Pakistan's $1.3 Billion IMF Bailout: Review Amidst Regional Tensions

Table of Contents

H2: The IMF Bailout Package: Terms and Conditions

The Pakistan IMF bailout isn't simply a handout; it comes with stringent conditions designed to ensure Pakistan's long-term financial stability. The IMF's stipulations aim to address the root causes of the economic crisis, forcing necessary reforms for sustainable growth. These conditions encompass fiscal reforms, currency devaluation, and structural adjustments across various sectors.

-

Details on fiscal consolidation measures: The bailout requires Pakistan to significantly reduce its fiscal deficit through a combination of increased taxation and reduced government spending. This includes measures to broaden the tax base, improve tax collection efficiency, and curtail non-essential government expenditures. This aspect of the Pakistan IMF bailout is crucial for regaining fiscal health.

-

Specifics regarding currency exchange rate adjustments: A key condition involves allowing the Pakistani Rupee to depreciate against major currencies. This devaluation aims to boost exports by making them more competitive internationally while simultaneously curbing imports. However, it also risks fueling inflation.

-

Requirements for structural reforms in key sectors (energy, taxation, etc.): The IMF demands sweeping structural reforms, particularly in the energy sector plagued by inefficiencies and losses. This includes tackling circular debt, improving energy pricing mechanisms, and attracting private investment. Tax reforms focus on widening the tax net and improving tax administration.

-

Potential impact on inflation and unemployment: The austerity measures mandated by the Pakistan IMF bailout might lead to short-term increases in inflation and potential job losses. The IMF, however, argues that these short-term pains are necessary for long-term economic stability and sustainable growth.

H2: Geopolitical Context and Regional Instability

Pakistan's economic woes are inextricably linked to the volatile geopolitical landscape of the region. Regional tensions, particularly strained relations with India and the ongoing situation in Afghanistan, significantly impact the country's economic stability and the success of the IMF bailout.

-

Analysis of how regional conflicts affect foreign investment: Political instability and security concerns deter foreign direct investment (FDI), a crucial component of economic growth. The ongoing tensions directly impact investor confidence, hindering Pakistan's ability to attract much-needed capital.

-

Assessment of the impact on Pakistan's trade relationships: Regional conflicts disrupt trade routes and relationships, affecting both imports and exports. This further exacerbates Pakistan's balance of payments problems.

-

Discussion of security concerns and their economic consequences: Security concerns, including terrorism and internal conflicts, divert resources away from development and create an environment unfavorable for economic activity. The resulting insecurity diminishes investor confidence and discourages economic growth.

-

Mention any external pressures influencing the bailout negotiations: External pressures from various global players influence the negotiations and conditions of the Pakistan IMF bailout. These external factors play a significant role in shaping the bailout's overall trajectory.

H2: Domestic Economic Challenges and the Bailout's Effectiveness

The Pakistan IMF bailout tackles Pakistan's deep-seated internal economic vulnerabilities. The country faces high debt levels, an energy crisis, and political instability, all hindering economic progress.

-

Examination of Pakistan's current debt burden and repayment capacity: Pakistan's high debt-to-GDP ratio significantly limits its fiscal space and its ability to invest in crucial sectors. The IMF bailout aims to address this issue through fiscal reforms and debt restructuring.

-

Analysis of the energy sector's challenges and reform requirements: The energy crisis, characterized by chronic power shortages and circular debt, severely hampers economic productivity. The IMF's conditions necessitate significant reforms in this sector to improve efficiency and attract private investment.

-

Assessment of the political climate's influence on economic policy implementation: Political instability and frequent changes in government can hinder the implementation of necessary economic reforms. A stable and consistent political environment is crucial for the success of the Pakistan IMF bailout.

-

Discussion of the potential for social unrest due to austerity measures: The austerity measures imposed as part of the Pakistan IMF bailout might lead to social unrest, especially if the burden of adjustment falls disproportionately on vulnerable segments of the population.

