Option Traders Favor Aussie Dollar Over Kiwi Amid Easing Trade Tensions

Table of Contents

Easing Trade Tensions Boosting AUD Demand

The increased demand for the Australian dollar is significantly linked to the global easing of trade tensions and the resulting positive impact on the Australian economy.

China's Economic Recovery and its Impact

China's economic recovery plays a pivotal role in boosting AUD demand. As a major trading partner for Australia, China's resurgence fuels increased demand for Australian commodities.

- Increased demand for Australian commodities: Australia's exports of iron ore and coal to China are booming, directly impacting export revenue.

- Positive impact on Australian export revenue and economic growth: This surge in commodity demand translates to higher export revenue, stimulating the Australian economy and strengthening the AUD.

- Improved investor confidence leading to higher AUD valuations: The improved economic outlook boosts investor confidence, leading to increased foreign investment in Australia and subsequently, a higher valuation for the AUD.

Reduced US-China Trade Friction

The reduced trade friction between the US and China contributes to a more stable global economic outlook, further benefiting export-oriented economies like Australia.

- Reduced uncertainty leads to increased foreign investment in Australia: Decreased uncertainty encourages foreign investment, injecting capital into the Australian economy and supporting the AUD.

- Positive implications for Australian businesses and economic growth: A more stable global environment fosters business growth and expansion in Australia, contributing to overall economic strength.

- Strengthening AUD against other major currencies: The improved economic conditions strengthen the AUD not only against the NZD but also against other major currencies in the forex market.

Kiwi Dollar Facing Headwinds

While the Aussie dollar enjoys tailwinds, the New Zealand dollar is facing several headwinds, contributing to the observed preference shift among option traders.

Dependence on Tourism and Global Demand

The NZD's performance is significantly linked to tourism and the global demand for its exports, making it more susceptible to external shocks.

- Slower recovery of global tourism post-pandemic impacting New Zealand's economy: The slower-than-expected recovery in global tourism negatively impacts New Zealand's economy, putting downward pressure on the NZD.

- Fluctuations in global demand for dairy and agricultural products affecting NZD: Fluctuations in global demand for New Zealand's key exports, such as dairy and agricultural products, directly influence the NZD's value.

- Increased reliance on a single sector increasing vulnerability: The NZD's heavy reliance on specific sectors makes it more vulnerable to external economic shifts compared to the more diversified Australian economy.

Domestic Economic Challenges

Internal economic challenges within New Zealand also play a role in the reduced demand for the NZD.

- Inflationary pressures and interest rate hikes impacting consumer spending: High inflation and subsequent interest rate hikes dampen consumer spending and negatively impact economic growth.

- Potential housing market corrections impacting the economy: Concerns about a potential housing market correction further contribute to economic uncertainty.

- Government policies and their effect on investor sentiment: Government policies and their impact on investor sentiment can influence the overall demand for the NZD.

Options Trading Strategies and AUD/NZD Dynamics

The shift in trader sentiment is clearly reflected in the options market, particularly in the AUD/NZD pair.

Increased AUD/NZD Call Options

The increase in call options on the AUD/NZD pair signifies the market's expectation of further AUD appreciation against the NZD.

- Traders betting on AUD strength against NZD: Option traders are actively betting on the continued strength of the AUD against the NZD.

- Analysis of implied volatility and option pricing: Understanding implied volatility and option pricing models is crucial for effective AUD/NZD options trading.

- Strategies for leveraging the AUD/NZD price movement using options: Various options strategies, such as bull spreads or straddles, can be employed to capitalize on the AUD/NZD price movements.

Risk-Reward Profile of AUD/NZD Trades

Successful AUD/NZD trading requires careful risk management.

- Understanding the risk-reward ratio for various option strategies: A thorough understanding of the risk-reward profile for each strategy is paramount.

- Importance of stop-loss orders and risk mitigation techniques: Implementing stop-loss orders and other risk mitigation techniques is crucial to limit potential losses.

- Diversification strategies for minimizing risk in currency trading: Diversifying your portfolio across different currency pairs and asset classes helps minimize overall risk.

Conclusion

The current preference of option traders for the Australian dollar over the New Zealand dollar reflects a complex interplay of global economic factors and the unique economic strengths and vulnerabilities of each nation. Easing trade tensions, a recovering Chinese economy, and potential headwinds facing New Zealand are key contributing factors. Understanding these dynamics is crucial for navigating the forex market effectively. If you are considering engaging in Aussie dollar and Kiwi dollar options trading, remember to conduct thorough research and develop a robust trading strategy. Analyze market conditions carefully and manage your risk accordingly when trading the AUD/NZD pair or any other currency pair. By staying informed on the latest developments impacting the AUD and NZD, you can make well-informed decisions and potentially profit from the ongoing shift in trader sentiment. Start your research on Aussie dollar and Kiwi dollar options trading today!

