Palantir Stock: A Buy Or Sell Recommendation

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir operates primarily through two platforms: Gotham and Foundry. Gotham caters to government agencies, providing advanced data analytics for intelligence, defense, and law enforcement. Foundry, on the other hand, targets commercial clients across various sectors, offering a platform for data integration, analysis, and operational optimization. This dual approach provides diversification, but also presents unique challenges.

Palantir employs a recurring revenue model, primarily through subscription fees and services. This model is crucial for long-term growth and predictability. However, it also means a dependence on contract renewals and securing new, often large-scale, contracts.

- High growth potential in government contracts (US and international): Palantir enjoys a strong presence in the US government sector and is actively expanding into international markets, presenting significant growth opportunities. Government contracts often involve long-term agreements, providing revenue stability.

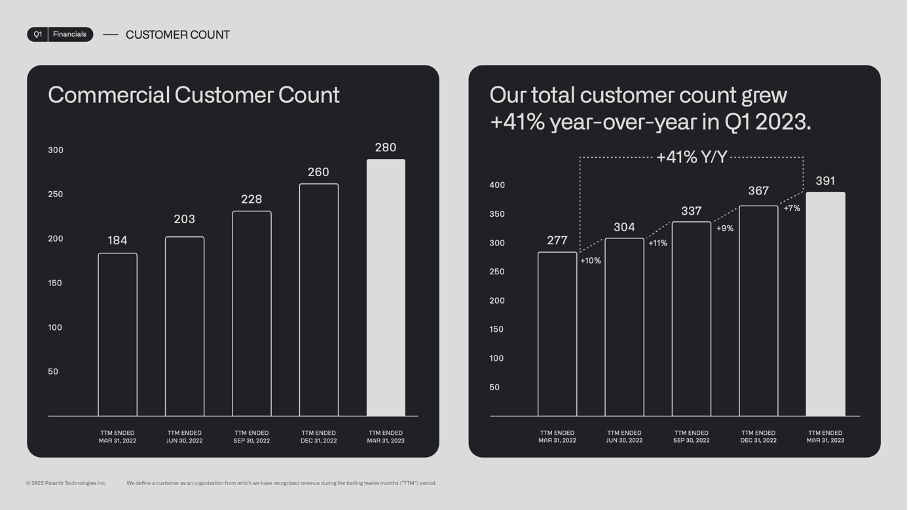

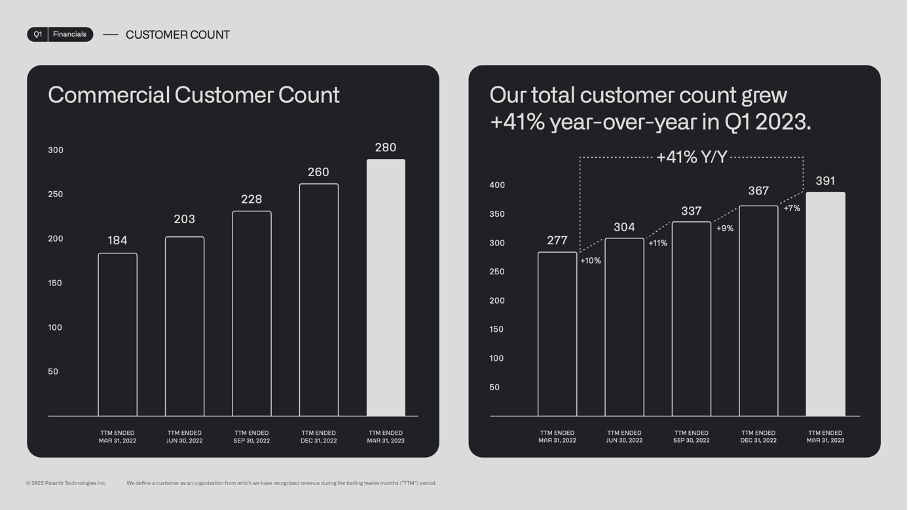

- Increasing adoption of Foundry in the commercial sector: While the commercial market is more competitive, Foundry's adoption is increasing, showing potential for substantial revenue growth in the future. This expansion diversifies Palantir’s revenue streams, reducing reliance on government contracts.

- Dependence on large contracts; risk of concentration: A significant portion of Palantir's revenue comes from a limited number of large contracts. The loss of a major client could significantly impact revenue and Palantir stock performance. This risk necessitates careful monitoring of contract renewals and client relationships.

- Analysis of recent revenue reports and growth projections: Recent financial reports should be meticulously reviewed to assess the actual revenue growth and compare it to projected figures. This allows for a more realistic evaluation of Palantir's financial health and future prospects.

Competitive Landscape and Market Position

Palantir faces competition from established players like Databricks and Snowflake in the broader big data analytics market. However, Palantir possesses unique competitive advantages. Its deep expertise in data integration, particularly within complex government environments, and its strong relationships with government agencies provide a significant barrier to entry for competitors.

