Palantir Stock Before May 5th: Is It A Buy? Wall Street's Verdict

Table of Contents

Our assessment leans towards a hold recommendation for Palantir stock before May 5th, acknowledging the inherent uncertainty and stressing the importance of independent investor research. Let's dive into the details.

Palantir's Recent Performance and Key Financial Metrics

Analyzing Palantir's stock price movements leading up to May 5th requires examining key financial indicators. The recent performance of Palantir stock has been mixed, reflecting broader market volatility and company-specific news. Understanding the underlying financial health is crucial for informed decision-making regarding Palantir stock.

- Revenue Growth: While Palantir has shown consistent revenue growth, the rate of growth needs to be considered against its valuation. Investors should assess if the growth justifies the current stock price of Palantir.

- Profitability: Palantir's journey towards profitability is an ongoing story. Analyzing its margins and operating expenses helps to gauge its long-term sustainability. Examining the path to profitability for Palantir stock is vital.

- Earnings Per Share (EPS): Tracking EPS reveals the profitability on a per-share basis, providing a key metric for evaluating Palantir stock's performance against expectations. Significant deviations from projected EPS could trigger volatility in the Palantir stock price.

Specific Data Points (Illustrative – replace with actual data):

- Q4 2023 Revenue: $500 million (hypothetical)

- Year-over-Year Revenue Growth: 25% (hypothetical)

- EPS: $0.10 (hypothetical)

- Comparison to Competitors: Outpacing some, lagging behind others in specific market segments (requires further research and comparison with competitors' financial data).

Wall Street Analysts' Ratings and Price Targets for Palantir Stock

Wall Street analysts offer a range of opinions on Palantir stock, making it essential to understand the consensus and the rationale behind different ratings. While individual analyst opinions can vary, understanding the overall sentiment is crucial for assessing Palantir stock's future prospects.

Analyst Ratings (Illustrative – replace with actual data):

- Analyst A: Buy, Price Target: $25

- Analyst B: Hold, Price Target: $20

- Analyst C: Sell, Price Target: $15

Factors Influencing Analyst Ratings:

- Growth Prospects: Analysts weigh Palantir's potential for future revenue growth based on its product offerings and market penetration.

- Valuation: The current market capitalization of Palantir relative to its earnings and future prospects significantly impacts analyst ratings.

- Market Conditions: Broader economic conditions and the technology sector's performance influence the outlook for Palantir stock.

Catalysts Affecting Palantir Stock Before May 5th

Several potential events could significantly influence Palantir stock before May 5th. Understanding these catalysts and their potential impact is key to evaluating investment risk for Palantir stock.

Potential Catalysts:

- Earnings Report: The release of Palantir's earnings report could trigger a significant price reaction, depending on whether it meets or surpasses expectations.

- New Contract Wins: Announcing substantial new contracts, particularly with large government agencies, could boost investor confidence and drive up the Palantir stock price.

- Product Launches: Introducing innovative new products or significant updates to existing platforms could positively impact Palantir stock.

Impact Assessment: Each catalyst has both upside and downside potential. A positive surprise could lead to a price surge, while disappointing news could result in a drop in Palantir stock price. The probability of each catalyst occurring needs to be carefully assessed.

Risks and Potential Downsides of Investing in Palantir Stock

Investing in Palantir stock carries inherent risks that potential investors should carefully consider. A balanced perspective necessitates understanding both the upside and downside potential of Palantir stock before making an investment decision.

Key Risks:

- High Valuation: Palantir's current valuation relative to its earnings is a significant risk factor.

- Government Contract Dependence: A substantial portion of Palantir's revenue comes from government contracts, making it susceptible to changes in government spending and policy.

- Competition: The data analytics market is intensely competitive, and Palantir faces challenges from established players and emerging startups.

