore successful private equity exits, like the Onex WestJet deal, to understand how to maximize your investment potential.

Featured Posts

-

2025 Astros Foundation College Classic All Tournament Team Revealed

May 11, 2025

2025 Astros Foundation College Classic All Tournament Team Revealed

May 11, 2025 -

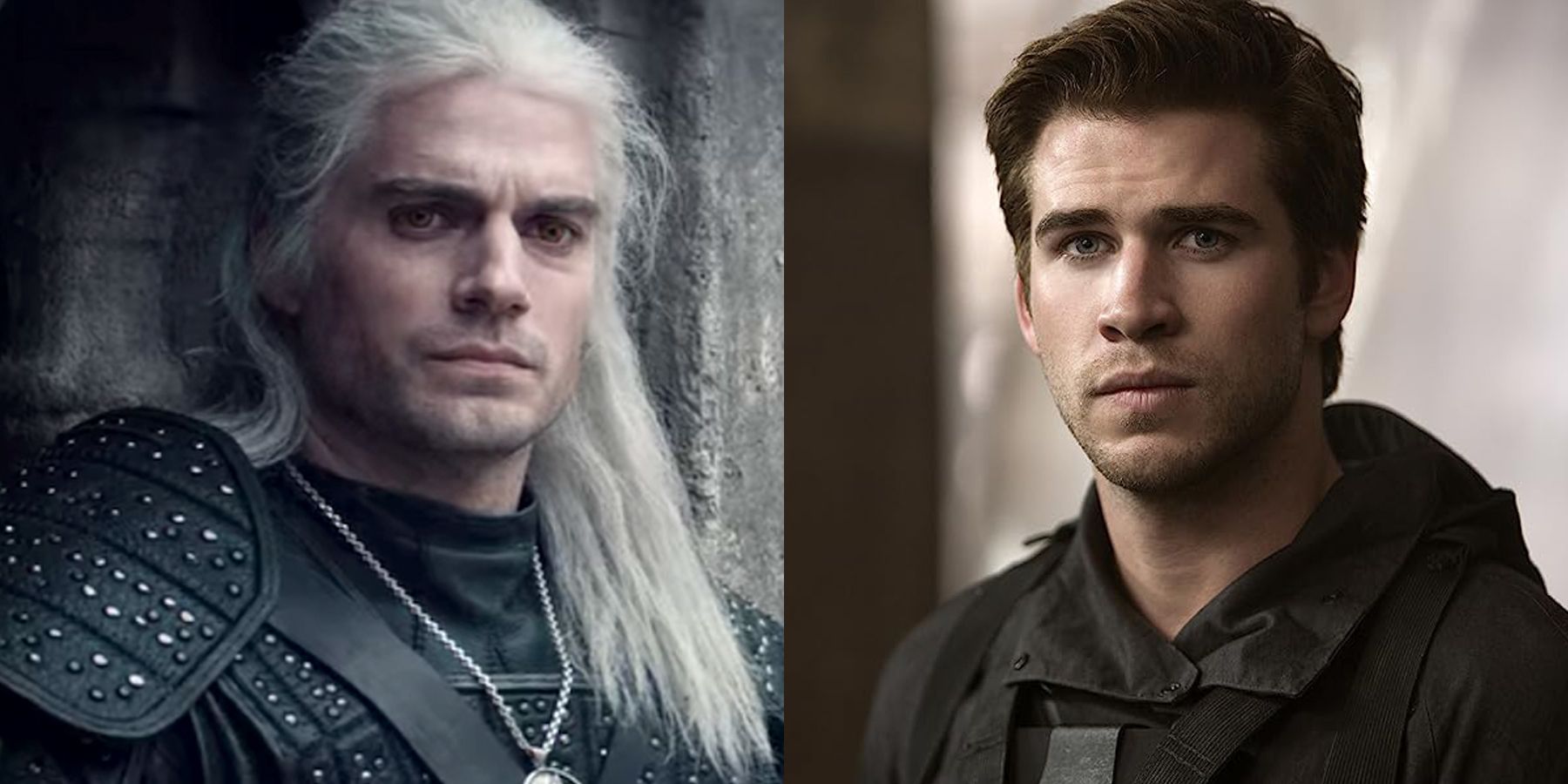

Geralts New Face The Impact Of Henry Cavills Absence On The Witcher

May 11, 2025

Geralts New Face The Impact Of Henry Cavills Absence On The Witcher

May 11, 2025 -

Tres Toros Uruguayos Rumbo A China Un Regalo Presidencial Para Xi Jinping

May 11, 2025

Tres Toros Uruguayos Rumbo A China Un Regalo Presidencial Para Xi Jinping

May 11, 2025 -

Payton Pritchards Career Achievement The Impact Of His Early Life

May 11, 2025

Payton Pritchards Career Achievement The Impact Of His Early Life

May 11, 2025 -

John Wick Experience Opens In Las Vegas

May 11, 2025

John Wick Experience Opens In Las Vegas

May 11, 2025

Latest Posts

-

Rate Cut Bets Falter After Powells Less Dovish Remarks Impact On Bond Traders

May 12, 2025

Rate Cut Bets Falter After Powells Less Dovish Remarks Impact On Bond Traders

May 12, 2025 -

India Pakistan Border Tensions Five Soldiers Dead Ceasefire Remains

May 12, 2025

India Pakistan Border Tensions Five Soldiers Dead Ceasefire Remains

May 12, 2025 -

Sag Aftra Joins Wga Complete Hollywood Production Shutdown

May 12, 2025

Sag Aftra Joins Wga Complete Hollywood Production Shutdown

May 12, 2025 -

Blue Origins Launch Abort Subsystem Malfunction Grounds New Shepard

May 12, 2025

Blue Origins Launch Abort Subsystem Malfunction Grounds New Shepard

May 12, 2025 -

Alterya Acquired By Chainalysis Boosting Blockchain Security With Ai

May 12, 2025

Alterya Acquired By Chainalysis Boosting Blockchain Security With Ai

May 12, 2025