Palantir Technologies: A Deep Dive Into Its Stock Performance And Potential

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir's core offerings are centered around two platforms: Gotham and Foundry. Gotham is primarily targeted towards government agencies, providing powerful data integration and analysis capabilities for national security and intelligence applications. Foundry, on the other hand, caters to the commercial sector, offering similar data analytics solutions to a wider range of industries, including finance, healthcare, and manufacturing.

-

Government Contracts and Revenue Stability: Government contracts form a significant portion of Palantir's revenue. While these contracts offer stability and predictable income streams, they are also subject to budgetary constraints and political changes. Understanding the renewal rates and the pipeline of future government contracts is crucial for assessing Palantir's revenue predictability.

-

Commercial Sector Growth and Key Clients: Palantir's growth in the commercial sector is a key indicator of its long-term potential. Identifying and analyzing key commercial clients and their success stories can provide insights into the effectiveness of Foundry and its market penetration. Tracking the number of commercial contracts and their average contract value is essential for understanding this growth trajectory.

-

Subscription Model and Recurring Revenue: Palantir operates primarily on a subscription-based model, ensuring a steady stream of recurring revenue. This model reduces dependence on one-time sales and creates a more predictable and sustainable revenue stream. Analyzing the percentage of revenue derived from subscriptions and the churn rate is vital for assessing the health and stability of the business.

-

Pricing Strategy and Effectiveness: Palantir's pricing strategy, which balances the value provided by its platforms with the affordability for its clients, is a critical aspect of its success. Understanding the pricing model, including factors such as contract length, data volume, and features offered, is necessary for assessing the company’s financial health and its ability to maintain profitability.

Analysis of Palantir Technologies Stock Performance

Since its IPO, Palantir Technologies stock has experienced significant price fluctuations. [Insert a chart or graph here showing Palantir's stock price performance since its IPO. Source the chart clearly]. These fluctuations have been influenced by a number of factors, including earnings reports, news related to contract wins or losses, and broader market sentiment.

-

Significant Price Fluctuations and Contributing Factors: Analyzing past stock price movements requires considering factors such as news announcements (e.g., new contract wins, product launches, changes in leadership), quarterly earnings reports, and overall market trends. A deep dive into press releases and financial reports will help investors understand the factors driving these price changes.

-

Key Financial Metrics: Investors should monitor key financial metrics such as Earnings Per Share (EPS), revenue growth, debt-to-equity ratio, and operating margins. These metrics provide insights into the company's profitability, financial health, and ability to generate sustainable growth. Comparing these metrics year-over-year and against competitors will provide a clearer picture of Palantir's financial performance.

-

Comparison with Competitors: Benchmarking Palantir's performance against its competitors in the data analytics market is crucial. This involves analyzing similar metrics (revenue growth, profitability, market share) for companies like Snowflake, Databricks, and others to gain a broader perspective on Palantir's position within the industry.

Identifying Risks and Opportunities for Palantir Technologies

While Palantir enjoys a strong position in the data analytics market, it faces several risks and opportunities.

-

Competition: The data analytics market is becoming increasingly competitive. Key competitors, such as those mentioned above, possess significant resources and expertise, posing a potential threat to Palantir's market share. Analyzing the competitive landscape and understanding the strengths and weaknesses of key competitors is essential.

-

Reliance on Government Contracts: Palantir's significant reliance on government contracts exposes it to the risks associated with political changes, budget cuts, and regulatory shifts. Diversifying its client base and reducing reliance on government contracts is crucial for mitigating this risk.

-

Technological Disruption: The rapid pace of technological change poses a risk to Palantir's long-term competitiveness. Staying ahead of the curve by investing in research and development and adapting to new technologies such as AI and cloud computing is critical for its future success.

-

Geopolitical Risks: The nature of Palantir’s government contracts exposes it to geopolitical risks. International relations and political instability can impact the procurement and continuation of these contracts.

-

Opportunities for Expansion: Palantir has opportunities to expand into new markets (e.g., emerging economies) and develop new product lines to broaden its revenue streams.

