Palantir Stock Analysis: Is It A Good Investment?

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir operates primarily through two platforms: Gotham and Foundry. Gotham targets government agencies, providing advanced data analytics solutions for national security and intelligence operations. Foundry, meanwhile, focuses on the commercial sector, offering a flexible platform for various industries to leverage their data effectively.

Government Contracts

Government contracts form a substantial portion of Palantir's revenue. This reliance, while currently providing a stable income stream, presents both opportunities and risks.

- Examples of government contracts: Palantir works with numerous intelligence agencies and government departments across various countries. Specific contract details are often confidential due to national security concerns.

- Contract renewal rates: Maintaining high contract renewal rates is crucial for Palantir's financial stability. Success in this area indicates strong client satisfaction and the value proposition of their services.

- Potential future government spending: Increased government investment in national security and data analytics could significantly benefit Palantir's future revenue streams. However, budget cuts or shifts in government priorities could negatively impact the company's growth.

Commercial Growth

Palantir's expansion into the commercial sector is a key indicator of its long-term growth potential. Success here will diversify its revenue streams and reduce reliance on government contracts.

- Examples of successful commercial partnerships: Palantir has secured partnerships with major corporations across various sectors, including healthcare, finance, and manufacturing. These partnerships showcase the adaptability and value of its Foundry platform.

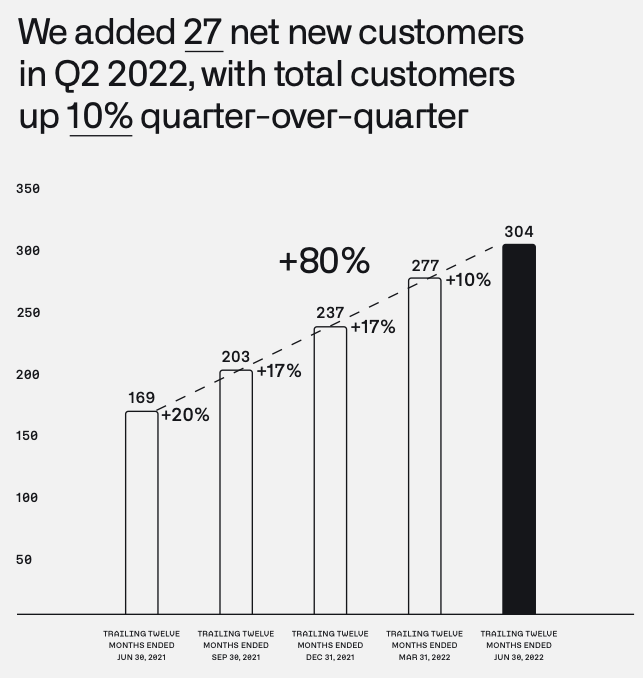

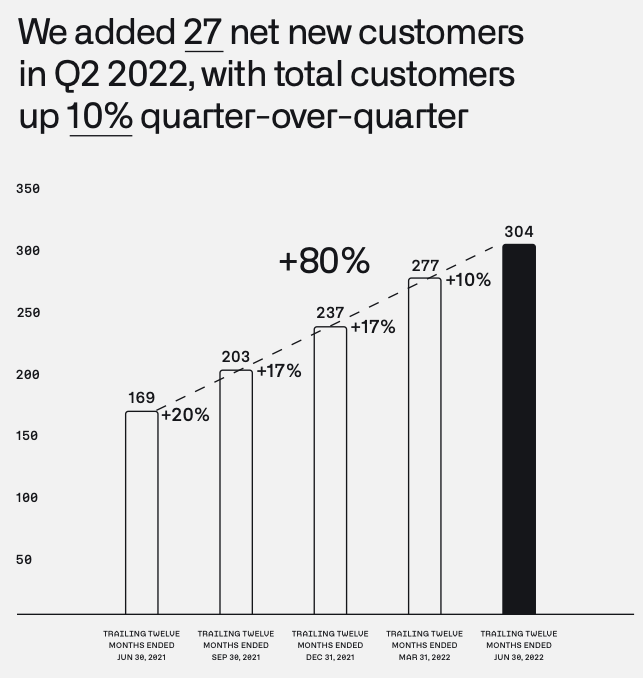

- Growth rates in the commercial sector: Monitoring the growth rate in the commercial segment is vital in assessing Palantir’s overall performance and future prospects. Consistent growth in this area signifies successful market penetration.

- Market share comparisons: Analyzing Palantir's market share against competitors within the commercial big data analytics market provides context for its performance and future potential.

Revenue and Profitability

Analyzing Palantir's financial reports reveals insights into its revenue growth and profitability.

- Key financial metrics (revenue, EBITDA, net income): These metrics provide a clear picture of Palantir’s financial health. Consistent positive revenue growth is a key indicator of success.

