Personal Loan Interest Rates Today: Factors Affecting Your Approval

Table of Contents

Your Credit Score: The Cornerstone of Loan Approval

Your credit score is the single most important factor influencing your personal loan interest rates today. Lenders use it to assess your creditworthiness and predict your likelihood of repaying the loan.

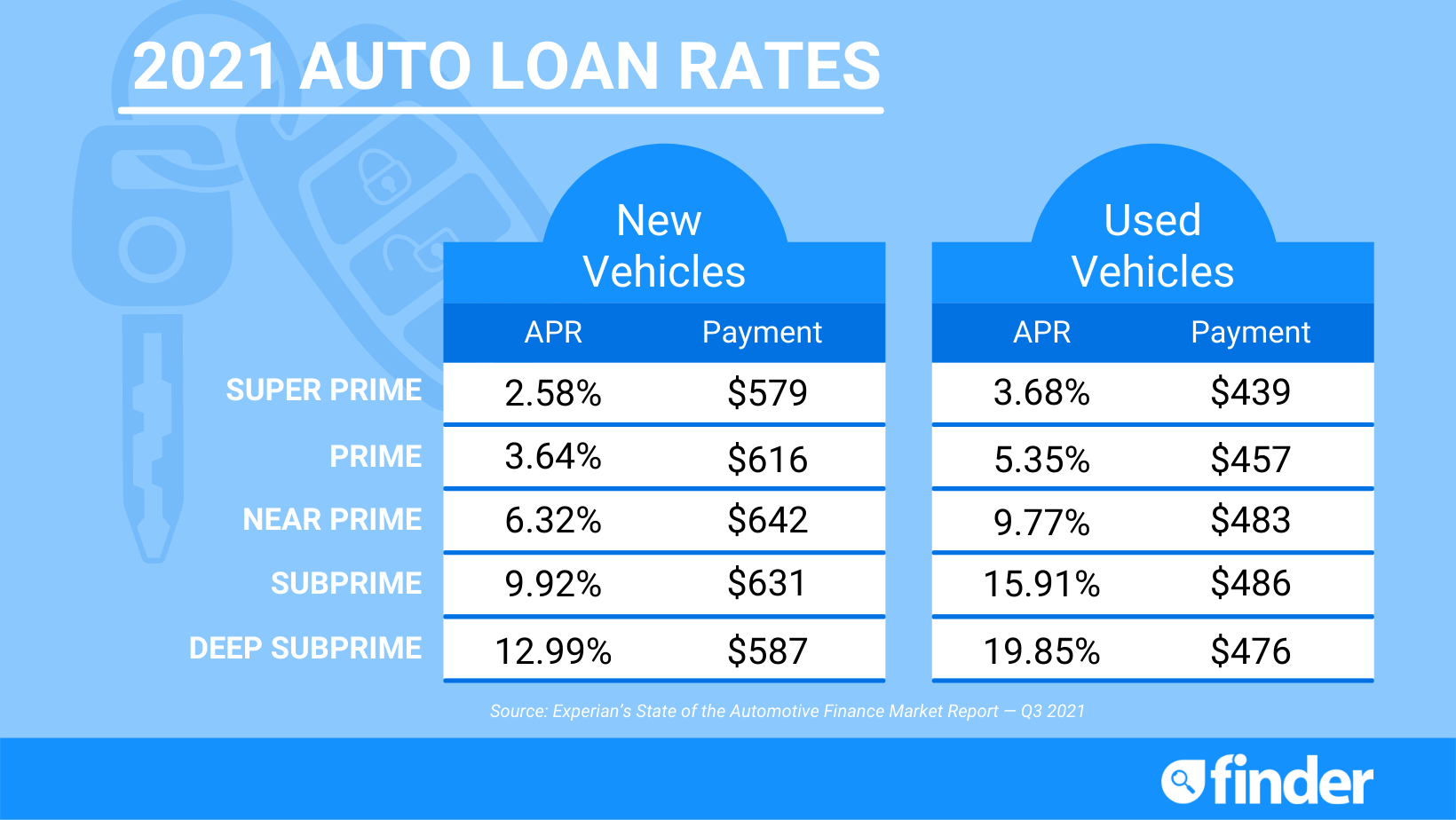

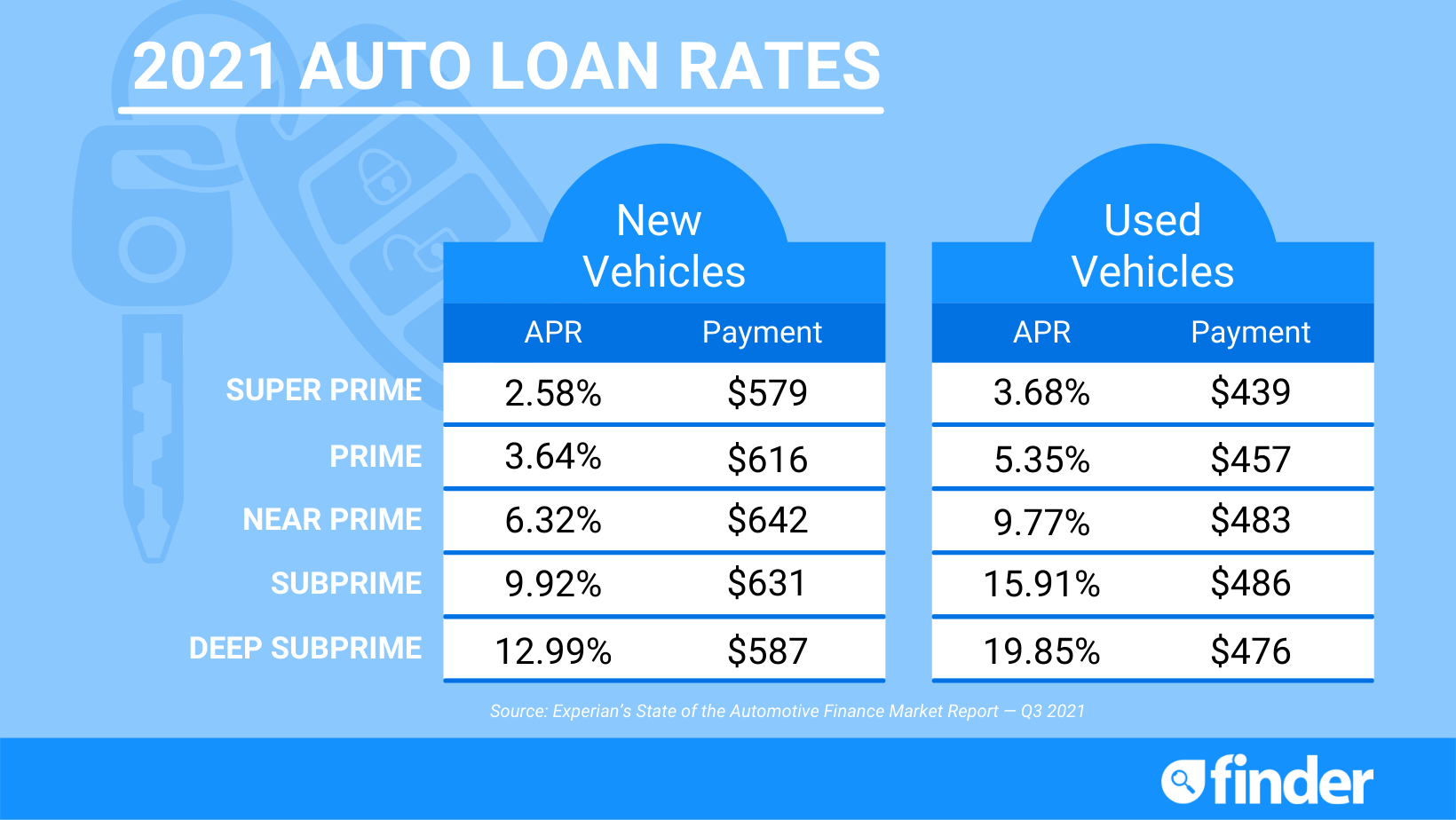

How Credit Score Impacts Interest Rates:

A higher credit score translates directly to lower interest rates. Lenders view a high score as a lower risk. The better your credit history, the more likely you are to qualify for the most favorable personal loan rates today. Conversely, a poor credit score can lead to significantly higher interest rates or even loan denial.

- Check your credit report for errors before applying. Disputes any inaccuracies to improve your score.

- Aim for a score above 700 for the best rates. This is generally considered good credit, increasing your chances of approval and securing lower interest rates.

- Regularly monitor your credit utilization ratio (the amount of credit you're using compared to your total credit limit). Keeping this ratio low (ideally below 30%) demonstrates responsible credit management and can positively impact your score.

Improving Your Credit Score:

Even a small improvement in your credit score can lead to significant savings on interest over the life of your loan.

- Pay bills on time consistently. This is the most crucial factor in building good credit.

- Keep credit card balances low. High credit utilization negatively impacts your score.

- Avoid opening multiple new accounts in a short period. This can signal increased risk to lenders.

Debt-to-Income Ratio (DTI): A Measure of Your Financial Burden

Your debt-to-income ratio (DTI) is another critical factor lenders consider when assessing your personal loan application.

Understanding DTI:

Lenders assess your DTI to gauge your ability to manage monthly payments alongside your existing financial obligations. A lower DTI is more favorable, showing lenders you have sufficient disposable income to comfortably repay the loan.