Featured Posts

-

Cheap But Good Finding Quality On A Budget

May 06, 2025

Cheap But Good Finding Quality On A Budget

May 06, 2025 -

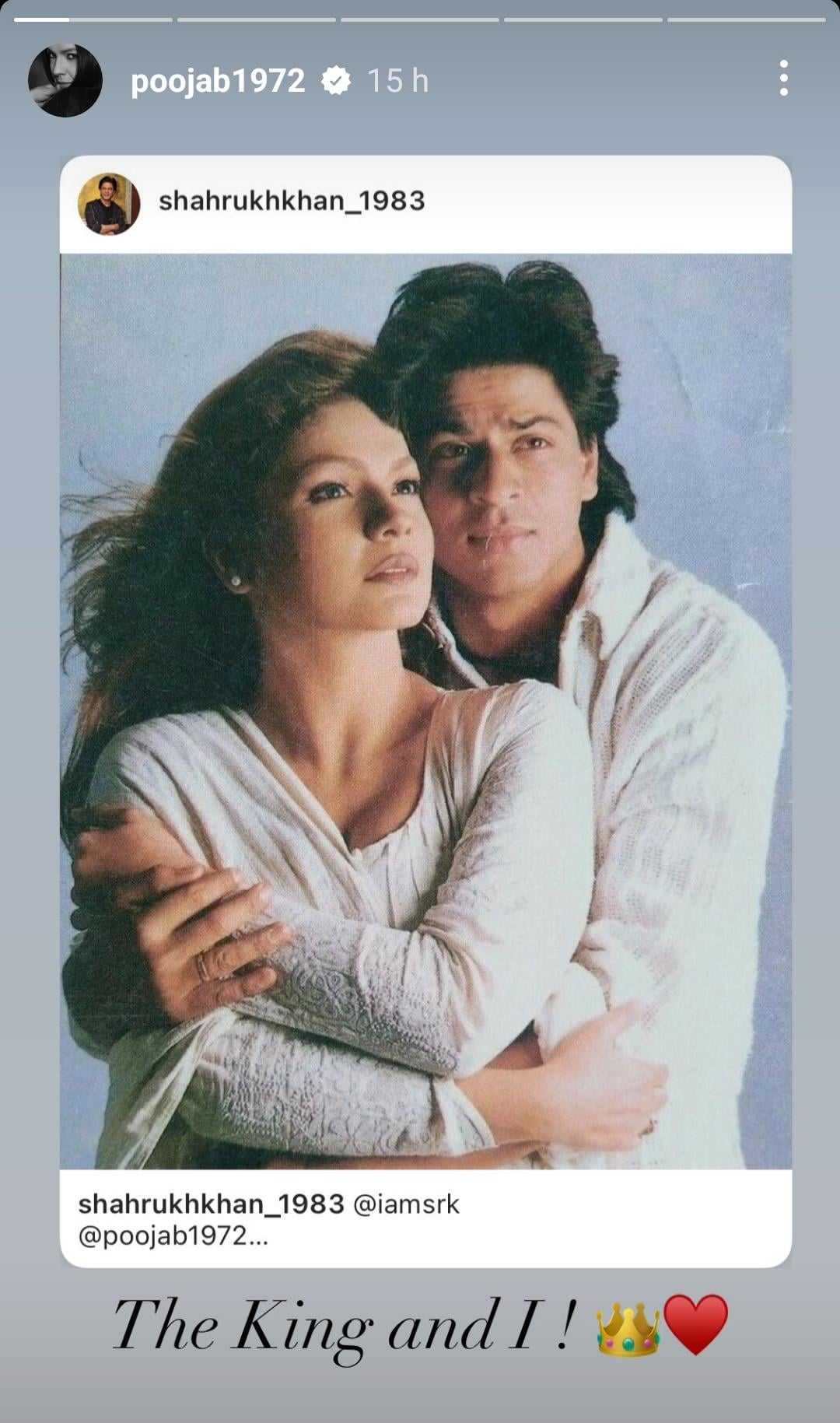

Demi Moores 1991 Body Paint Photoshoot Inspiration For Pooja Bhatts Bold Look

May 06, 2025

Demi Moores 1991 Body Paint Photoshoot Inspiration For Pooja Bhatts Bold Look

May 06, 2025 -

Nikes New Jordan Chiles And Sha Carri Richardson So Win Shirts A Closer Look

May 06, 2025

Nikes New Jordan Chiles And Sha Carri Richardson So Win Shirts A Closer Look

May 06, 2025 -

Suki Waterhouse And The Retro Trainer Revival

May 06, 2025

Suki Waterhouse And The Retro Trainer Revival

May 06, 2025 -

Koku Ve Itibar Baglanti Nasil Kurulur

May 06, 2025

Koku Ve Itibar Baglanti Nasil Kurulur

May 06, 2025