Pakistan Economic Crisis: IMF's Review Of $1.3 Billion Loan In Question

Table of Contents

Key Conditions for IMF Loan Disbursement and Pakistan's Compliance

The IMF has imposed stringent conditions for the release of the $1.3 billion loan, focusing on crucial fiscal reforms, structural adjustments, and monetary policy changes. Meeting these conditions is paramount for Pakistan to receive the much-needed financial assistance and stabilize its economy. These conditions aim to address the root causes of the economic crisis and pave the way for sustainable growth.

-

Revenue Generation Measures: Pakistan needs to significantly boost its revenue generation through comprehensive tax reforms. This includes broadening the tax base, improving tax collection efficiency, and tackling tax evasion. Specific measures involve increasing the tax-to-GDP ratio and implementing stricter regulations on tax avoidance.

-

Expenditure Cuts: Substantial cuts in government expenditure are essential. This involves rationalizing energy subsidies, reducing non-essential government spending, and improving the efficiency of public services. Difficult choices will need to be made to balance the budget and reduce the fiscal deficit.

-

Exchange Rate Adjustments: Managing the devaluation of the Pakistani Rupee is a key challenge. The IMF likely requires a market-determined exchange rate to reflect the true economic fundamentals and improve external competitiveness. This often involves painful adjustments that impact the cost of imports.

-

State-Owned Enterprises (SOEs) Reforms: Restructuring and potentially privatizing loss-making SOEs are crucial for improving efficiency and reducing the burden on the national budget. This process often involves political resistance due to vested interests and potential job losses.

-

Progress (or lack thereof): While Pakistan has taken some steps towards fulfilling these conditions, significant challenges remain. The pace of reforms has often been slow, hampered by political infighting and resistance from various stakeholders. The IMF's assessment of Pakistan's progress will be crucial in determining whether the loan will be disbursed. The lack of consistent policy implementation and bureaucratic hurdles are major obstacles.

Political Instability and its Impact on Economic Reforms

Political instability significantly hinders the implementation of crucial economic reforms. Frequent changes in government, policy inconsistencies, and a lack of consensus among political parties create an environment of uncertainty that discourages investment and undermines the credibility of reform efforts.

-

Impact of Changing Governments: Shifting political priorities and policy reversals by successive governments erode investor confidence and hinder the implementation of long-term structural reforms.

-

Resistance from Vested Interests: Powerful vested interests often resist reforms that threaten their privileges or economic benefits, leading to delays and compromises that undermine the effectiveness of the reforms.

-

Public Perception and Acceptance of Austerity Measures: The public's acceptance of austerity measures, such as subsidy cuts and tax increases, is crucial for the success of economic reforms. However, a lack of transparency and communication from the government can lead to social unrest and opposition to necessary changes.

Political stability and a strong, cohesive government are essential for implementing effective and consistent economic policies, attracting foreign investment, and restoring confidence in the Pakistan economy. The current political climate presents a major hurdle to achieving these goals.

The Ripple Effects of Delayed IMF Loan

A delayed or failed disbursement of the IMF loan would have devastating consequences for Pakistan's economy. The already fragile situation would worsen, potentially leading to a full-blown economic crisis.

-

Further Devaluation of the Pakistani Rupee: A delayed loan would likely lead to a further sharp devaluation of the Pakistani Rupee, increasing the cost of imports and fueling inflation.

-

Increased Inflation and Cost of Living Crisis: Higher inflation would exacerbate the existing cost of living crisis, impacting the most vulnerable segments of the population and potentially leading to social unrest.

-

Potential Debt Default and its Ramifications: Failure to secure the IMF loan could push Pakistan closer to a debt default, triggering a financial crisis with far-reaching global implications.

-

Impact on Social Programs and Poverty Levels: Reduced government revenue and increased spending pressures could force cuts to essential social programs, exacerbating poverty and inequality.

The potential for social unrest and the broader geopolitical implications of an economic collapse in Pakistan are significant and cannot be ignored.

External Factors Influencing the Situation

Global economic factors further complicate Pakistan's situation. Rising interest rates in developed economies, the threat of a global recession, and reduced global demand for Pakistani exports all negatively impact Pakistan's ability to overcome its crisis.

-

Impact of Global Inflation on Pakistan's Import Bill: Higher global inflation significantly increases the cost of Pakistan's imports, widening the trade deficit and putting further pressure on the Rupee.

-

Reduced Global Demand for Pakistani Exports: Reduced global demand for Pakistani goods and services hurts export revenues, making it harder to earn foreign exchange and repay debts.

-

Difficulty in Accessing International Markets for Financing: The global economic slowdown makes it more difficult for Pakistan to access international financial markets to secure alternative sources of funding.

Conclusion

The IMF's review of the $1.3 billion loan to Pakistan is critical, but fraught with challenges. The success hinges on effective implementation of necessary economic reforms, navigating political instability, and weathering global economic headwinds. Failure to secure the loan could trigger a severe economic crisis with far-reaching consequences. Understanding the intricacies of the Pakistan economic crisis and the IMF's involvement is crucial for informed discussion and potential solutions. Stay updated on the latest developments regarding the IMF loan and its impact on the Pakistan economy. We urge readers to actively follow the developments surrounding the $1.3 billion loan and the broader Pakistan economic crisis.

