Palantir Technology Stock: A Pre-May 5th Investment Analysis From Wall Street

Table of Contents

Palantir's Recent Financial Performance and Key Metrics

Examining Palantir's recent quarterly earnings reports is crucial for assessing its financial health and predicting future performance. Investors should focus on revenue growth, profitability, and key performance indicators (KPIs) to gauge the company's overall trajectory.

-

Revenue Growth: Analyzing the growth rate of Palantir's revenue, both year-over-year and quarter-over-quarter, provides insights into the company's ability to attract and retain customers. A consistent upward trend indicates strong market demand and a healthy business model. Comparing Q1 2024 results against previous quarters and analyst expectations will highlight the company's performance against its own goals and industry benchmarks.

-

Profitability: Examining metrics like gross margin, operating margin, and net income helps assess Palantir's efficiency and profitability. Improving margins suggest operational improvements and cost-effectiveness.

-

Key Performance Indicators (KPIs): Beyond the traditional financial metrics, investors should focus on KPIs that reflect Palantir's growth strategy, such as:

- Customer acquisition cost (CAC): A lower CAC indicates efficient customer acquisition strategies.

- Average contract value (ACV): A higher ACV suggests that Palantir is securing larger and more valuable contracts.

- Customer churn rate: A low churn rate demonstrates strong customer retention.

- Government vs. Commercial Revenue: The balance and growth of revenue streams from both government and commercial sectors is vital to assess long-term sustainability and resilience.

Growth Prospects and Future Market Opportunities

Palantir's future growth hinges on its ability to expand into new markets and capitalize on emerging technologies. The company's strategic initiatives, competitive landscape, and potential for continued government contracts significantly influence its long-term prospects.

-

Market Expansion: Palantir is actively expanding its presence in various sectors, including healthcare, finance, and energy. Success in these new markets will be crucial for sustained growth. Geographical expansion into new regions also presents significant growth opportunities.

-

Government Contracts: Palantir's significant government contracts provide a stable revenue stream, but over-reliance on this sector poses a risk. The long-term value and renewal of these contracts are critical for continued financial stability.

-

Competitive Advantages: Palantir's proprietary data analytics platform and strong partnerships give it a competitive edge. Analyzing the competitive landscape and assessing its ability to maintain this advantage is essential for assessing the long-term potential of Palantir stock.

-

AI Integration and Emerging Technologies: The integration of Artificial Intelligence (AI) and machine learning into Palantir's platform is a key driver of future growth. The company's ability to leverage these technologies effectively will be a significant determinant of its success.

Wall Street Sentiment and Analyst Ratings

Understanding Wall Street's sentiment towards Palantir stock is crucial for investors. Analyzing analyst ratings, price targets, and the reasoning behind their recommendations provides valuable insights.

-

Analyst Ratings: A summary of buy, hold, and sell recommendations from major financial analysts provides a snapshot of the overall market sentiment. A higher proportion of buy recommendations generally indicates positive market sentiment.

-

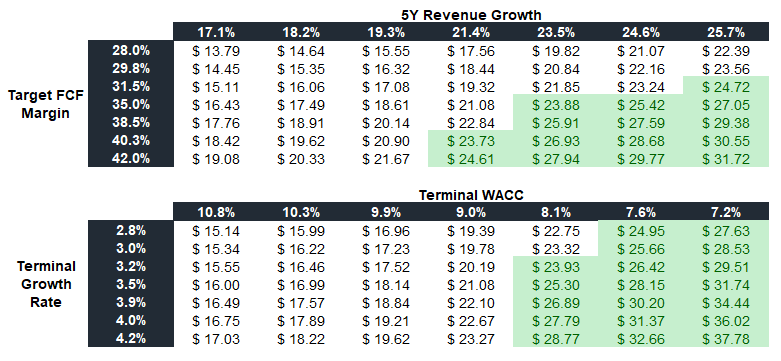

Price Targets: Comparing the range of price targets from different analysts gives a broader perspective on the potential upside or downside of PLTR stock. Significant variations in price targets suggest uncertainty about the company's future performance.

-

Brokerage Firm Upgrades/Downgrades: Any significant changes in analyst ratings in the lead-up to May 5th should be closely examined. Upgrades or downgrades often reflect significant news or changes in the company's outlook.

Risk Factors to Consider Before Investing in Palantir Stock

Investing in Palantir Technologies stock involves inherent risks, some specific to the company and others common to the technology sector. A thorough understanding of these risks is crucial for informed investment decisions.

-

Technology Sector Volatility: The technology sector is notoriously volatile, and Palantir stock is no exception. Market fluctuations can significantly impact the stock price, regardless of the company's underlying performance.

-

Dependence on Government Contracts: Palantir's significant reliance on government contracts creates exposure to potential changes in government spending or policy.

-

Competition: The data analytics market is highly competitive, with several established players and emerging competitors. Palantir's ability to maintain its competitive advantage is crucial for its long-term success.

-

Financial Health: Analyzing the company's debt levels, cash flow, and overall financial health is essential for assessing its resilience to economic downturns.

Conclusion

This pre-May 5th analysis of Palantir Technology stock reveals a complex picture with both opportunities and risks. While Palantir exhibits potential for growth in various sectors and boasts innovative technology, investors should carefully weigh the financial performance, market sentiment, and inherent risks before making any investment decisions. Understanding the factors influencing Palantir Technology stock is crucial for informed investing. Conduct thorough research and consider consulting a financial advisor before investing in PLTR or any other stock. Remember to carefully review your investment strategy and risk tolerance before making any decisions regarding Palantir stock. The information provided here is for informational purposes only and does not constitute financial advice.

Featured Posts

-

El Salvador Prison Transfers A Debate On Due Process And Human Rights

May 10, 2025

El Salvador Prison Transfers A Debate On Due Process And Human Rights

May 10, 2025 -

Nyt Strands Game 376 Hints And Solutions For March 14

May 10, 2025

Nyt Strands Game 376 Hints And Solutions For March 14

May 10, 2025 -

Investing In Palantir Assessing The 40 Growth Forecast For 2025

May 10, 2025

Investing In Palantir Assessing The 40 Growth Forecast For 2025

May 10, 2025 -

Easter Weekend In Lake Charles Live Music Events And Entertainment

May 10, 2025

Easter Weekend In Lake Charles Live Music Events And Entertainment

May 10, 2025 -

Woman Convicted Of Racist Murder In Unprovoked Stabbing

May 10, 2025

Woman Convicted Of Racist Murder In Unprovoked Stabbing

May 10, 2025