Conclusion: Palantir Stock Before May 5th – The Final Verdict

Our analysis suggests a hold recommendation for Palantir stock before May 5th. While Palantir exhibits growth potential and has attracted positive attention, the risks associated with its valuation, dependence on government contracts, and intense competition need careful consideration. The potential catalysts before May 5th add further uncertainty.

Make an informed decision about Palantir stock based on your own risk tolerance and investment goals. Remember, this is not financial advice. Conduct thorough research, consult with a financial advisor, and diversify your portfolio before investing in Palantir stock or any other security. Consider consulting reputable financial news sources and analyst reports for further insights into Palantir stock's performance and future prospects.

Featured Posts

-

Rhlt Barbwza Bed Khsart Alasnan Fy Merkt Marakana

May 09, 2025

Rhlt Barbwza Bed Khsart Alasnan Fy Merkt Marakana

May 09, 2025 -

Masshtabnoe Otklyuchenie Sveta V Sverdlovskoy Oblasti Posle Snegopada

May 09, 2025

Masshtabnoe Otklyuchenie Sveta V Sverdlovskoy Oblasti Posle Snegopada

May 09, 2025 -

2025 Presidential Politics A Focus On Day 109 Of The Trump Administration

May 09, 2025

2025 Presidential Politics A Focus On Day 109 Of The Trump Administration

May 09, 2025 -

Wynne Evans Health Update A Nasty Illness And Showbiz Return

May 09, 2025

Wynne Evans Health Update A Nasty Illness And Showbiz Return

May 09, 2025 -

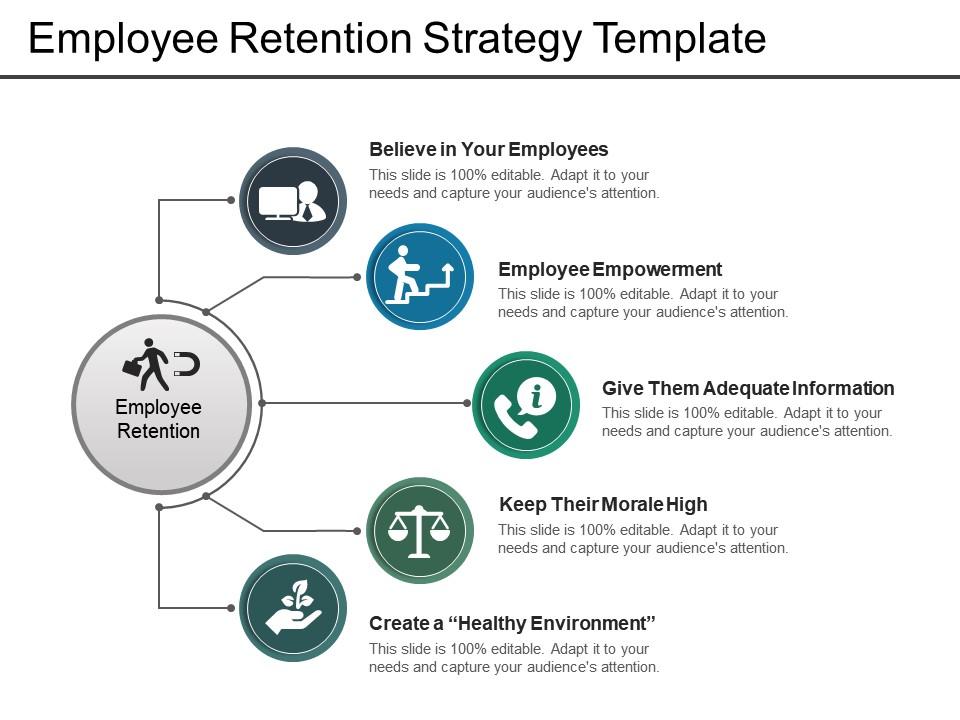

Investing In Middle Management A Strategy For Business Growth And Employee Retention

May 09, 2025

Investing In Middle Management A Strategy For Business Growth And Employee Retention

May 09, 2025