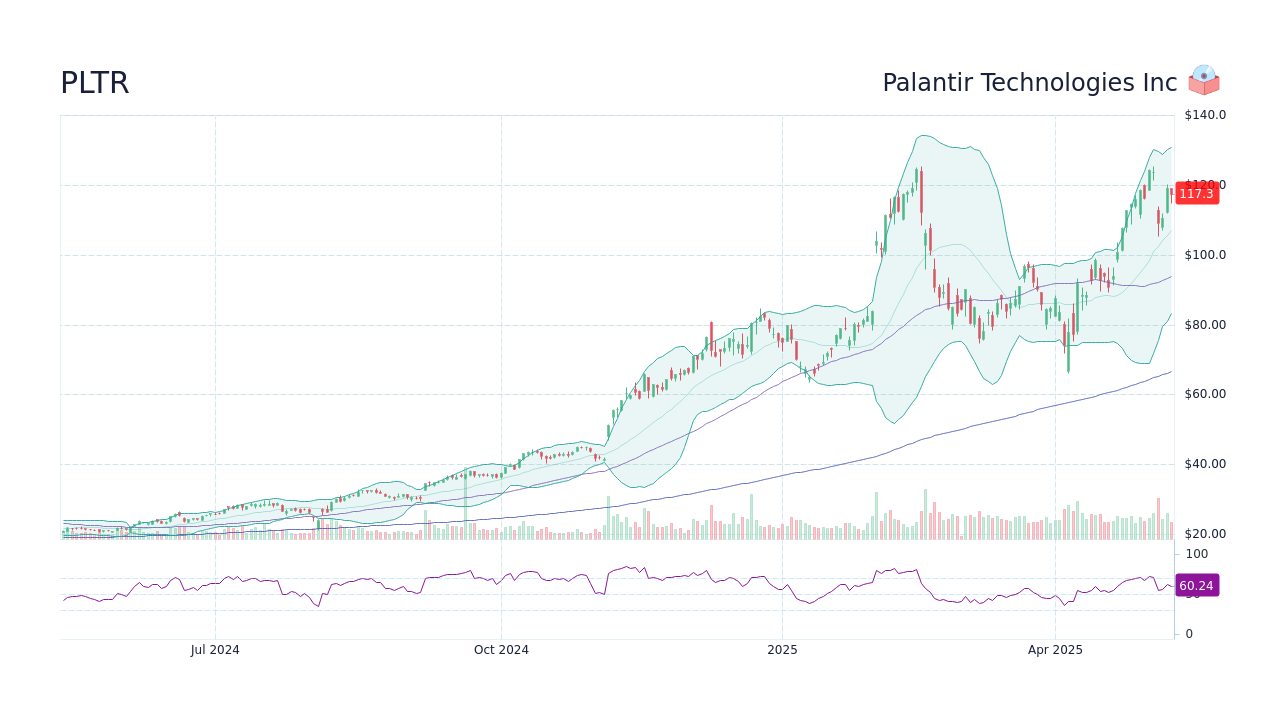

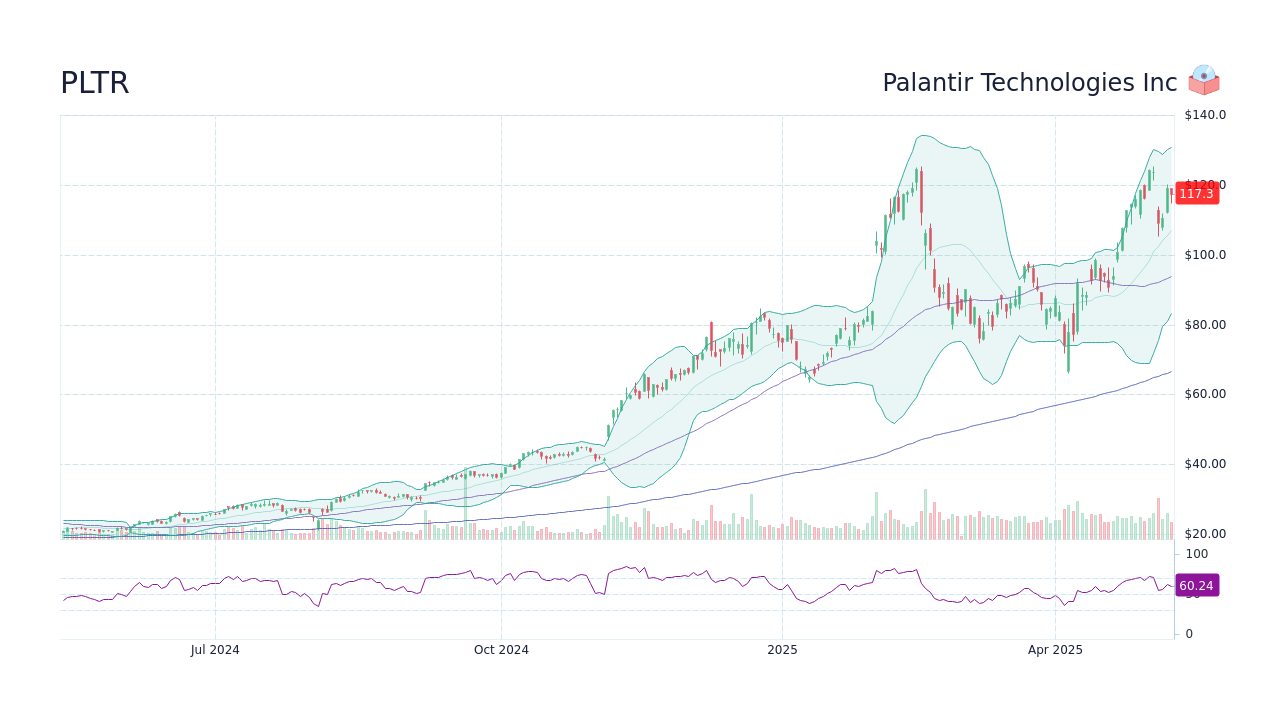

Palantir Stock Forecast 2025: Evaluating A Potential 40% Surge

Table of Contents

Palantir's Current Market Position and Growth Trajectory

Analyzing Revenue Growth and Profitability

Palantir's financial performance provides a crucial baseline for any Palantir stock forecast. Recent years have shown significant revenue growth, driven largely by increased demand for its advanced data analytics solutions. Let's examine the key metrics:

- Revenue Growth: While specific figures fluctuate quarter to quarter, Palantir has consistently demonstrated strong year-over-year revenue growth, exceeding expectations in several periods. This sustained growth indicates a healthy market appetite for their offerings.

- Net Income: While profitability remains a focus for Palantir, the company is prioritizing growth and market penetration, which has resulted in periods of net losses. However, improvements in operating margins suggest a path towards sustained profitability.

- Operating Margins: Palantir's operating margins have shown signs of improvement, reflecting increasing efficiency in operations and a greater focus on cost control. This trend is vital for long-term sustainability and investor confidence.

Key factors driving this growth include substantial government contracts, particularly within the defense and intelligence sectors, and expanding partnerships with commercial enterprises in various industries, such as finance and healthcare.

Competitive Landscape and Market Share

Palantir operates in a fiercely competitive landscape. Key competitors include established players like Snowflake, Databricks, and smaller, more agile startups constantly innovating in the big data and analytics space. However, Palantir maintains several key competitive advantages:

- Unique Selling Propositions (USPs): Palantir's platforms, Foundry and Gotham, offer unique capabilities in data integration, analysis, and visualization, catering to complex, high-stakes environments.

- Strong Government Relationships: Palantir's deep ties with government agencies, particularly in the US, provide a stable and significant revenue stream.

- Focus on Complex Data Problems: Palantir specializes in solving highly complex data problems, a niche that not all competitors successfully address.