- Year-over-year growth: Comparing year-over-year growth figures helps establish trends and assess the effectiveness of Palantir's business strategies.

- Comparison to industry peers: Benchmarking Palantir against its competitors reveals its relative performance within the big data analytics market. This allows for a more comprehensive evaluation of its financial standing. (Note: Charts and graphs would be included here in a full article).

Competitive Landscape and Market Analysis

Palantir faces competition from established players and emerging startups in the big data analytics market. Key competitors include Databricks, Snowflake, and other cloud-based data analytics providers.

Market Share and Growth Potential

The big data analytics market is expanding rapidly, driven by increased data generation and the growing need for advanced analytical capabilities.

- Market size forecasts: Market research reports provide forecasts for the future size of the big data analytics market, offering insights into Palantir’s potential for growth.

- Palantir’s projected market share: Estimates of Palantir’s future market share indicate its competitiveness and potential for capturing a larger slice of the market.

- Factors affecting market growth: Technological advancements, regulatory changes, and economic conditions are all factors that influence market growth and Palantir's ability to capitalize on opportunities.

Technological Advantages

Palantir possesses several technological advantages that could provide a competitive edge:

- Proprietary algorithms: Palantir’s unique algorithms enable advanced data analysis and insights.

- Data integration capabilities: Its platform's ability to integrate diverse data sources is a key strength.

Risk Factors and Potential Downsides

Investing in Palantir stock carries several risks:

Dependence on Government Contracts

The substantial reliance on government contracts exposes Palantir to potential risks from budget cuts or changes in government priorities.

Competition and Technological Disruption

Intense competition and rapid technological advancements could disrupt Palantir's market position.

Valuation and Stock Price

Palantir's stock price has exhibited significant volatility. Analyzing its valuation metrics is crucial:

- P/E ratio: A high P/E ratio could suggest overvaluation.

- Price-to-Sales ratio: Comparing the price-to-sales ratio to industry peers provides context for Palantir's valuation.

- Comparison to similar companies' valuations: A comparative analysis helps determine if Palantir is fairly valued relative to its competitors.

Future Outlook and Investment Implications

Palantir's future performance will depend on several factors, including its success in the commercial sector, its ability to maintain and grow its government contracts, and its capacity to innovate and adapt to the evolving competitive landscape.

Growth Projections

Based on the analysis above, projecting Palantir’s future growth requires careful consideration of its financial performance, competitive landscape, and potential risks. Conservative and optimistic growth scenarios should be considered.

Investment Recommendation

Based on this analysis, a balanced approach is recommended. While Palantir possesses strong potential for long-term growth, the risks associated with its dependence on government contracts and the competitive nature of the market must be acknowledged. Further, a thorough independent due diligence process is essential before making any investment decision. Therefore, the recommendation is Hold at this time. Re-evaluation is recommended as new financial data and market conditions emerge.

- Reasons for the recommendation: The recommendation is based on the analysis of Palantir's current financial standing, market position, and future outlook, considering both positive and negative factors.

- Potential return on investment: The potential for return depends on several factors, including the company's success in achieving its growth projections and maintaining its market position.

- Risk tolerance considerations: Investors should consider their personal risk tolerance before investing in Palantir stock given the volatility associated with the company and the sector.

Conclusion

This Palantir stock analysis offers insights into the company's financial performance, competitive landscape, and future outlook. While Palantir shows promise in the big data analytics field, the risks inherent in its business model require careful consideration. The recommendation is to hold, but this analysis is for informational purposes only and not financial advice. Conduct your own thorough due diligence before investing in Palantir stock, considering your own risk tolerance and investment goals. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Vu Bao Hanh Tre Em O Tien Giang Yeu Cau Cham Dut Hoat Dong Giu Tre Ngay Lap Tuc

May 09, 2025

Vu Bao Hanh Tre Em O Tien Giang Yeu Cau Cham Dut Hoat Dong Giu Tre Ngay Lap Tuc

May 09, 2025 -

Is Your Investment A Real Safe Bet A Critical Assessment

May 09, 2025

Is Your Investment A Real Safe Bet A Critical Assessment

May 09, 2025 -

Strictly Come Dancing Wynne Evans Unexpected Career Change

May 09, 2025

Strictly Come Dancing Wynne Evans Unexpected Career Change

May 09, 2025 -

Mulher Que Se Diz Madeleine Mc Cann Presa No Reino Unido Policia Investiga Caso

May 09, 2025

Mulher Que Se Diz Madeleine Mc Cann Presa No Reino Unido Policia Investiga Caso

May 09, 2025 -

Celebrity Antiques Road Trip Exploring The Locations And Finds

May 09, 2025

Celebrity Antiques Road Trip Exploring The Locations And Finds

May 09, 2025