Palantir Stock: Should You Invest Before The May 5th Earnings Report?

Table of Contents

Palantir Technologies is a data analytics company specializing in providing software and services to government and commercial clients. Its unique business model, focusing on large-scale data integration and analysis, positions it at the forefront of the rapidly evolving data-driven economy. However, the volatility inherent in the tech sector, coupled with the company's specific market position, makes assessing the optimal investment timing crucial.

Palantir's Recent Performance and Market Position

Palantir stock has experienced significant fluctuations in recent months. While periods of growth have been interspersed with periods of decline, understanding these trends is critical for any investor considering a purchase of Palantir stock. A detailed analysis of the past year's stock price charts reveals periods of both substantial gains and losses, reflecting the inherent volatility of the technology sector and the specific challenges and successes of Palantir.

The competitive landscape for data analytics is fiercely contested. Palantir faces competition from established tech giants like Microsoft and Amazon Web Services (AWS), as well as specialized analytics firms. However, Palantir's focus on large-scale government contracts and its proprietary technology provide a degree of differentiation. The company's continued success hinges on its ability to secure and retain these contracts, and to successfully expand into new commercial markets.

Key Performance Indicators (KPIs) offer further insights. While revenue growth has generally been positive, profitability has been a more fluctuating aspect of Palantir's performance. Monitoring metrics like customer acquisition cost (CAC) and customer lifetime value (CLTV) is crucial in gauging the long-term health and sustainability of the business model.

- Recent contract wins and losses: Analyzing recent contract announcements provides valuable insight into Palantir's ability to secure new business.

- Expansion into new markets: Palantir's progress in expanding beyond its traditional government clientele into commercial sectors is key to its future growth.

- Technological advancements and innovations: Continuous innovation and the development of new analytical capabilities are crucial to Palantir's ability to maintain a competitive edge.

Analyzing the Potential Impact of the May 5th Earnings Report

Analyst predictions for Palantir's Q1 2024 earnings vary, leading to a range of possible scenarios. Some analysts predict that Palantir will exceed expectations, potentially leading to a surge in Palantir stock price. Others anticipate results that meet or even fall short of expectations, which could trigger a decline.

The market's reaction will depend heavily on how Palantir's actual results compare to these expectations. A significant positive surprise could lead to a substantial short-term increase in the Palantir stock price, while a negative surprise could trigger a sell-off. Furthermore, investor sentiment and overall market conditions will also play a crucial role in shaping the reaction.

Investing in Palantir stock, like any investment, carries inherent risks. Market volatility, intensified competition, and geopolitical factors could all negatively impact Palantir's performance and, consequently, its stock price.

- Factors that could positively influence the stock price: Exceeding earnings expectations, securing significant new contracts, and announcing successful product launches.

- Factors that could negatively influence the stock price: Missing earnings expectations, increased competition, economic downturn, and unexpected geopolitical events.

Alternative Investment Strategies

Before investing in Palantir stock, it is crucial to consider diversification. Concentrating your investments in a single, potentially volatile stock like Palantir can expose your portfolio to significant risk. Diversification across different asset classes is a key strategy for mitigating risk and ensuring the long-term health of your investment portfolio.

Your personal risk tolerance is a critical factor. If you are averse to risk, investing in Palantir stock may not be suitable for your portfolio. Understanding your risk tolerance and aligning your investments with it is crucial for making sound financial decisions.

Whether you adopt a long-term or short-term investment strategy depends largely on your investment goals and risk tolerance. A long-term approach may be appropriate for investors who can withstand short-term volatility, while a short-term approach might suit investors seeking quick returns but accepting higher risk.

- Strategies for mitigating risk when investing in Palantir stock: Dollar-cost averaging (DCA) can help reduce the impact of price volatility.

- Alternative investment options for investors with similar risk appetites: Exploring other technology stocks, ETFs, or mutual funds may offer diversification benefits.

Conclusion: Should You Invest in Palantir Stock Before May 5th?

