Pakistan Stock Exchange Portal Down: Volatility And Tensions Impact Trading

Table of Contents

Causes of the Pakistan Stock Exchange Downtime

Understanding the reasons behind the PSX downtime is crucial for preventing future occurrences. The causes can be broadly categorized into technical issues and external factors influencing the stability of the exchange.

Technical Issues

Several technical factors could have contributed to the PSX outage. These include:

- Potential server failures or network outages: A failure in the primary servers or network infrastructure could have rendered the entire trading platform inaccessible. This emphasizes the need for robust, redundant systems.

- Software glitches or system errors impacting PSX's trading platform: Bugs in the software controlling the trading system could have caused unexpected errors, leading to the shutdown. Regular software updates and rigorous testing are vital to prevent such issues.

- Lack of redundancy and backup systems contributing to prolonged downtime: The absence of backup systems to seamlessly take over in case of primary system failure exacerbated the duration of the outage. Implementing redundant systems is essential for business continuity.

- Cybersecurity threats and potential hacking attempts: While not confirmed, the possibility of a cyberattack cannot be ruled out. A successful attack could have crippled the PSX's systems, underscoring the importance of robust cybersecurity measures.

External Factors

Beyond technical issues, external factors can significantly influence PSX functionality and contribute to downtime. These include:

- Increased trading volume leading to system overload: A surge in trading activity could have overwhelmed the PSX's systems, resulting in an outage. Scalability and capacity planning are vital for handling peak demand.

- Political instability and uncertainty impacting investor confidence: Periods of political turmoil can lead to market volatility and increased trading activity, potentially stressing the system’s capacity.

- Economic factors such as inflation and currency fluctuations: Economic instability can create uncertainty, resulting in increased trading volume and pressure on the PSX's infrastructure.

- Natural disasters or power outages affecting PSX infrastructure: Power outages or natural disasters can directly impact the PSX's physical infrastructure and lead to downtime. Investing in robust power backup systems and disaster recovery plans is crucial.

Impact of PSX Downtime on Trading and Investors

The PSX downtime had a multifaceted impact on trading activities and investor sentiment.

Trading Disruption

The outage significantly disrupted trading, leading to various consequences:

- Inability to buy or sell shares during the downtime: Investors were prevented from participating in the market, potentially missing out on profitable opportunities or incurring losses.

- Missed trading opportunities leading to potential financial losses: The inability to trade during the outage caused financial losses for many investors, depending on market movements during the downtime.

- Delayed settlement of transactions and potential delays in payments: The outage caused delays in clearing and settling trades, leading to disruptions in the payment cycle.

- Increased uncertainty and volatility in the market after the PSX outage: The downtime itself amplified market uncertainty, potentially leading to increased volatility upon reopening.

Investor Sentiment and Confidence

The PSX downtime had a substantial negative impact on investor sentiment:

- Erosion of investor confidence in the PSX and market stability: The outage undermined investor trust in the PSX's reliability and operational efficiency.

- Potential capital flight as investors seek safer investment options: Investors may have shifted their investments to other markets perceived as more stable and reliable.

- Negative impact on foreign investment and economic growth: The incident could deter foreign investors, hindering economic growth.

- Increased anxiety and uncertainty amongst retail and institutional investors: The outage created anxiety and uncertainty among all investor types.

Regulatory Response and Future Implications

The PSX downtime necessitates a strong regulatory response and proactive measures to prevent future occurrences.

Regulatory Scrutiny

The incident will likely lead to:

- Investigation into the causes of the PSX downtime by relevant authorities: A thorough investigation is necessary to identify the root causes and hold responsible parties accountable.

- Review of existing infrastructure and cybersecurity measures at the PSX: A comprehensive review of the PSX's IT infrastructure and cybersecurity protocols is essential to identify vulnerabilities and implement improvements.

- Potential for regulatory penalties and reforms to improve system resilience: Depending on the findings of the investigation, regulatory penalties and reforms may be imposed to enhance the PSX's resilience.

- Enhanced transparency and communication with investors during future outages: Improved communication strategies are needed to keep investors informed during any future disruptions.

