Payday Loans For Bad Credit: Guaranteed Approval Direct From Top Lenders

Table of Contents

Understanding Payday Loans and Bad Credit

Payday loans are short-term, small-dollar loans designed to bridge the gap until your next payday. They're typically repaid within a few weeks. While they're often marketed as "guaranteed approval payday loans," it's crucial to understand that lenders still assess your application. However, some lenders have more lenient requirements for bad credit applicants than traditional banks or credit unions. The key difference lies in who you borrow from:

- Direct Lenders: You borrow directly from the lending institution. This often simplifies the process and can offer clearer terms.

- Third-Party Brokers: These intermediaries connect you with multiple lenders. While they might offer a wider selection, the process can be more complex, and fees might be higher.

Let's break down some key aspects:

- APR and Interest Rates: Payday loans typically come with high Annual Percentage Rates (APR) and interest rates. This is because of the short repayment period and the inherent risk associated with lending to individuals with bad credit.

- Short Repayment Period: The loan is typically due on your next payday, creating a short repayment window.

- Responsible Borrowing: It’s vital to borrow only what you can comfortably repay on time. Failing to do so can lead to severe financial consequences.

- Defaulting on a Payday Loan: Defaulting can result in late fees, damage to your credit score, and potential collection actions.

Finding Reputable Direct Lenders for Bad Credit Payday Loans

Navigating the payday loan landscape can be tricky, especially with bad credit. Many predatory lenders operate online, preying on vulnerable borrowers. Protecting yourself requires careful research and due diligence. Here's how to identify trustworthy direct lenders:

- Licensed and Regulated: Ensure the lender is licensed and regulated in your state. This provides a layer of consumer protection.

- Transparent Fees and Interest Rates: Avoid lenders who are vague about their fees and interest rates. Transparency is key to responsible borrowing.

- Customer Reviews and Testimonials: Check online reviews and testimonials from past borrowers. Look for patterns and consistent feedback.

- Beware of "Guaranteed Approval": Be wary of lenders promising guaranteed approval without conducting any credit checks. Legitimate lenders will still assess your application.

Use resources like the Better Business Bureau (BBB) and your state's financial regulator to research lenders and check their reputation.

The Application Process for Bad Credit Payday Loans

The application process for bad credit payday loans is typically straightforward. Most lenders offer online application forms, requiring basic personal and financial information:

- Online Application: Fill out the online application form, providing accurate details about your income, employment, and bank account.

- Verification: The lender will verify the information you provide, including your employment status and bank account details.

- Accurate Details: Providing false or inaccurate information can jeopardize your application and potentially lead to legal consequences.

- Quick Approval: Depending on the lender, you might receive approval quickly, sometimes within the same day. Some lenders offer same-day funding.

Managing Your Payday Loan Responsibly

Securing a payday loan should be a last resort. Even with guaranteed approval, it's crucial to manage your loan responsibly:

- Repayment Plan: Create a realistic repayment plan before accepting the loan, ensuring you can comfortably repay it on time.

- Financial Management: Address the underlying financial issues that led to needing a payday loan. This might involve creating a budget, reducing expenses, or exploring additional income streams.

- Debt Traps: Avoid falling into a cycle of debt by taking out multiple payday loans simultaneously.

- Alternatives: Consider alternative solutions such as negotiating with creditors, seeking help from a credit counselor, or exploring other borrowing options.

Alternatives to Payday Loans for Bad Credit

While payday loans might seem convenient, they are not always the best option. Consider these alternatives:

- Personal Loans: Banks or credit unions might offer personal loans with lower interest rates and longer repayment periods.

- Small Business Loans: If you have a small business, you might qualify for a small business loan.

- Peer-to-Peer Lending: Peer-to-peer lending platforms connect borrowers with individual lenders.

- Credit Builder Loans: These loans are designed to help you build your credit history.

Conclusion: Securing Your Financial Future with Payday Loans for Bad Credit

Payday loans for bad credit can provide temporary relief, but they should be approached cautiously. Choosing a reputable direct lender is crucial to avoid scams and predatory lending practices. Remember, responsible borrowing is paramount. Understand the terms, fees, and interest rates before committing to a loan. While guaranteed approval payday loans might seem appealing, always explore alternatives and prioritize long-term financial health. Don't let bad credit hold you back. Explore your options for payday loans for bad credit today, but remember to choose a reputable direct lender and borrow responsibly.

Featured Posts

-

Late Game Heroics Stowers Walk Off Grand Slam Leads Marlins To Victory

May 28, 2025

Late Game Heroics Stowers Walk Off Grand Slam Leads Marlins To Victory

May 28, 2025 -

Is The Bond Market Crisis Bigger Than You Think

May 28, 2025

Is The Bond Market Crisis Bigger Than You Think

May 28, 2025 -

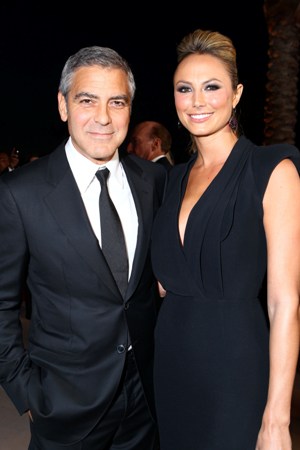

The Clooney Jackman Broadway Rivalry What To Expect

May 28, 2025

The Clooney Jackman Broadway Rivalry What To Expect

May 28, 2025 -

Alcaraz Confident Swiatek Struggles French Open 2024 Preview

May 28, 2025

Alcaraz Confident Swiatek Struggles French Open 2024 Preview

May 28, 2025 -

Is Jennifer Lopez Hosting The American Music Awards In May A Look At The Rumors

May 28, 2025

Is Jennifer Lopez Hosting The American Music Awards In May A Look At The Rumors

May 28, 2025