Palantir Stock Investment Strategy Before May 5th

Table of Contents

Analyzing Palantir's Current Financial Performance and Future Projections

Understanding Palantir's financial standing is paramount to any sound investment strategy. We need to look beyond the headlines and analyze the key metrics that paint a clearer picture of the company's potential. This involves scrutinizing its recent financial reports and considering expert predictions for future growth.

-

Review of Q4 2022 and Full-Year 2022 Earnings Reports: Examining Palantir's recent earnings reports is critical. Key areas to focus on include revenue growth, operating margins, and the overall trajectory of profitability. A year-over-year comparison will help identify trends and potential areas of concern. Did they meet or exceed analyst expectations? What are the long-term implications of their financial performance?

-

Analysis of Palantir's Revenue Streams and Their Growth Potential: Palantir's revenue comes from various sources, including government contracts and commercial partnerships. Assessing the growth potential of each revenue stream is essential. Which sectors are showing the most promising growth? Are they effectively diversifying their income streams?

-

Discussion of Key Financial Ratios (e.g., P/E Ratio, PEG Ratio): Analyzing key financial ratios like the Price-to-Earnings (P/E) ratio and Price/Earnings to Growth (PEG) ratio helps determine whether Palantir stock is overvalued or undervalued compared to its peers and historical performance. A comparative analysis against competitors in the big data and AI sector is crucial here.

-

Examination of Market Sentiment and Analyst Ratings for PLTR Stock: Monitoring market sentiment and analyst ratings provides valuable insights into the overall outlook for Palantir. Are analysts bullish or bearish on the stock? What are their price targets? This information should be considered, but not solely relied upon.

-

Consideration of Potential Risks and Challenges Facing Palantir: No investment is without risk. Potential challenges for Palantir could include increased competition, dependence on government contracts, or difficulties scaling its operations. A thorough risk assessment is essential before making any investment decisions.

Evaluating Market Conditions and Macroeconomic Factors Affecting Palantir Stock

Palantir's stock price isn't solely determined by its internal performance; broader market conditions and macroeconomic factors play a significant role.

-

Impact of Rising Interest Rates on Tech Valuations: Rising interest rates typically lead to lower valuations for growth stocks like Palantir, as investors demand higher returns. Understanding the Federal Reserve's monetary policy and its potential impact is crucial.

-

Analysis of Current Inflation Rates and Their Effect on Consumer Spending: Inflation can significantly impact consumer spending, potentially affecting Palantir's commercial revenue streams. Analyzing the relationship between inflation and consumer confidence is important.

-

Assessment of Geopolitical Risks and Their Potential Influence on Palantir's Business: Geopolitical instability can create uncertainty in the market and impact the performance of tech stocks. Understanding potential risks associated with global events is crucial for assessing Palantir's vulnerability.

-

Comparison of Palantir's Performance to Other Big Data and AI Companies: Benchmarking Palantir's performance against competitors like Databricks, Snowflake, and other AI-focused companies provides context and helps assess its relative value and growth potential.

Developing a Personalized Palantir Investment Strategy Before May 5th

A successful Palantir investment strategy requires personalization based on your individual circumstances.

-

Defining Your Investment Goals and Risk Tolerance: Before investing, clearly define your investment goals (long-term growth, short-term gains, etc.) and your risk tolerance (conservative, moderate, aggressive).

