Palantir Technology Stock Investment: Should You Buy Before May 5th?

Table of Contents

Palantir's Recent Financial Performance and Growth Prospects

Analyzing Palantir's recent financial performance is crucial for assessing its investment potential. We need to look beyond simple stock price movements and delve into the underlying fundamentals. Let's examine key metrics to gauge the company's growth trajectory.

-

Revenue Growth: Palantir has demonstrated consistent revenue growth in recent years, though the rate of growth may fluctuate quarter to quarter. Comparing the revenue growth rate year-over-year provides a clearer picture of the company's expansion. Examining the sources of this growth – whether it's from existing clients or new customer acquisition – is equally important for long-term investors. Looking at the breakdown of revenue across different sectors will also illuminate its growth strategy.

-

Profitability: Palantir's path to profitability is a key factor for potential investors. While the company has shown improvements in its operating margin, analyzing trends in profit margins and operating expenses is vital for understanding the sustainability of its growth. Are cost-cutting measures contributing to profitability, or is it primarily driven by increased revenue?

-

Key Partnerships and Contract Wins: Palantir's success is often tied to its ability to secure significant contracts, particularly with government agencies and large corporations. Tracking key partnerships and contract wins provides insights into the company's competitive advantage and future revenue streams. Understanding the scope and duration of these contracts is crucial.

-

Market Expansion: Palantir's expansion into new markets, such as healthcare and aerospace, demonstrates its ambition to diversify its revenue streams and reduce reliance on any single sector. The success of these expansions will be a critical determinant of future growth. Assessing the competitiveness of these new markets and the company's penetration strategy is essential.

-

Customer Base Growth and Retention: A growing and loyal customer base is indicative of a healthy business. Analyzing customer acquisition costs and customer churn rates reveals the effectiveness of Palantir’s sales and marketing efforts and the overall strength of its customer relationships.

Upcoming Catalysts and Potential Market Impacts

The period leading up to May 5th could see significant events impacting PLTR stock. Understanding these potential catalysts and their likely market impact is crucial for informed investment decisions.

-

Announcements around May 5th: Any scheduled earnings calls, product launches, or partnership announcements around May 5th could significantly move the stock price. Investors should carefully review any official announcements from Palantir and be prepared for potential market volatility.

-

Market Reactions: The market's reaction to these announcements will depend on whether the news is perceived as positive or negative. Exceeding earnings expectations or announcing a groundbreaking partnership could drive the stock price upwards, while disappointing results or negative news could lead to a decline.

-

Macroeconomic Factors: Broader macroeconomic trends, such as interest rate hikes, inflation, and overall economic growth, significantly influence the tech sector and Palantir's valuation. Understanding the prevailing macroeconomic environment is essential for predicting market reactions to company-specific news.

-

Competitive Landscape: The competitive landscape within the data analytics industry is dynamic. Monitoring the activities of competitors and assessing their relative strengths and weaknesses is vital for evaluating Palantir's long-term prospects.

-

Geopolitical Factors: Geopolitical events and international relations can significantly impact Palantir's business, especially given its involvement in government contracts and operations in various countries. Keeping abreast of geopolitical developments is crucial for assessing potential risks and opportunities.

Risks and Considerations Before Investing in Palantir Stock

Before investing in Palantir, it's essential to acknowledge and assess the inherent risks.

-

High Valuation: Palantir's stock valuation relative to its peers and its profitability is a key concern for some investors. Analyzing its price-to-earnings ratio and comparing it to similar companies can help determine whether the stock is overvalued.

-

Dependence on Government Contracts: A significant portion of Palantir's revenue comes from government contracts. This dependence creates vulnerability to changes in government spending or policy.

-

Competition: The data analytics market is competitive, with established players and emerging startups vying for market share. Palantir faces competition from both large tech companies and specialized data analytics firms.

-

Potential for Future Losses: Despite recent progress, Palantir has historically experienced periods of losses. Future profitability is not guaranteed.

-

Regulatory Risks: Operating in a regulated industry, Palantir faces regulatory and compliance risks that could negatively impact its operations and financial performance.

Alternative Investment Strategies

Investors seeking exposure to the data analytics sector but hesitant about Palantir's risk profile might consider alternative investment strategies. This could involve investing in other data analytics companies with potentially lower valuations or more established profitability or diversifying investments across various technology ETFs. Carefully research and compare the risk profiles and potential returns of different investment vehicles.