Featured Posts

-

Young Thugs New Album Uy Scuti When Is It Coming Out

May 10, 2025

Young Thugs New Album Uy Scuti When Is It Coming Out

May 10, 2025 -

West Ham United A 25m Financial Gap And The Path Forward

May 10, 2025

West Ham United A 25m Financial Gap And The Path Forward

May 10, 2025 -

Wildfire Speculation Examining The Market For Los Angeles Disaster Bets

May 10, 2025

Wildfire Speculation Examining The Market For Los Angeles Disaster Bets

May 10, 2025 -

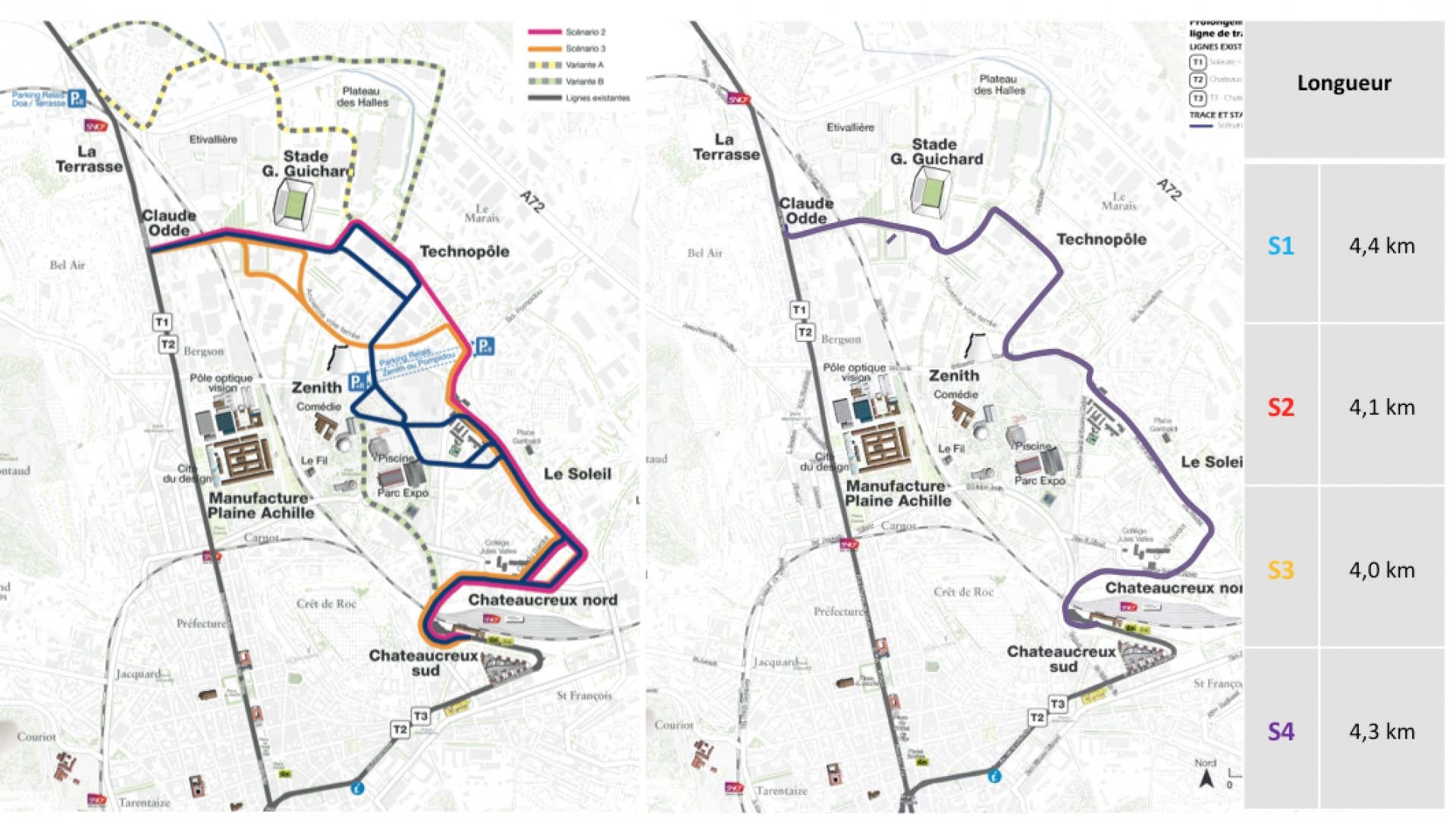

Dijon Concertation Achevee Pour La 3e Ligne De Tramway

May 10, 2025

Dijon Concertation Achevee Pour La 3e Ligne De Tramway

May 10, 2025 -

The Stigma Of Mental Illness And Violent Crime Why We Fail

May 10, 2025

The Stigma Of Mental Illness And Violent Crime Why We Fail

May 10, 2025

Latest Posts

-

Ajaxs Brobbey Power And Pace A Concern For Europa League Rivals

May 10, 2025

Ajaxs Brobbey Power And Pace A Concern For Europa League Rivals

May 10, 2025 -

Brian Brobbey Physical Prowess Poses Europa League Threat

May 10, 2025

Brian Brobbey Physical Prowess Poses Europa League Threat

May 10, 2025 -

Us Government Funding And Transgender Animal Research Whats The Story

May 10, 2025

Us Government Funding And Transgender Animal Research Whats The Story

May 10, 2025 -

Brian Brobbeys Strength A Nightmare For Europa League Opponents

May 10, 2025

Brian Brobbeys Strength A Nightmare For Europa League Opponents

May 10, 2025 -

Exploring The Reality Of Us Funding For Transgender Mouse Research

May 10, 2025

Exploring The Reality Of Us Funding For Transgender Mouse Research

May 10, 2025