Palantir's Potential: Can It Achieve A Trillion-Dollar Market Cap By The End Of The Decade?

Table of Contents

Palantir Technologies, the enigmatic data analytics firm, has captured the imagination of investors with its ambitious goals and rapid growth in the burgeoning big data market. The company's aspiration? To achieve a trillion-dollar market capitalization by the end of the decade. This audacious target raises the central question: What is Palantir's potential, and is this lofty goal realistic? This article delves into Palantir's current market position, growth trajectory, and the key factors influencing its potential for achieving this monumental stock valuation. We will explore the challenges and risks it faces, ultimately providing a valuation analysis and assessing the probability of Palantir reaching its ambitious trillion-dollar market cap.

H2: Palantir's Current Market Position and Growth Trajectory

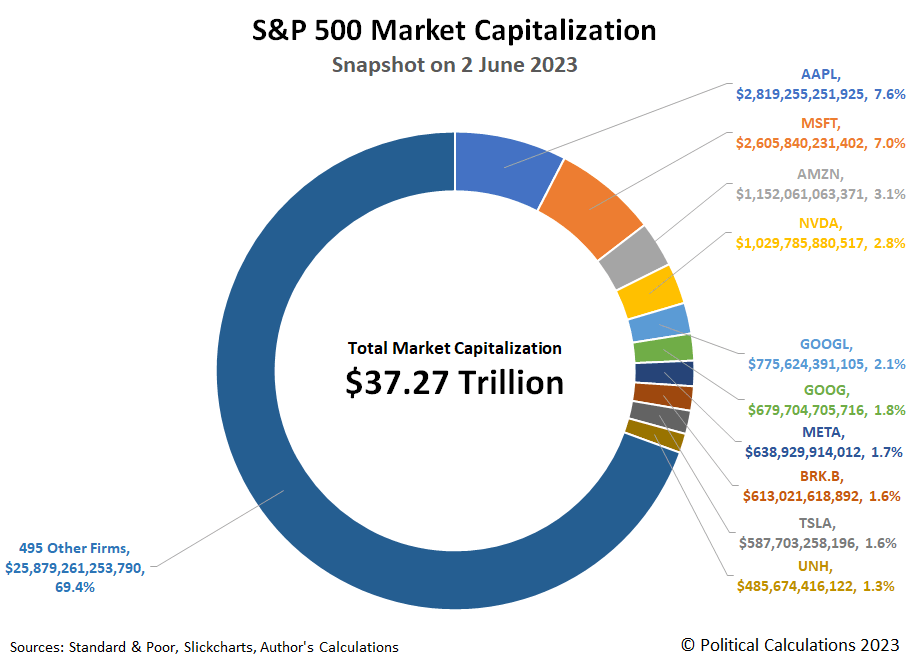

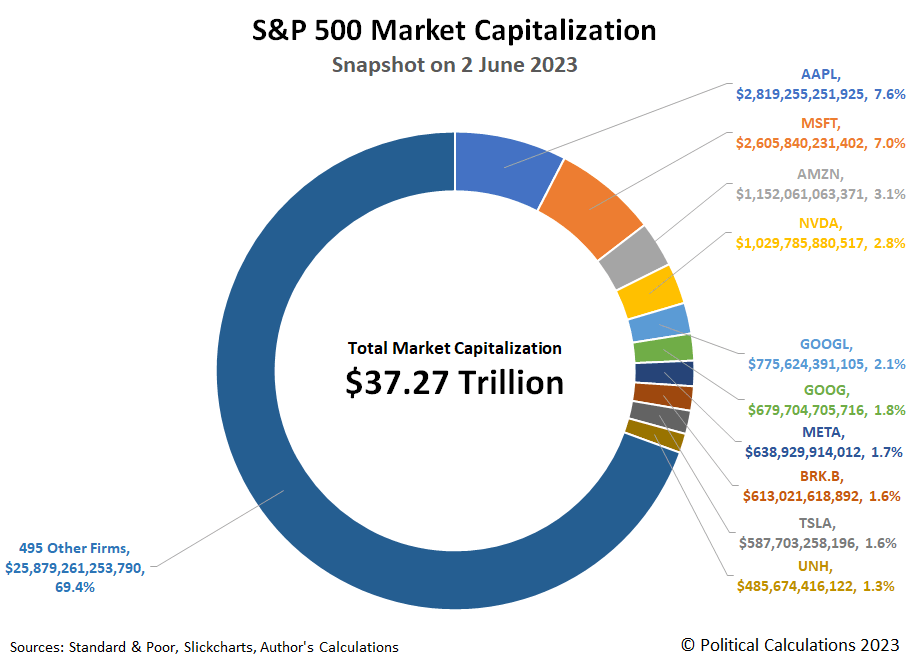

Palantir's current market capitalization, while significant, is still a considerable distance from a trillion dollars. Analyzing its recent financial performance is crucial to understanding its potential for future growth. Examining key financial indicators like revenue, earnings, and year-over-year growth provides a picture of its trajectory. Recent contracts and partnerships, particularly within the government and commercial sectors, are essential factors. Analyzing market share and competition within the data analytics landscape helps gauge its position in relation to established players.

