Palantir's 30% Drop: A Buying Opportunity?

Table of Contents

Analyzing the Causes of Palantir's Decline

Several factors contributed to Palantir's recent stock price slump. Understanding these underlying issues is crucial before considering any investment.

Disappointing Q2 Earnings

Palantir's Q2 2024 earnings report fell short of analyst expectations, triggering a sell-off. While the company reported revenue growth, it was slower than anticipated, and profitability metrics also disappointed. Key performance indicators, such as customer acquisition costs and the rate of new contract signings, were cited as contributing factors to the underwhelming Palantir Q2 results. The lower-than-projected Palantir revenue growth fueled concerns about the company's ability to sustain its rapid expansion. This shortfall in Palantir earnings significantly impacted investor confidence.

Macroeconomic Factors

The broader macroeconomic environment also played a role. Rising inflation, fears of a potential economic recession, and a general risk-off environment have led to increased investor caution across the stock market. This market downturn has disproportionately affected high-growth technology stocks like Palantir, as investors seek safer investments. The prevailing investor sentiment is one of uncertainty, making investors less willing to take on risk, particularly with companies showing signs of slowing growth. The impact of inflation on both consumer spending and corporate budgets also likely contributed to the Palantir price drop.

Competition and Market Saturation

The data analytics market is becoming increasingly competitive. Palantir faces stiff competition from established players and emerging startups offering similar services. While Palantir holds a strong position in the government sector, its expansion into the commercial market is facing challenges from competitors with broader market reach and possibly more competitive pricing. This market competition, coupled with concerns about market saturation in certain niches, adds to the uncertainty surrounding Palantir's future growth trajectory.

Evaluating Palantir's Long-Term Potential

Despite the recent setbacks, Palantir possesses several attributes that suggest significant long-term potential.

Government Contracts and Future Growth

A substantial portion of Palantir's revenue comes from lucrative government contracts. The long-term outlook for this sector remains positive, with continued demand for advanced data analytics and intelligence solutions from government agencies globally. Securing additional Palantir government contracts will be key to maintaining revenue growth and alleviating concerns about the company's reliance on this sector. However, the competitive bidding process and potential changes in government priorities present a degree of risk. The long-term prospects of these Palantir government contracts are generally considered favorable, but not without inherent uncertainties.

Innovation and Technological Advancements

Palantir is committed to innovation and invests heavily in research and development. The company continues to develop cutting-edge data analytics and artificial intelligence (AI) capabilities. The introduction of new product offerings and the ongoing enhancement of existing platforms suggests a future focused on technological advancements. These efforts, if successful, could create significant opportunities for market disruption and lead to substantial long-term growth.

Valuation and Potential for Upside

While Palantir's current stock valuation may appear high to some, a discounted cash flow (DCF) analysis, considering its future growth potential and market dominance in specific sectors, might indicate significant upside potential. If the company successfully navigates the current challenges and delivers on its growth projections, the Palantir valuation could significantly increase. This potential for significant upside is a primary reason why some investors might view the recent Palantir price drop as a buying opportunity.

Risk Factors to Consider Before Investing in Palantir

Before investing in Palantir, it's essential to acknowledge the inherent risks:

- High Valuation

- Dependence on Government Contracts

- Intense Market Competition

- Macroeconomic Uncertainty

These investment risks, particularly Palantir risks, should be carefully weighed against the potential rewards. Understanding the overall stock market risks in the current economic climate is also essential.

Conclusion: Is Palantir a Buy After its 30% Drop?

The recent 30% drop in Palantir's stock price presents a complex investment scenario. While disappointing Q2 earnings and macroeconomic headwinds pose significant challenges, Palantir's long-term potential, driven by government contracts, technological innovation, and potential market disruption, remains compelling. The Palantir price drop might indeed represent a buying opportunity for long-term investors with a high-risk tolerance. However, the considerable Palantir risks outlined above cannot be ignored.

Before making any investment decisions related to Palantir stock, conduct thorough research, analyze the company's financials, and consider its Palantir long-term potential in the context of current market conditions and your personal risk profile. Remember to consult a qualified financial advisor before making any investment decisions. Consider whether this represents a true buy the dip scenario based on your own stock market investment strategy and risk tolerance. This Palantir stock analysis should inform your decision, but it is not a substitute for professional advice.