Valuation and Investment Considerations for Palantir Stock

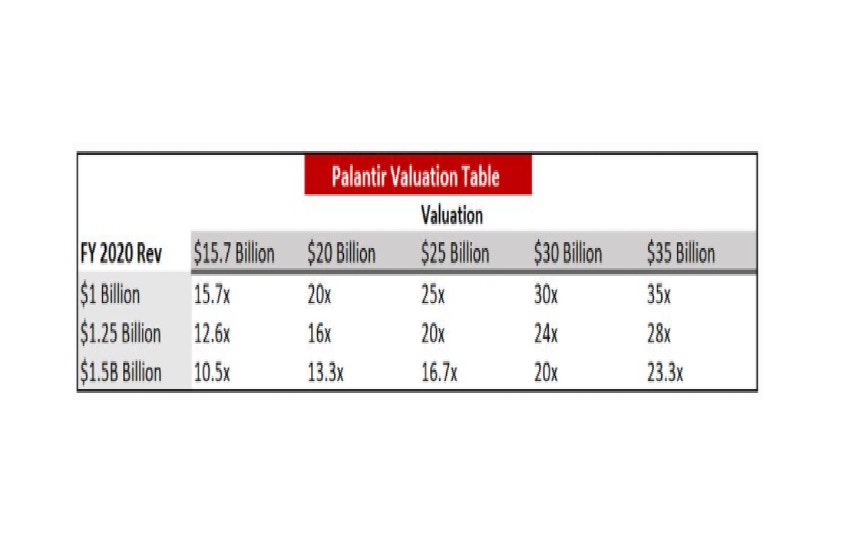

Valuing Palantir Technologies stock requires employing various methods, including discounted cash flow (DCF) analysis and comparable company analysis.

-

Valuation Methods: Different valuation methods will yield different results. A comprehensive valuation should consider multiple methods to provide a more robust estimate of Palantir's intrinsic value.

-

Current Valuation: [Insert current valuation based on available data and chosen method(s). Clearly state the assumptions and limitations of the valuation].

-

Future Growth Potential: Assessing Palantir's future growth potential is crucial for determining its investment appeal. Factors such as market expansion, new product development, and the success of its commercial strategy will significantly influence future growth.

-

Investor Profiles: Palantir stock may be more suitable for some investor profiles than others. Long-term investors with a higher risk tolerance might find it more attractive than short-term traders.

Conclusion

Investing in Palantir Technologies stock requires a thorough understanding of its business model, financial performance, and the inherent risks and opportunities associated with it. While Palantir's innovative technology and strong government contracts offer stability, its reliance on these contracts and the competitive data analytics landscape present challenges. The analysis of its stock performance, financial metrics, and competitive positioning is crucial for informed decision-making. Remember that the information provided here is for educational purposes only and does not constitute financial advice. Investing in Palantir Technologies stock requires careful consideration of the factors discussed above. Conduct your own thorough due diligence and consult with a financial advisor before making any investment decisions regarding Palantir Technologies stock.

Featured Posts

-

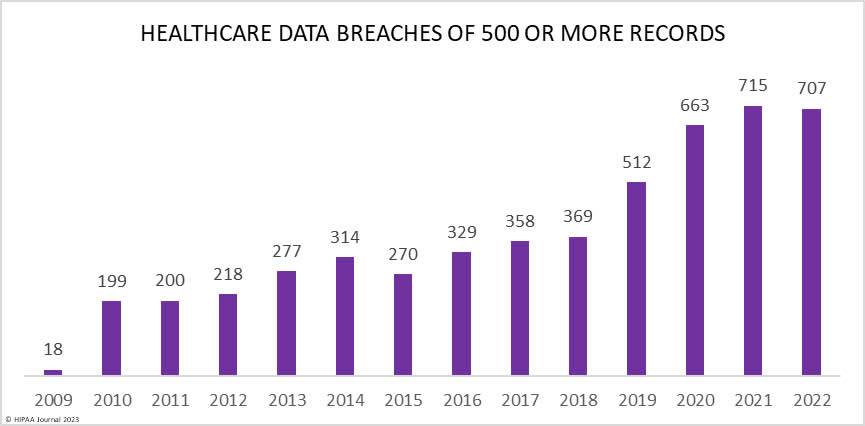

Serious Data Breach Police Investigate Illegal Access Of Patient Data By Nhs Staff In Nottingham

May 09, 2025

Serious Data Breach Police Investigate Illegal Access Of Patient Data By Nhs Staff In Nottingham

May 09, 2025 -

Extreme V Mware Price Increase At And T Reports 1050 Jump Proposed By Broadcom

May 09, 2025

Extreme V Mware Price Increase At And T Reports 1050 Jump Proposed By Broadcom

May 09, 2025 -

Apple And Ai A Critical Analysis Of Its Current Standing

May 09, 2025

Apple And Ai A Critical Analysis Of Its Current Standing

May 09, 2025 -

Leon Draisaitl Injury Oilers Playoff Hopes Hinge On His Return

May 09, 2025

Leon Draisaitl Injury Oilers Playoff Hopes Hinge On His Return

May 09, 2025 -

Varm Vinter Forer Til At Skisentre Stenger

May 09, 2025

Varm Vinter Forer Til At Skisentre Stenger

May 09, 2025