H2: Long-Term Implications and Sustainable Economic Growth

The long-term success of the Pakistan IMF bailout depends on Pakistan's ability to adopt sustainable growth strategies. This requires significant reforms and a fundamental shift in economic policy.

-

Discussion of the need for diversification of the economy: Pakistan needs to diversify its economy, reducing its reliance on specific sectors and enhancing its resilience to external shocks. Diversification is key to long-term sustainable growth.

-

Analysis of potential for growth in specific sectors (e.g., technology, agriculture): Focusing on sectors with high growth potential, such as technology and agriculture, can stimulate economic development and create new jobs. Investing in these areas will be vital for the success of the Pakistan IMF bailout.

-

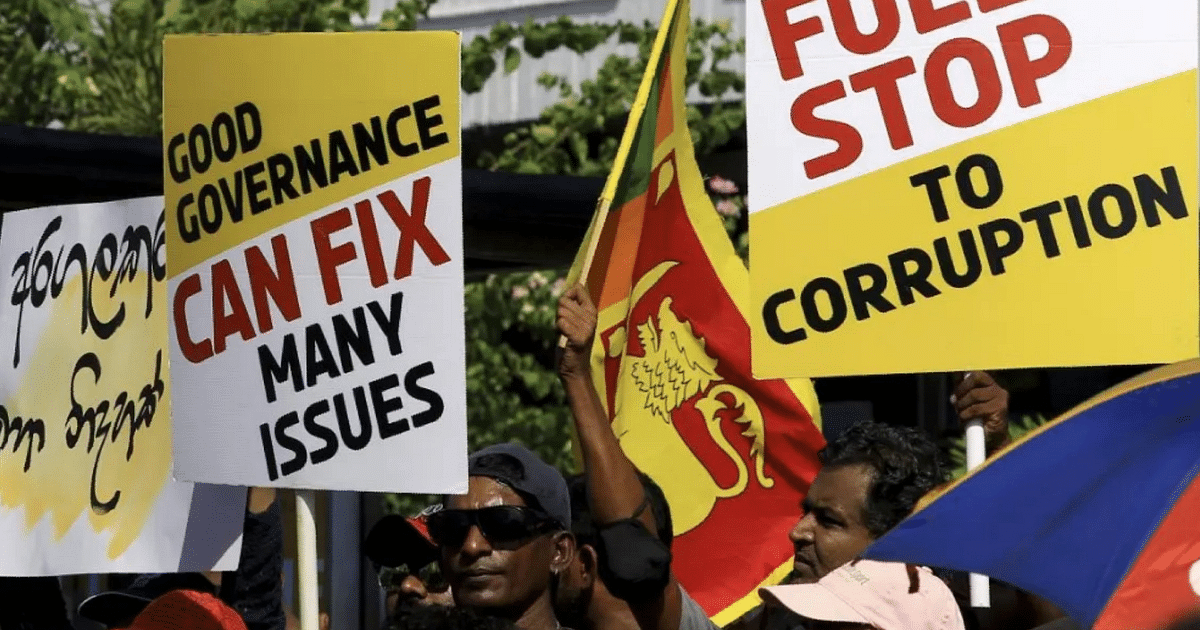

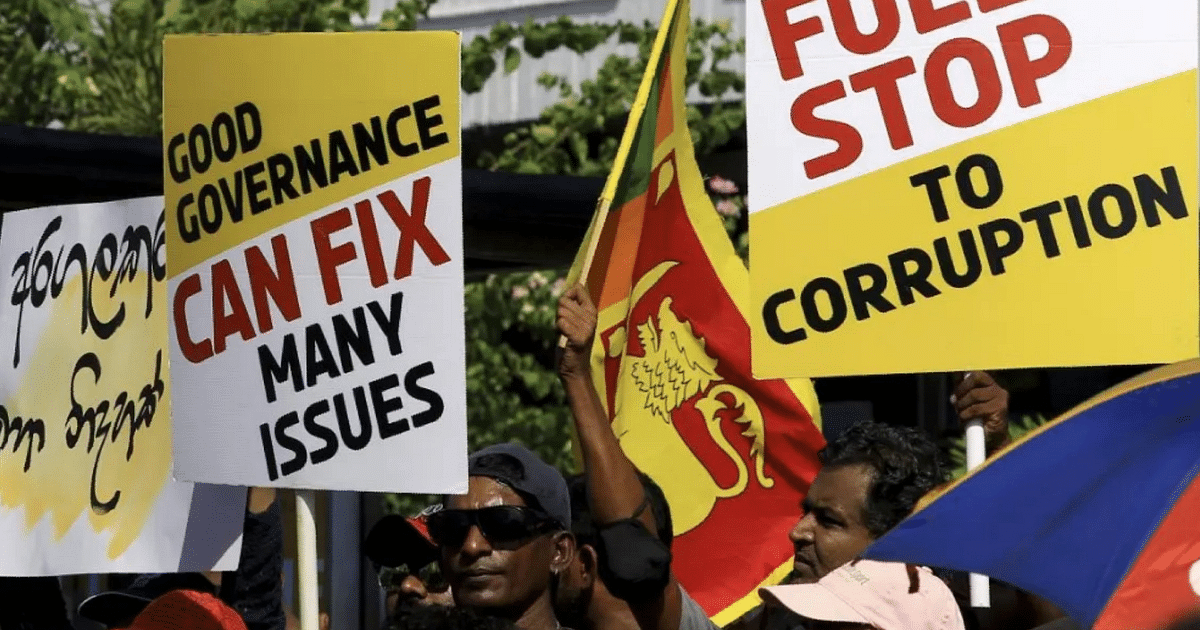

Evaluation of the potential for improved governance and transparency: Improved governance and transparency are essential for attracting foreign investment and fostering a stable investment climate. These are necessary components for the long-term success of the Pakistan IMF bailout.

-

Assessment of the likelihood of achieving long-term economic stability: The likelihood of achieving long-term economic stability hinges on successful implementation of the IMF's conditions, coupled with effective domestic policies and a stable political environment. This is the ultimate goal of the Pakistan IMF bailout.

Conclusion:

The Pakistan IMF bailout represents a crucial, albeit complex, intervention in a challenging economic and geopolitical landscape. The success of this $1.3 billion package hinges on the effective implementation of stringent conditions, coupled with addressing deep-rooted domestic challenges and navigating the volatile regional environment. Understanding the intricate interplay of these factors is critical for assessing the long-term prospects of Pakistan's economy. Further analysis and monitoring of the Pakistan IMF bailout are essential to gauge its true impact on the nation's financial health and its journey towards sustainable economic growth. Stay informed on developments related to the Pakistan IMF bailout for a comprehensive understanding of this critical situation.

Featured Posts

-

International Transgender Day Of Visibility 3 Ways To Be A Better Ally

May 10, 2025

International Transgender Day Of Visibility 3 Ways To Be A Better Ally

May 10, 2025 -

The Snl Harry Styles Impression A Disappointment For The Singer

May 10, 2025

The Snl Harry Styles Impression A Disappointment For The Singer

May 10, 2025 -

From Gang Violence To Political Debate The Story Of Kilmar Abrego Garcia And El Salvadors Exodus

May 10, 2025

From Gang Violence To Political Debate The Story Of Kilmar Abrego Garcia And El Salvadors Exodus

May 10, 2025 -

How Elon Musk Made His Billions A Deep Dive Into His Financial Empire

May 10, 2025

How Elon Musk Made His Billions A Deep Dive Into His Financial Empire

May 10, 2025 -

Trumps Pick For Dc Top Prosecutor Jeanine Pirro And Fox News Role

May 10, 2025

Trumps Pick For Dc Top Prosecutor Jeanine Pirro And Fox News Role

May 10, 2025