- Palantir's unique position in the government sector: Palantir's established position and reputation within the government sector offer a strong competitive advantage, creating a niche market difficult for competitors to penetrate.

- Challenges faced in the competitive commercial market: The commercial market is significantly more competitive. Palantir needs to consistently demonstrate the value proposition of Foundry to gain market share against established players with broader reach.

- Analysis of Palantir's market share and growth compared to competitors: A comparative analysis of Palantir's market share, revenue growth, and customer acquisition rates against its main competitors provides valuable insights into its competitive positioning.

- Discussion of potential partnerships and acquisitions: Strategic partnerships or acquisitions could significantly enhance Palantir’s competitive position and accelerate its growth trajectory.

Financial Performance and Valuation

Analyzing Palantir's financial statements – including revenue, profit margins, and cash flow – is crucial for evaluating its financial health. Key financial ratios, such as the Price-to-Sales (P/S) ratio and Price-to-Earnings (P/E) ratio, help in determining its valuation relative to its peers and the market. The company's debt levels and overall financial sustainability are also important considerations.

- Detailed analysis of Palantir's profitability and growth: Examining Palantir's revenue growth, profit margins, and operating cash flow is crucial in assessing its financial performance and sustainability.

- Comparison of valuation metrics to competitors: Comparing Palantir’s valuation metrics (P/S, P/E) to those of its main competitors provides insights into its relative valuation and potential investment attractiveness.

- Assessment of long-term financial sustainability: Analyzing Palantir’s cash flow, debt levels, and future projections helps in determining its long-term financial health and stability.

- Discussion of future financial projections and their implications for stock price: Analyzing Palantir’s future financial projections, taking into account potential growth rates and market conditions, provides important insights into its future stock price trajectory.

Risk Factors Affecting Palantir Stock

Investing in Palantir stock carries inherent risks. Geopolitical instability can impact government contracts, while competition in the commercial market poses a constant challenge. The company’s dependence on a relatively small number of large clients increases vulnerability to the loss of key contracts.

- Geopolitical risks and their impact on government contracts: International conflicts or shifts in government priorities can affect the demand for Palantir’s services and the timing of payments for government contracts.

- Competitive pressures in the commercial market: The commercial market is highly competitive, with established players continuously innovating and improving their offerings. Maintaining a competitive edge requires continuous investment in research and development and strategic partnerships.

- Dependence on a small number of large clients: Losing a key client can significantly impact Palantir's revenue and profitability. Diversification of clientele is crucial to mitigating this risk.

- Potential regulatory hurdles and compliance issues: The nature of Palantir's work in government and sensitive sectors exposes it to potential regulatory scrutiny and compliance requirements.

Conclusion

Our analysis of Palantir stock reveals a company with strong potential fueled by its unique position in the government sector and growing adoption of Foundry in the commercial market. However, its dependence on large contracts, competitive pressures, and inherent geopolitical risks represent significant challenges. The recurring revenue model offers a degree of stability, but careful monitoring of contract renewals and client relationships is crucial. A thorough examination of Palantir's financial statements and valuation metrics is essential to assess its long-term sustainability and investment viability.

Buy, Sell, or Hold Recommendation: Based on the analysis, a cautious "Hold" recommendation is suggested. While Palantir presents significant long-term potential, the inherent risks and competitive pressures warrant a watchful approach. Further research and monitoring of financial performance and market conditions are crucial before considering a buy decision.

Call to Action: Do your due diligence before investing in Palantir stock. Consider carefully your investment strategy and risk tolerance before making any decisions regarding Palantir Technologies (PLTR). Remember, this analysis is not financial advice.

Featured Posts

-

Bundesliga 2 Matchday 27 Results And Table Update Cologne On Top

May 09, 2025

Bundesliga 2 Matchday 27 Results And Table Update Cologne On Top

May 09, 2025 -

Madeleine Mc Cann Disappearance A 23 Year Olds Dna Test And The Ongoing Investigation

May 09, 2025

Madeleine Mc Cann Disappearance A 23 Year Olds Dna Test And The Ongoing Investigation

May 09, 2025 -

The Next Warren Buffett A Canadian Billionaires Unconventional Path

May 09, 2025

The Next Warren Buffett A Canadian Billionaires Unconventional Path

May 09, 2025 -

Dakota Johnsons Materialist Premiere Family Support And Red Carpet Photos

May 09, 2025

Dakota Johnsons Materialist Premiere Family Support And Red Carpet Photos

May 09, 2025 -

Kimbal Musk Exploring The Life And Career Of Elon Musks Brother

May 09, 2025

Kimbal Musk Exploring The Life And Career Of Elon Musks Brother

May 09, 2025