Pause On Diversity And Climate Reporting: Canadian Regulators Respond To Criticism

Table of Contents

The Regulatory Pause: What it Means for Canadian Businesses

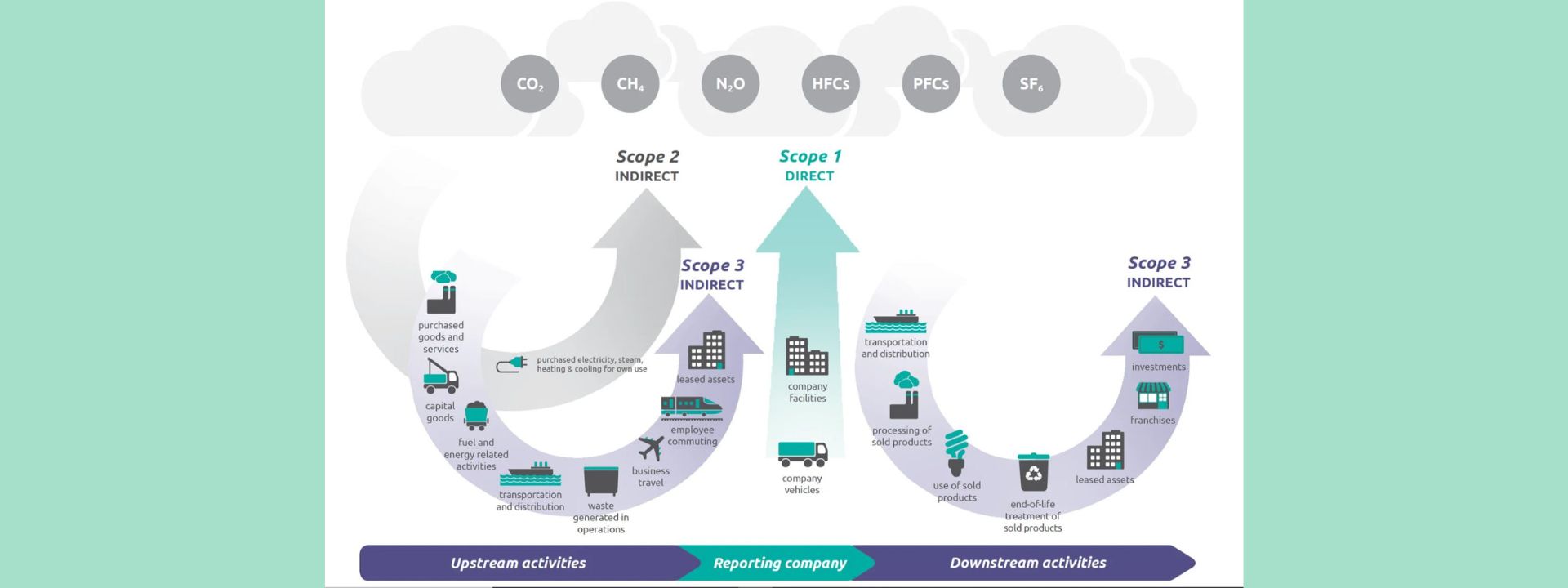

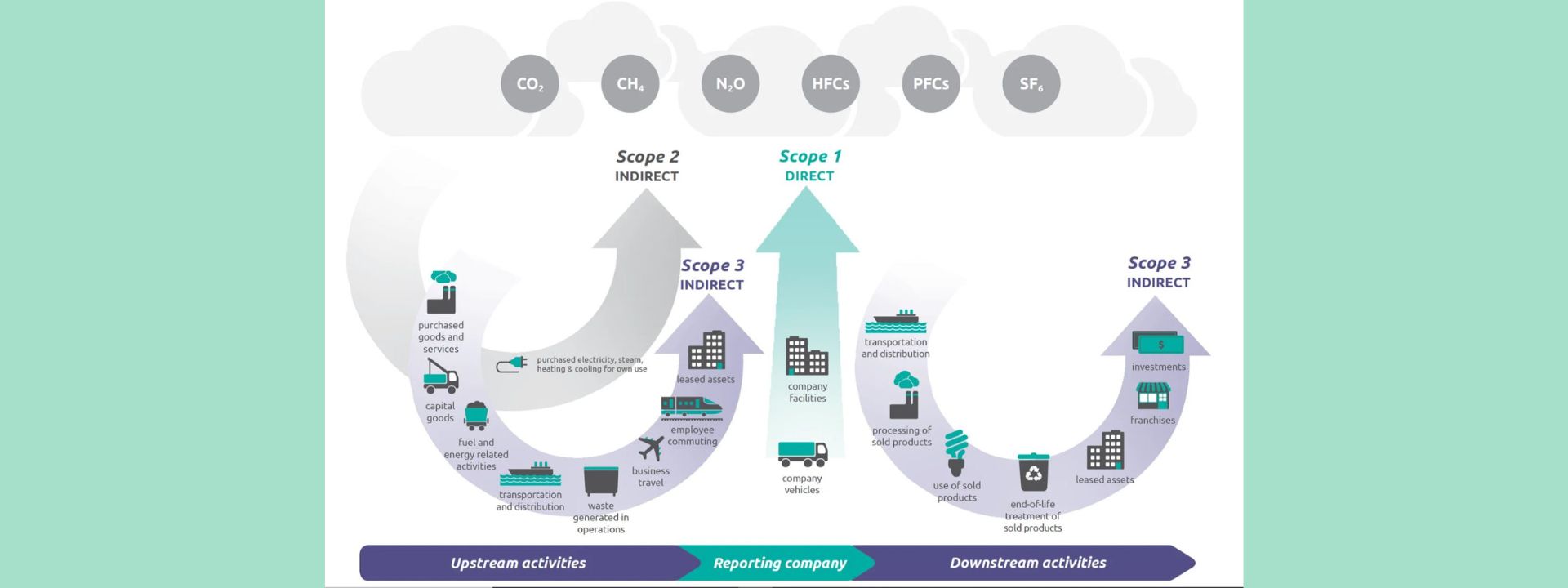

The pause primarily affects specific elements within broader Environmental, Social, and Governance (ESG) reporting mandates, particularly those concerning climate-related financial disclosures and certain diversity metrics. While the exact details vary, the overarching aim was to address implementation challenges and ensure a more harmonized approach.

-

Regulatory Bodies Involved: The primary regulatory bodies involved are the Ontario Securities Commission (OSC) and the Canadian Securities Administrators (CSA), representing securities regulators across all provinces and territories. Their coordinated approach is vital for consistent Canadian climate reporting regulations nationwide.

-

Timeline of the Pause: The pause began in [Insert Start Date] and is currently anticipated to last until [Insert Anticipated End Date or timeframe]. This timeline is subject to change, pending further consultations and revisions.

-

Reasons for the Pause: Regulators cited several reasons for the temporary suspension. These included the need for further consultation with stakeholders to ensure the regulations are both effective and achievable, concerns about the potential for inconsistencies in reporting across different sectors, and a desire to better align Canadian standards with international best practices, such as those promoted by the Task Force on Climate-related Financial Disclosures (TCFD). This highlights the complexity of establishing robust Canadian climate reporting regulations.

Criticism and Concerns Raised by Stakeholders

The regulatory pause has drawn significant criticism from various stakeholder groups. The primary concerns revolve around the potential negative impacts on transparency, accountability, and Canada's commitment to environmental sustainability.

-

Investor Concerns: Many investors expressed worries that the pause signals a retreat from transparency and accountability on climate-related risks. This could impact investment decisions and potentially hinder the flow of capital towards sustainable businesses. The uncertainty surrounding future Canadian climate reporting regulations adds to this concern.

-

Advocacy Group Concerns: Environmental and social justice advocacy groups voiced concerns that the pause represents a setback for ESG progress, particularly regarding diversity initiatives within organizations. They argue that the delay undermines efforts to promote responsible business practices and equitable representation.

