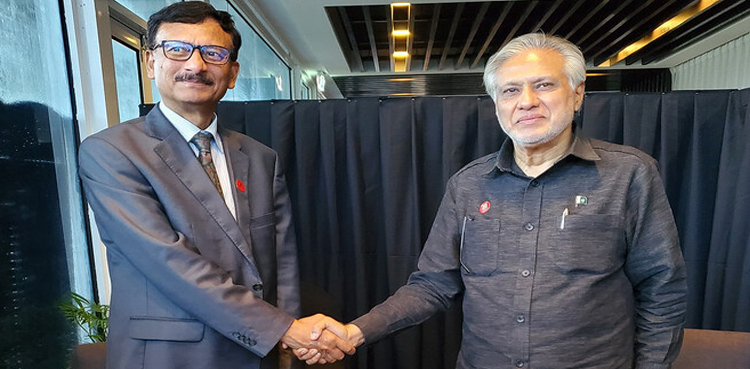

Pakistan, Sri Lanka, And Bangladesh To Strengthen Capital Market Cooperation

Table of Contents

The capital markets of Pakistan, Sri Lanka, and Bangladesh are poised for significant growth through strengthened cooperation. This collaborative effort promises to unlock new investment opportunities, promote regional economic integration, and foster stability within the South Asian financial landscape. This article explores the key initiatives driving this collaboration and its potential benefits, focusing on how this capital market cooperation will shape the future of the region.

Increased Investment Flows and Regional Integration

Strengthening capital market cooperation between Pakistan, Sri Lanka, and Bangladesh is expected to significantly boost investment flows and foster deeper regional integration. This will be achieved through a multifaceted approach focusing on easing investment processes and promoting regional trade.

Facilitating Cross-Border Investments

Several key initiatives are underway to make cross-border investments smoother and more attractive. These include:

- Reduced regulatory hurdles: Streamlining existing regulations and removing unnecessary bureaucratic barriers will significantly reduce the time and cost associated with foreign direct investment (FDI). Specific examples could include easing restrictions on foreign ownership limits in certain sectors.

- Streamlined investment processes: The implementation of online portals and digital platforms for investment applications will expedite the approval process, making it more efficient and transparent.

- Information sharing agreements: Establishing mechanisms for sharing critical market information between regulatory bodies will enhance transparency and reduce information asymmetry, thus fostering greater investor confidence.

- Establishment of joint investment funds: Creating joint investment funds will pool resources and expertise, allowing for larger-scale investments in regional infrastructure and development projects. These funds could focus on sectors with high growth potential, attracting both domestic and foreign investors.

Promoting Regional Trade and Development

Increased capital flows resulting from this cooperation will directly contribute to regional trade and development. This is because:

- Increased access to capital for SMEs: Smaller and medium-sized enterprises (SMEs) will gain better access to funding, fueling their growth and contributing to job creation and economic diversification.

- Improved infrastructure development projects: Collaborative investment in crucial infrastructure projects, such as transportation networks, energy grids, and communication systems, will enhance regional connectivity and facilitate trade. Examples could include joint ventures to build new ports or upgrade existing railways.

- Collaborative research and development initiatives: Pooling resources for research and development will promote innovation and technological advancement, creating new opportunities for growth across all three nations.

Enhanced Market Stability and Risk Mitigation

Harmonizing regulations and promoting transparency are crucial for enhancing market stability and mitigating risks in the region's capital markets.

Sharing of Best Practices and Regulatory Harmonization

Collaborative efforts to harmonize regulations and share best practices are essential for attracting foreign investment and maintaining stability. This involves:

- Joint regulatory oversight: Establishing joint committees and working groups comprising regulatory bodies from all three countries will allow for coordinated oversight and the development of consistent standards. This could involve the Securities and Exchange Commission of Pakistan, the Securities and Exchange Commission of Sri Lanka, and the Bangladesh Securities and Exchange Commission.

- Information sharing on market risks: Developing effective mechanisms for sharing information about potential market risks and vulnerabilities will allow for proactive risk management and prevent the spread of crises.

- Coordinated responses to financial crises: Establishing protocols for coordinated responses to financial crises will help mitigate systemic risk and ensure stability within the regional financial system.

- Development of common regulatory frameworks: Adopting common standards for accounting, reporting, and corporate governance will enhance transparency and comparability, making the regional market more attractive to international investors.

Strengthening Investor Confidence

Building investor confidence requires a commitment to transparency, robust investor protection mechanisms, and effective regulatory frameworks. Key steps include:

- Transparent regulatory environments: Ensuring that regulatory processes are transparent and predictable will reduce uncertainty and encourage investment.

- Robust investor protection mechanisms: Implementing strong investor protection laws and regulations will safeguard investor rights and build trust in the market.

- Increased market transparency: Promoting the disclosure of relevant information by listed companies will enhance market transparency and reduce information asymmetry, thereby fostering greater investor confidence.

Technological Advancement and Capacity Building

Leveraging technology and investing in capacity building are crucial for realizing the full potential of this capital market cooperation.

Leveraging Fintech for Enhanced Market Efficiency

The adoption of financial technology (Fintech) can significantly improve market efficiency and access to financial services. This includes:

- Adoption of common technology platforms: Adopting common technology platforms for trading, clearing, and settlement will enhance interoperability and reduce costs.

- Improved digital infrastructure: Investing in robust digital infrastructure will improve access to financial services, particularly in underserved areas.

- Development of fintech solutions tailored to the region: Creating fintech solutions tailored to the specific needs and challenges of the region will drive innovation and improve financial inclusion.

Capacity Building and Skill Development

Investing in human capital is essential for successful implementation of the collaborative initiatives. This requires:

- Joint training programs: Establishing joint training programs will enhance the skills and knowledge of market participants, regulatory bodies, and other stakeholders.

- Knowledge exchange initiatives: Facilitating knowledge exchange between experts from the three countries will help share best practices and foster innovation.

- Development of specialized expertise: Investing in developing specialized expertise in areas such as financial regulation, risk management, and fintech will support the long-term success of the initiatives.

Conclusion

Strengthened capital market cooperation among Pakistan, Sri Lanka, and Bangladesh presents a significant opportunity for economic growth and regional integration. Initiatives aimed at increasing investment flows, enhancing market stability, and promoting technological advancement are key to realizing this potential. The future of South Asian economic prosperity depends on the continued success of this capital market cooperation. Stay informed about further developments in Pakistan, Sri Lanka, and Bangladesh’s capital market integration to understand the opportunities and challenges ahead. Learn more about investment opportunities in this strengthened regional capital market.

Featured Posts

-

Police Misconduct Meeting Scheduled Following Nottingham Attacks Investigation

May 09, 2025

Police Misconduct Meeting Scheduled Following Nottingham Attacks Investigation

May 09, 2025 -

Trumps Dc Prosecutor Selection Jeanine Pirro

May 09, 2025

Trumps Dc Prosecutor Selection Jeanine Pirro

May 09, 2025 -

The Nottingham Attacks Hearing From Survivors

May 09, 2025

The Nottingham Attacks Hearing From Survivors

May 09, 2025 -

Bitcoin Madenciliginin Karliligi Neden Azaliyor Detayli Analiz

May 09, 2025

Bitcoin Madenciliginin Karliligi Neden Azaliyor Detayli Analiz

May 09, 2025 -

The Impact Of The Strictly Scandal On Wynne Evans Go Compare Role

May 09, 2025

The Impact Of The Strictly Scandal On Wynne Evans Go Compare Role

May 09, 2025