Long-Term Consequences

The PSX downtime highlights the need for long-term improvements:

- Need for investments in robust and resilient IT infrastructure: Significant investments are required to modernize and strengthen the PSX’s IT infrastructure.

- Strengthening cybersecurity protocols to prevent future disruptions: Robust cybersecurity measures are crucial to protect the PSX from cyber threats.

- Improved risk management strategies to mitigate the impact of outages: Effective risk management strategies can minimize the impact of future outages.

- Development of contingency plans to ensure minimal disruption to trading: Comprehensive contingency plans are necessary to minimize disruptions during future outages.

Conclusion:

The Pakistan Stock Exchange downtime underscores the vulnerability of financial markets to both technical failures and broader macroeconomic and geopolitical factors. The outage resulted in significant trading disruptions, negatively impacted investor confidence, and highlighted the urgent need for improved infrastructure, enhanced cybersecurity, and robust risk management strategies at the PSX. To ensure market stability and investor trust, addressing these issues is crucial. Further investigation into the causes of the PSX downtime and the implementation of preventative measures are essential to avoid future instances of Pakistan Stock Exchange downtime and to maintain confidence in the Pakistani financial markets. The future stability of the PSX depends on proactive measures to prevent future Pakistan Stock Exchange downtime events.

Featured Posts

-

Hanh Trinh Chuyen Gioi Cua Lynk Lee Tu Nhan Sac Den Tinh Yeu

May 10, 2025

Hanh Trinh Chuyen Gioi Cua Lynk Lee Tu Nhan Sac Den Tinh Yeu

May 10, 2025 -

Brian Brobbeys Strength A Nightmare For Europa League Opponents

May 10, 2025

Brian Brobbeys Strength A Nightmare For Europa League Opponents

May 10, 2025 -

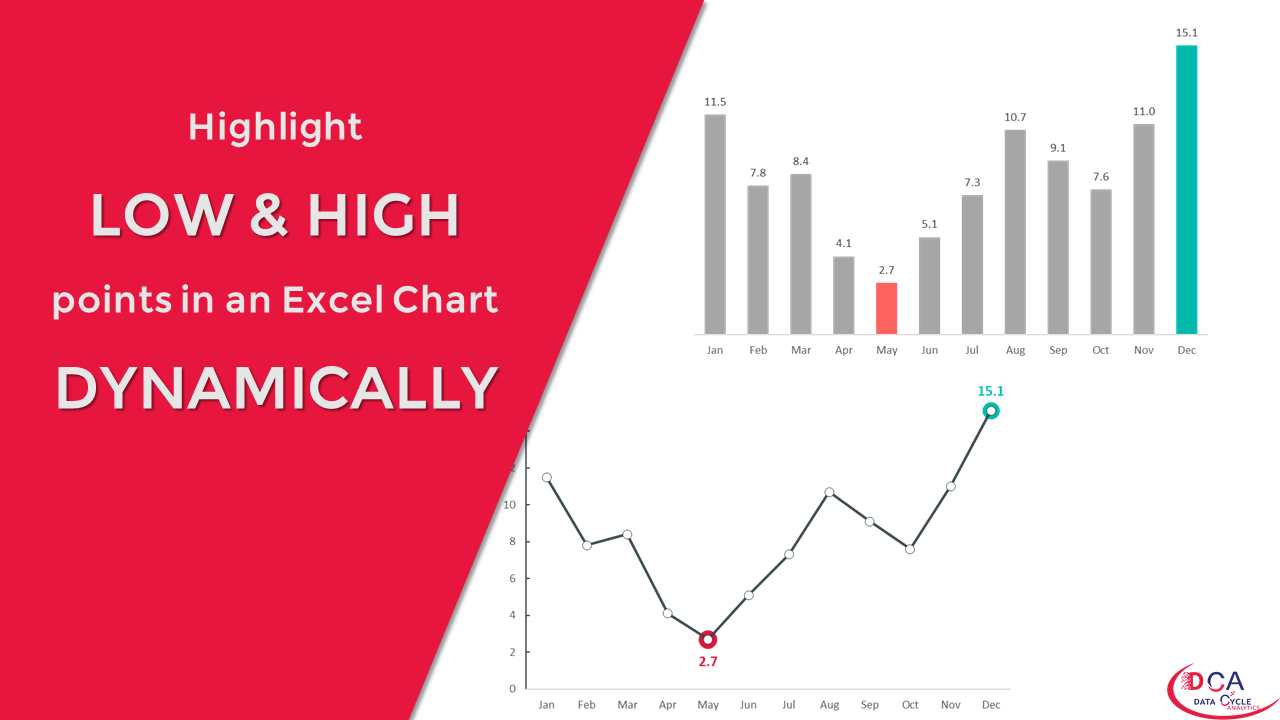

Stephen Kings 2025 Will The Monkey Be A Low Point Or A High Year For The Master Of Horror

May 10, 2025

Stephen Kings 2025 Will The Monkey Be A Low Point Or A High Year For The Master Of Horror

May 10, 2025 -

Trump Order Leads To Ihsaa Ban On Transgender Girls In Sports

May 10, 2025

Trump Order Leads To Ihsaa Ban On Transgender Girls In Sports

May 10, 2025 -

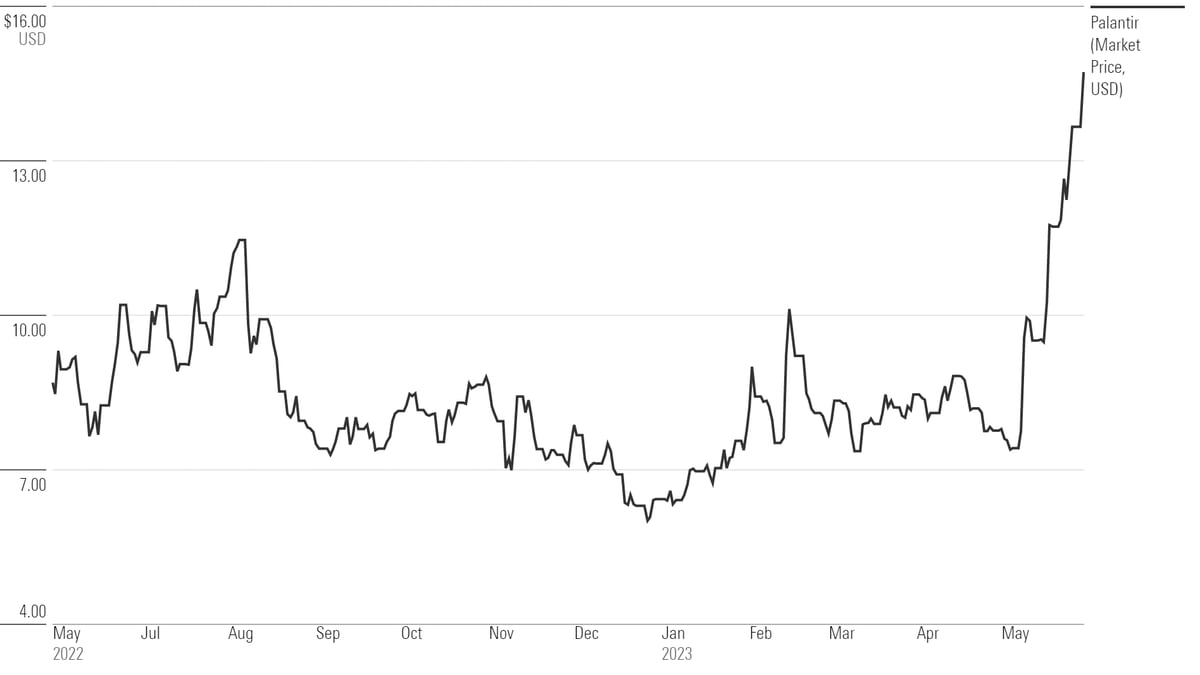

Is Palantir Stock A Smart Buy Before May 5th A Comprehensive Review

May 10, 2025

Is Palantir Stock A Smart Buy Before May 5th A Comprehensive Review

May 10, 2025