OPEC+ Meeting: Big Oil's Resistance To Increased Production

Table of Contents

Geopolitical Instability and Uncertainty

The global oil market is highly sensitive to geopolitical events, and the current environment is fraught with uncertainty, significantly impacting the OPEC+ meeting's outcome on increased production.

The Russia-Ukraine War and its Impact

The ongoing conflict in Ukraine continues to significantly disrupt global energy markets. Sanctions imposed on Russia, a major oil producer, have reduced its exports and created considerable uncertainty.

- Reduced Russian oil exports: Sanctions have limited Russia's ability to export its oil, tightening global supply.

- Fear of further supply disruptions: The conflict's unpredictable nature creates ongoing concerns about potential further disruptions to Russian oil production and export routes.

- Increased volatility in global oil markets: The uncertainty surrounding Russian oil supply fuels price volatility, making it challenging for OPEC+ to predict future market conditions and plan for increased production accordingly.

Tensions in the Middle East

Political instability in various oil-producing regions of the Middle East adds another layer of complexity. The risk of production disruptions due to conflict or internal political upheaval is ever-present.

- Potential for production disruptions due to conflict: Ongoing conflicts and tensions in the region pose a constant threat to oil production infrastructure and stability.

- Risk assessment impacting investment decisions: The heightened risk profile deters investment in new oil exploration and production projects, limiting future capacity for increased production.

- Influence on OPEC+ decision-making: The geopolitical landscape significantly influences the deliberations and decisions of the OPEC+ meeting regarding increased production, prioritizing security and stability.

Internal OPEC+ Dynamics and National Interests

The OPEC+ alliance, while functioning as a coordinated entity, comprises nations with diverse economic and political priorities. This internal heterogeneity influences the collective response to calls for increased oil production.

Differing National Priorities

Individual member states within OPEC+ have varied economic and political agendas that impact their willingness to increase production. Some prioritize maximizing their own revenue, potentially at the expense of global stability.

- Saudi Arabia's strategic oil reserves management: Saudi Arabia, a key player in OPEC+, carefully manages its oil reserves, considering long-term strategic goals alongside immediate revenue maximization.

- Individual member states' production capacity constraints: Not all member states possess the same production capacity. Some may lack the infrastructure or resources to significantly boost output.

- Competition between OPEC+ members: Competition for market share among OPEC+ members can influence their willingness to cooperate on increasing overall production.

Maintaining Market Share and Price Stability

OPEC+ aims to manage oil supply to influence prices. A sudden increase in production could lead to lower prices, negatively impacting the revenue of member states.

- Balancing supply and demand to maintain price levels: OPEC+ seeks to find a balance between supply and demand to maintain oil prices within a desired range.

- Preventing a price crash: A rapid increase in production could trigger a price crash, harming the economies of member states heavily reliant on oil revenues.

- Long-term strategic considerations: OPEC+'s decisions consider not just immediate market conditions but also long-term strategic goals and the sustainability of oil production.

Investment and Production Capacity Constraints

The current capacity for increased oil production is also limited by past underinvestment and existing infrastructure challenges.

Underinvestment in Oil Exploration and Production

Years of low oil prices led to reduced investment in exploration and production, creating a bottleneck in the potential for rapid output increases.

- Time lag between investment decisions and increased production: Increasing oil production is not an immediate process. It requires significant upfront investment and time to yield results.

- Shortages of skilled labor and equipment: The industry faces shortages of skilled workers and specialized equipment, hindering the speed of production increases.

- Difficulty in quickly scaling up production: Existing oil fields may not have the capacity for rapid expansion, necessitating significant investments in new infrastructure.

Operational Challenges and Infrastructure Limitations

Even if investment were to increase dramatically, existing infrastructure in some oil-producing nations may struggle to handle a significant increase in production.

- Pipeline capacity constraints: Existing pipelines may lack the capacity to transport significantly higher volumes of crude oil.

- Refining capacity limitations: Refining capacity may also constrain the ability to process additional crude oil.

- Transportation bottlenecks: Transportation infrastructure, including ports and shipping, may face bottlenecks, limiting the ability to export increased oil production.

Conclusion

The OPEC+ meeting's resistance to significantly increase oil production is a multifaceted issue stemming from geopolitical uncertainties, internal OPEC+ dynamics, and production capacity constraints. While calls for increased supply persist to curb inflation and stabilize energy markets, the decision-making process underscores the intricate balancing act between national interests and global energy security. Understanding these factors influencing the OPEC+ meeting and its impact on increased production is crucial for navigating the evolving global oil market. To stay informed about future OPEC+ meetings and their implications for oil production, continue following reputable news sources and market analysis.

Featured Posts

-

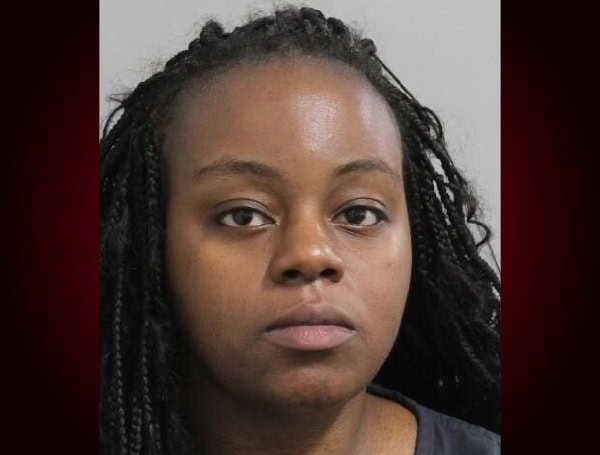

16 Year Olds Death Mother Faces Criminal Neglect Charges

May 04, 2025

16 Year Olds Death Mother Faces Criminal Neglect Charges

May 04, 2025 -

Alexander Volkanovski Vs Diego Lopes Ufc 314 Fight Card Analysis

May 04, 2025

Alexander Volkanovski Vs Diego Lopes Ufc 314 Fight Card Analysis

May 04, 2025 -

Hearns Plan To Keep Berlanga A Fight With Plant Or Charlo

May 04, 2025

Hearns Plan To Keep Berlanga A Fight With Plant Or Charlo

May 04, 2025 -

Ufc Fight Schedule Unveiling The May 2025 Events Featuring Ufc 315

May 04, 2025

Ufc Fight Schedule Unveiling The May 2025 Events Featuring Ufc 315

May 04, 2025 -

Germany To Basel Abor And Tynnas Travel Plans

May 04, 2025

Germany To Basel Abor And Tynnas Travel Plans

May 04, 2025