Palantir Stock: A 40% Increase Predicted For 2025 – Investment Opportunity?

Table of Contents

Factors Supporting a 40% Increase in Palantir Stock by 2025

Several factors suggest that the predicted 40% increase in Palantir stock by 2025 isn't entirely out of reach.

Growing Government Contracts and Expansion into Commercial Markets

Palantir's success is significantly rooted in its strong presence in the government sector. Securing large-scale contracts with the US government and expanding into international markets has been a cornerstone of its growth. However, equally important is the company's strategic push into the commercial sector. This diversification significantly reduces its reliance on government contracts, offering a more stable revenue stream.

- Key Government Contracts: Palantir has secured significant contracts with various US intelligence agencies and departments, as well as international government organizations. These long-term agreements provide a consistent revenue stream.

- Successful Commercial Partnerships: Palantir's foray into commercial markets has yielded promising results. Partnerships with major corporations across diverse sectors demonstrate the adaptability and scalability of its platform. These commercial clients leverage Palantir's technology for operational efficiency, risk management, and improved decision-making. The continued expansion into this sector signifies substantial growth potential for Palantir stock.

- Keywords: Palantir government contracts, Palantir commercial clients, Palantir revenue growth

Technological Innovation and Competitive Advantage

Palantir's proprietary technology, particularly its flagship platform Foundry, sets it apart from competitors in the big data analytics space. Foundry provides a user-friendly interface for data integration, analysis, and visualization, making complex data accessible to a broader range of users. This technological advantage is a significant driver of its growth.

- Key Technological Advantages: Palantir's expertise in AI, machine learning, and data integration provides a significant competitive edge. Its platform is designed for scalability and adaptability, catering to the complex data needs of both government and commercial clients.

- Keywords: Palantir Foundry, Palantir technology, data analytics, AI, machine learning

