PBOC Daily Yuan Support Below Estimates: First Time In 2024

Table of Contents

Understanding the PBOC's Daily Yuan Support Mechanism

The PBOC plays a vital role in managing the Yuan's (also known as the RMB or Chinese Yuan) exchange rate. Its mandate involves maintaining a relatively stable currency value to support economic stability and growth. One of the key tools employed is daily intervention in the forex market, where the PBOC buys or sells Yuan to influence its value against other major currencies, primarily the US dollar. This daily support typically involves a range of operations designed to maintain the Yuan within a desired trading band. The recent drop below estimates signals a potential shift in this strategy, and understanding the usual support level's significance requires examining the PBOC's actions within this context.

- The PBOC's Mandate: The PBOC aims to balance economic growth with price stability, and a stable Yuan is considered crucial for both.

- Daily Support Operations: These involve buying Yuan to increase demand and support its value, or selling Yuan to reduce demand if it appreciates too rapidly. These actions are often conducted through state-owned banks.

- Influencing Factors: The PBOC's decisions on intervention are influenced by various domestic and international factors, including inflation rates, trade balances, capital flows, and global economic conditions.

Reasons Behind the Unexpected Drop in Support

Several factors could contribute to the PBOC's reduced daily Yuan support. The interplay of these elements paints a complex picture of the challenges facing China's currency management. Analyzing each factor provides valuable insight into the market dynamics at play.

- US Dollar Strength: A strong US dollar typically puts downward pressure on other currencies, including the Yuan. If the dollar appreciates significantly, the PBOC might choose to reduce intervention to conserve its forex reserves.

- Global Economic Slowdown: Global economic uncertainty and a potential slowdown can reduce demand for Chinese exports, impacting the Yuan's value and necessitating less intervention to support it.

- Inflationary Pressures: High inflation within China could prompt the PBOC to prioritize managing domestic prices over maintaining a specific exchange rate, leading to a reduction in daily support for the Yuan.

- Geopolitical and Trade Tensions: Ongoing trade disputes or geopolitical events can create uncertainty and affect investor confidence, leading to capital outflow and increased pressure on the Yuan, potentially reducing the need for substantial PBOC intervention.

- Capital Outflow: If significant capital is flowing out of China, the PBOC might reduce its support to manage the exchange rate more effectively, preventing excessive depletion of forex reserves.

Market Implications and Investor Sentiment

The reduced PBOC daily Yuan support has immediate and potentially long-term implications for the forex market and investor sentiment. Increased volatility is expected, creating both opportunities and risks.

- RMB Volatility: The Yuan's exchange rate is likely to become more volatile in the short term, creating uncertainty for businesses engaged in international trade and investment.

- Impact on Foreign Investment: Decreased confidence in the Yuan's stability could discourage foreign investment in China, impacting economic growth.

- Trade Implications: Fluctuations in the Yuan's value can significantly affect the competitiveness of Chinese exports and the cost of imports.

- Increased Speculation: The increased volatility creates opportunities for speculation in the forex market, with traders potentially betting on the Yuan's future direction.

- Investor Advice: Investors with significant Yuan exposure should carefully monitor the situation and consider hedging strategies to mitigate currency risk.

Future Outlook for the Yuan and PBOC Intervention

Predicting the future trajectory of the Yuan and the PBOC's intervention strategy is challenging, given the complex interplay of domestic and global economic forces. However, several scenarios merit consideration.

- Yuan Forecast: The short-term outlook for the Yuan remains uncertain, with potential for further depreciation depending on the evolution of the factors discussed above.

- PBOC Policy Adjustments: The PBOC might adjust its intervention strategy, potentially increasing support if the Yuan depreciates significantly or decreasing it further if other priorities emerge.

- Impact on China's Economy: Sustained Yuan depreciation could impact China's economic growth, particularly if it leads to higher import costs and reduced export competitiveness.

- Alternative Scenarios: Other factors, such as unexpected policy changes or major geopolitical events, could significantly alter the outlook for the Yuan and PBOC intervention.

Conclusion

The PBOC's daily Yuan support falling below estimates for the first time in 2024 marks a significant development with potential implications for the global economy. The interplay of US dollar strength, global economic slowdown, and other domestic factors necessitates close monitoring of the situation. Understanding the PBOC's intervention strategies and the market's reaction is crucial for investors and businesses. The increased volatility introduces both risks and opportunities in the forex market. Stay informed about the latest developments regarding PBOC daily Yuan support and its impact on the currency market. Follow our blog for further updates and analysis on the Yuan's exchange rate and the PBOC's monetary policy. Subscribe to receive timely alerts on significant shifts in PBOC daily Yuan support levels.

Featured Posts

-

Former All Star Jake Peavy Named Special Assistant To Padres Ceo

May 15, 2025

Former All Star Jake Peavy Named Special Assistant To Padres Ceo

May 15, 2025 -

2026 Bmw I X A Best Case Scenario Electric Vehicle

May 15, 2025

2026 Bmw I X A Best Case Scenario Electric Vehicle

May 15, 2025 -

Microsofts Significant Job Cuts Details On The 6 000 Layoffs

May 15, 2025

Microsofts Significant Job Cuts Details On The 6 000 Layoffs

May 15, 2025 -

The Rise Of A Challenger How One App Could Weaken Metas Grip

May 15, 2025

The Rise Of A Challenger How One App Could Weaken Metas Grip

May 15, 2025 -

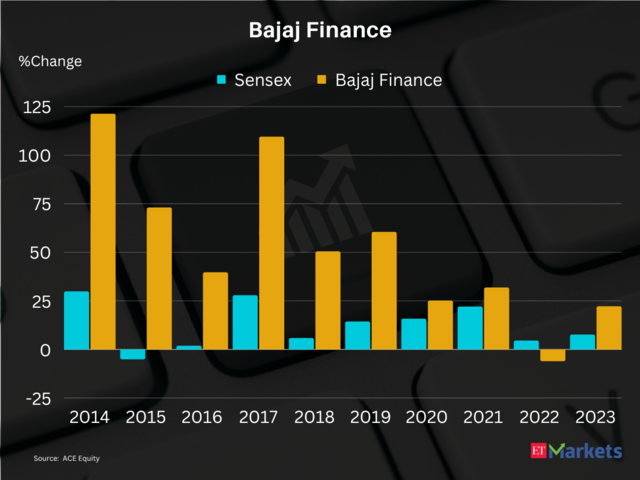

Significant Sensex Gains Stocks That Outperformed Today

May 15, 2025

Significant Sensex Gains Stocks That Outperformed Today

May 15, 2025