-

Impact on Foreign Investment: The pause has raised concerns about attracting foreign investment, especially from jurisdictions with more stringent climate-related reporting requirements. Inconsistency with global sustainability standards could make Canada less attractive as a destination for responsible investors.

-

Public Statements: Several prominent investor groups and advocacy organizations have issued public statements expressing their disappointment and urging regulators to expedite the development of clear and comprehensive Canadian climate reporting regulations.

The Debate around Materiality and Scope of Climate-Related Disclosures

A key element of the debate centres on defining "material" climate-related risks. This involves determining which climate-related factors are significant enough to impact a company's financial performance and should therefore be disclosed.

-

Sector-Specific Challenges: Assessing and reporting climate-related financial risks varies considerably across different sectors. Energy companies face different challenges than, say, technology companies. Establishing consistent metrics across these diverse industries is a complex undertaking.

-

Consistent Metrics: The challenge lies in establishing consistent and comparable metrics across industries to ensure meaningful comparisons and informed decision-making. This requires a careful consideration of diverse methodologies and frameworks.

-

Influence of International Frameworks: The TCFD's recommendations provide a significant influence, but aligning fully with international frameworks while accommodating the unique aspects of the Canadian context is essential for effective Canadian climate reporting regulations.

Looking Ahead: Future Directions for Canadian Climate Reporting Regulations

The future direction of Canadian climate reporting will depend heavily on the outcome of ongoing consultations and the lessons learned during the pause.

-

Resumption of Regulations: The anticipated timeline for the resumption of regulations or the introduction of revised rules is crucial. Clear communication regarding this timeline is essential for businesses to prepare.

-

Revised Regulations: Feedback from stakeholders will likely lead to modifications in the regulations, focusing on improving clarity, reducing complexity, and increasing consistency across sectors.

-

Collaboration and Consultation: Continued collaboration between regulators, industry stakeholders, investors, and other relevant parties is vital for developing robust and effective regulations that support both economic growth and environmental sustainability.

-

Federal Initiatives: Developments at the federal level, including potential national standards for climate-related disclosures, could significantly impact the future landscape of Canadian climate reporting regulations.

Conclusion

The temporary pause on certain aspects of diversity and climate reporting in Canada has ignited important discussions about the balance between regulatory ambition and practical implementation. While the pause addresses concerns regarding complexity and consistency, it also highlights the urgent need for clear, effective, and internationally aligned standards for climate-related financial disclosures. The future direction of Canadian climate reporting regulations will significantly influence the country’s ability to attract investment, meet its climate goals, and foster sustainable economic growth. Stay informed about updates on Canadian climate reporting regulations to ensure your business is prepared for the evolving regulatory landscape. Regularly review official announcements from the CSA and OSC for the latest information on Canadian climate reporting regulations and related developments.

Featured Posts

-

Australian Fiscal Policy Outlook Goldman Sachs Assessment Of Labor And Opposition

Apr 25, 2025

Australian Fiscal Policy Outlook Goldman Sachs Assessment Of Labor And Opposition

