Palantir Technologies Stock: Buy Or Sell? A Data-Driven Perspective

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir's core offerings, Gotham and Foundry, are powerful data analytics platforms designed to help organizations extract actionable insights from complex datasets. Gotham primarily targets government agencies, providing crucial support for national security and intelligence operations. Foundry, on the other hand, focuses on the commercial sector, helping businesses across various industries improve operational efficiency and make data-driven decisions. Understanding Palantir’s revenue streams is crucial for assessing Palantir Stock Investment potential.

Analyzing revenue growth reveals a mixed picture. While government contracts offer stability and recurring revenue, they also present potential limitations due to budgetary constraints and lengthy procurement cycles. The commercial sector, however, shows significant potential for expansion and increased market share, driving future growth in Palantir Stock.

- Government contracts: High revenue certainty but potentially slower growth compared to commercial.

- Commercial growth: High growth potential, but success hinges on acquiring and retaining clients in a competitive market.

- Recurring revenue: A significant portion of Palantir's revenue comes from subscription-based contracts, enhancing long-term sustainability and predictability, a key factor for Palantir Stock Investment.

- Key partnerships and strategic alliances: Collaborations with major technology companies and industry players can boost Palantir's market reach and accelerate adoption of its platforms.

Financial Performance and Valuation

A comprehensive evaluation of Palantir Technologies stock requires a deep dive into its financial performance. While revenue growth has been impressive, profitability remains a key area of focus for investors considering a Palantir Stock Investment. Analyzing key metrics such as revenue growth, profit margins, and cash flow is crucial. Comparing Palantir's valuation (e.g., using the P/E ratio) against competitors in the data analytics space provides further context.

- Profitability trends and projections: Examining historical and projected profit margins helps assess the long-term financial health of the company and its potential for future returns.

- Debt levels and financial health: Understanding Palantir's debt burden and overall financial stability is crucial for gauging the risk associated with a Palantir Stock Investment.

- Comparison to competitor valuations: Benchmarking Palantir against similar data analytics companies reveals whether its valuation is justified by its growth prospects and market position.

- Long-term growth potential and its impact on valuation: Assessing the company's potential for long-term growth is vital for estimating future returns on a Palantir Stock Investment.

Risk Assessment and Potential Challenges

Investing in Palantir Technologies stock entails inherent risks. A thorough risk assessment is essential before deciding whether to Buy Palantir Stock or Sell Palantir Stock.

- Competitive landscape and market saturation risks: The data analytics market is highly competitive, posing a challenge to Palantir's growth.

- Data privacy and security concerns: Handling sensitive data necessitates stringent security measures, and any breaches could severely impact Palantir's reputation and stock price.

- Dependence on government contracts: Over-reliance on government contracts exposes Palantir to potential budget cuts or changes in government priorities.

- Economic sensitivity of the business model: Economic downturns could impact the demand for Palantir's services, particularly in the commercial sector.

