Palantir Technologies Stock: Buy, Sell, Or Hold? A Current Market Evaluation

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir Technologies operates in the burgeoning big data and analytics market, offering two primary platforms: Gotham, focused on government clients, and Foundry, targeting commercial enterprises. Understanding Palantir's revenue streams is crucial for evaluating Palantir Technologies stock. The company's revenue growth trajectory has been notable, though it's essential to consider its sources.

-

Government Contracts and Revenue Stability: A significant portion of Palantir's revenue comes from long-term government contracts, providing a degree of revenue stability. However, reliance on government spending can also introduce vulnerability to shifts in government priorities and budget cuts.

-

Commercial Sector Growth and Future Expansion: Palantir's commercial sector growth is a key indicator of its long-term potential. The success of Foundry in securing and retaining commercial clients will be a major driver of future revenue and overall valuation of Palantir Technologies stock.

-

Recurring Revenue Model: The shift towards a recurring revenue model, through software licenses and subscriptions, is a positive sign for long-term financial stability. This reduces reliance on one-time sales and creates predictable income streams.

-

Key Partnerships and Collaborations: Palantir's strategic partnerships and collaborations with leading technology companies can significantly enhance its product offerings and market reach, positively impacting Palantir Technologies stock.

Financial Performance and Valuation

Analyzing Palantir's financial performance is critical for assessing Palantir Technologies stock. While the company has shown revenue growth, profitability has been a fluctuating aspect, impacting the valuation of Palantir Technologies stock. Key metrics to consider include:

-

Revenue Growth: Consistent revenue growth is a positive sign, but investors should also analyze the sources of this growth to ascertain its sustainability.

-

Earnings Per Share (EPS): EPS provides insight into the profitability of Palantir Technologies stock, indicating the portion of earnings attributable to each outstanding share.

-

Free Cash Flow: Free cash flow (FCF) is crucial as it reflects the cash generated by the business that is available for reinvestment, dividends, or debt reduction. Positive FCF is generally a favorable sign for Palantir Technologies stock.

-

Valuation Metrics: Comparing Palantir's P/S ratio and P/E ratio to its competitors in the data analytics sector helps determine whether Palantir Technologies stock is overvalued or undervalued relative to its peers. Macroscopic factors like interest rates significantly influence valuation.

Competitive Landscape and Future Outlook

Palantir Technologies faces stiff competition in the big data and analytics market. Understanding its competitive position and future prospects is essential for evaluating Palantir Technologies stock.

-

Competitive Analysis: Key competitors include established tech giants like Microsoft, Amazon, and Google, each possessing significant resources and market share.

-

Technological Advantages and Disadvantages: Palantir's proprietary technology provides a competitive edge, but it's crucial to evaluate its adaptability to emerging technologies like AI and cloud computing.

-

Future Growth Opportunities: The potential for expansion into new markets and the development of innovative data analytics solutions will be crucial drivers of future growth for Palantir Technologies stock.

-

Risks and Challenges: The company faces challenges such as maintaining its technological leadership, adapting to changing market demands, and managing its dependence on government contracts.

Risk Assessment for Palantir Technologies Stock

Investing in Palantir Technologies stock carries inherent risks:

-

High Valuation: Palantir's valuation might be considered high relative to its current earnings, making it susceptible to price corrections.

-

Dependence on Government Contracts: Over-reliance on government contracts exposes Palantir to political and budgetary risks, creating volatility for Palantir Technologies stock.

-

Competition: Intense competition from established tech giants could constrain Palantir's growth and market share.

-

Geopolitical and Regulatory Risks: Geopolitical instability and regulatory changes can significantly impact Palantir's business operations and the price of Palantir Technologies stock.

Conclusion: Palantir Technologies Stock: The Verdict

This analysis reveals that Palantir Technologies stock presents both compelling opportunities and significant risks. While the company's innovative technology and growing revenue are positives, its high valuation, reliance on government contracts, and fierce competition warrant caution. Whether to buy, sell, or hold Palantir Technologies stock ultimately depends on your individual risk tolerance and investment strategy.

Make an informed decision about your Palantir Technologies Stock investment today. Conduct thorough research and consider consulting a financial advisor before making any investment decisions.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and past performance is not indicative of future results. Always conduct your own due diligence and consult with a qualified financial advisor before making investment decisions.

Featured Posts

-

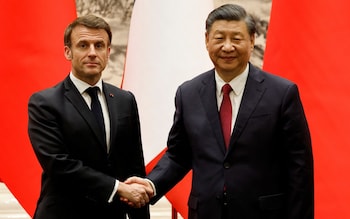

Macron Announces Planned Signing Of France Poland Friendship Treaty

May 10, 2025

Macron Announces Planned Signing Of France Poland Friendship Treaty

May 10, 2025 -

Chuyen Tinh Dep Cua Lynk Lee Sau Khi Chuyen Gioi

May 10, 2025

Chuyen Tinh Dep Cua Lynk Lee Sau Khi Chuyen Gioi

May 10, 2025 -

Conservative Pundit Jeanine Pirro Headed To North Idaho

May 10, 2025

Conservative Pundit Jeanine Pirro Headed To North Idaho

May 10, 2025 -

Woman Convicted Of Racist Murder In Unprovoked Stabbing

May 10, 2025

Woman Convicted Of Racist Murder In Unprovoked Stabbing

May 10, 2025 -

43 Billion Increase Space X Stake Now Outweighs Elon Musks Tesla Investment

May 10, 2025

43 Billion Increase Space X Stake Now Outweighs Elon Musks Tesla Investment

May 10, 2025