Apr 25, 2025 -

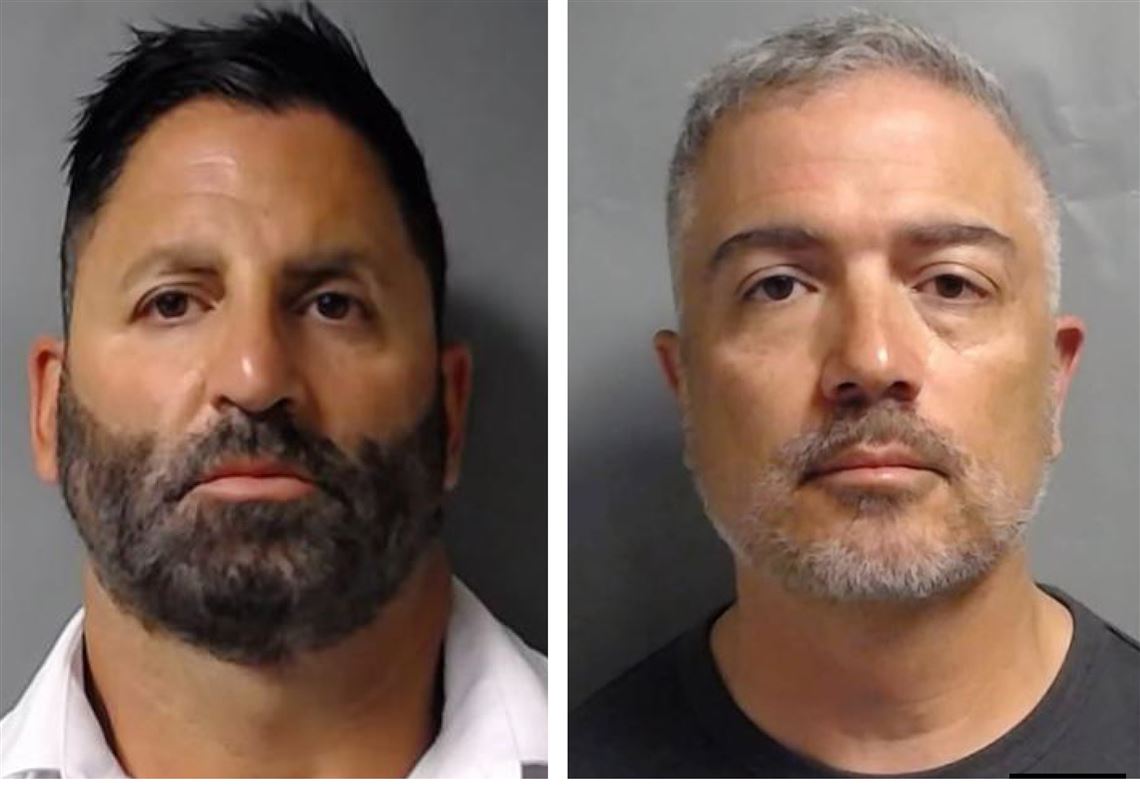

Brian Tyree Henry And Wagner Moura Impersonate Dea Agents In Dope Thief Trailer

Apr 25, 2025

Brian Tyree Henry And Wagner Moura Impersonate Dea Agents In Dope Thief Trailer

Apr 25, 2025 -

Elon Musks Robotaxi Hype Versus Reality

Apr 25, 2025

Elon Musks Robotaxi Hype Versus Reality

Apr 25, 2025 -

20 Fevralya Kot Kellog Pribudet V Ukrainu Analiz Situatsii

Apr 25, 2025

20 Fevralya Kot Kellog Pribudet V Ukrainu Analiz Situatsii

Apr 25, 2025 -

High Stock Valuations And Investor Confidence A Bof A Analysis

Apr 25, 2025

High Stock Valuations And Investor Confidence A Bof A Analysis

Apr 25, 2025

Latest Posts

-

Boxing Seminar Announcement Ace Power Promotion March 26

Apr 30, 2025

Boxing Seminar Announcement Ace Power Promotion March 26

Apr 30, 2025 -

Ace Power Promotion Hosts Boxing Seminar On March 26

Apr 30, 2025

Ace Power Promotion Hosts Boxing Seminar On March 26

Apr 30, 2025 -

Could Gillian Anderson Be The Next Doctor Who Villain Ncuti Gatwas Pick

Apr 30, 2025

Could Gillian Anderson Be The Next Doctor Who Villain Ncuti Gatwas Pick

Apr 30, 2025 -

Ace Power Promotions Boxing Seminar March 26th

Apr 30, 2025

Ace Power Promotions Boxing Seminar March 26th

Apr 30, 2025 -

Un Nouveau X Files Par Ryan Coogler Possibilites Et Defis

Apr 30, 2025

Un Nouveau X Files Par Ryan Coogler Possibilites Et Defis

Apr 30, 2025