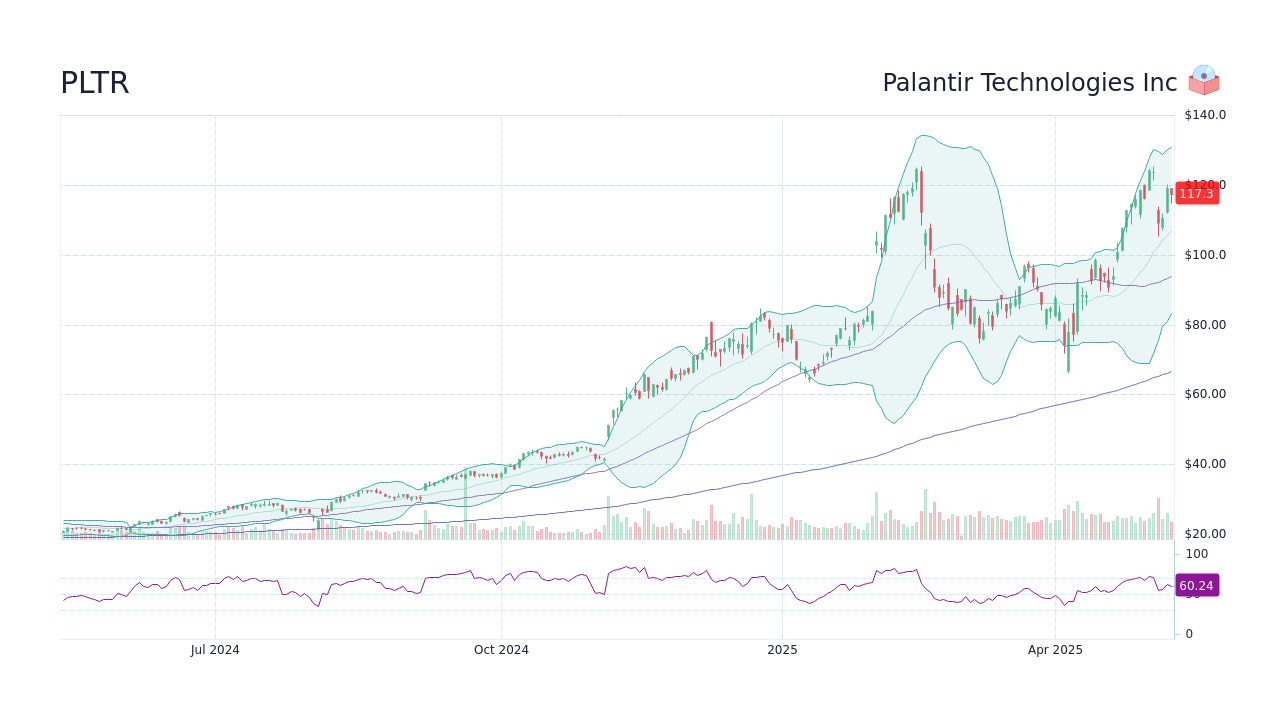

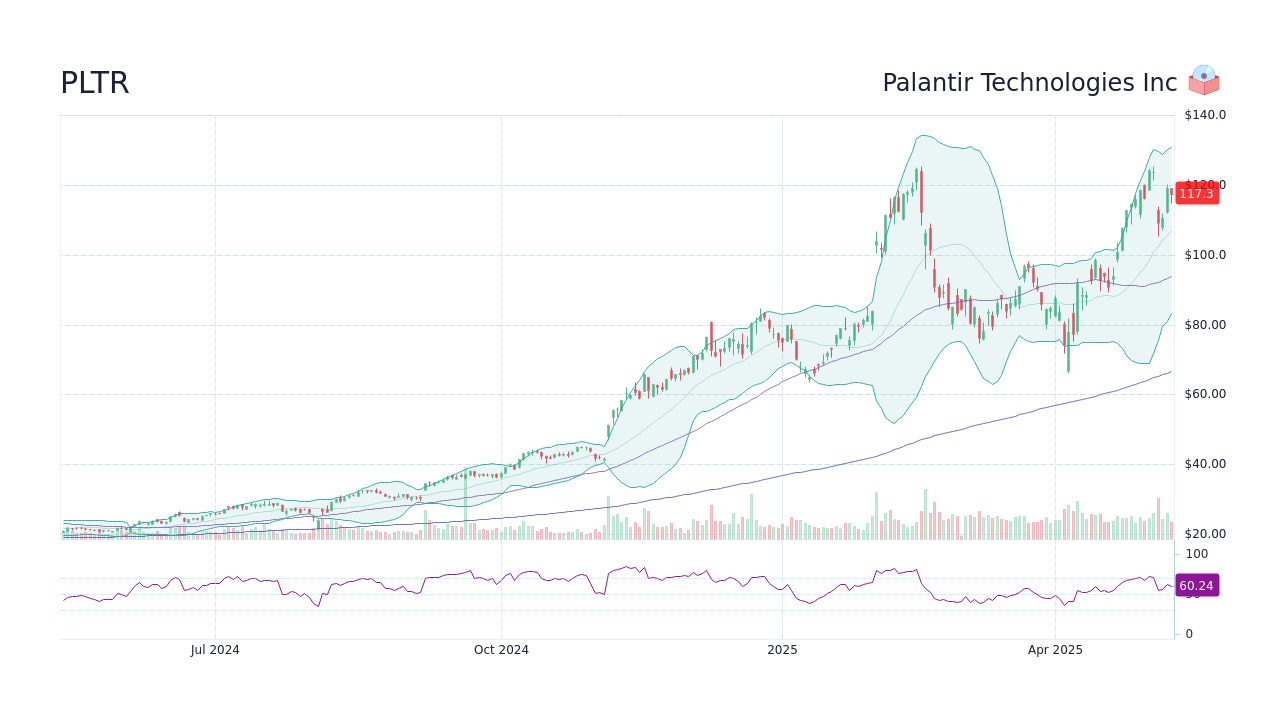

Technical Analysis and Chart Patterns (Optional)

While fundamental analysis forms the backbone of any investment decision, some investors consider technical analysis as a supplementary tool. This section would typically include a brief overview of relevant technical indicators such as moving averages, support and resistance levels, and chart patterns (if appropriate expertise is available). It's crucial to emphasize that technical analysis is not a foolproof predictor of future price movements and should be used cautiously. Disclaimer: This section is omitted due to the complexity and inherent limitations of technical analysis without detailed expertise and current market data.

Conclusion: Making an Informed Decision on Palantir Technologies Stock

In conclusion, deciding whether to Buy Palantir Stock or Sell Palantir Stock requires a careful evaluation of Palantir's innovative business model, its financial performance, and the inherent risks associated with the company. This analysis provides a framework for assessing these factors, but it is not a substitute for independent research. While Palantir shows immense potential for growth, particularly in the commercial sector, risks related to competition, data security, and economic conditions must be carefully considered. Therefore, the decision to Buy Palantir Stock or Sell Palantir Stock ultimately depends on your individual risk tolerance, financial goals, and thorough due diligence. Remember to conduct your own comprehensive research and consult a financial advisor before making any investment decisions regarding Palantir Technologies stock.

Featured Posts

-

Legal Battle Over Banned Chemicals E Bay And The Limits Of Section 230

May 10, 2025

Legal Battle Over Banned Chemicals E Bay And The Limits Of Section 230

May 10, 2025 -

Four Mind Bending Randall Flagg Theories That Reinterpret Stephen Kings Works

May 10, 2025

Four Mind Bending Randall Flagg Theories That Reinterpret Stephen Kings Works

May 10, 2025 -

Vstrecha Zelenskogo I Trampa Makron O Rezultatakh Peregovorov V Vatikane

May 10, 2025

Vstrecha Zelenskogo I Trampa Makron O Rezultatakh Peregovorov V Vatikane

May 10, 2025 -

Luxury Car Sales In China Examining The Difficulties Faced By Bmw Porsche And Others

May 10, 2025

Luxury Car Sales In China Examining The Difficulties Faced By Bmw Porsche And Others

May 10, 2025 -

Hanh Trinh Chuyen Gioi Cua Lynk Lee Tu Nhan Sac Den Tinh Yeu

May 10, 2025

Hanh Trinh Chuyen Gioi Cua Lynk Lee Tu Nhan Sac Den Tinh Yeu

May 10, 2025