Palantir's recent performance has been mixed, and its future success depends on various factors, including its ability to secure contracts, expand into new markets, and maintain its competitive edge. The May 5th earnings report will provide crucial insights into the company's progress and could significantly influence its stock price. The inherent volatility of Palantir stock necessitates a careful assessment of your personal risk tolerance and investment goals before making any decisions. Diversification should always be a cornerstone of your investment strategy.

Therefore, the question of whether to invest in Palantir stock before May 5th cannot be answered definitively. The analysis presented highlights both the potential for substantial returns and the considerable risks involved. Before making any Palantir investment, consider carefully the analysis presented and conduct your own thorough research. Analyze the risk factors, understand your own risk tolerance, and explore suitable diversification strategies for your investment portfolio. A well-informed investment decision is always the best approach to managing your financial future.

Featured Posts

-

High Potential Season 2 Renewal Status And Episode Information

May 10, 2025

High Potential Season 2 Renewal Status And Episode Information

May 10, 2025 -

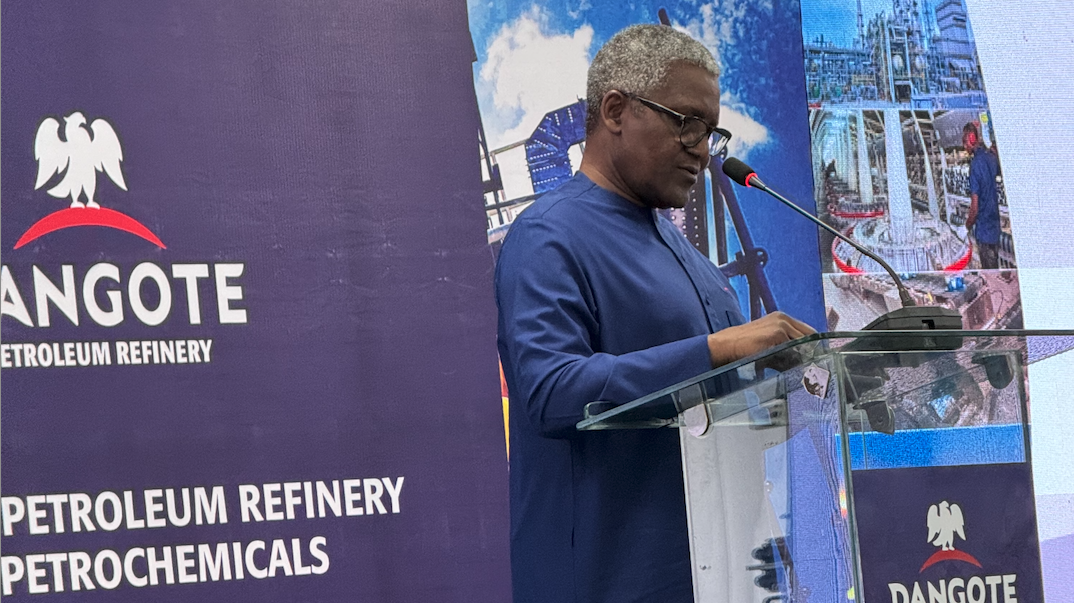

Nigerian Petrol Prices Understanding The Influence Of Dangote And Nnpc

May 10, 2025

Nigerian Petrol Prices Understanding The Influence Of Dangote And Nnpc

May 10, 2025 -

Analyzing West Hams 25 Million Financial Deficit

May 10, 2025

Analyzing West Hams 25 Million Financial Deficit

May 10, 2025 -

Emergency Mining Ban In Peru A 200 Million Blow To Gold Production

May 10, 2025

Emergency Mining Ban In Peru A 200 Million Blow To Gold Production

May 10, 2025 -

How Palantirs Nato Partnership Will Change Public Sector Ai Prediction

May 10, 2025

How Palantirs Nato Partnership Will Change Public Sector Ai Prediction

May 10, 2025