- Current market cap and year-over-year growth: (Insert current market cap data and year-over-year growth figures here. Source the data with reputable links.)

- Key financial indicators (revenue, earnings, etc.): (Insert relevant financial data and analysis, sourced appropriately.)

- Analysis of recent contracts and partnerships: (Discuss significant recent contracts and partnerships, highlighting their impact on revenue and growth.)

- Mention competition and market share: (Identify key competitors like AWS, Microsoft Azure, and Google Cloud, and discuss Palantir's market share and strategies for gaining competitive advantage.)

H2: Key Factors Contributing to Palantir's Potential for Growth

Palantir possesses several competitive advantages that contribute to its potential for substantial growth. Its proprietary technology offers superior data integration and analysis capabilities, a critical factor in the increasingly complex data landscape. Its strong foundation of government contracts provides a stable revenue stream and enhances its credibility. However, the potential for expansion into the commercial sector, particularly in lucrative areas like healthcare and finance, is substantial. Furthermore, strategic partnerships and acquisitions can significantly accelerate its growth trajectory.

- Technological superiority in data integration and analysis: (Elaborate on Palantir's technological advantages, citing specific examples of its software's capabilities and unique features.)

- Government contracts and their long-term implications: (Discuss the significance of government contracts for Palantir's revenue stability and future growth projections.)

- Potential for growth in the commercial sector (e.g., healthcare, finance): (Analyze the market opportunity in these sectors and Palantir's potential to capture market share.)

- Strategic partnerships and acquisitions: (Discuss past and potential future partnerships and acquisitions that could drive growth.)

H2: Challenges and Risks Facing Palantir's Growth

Despite its considerable potential, Palantir faces several challenges and risks that could impede its progress towards a trillion-dollar valuation. Intense competition from established tech giants, coupled with data privacy concerns and regulatory hurdles, represent significant obstacles. Its reliance on government contracts exposes it to potential budgetary constraints and political shifts. Moreover, the economic sensitivity of its business model makes it vulnerable to macroeconomic downturns.

- Competitive landscape and the threat from established players: (Discuss the competitive pressures from established players and emerging technologies.)

- Data privacy concerns and regulatory compliance: (Analyze the regulatory landscape and potential risks related to data privacy and compliance.)

- Dependence on government contracts: (Highlight the risks associated with over-reliance on government contracts and the need for diversification.)

- Economic sensitivity of its business model: (Discuss the potential impact of economic downturns on Palantir's revenue and growth.)

H2: Valuation Analysis and Probability of Reaching a Trillion-Dollar Market Cap

Analyzing Palantir's valuation requires examining various metrics such as Price-to-Sales ratio (P/S) and Price-to-Earnings ratio (P/E), comparing them to similar companies in the data analytics sector. A discounted cash flow (DCF) analysis can provide a more comprehensive projection of its future value. Considering best-case, worst-case, and most likely scenarios allows for a nuanced assessment of its probability of reaching a trillion-dollar market cap. Qualitative factors, such as technological advancements, competitive dynamics, and regulatory changes, must also be considered.

- Comparison with competitor valuations: (Compare Palantir's valuation metrics with those of its competitors.)

- Scenario analysis (best-case, worst-case, most likely): (Present a range of possible outcomes based on different assumptions about future growth and market conditions.)

- Discounted cash flow (DCF) analysis: (Provide a DCF analysis, outlining assumptions and projections.)

- Qualitative factors affecting valuation: (Discuss non-financial factors that could influence Palantir's valuation.)

Conclusion:

Palantir's potential for achieving a trillion-dollar market cap by the end of the decade is a complex question with no easy answer. While its innovative technology, strong client base, and potential for expansion in the commercial sector present compelling arguments for its growth, challenges like competition, regulatory hurdles, and economic sensitivity cannot be ignored. A thorough valuation analysis considering various scenarios reveals a range of possible outcomes. Further investigation into Palantir's strategic initiatives, technological advancements, and the evolving data analytics market is crucial to accurately assessing Palantir's potential and its journey toward a trillion-dollar market cap. Learn more about Palantir's potential and its future valuation. Explore the investment opportunities presented by Palantir's growth trajectory.

Featured Posts

-

Dijon La Contribution Meconnue De Melanie Eiffel A La Construction De La Tour Eiffel

May 10, 2025

Dijon La Contribution Meconnue De Melanie Eiffel A La Construction De La Tour Eiffel

May 10, 2025 -

Recent Bangkok Post Articles On Transgender Equality And Inclusion

May 10, 2025

Recent Bangkok Post Articles On Transgender Equality And Inclusion

May 10, 2025 -

New Details Emerge Young Thugs Uy Scuti Album Release

May 10, 2025

New Details Emerge Young Thugs Uy Scuti Album Release

May 10, 2025 -

Uk Tightens Visa Rules Overstay Concerns Prompt Stricter Measures For Nigerians

May 10, 2025

Uk Tightens Visa Rules Overstay Concerns Prompt Stricter Measures For Nigerians

May 10, 2025 -

Sensex And Nifty Today Live Market Updates And Analysis

May 10, 2025

Sensex And Nifty Today Live Market Updates And Analysis

May 10, 2025