Conclusion

Investing in Palantir Technologies stock before May 5th requires careful consideration of its recent financial performance, upcoming catalysts, and inherent risks. While Palantir shows promise in its revenue growth and market expansion, investors should thoroughly assess the company’s valuation, dependence on government contracts, and competitive landscape before making any decisions. Remember to conduct thorough due diligence and consult with a financial advisor before investing. Should you buy Palantir stock before May 5th? The decision ultimately depends on your risk tolerance and investment goals. Remember this is not financial advice, and thorough research is essential before investing in any stock.

Featured Posts

-

Case Study Bmw And Porsches Strategies In A Changing Chinese Market

May 09, 2025

Case Study Bmw And Porsches Strategies In A Changing Chinese Market

May 09, 2025 -

Decision On Jeffrey Epstein Files Should A Public Vote Overturn Ag Pam Bondis Ruling

May 09, 2025

Decision On Jeffrey Epstein Files Should A Public Vote Overturn Ag Pam Bondis Ruling

May 09, 2025 -

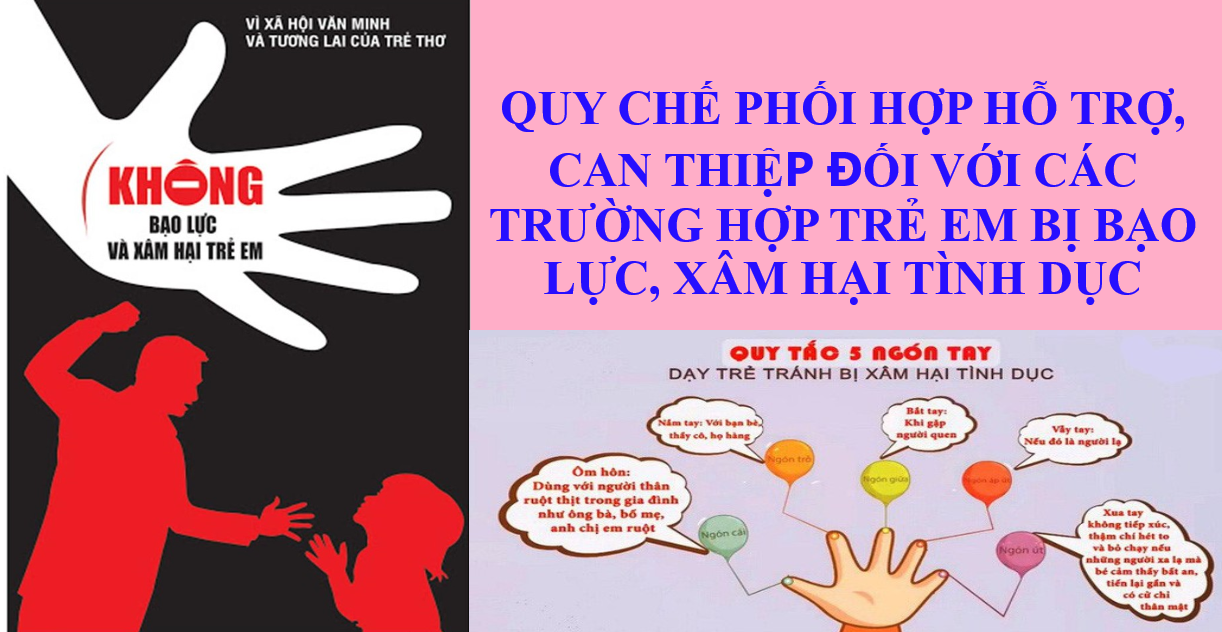

Bao Ve Tre Em Ra Soat Va Xu Ly Nghiem Cac Vu Bao Hanh Tai Co So Giu Tre Tu Nhan

May 09, 2025

Bao Ve Tre Em Ra Soat Va Xu Ly Nghiem Cac Vu Bao Hanh Tai Co So Giu Tre Tu Nhan

May 09, 2025 -

The Shifting Sands Of The Chinese Auto Industry A Look At Bmw And Porsches Experience

May 09, 2025

The Shifting Sands Of The Chinese Auto Industry A Look At Bmw And Porsches Experience

May 09, 2025 -

Draisaitls Return Timeline Will The Edmonton Oilers Star Make The Playoffs

May 09, 2025

Draisaitls Return Timeline Will The Edmonton Oilers Star Make The Playoffs

May 09, 2025