Featured Posts

-

27 Saves One Win Adin Hill Leads Golden Knights Past Blue Jackets

May 10, 2025

27 Saves One Win Adin Hill Leads Golden Knights Past Blue Jackets

May 10, 2025 -

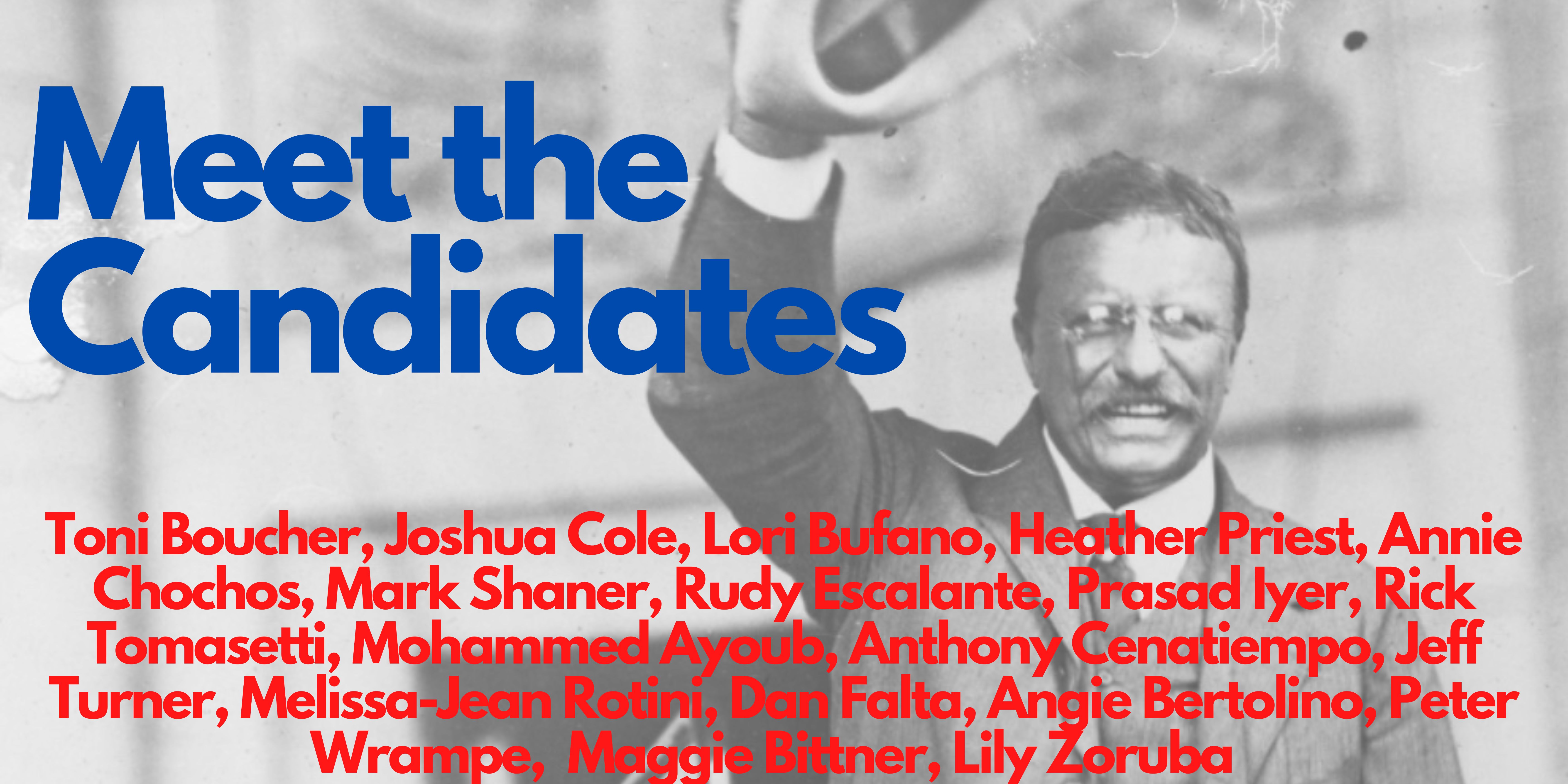

Your Guide To The Nl Federal Election Candidates

May 10, 2025

Your Guide To The Nl Federal Election Candidates

May 10, 2025 -

How To Be A Better Ally On International Transgender Day Of Visibility And Beyond

May 10, 2025

How To Be A Better Ally On International Transgender Day Of Visibility And Beyond

May 10, 2025 -

Don De Cheveux A Dijon Pour La Bonne Cause

May 10, 2025

Don De Cheveux A Dijon Pour La Bonne Cause

May 10, 2025 -

The Fentanyl Crisis And Its Impact On U S China Trade Relations

May 10, 2025

The Fentanyl Crisis And Its Impact On U S China Trade Relations

May 10, 2025