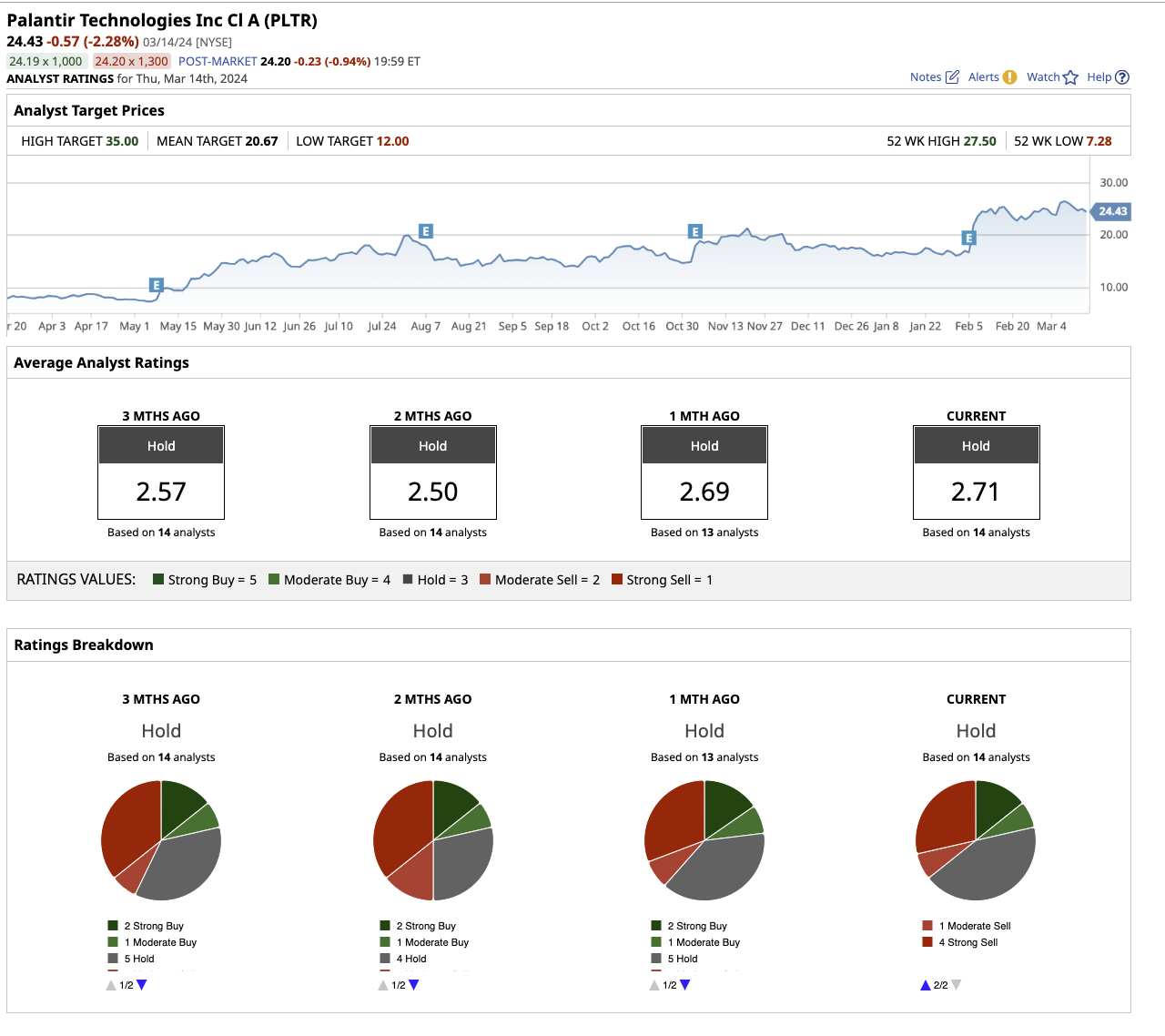

Strong Financial Performance and Future Projections

Analyzing Palantir's recent financial reports reveals a company demonstrating consistent growth, although profitability remains a key area of focus for investors. While revenue growth is impressive, careful consideration of profit margins and operational efficiency is necessary. Numerous financial analysts project substantial growth for Palantir, aligning with the 40% prediction. However, it's crucial to critically evaluate these projections and understand the underlying assumptions.

- Key Financial Metrics: Investors should carefully review Palantir's revenue, operating expenses, and net income to assess its financial health. Tracking these metrics alongside analyst forecasts provides a comprehensive view of the company's financial trajectory.

- Keywords: Palantir financial performance, Palantir earnings, Palantir stock price, market capitalization

Challenges and Risks Associated with Investing in Palantir Stock

Despite the promising outlook, several challenges and risks are associated with investing in Palantir stock. Understanding these is crucial before making an investment decision.

Dependence on Government Contracts

A significant portion of Palantir's revenue comes from government contracts. This reliance creates vulnerability to potential budget cuts, changes in government priorities, and geopolitical instability. While Palantir is actively diversifying into the commercial sector, this dependence remains a considerable risk factor for Palantir stock.

- Keywords: Palantir government dependence, contract risk, political risk

Intense Competition in the Big Data Market

The big data analytics market is incredibly competitive, with major players like AWS, Google Cloud, and Microsoft Azure vying for market share. Palantir needs to maintain its technological edge and continue innovating to fend off this competition and secure its position in the market.

- Keywords: Palantir competitors, big data market competition

Valuation and Market Sentiment

Palantir's current valuation needs careful scrutiny. Market sentiment plays a substantial role in the stock price, making it susceptible to volatility. Periods of negative sentiment could significantly impact the stock's performance, regardless of the company's underlying fundamentals.

- Keywords: Palantir stock valuation, market sentiment, stock price volatility

Conclusion: Palantir Stock Investment: A Calculated Risk?

The 40% growth prediction for Palantir stock by 2025 presents a compelling investment opportunity, driven by factors like growing government contracts, expansion into commercial markets, and technological innovation. However, risks associated with government contract dependence, intense competition, and market sentiment must be carefully considered. While the potential rewards are significant, investing in Palantir stock involves a calculated risk. Therefore, thorough due diligence, understanding your risk tolerance, and diversification of your investment portfolio are crucial before making any investment decisions. Consider the potential of Palantir stock for your investment portfolio, but remember to conduct your own research and assess your risk tolerance before investing.