Estimating Palantir's precise market share is challenging, but its strong position within specific government and commercial niches suggests significant growth potential.

Factors Influencing Palantir Stock Price in 2025

Technological Advancements and Innovation

Palantir's continued success hinges on its ability to innovate and adapt to evolving market needs. Its R&D efforts are critical to any positive Palantir stock price prediction.

- AI Integration: The integration of artificial intelligence and machine learning into Palantir's platforms enhances its analytical capabilities and opens up new market opportunities.

- New Product Launches: The introduction of new products and features will be crucial in maintaining a competitive edge and attracting new clients.

- Data Analytics Advancements: Continued advancements in data analytics capabilities will be key to providing superior value to clients.

Government Spending and Geopolitical Factors

Government spending, particularly in defense and intelligence, significantly impacts Palantir's revenue.

- Increased Government Investment: Increased global investment in data analytics and national security will likely benefit Palantir.

- Geopolitical Instability: Conversely, geopolitical instability and shifts in government priorities could negatively impact contract awards and revenue streams.

Economic Conditions and Investor Sentiment

Macroeconomic factors play a substantial role in investor sentiment and stock valuations.

- Interest Rate Hikes: Rising interest rates can dampen investor enthusiasm for growth stocks like Palantir.

- Inflation: High inflation could impact government budgets and corporate spending on data analytics solutions.

- Overall Market Volatility: General market volatility significantly influences investor confidence in individual stocks, including Palantir.

Potential Risks and Challenges

While the potential for a 40% surge is plausible, several risks and challenges could hinder Palantir's growth.

Competition and Market Saturation

The data analytics market is increasingly competitive, posing significant challenges:

- Established Players: Existing players are constantly innovating and expanding their product offerings.

- Emerging Startups: New startups with disruptive technologies can pose a threat to Palantir's market share.

Dependence on Government Contracts

Palantir's reliance on government contracts introduces several risks:

- Contract Delays: Delays in contract awards or renewals can disrupt revenue streams.

- Contract Cancellations: Unforeseen circumstances could lead to contract cancellations, negatively impacting revenue.

Data Privacy and Security Concerns

Data privacy and security are paramount in Palantir's industry.

- Regulatory Compliance: Meeting increasingly stringent data privacy regulations is crucial.

- Data Breaches: Any data breaches could severely damage Palantir's reputation and client relationships.

Conclusion

A 40% surge in Palantir stock price by 2025 is certainly a possibility, driven by its strong growth trajectory, technological advancements, and potentially significant government contracts. However, investors must carefully consider the risks associated with increasing competition, reliance on government contracts, and the broader macroeconomic environment. This Palantir stock forecast 2025 presents a compelling investment opportunity, but thorough due diligence is essential. Conduct thorough due diligence before investing in Palantir stock and learn more about Palantir's future prospects and the Palantir Stock Forecast 2025. Stay informed on the latest Palantir stock price predictions and make informed decisions based on your own risk tolerance. Remember, this analysis is not financial advice; always consult with a financial professional before making investment decisions.

Featured Posts

-

Strengthening The Eu Response To Us Tariffs A French Ministers Call

May 10, 2025

Strengthening The Eu Response To Us Tariffs A French Ministers Call

May 10, 2025 -

Makron Starmer Merts I Tusk Proignorirovali Priglashenie V Kiev 9 Maya

May 10, 2025

Makron Starmer Merts I Tusk Proignorirovali Priglashenie V Kiev 9 Maya

May 10, 2025 -

Sensex And Nifty Today Live Market Updates And Analysis

May 10, 2025

Sensex And Nifty Today Live Market Updates And Analysis

May 10, 2025 -

Easing Regulations For Bond Forwards A Boon For Indian Insurers

May 10, 2025

Easing Regulations For Bond Forwards A Boon For Indian Insurers

May 10, 2025 -

Find Live Music And Events In Lake Charles This Easter Weekend

May 10, 2025

Find Live Music And Events In Lake Charles This Easter Weekend

May 10, 2025