-

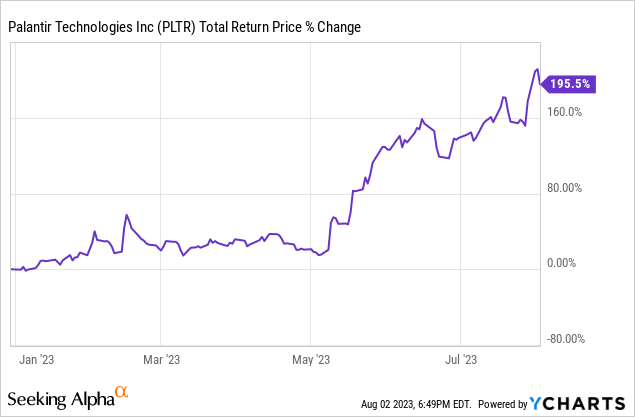

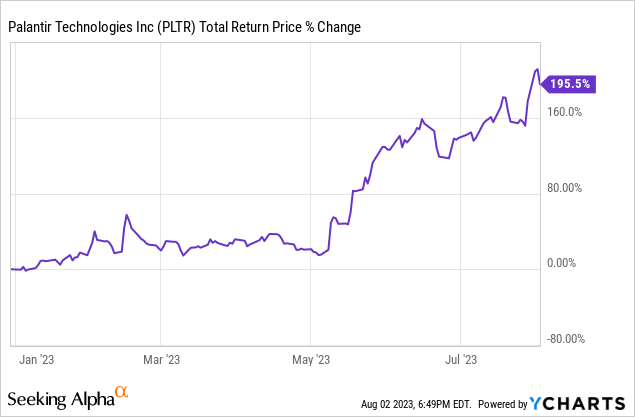

Assessing the Potential Risks and Rewards of Investing in Palantir: Weigh the potential upside against the potential downside. Consider the volatility of Palantir's stock price and your ability to withstand potential losses.

-

Choosing the Appropriate Investment Timeframe (Short-Term or Long-Term): Are you a day trader looking for quick gains, or a long-term investor seeking significant growth over several years? Your timeframe will dictate your investment approach.

-

Determining the Optimal Investment Amount Based on Your Portfolio: Invest only what you can afford to lose. Never invest more than a small percentage of your overall portfolio in a single stock, especially one as volatile as Palantir.

-

Discussing the Importance of Diversification Within Your Investment Portfolio: Diversification is key to mitigating risk. Don't put all your eggs in one basket. Spread your investments across different asset classes to reduce overall portfolio volatility.

Analyzing Potential Catalysts and Risks Before May 5th

Several factors could impact Palantir's stock price before May 5th.

-

Examination of Any Upcoming News or Announcements from Palantir: Keep a close eye on any press releases, news articles, or announcements from Palantir that might impact the stock price.

-

Assessment of the Potential Impact of New Product Launches or Partnerships: New product launches or strategic partnerships could be significant catalysts, positively impacting the stock price.

-

Analysis of Regulatory Risks and Their Potential Effect on Palantir's Operations: Regulatory changes or potential legal challenges could negatively impact Palantir's business and stock price.

-

Identification of Potential Black Swan Events That Could Unexpectedly Impact the Stock Price: Unforeseen events (e.g., geopolitical crises, significant market corrections) can have a dramatic impact. Consider the range of possible scenarios.

Conclusion

Investing in Palantir stock requires a well-defined strategy that considers its financial performance, market conditions, and potential catalysts. Thorough research and a personalized approach are essential before making any investment decisions. Remember to assess your risk tolerance and investment goals. Don't solely rely on analyst predictions; conduct your own due diligence.

Develop your own informed Palantir stock investment strategy before May 5th based on your risk tolerance and investment goals. Remember, this article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Broad Street Diners Fate Demolition For Hyatt Hotel Project

May 10, 2025

Broad Street Diners Fate Demolition For Hyatt Hotel Project

May 10, 2025 -

Nonbinary Activists Death A Reflection On The Challenges Faced By The Transgender Community In America

May 10, 2025

Nonbinary Activists Death A Reflection On The Challenges Faced By The Transgender Community In America

May 10, 2025 -

5 Times Morgans Intelligence Faltered In High Potential Season 1

May 10, 2025

5 Times Morgans Intelligence Faltered In High Potential Season 1

May 10, 2025 -

Blue Origins Rocket Launch Abruptly Cancelled Subsystem Failure

May 10, 2025

Blue Origins Rocket Launch Abruptly Cancelled Subsystem Failure

May 10, 2025 -

Strengthening The Eu Response To Us Tariffs A French Ministers Call

May 10, 2025

Strengthening The Eu Response To Us Tariffs A French Ministers Call

May 10, 2025