Featured Posts

-

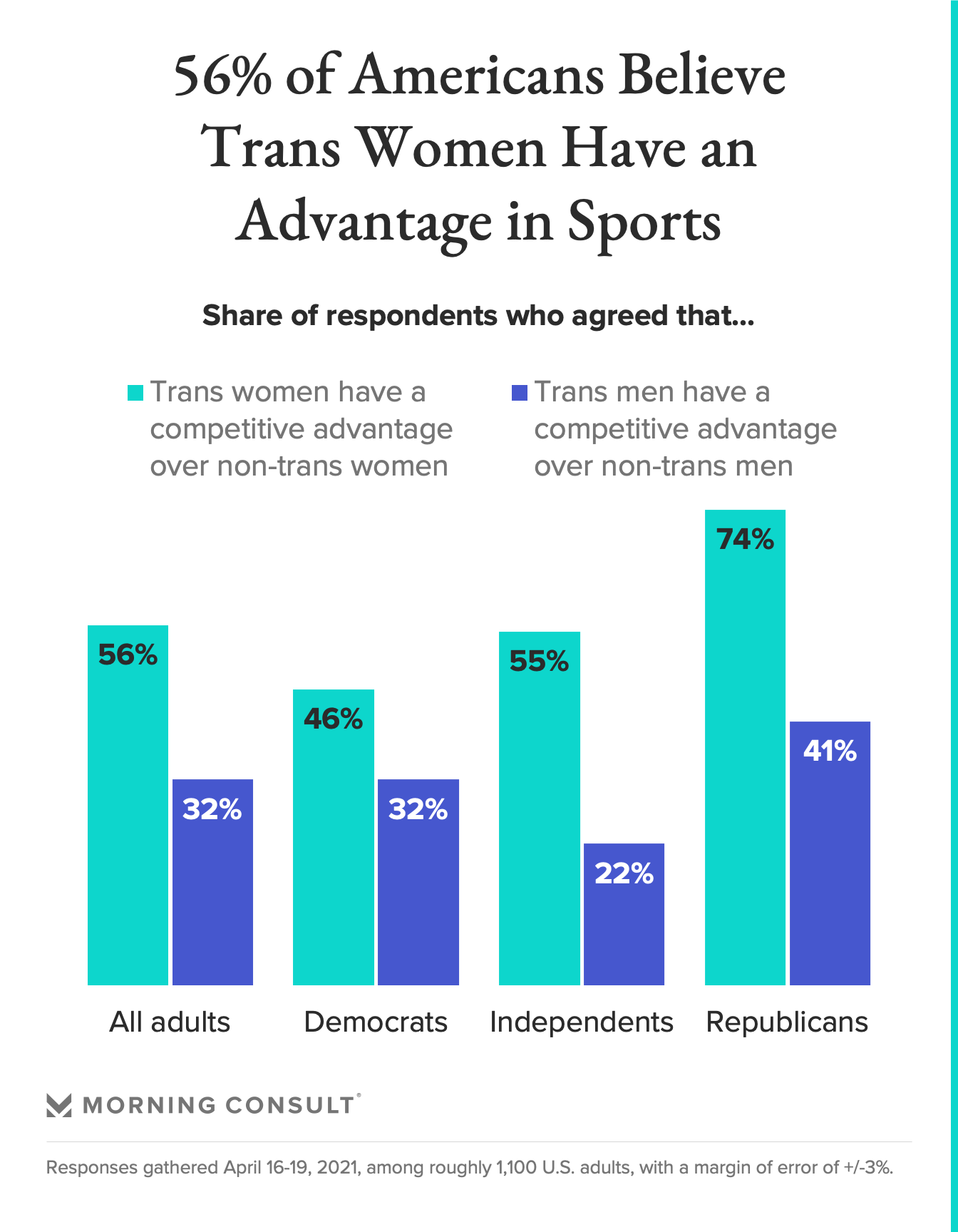

Following Trumps Order Ihsaas Policy Change On Transgender Participation In Girls Sports

May 10, 2025

Following Trumps Order Ihsaas Policy Change On Transgender Participation In Girls Sports

May 10, 2025 -

Rhlt Barys San Jyrman Nhw Alfwz Bdwry Abtal Awrwba

May 10, 2025

Rhlt Barys San Jyrman Nhw Alfwz Bdwry Abtal Awrwba

May 10, 2025 -

Nl Federal Election Get To Know Your Candidates

May 10, 2025

Nl Federal Election Get To Know Your Candidates

May 10, 2025 -

Nottingham Attack Survivor Speaks Out Heartbreaking Plea After Triple Killing

May 10, 2025

Nottingham Attack Survivor Speaks Out Heartbreaking Plea After Triple Killing

May 10, 2025 -

Stock Market Prediction 2 Potential Winners Outpacing Palantir 3 Year Outlook

May 10, 2025

Stock Market Prediction 2 Potential Winners Outpacing Palantir 3 Year Outlook

May 10, 2025