Pakistan's Volatile Market: Stock Exchange Portal Offline Due To Geopolitical Tensions

Table of Contents

Geopolitical Factors Triggering Market Instability

The recent instability in Pakistan's stock market is intrinsically linked to a confluence of destabilizing geopolitical factors. These external pressures significantly impact investor confidence and contribute to the overall volatility.

The Impact of Regional Conflicts:

- Afghanistan Situation: The ongoing instability in neighboring Afghanistan continues to cast a long shadow over Pakistan's economy. The influx of refugees, security concerns along the border, and the disruption of trade routes all negatively impact investor sentiment. Decreased foreign direct investment (FDI) flows directly correlate with this persistent uncertainty.

- India-Pakistan Relations: Strained relations between India and Pakistan, marked by periodic escalations and unresolved territorial disputes, further exacerbate market anxieties. These tensions create an atmosphere of uncertainty, discouraging both domestic and international investment.

- Geopolitical Risk: The cumulative effect of these regional conflicts creates a high level of geopolitical risk, directly impacting investor confidence and leading to increased market volatility. This risk premium is reflected in the fluctuating value of the Pakistani Rupee and the performance of the PSX.

International Relations and Sanctions:

- International Sanctions: The potential for international sanctions, either directly targeting Pakistan or impacting its trading partners, contributes to the market's fragility. Any perceived threat of sanctions can trigger immediate capital flight and a sharp decline in stock prices.

- Pakistan's Foreign Policy: Fluctuations in Pakistan's foreign policy and its relationships with key global players inevitably influence the perception of risk by investors. Positive developments can boost confidence, while negative shifts can trigger sell-offs.

- Market Uncertainty: The uncertainty surrounding Pakistan's international relations adds another layer of complexity to the already volatile market environment. This uncertainty makes it difficult for investors to make informed decisions, leading to increased market fluctuations.

The Stock Exchange Portal Outage: Causes and Consequences

The sudden outage of Pakistan's stock exchange portal further amplified the existing market anxieties. Determining the exact cause is crucial to understanding the broader implications.

Technical Issues vs. Deliberate Shutdown:

- Technical Glitch: While a technical malfunction is a possibility, the timing of the outage, coinciding with heightened geopolitical tensions, raises questions. A thorough investigation is needed to rule out other possibilities.

- Cybersecurity Threat: The possibility of a sophisticated cyberattack targeting the PSX cannot be discounted. Such an attack could have significant consequences, undermining investor confidence and potentially revealing sensitive financial data.

- Deliberate Shutdown: While unlikely, the possibility of a deliberate shutdown by authorities, perhaps in response to extreme market volatility, cannot be entirely dismissed. This scenario, however, would require official confirmation and transparency.

Impact on Investors and the Economy:

- Investor Losses: The outage resulted in significant trading disruptions, potentially leading to substantial financial losses for many investors. The inability to execute trades at favorable prices has direct consequences for investment portfolios.

- Economic Fallout: The broader economic impact extends beyond individual investors. The disruption to the stock market can negatively affect business confidence, investment decisions, and overall economic growth.

- Market Confidence: The outage has severely impacted market confidence, increasing investor uncertainty and potentially prompting further capital flight. Restoring trust will be crucial for market recovery.

Government Response and Future Outlook

The government's response to the outage and its ability to address the underlying issues will be critical in determining the future trajectory of Pakistan's stock market.

Government Actions and Statements:

- Official Statements: The government needs to release clear and transparent statements regarding the cause of the outage and the steps being taken to prevent future occurrences.

- PSX Recovery: Swift action is required to restore full functionality to the PSX portal and ensure the smooth flow of trading activities.

- Market Regulation: Reviewing and strengthening market regulations is crucial to prevent similar disruptions and build a more resilient financial system.

Predictions and Expert Opinions:

- Market Forecast: Financial analysts' forecasts vary widely, reflecting the significant uncertainties. Some predict a slow recovery, while others anticipate more prolonged volatility.

- Economic Outlook: The long-term economic outlook for Pakistan is dependent on addressing both domestic economic challenges and the external geopolitical pressures.

- Investor Advice: Experts generally advise investors to exercise caution and diversify their portfolios to mitigate risks in the current volatile environment.

Conclusion:

The recent outage of Pakistan's stock exchange portal, occurring amidst escalating geopolitical tensions, vividly illustrates the fragility of Pakistan's financial markets. The interconnectedness of regional conflicts, international relations, and domestic economic vulnerabilities is undeniable. The government's response and the subsequent market recovery will be crucial factors in shaping the country's economic future. Stay updated on the latest developments regarding Pakistan's volatile stock market and the ongoing geopolitical situation for informed investment decisions. Understanding the interplay between geopolitical risks and domestic market conditions is paramount for navigating Pakistan's volatile market and making sound investment choices.

Featured Posts

-

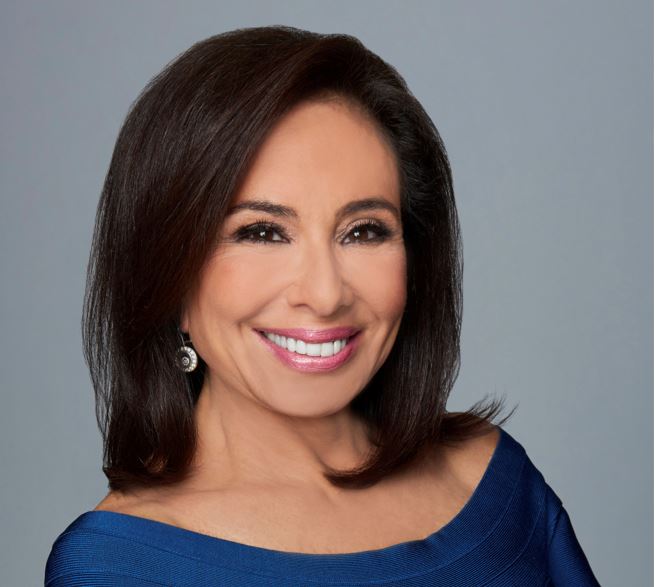

Judge Jeanine Pirro An Exclusive Look At Fox News And Her Life

May 10, 2025

Judge Jeanine Pirro An Exclusive Look At Fox News And Her Life

May 10, 2025 -

Growing Tensions In Pakistan Cause Stock Exchange Portal Outage And Market Volatility

May 10, 2025

Growing Tensions In Pakistan Cause Stock Exchange Portal Outage And Market Volatility

May 10, 2025 -

New Report Uk Government Plans To Tighten Visa Rules For Specific Countries

May 10, 2025

New Report Uk Government Plans To Tighten Visa Rules For Specific Countries

May 10, 2025 -

Tesla And Elon Musk A Net Worth Analysis Considering Us Economic Conditions

May 10, 2025

Tesla And Elon Musk A Net Worth Analysis Considering Us Economic Conditions

May 10, 2025 -

How Bert Kreischers Wife Feels About His Netflix Sex Jokes

May 10, 2025

How Bert Kreischers Wife Feels About His Netflix Sex Jokes

May 10, 2025