- Calculate your DTI by dividing your total monthly debt payments by your gross monthly income. This includes credit card payments, car loans, student loans, and any other recurring debts.

- Aim for a DTI below 43% for better loan approval chances. While some lenders may accept higher DTIs, a lower ratio significantly increases your odds of approval and securing a better interest rate.

- Reduce high-interest debt before applying for a personal loan to improve your DTI. Consolidating debt can streamline your payments and improve your DTI.

Loan Amount and Loan Term: The Size and Duration of Your Loan

The amount you borrow and the repayment period (loan term) significantly influence your personal loan interest rates today.

Impact on Interest Rates:

Larger loan amounts often come with higher interest rates. Lenders perceive larger loans as riskier. Similarly, longer loan terms can increase the total interest paid, even if the monthly payments are lower.

- Borrow only what you need to avoid unnecessary interest payments. Carefully budget and determine the exact amount you require.

- Explore different loan terms to find a balance between monthly payments and total interest. Shorter terms mean higher monthly payments but significantly lower overall interest.

- Consider a shorter loan term to pay less in interest overall, despite higher monthly payments. This is often the most cost-effective approach in the long run.

The Lender and the Type of Loan: Different Options, Different Rates

Interest rates vary significantly between lenders and loan types. Shopping around is crucial for securing the best possible terms.

Lender Variations:

Interest rates vary significantly between banks, credit unions, and online lenders. Each lender has its own lending criteria and risk assessment models.

- Check rates from banks, credit unions, and online lenders. Compare offers to find the most competitive rates.

- Consider secured vs. unsecured loans; secured loans typically offer lower rates. Secured loans require collateral, reducing the lender's risk.

- Read reviews and compare fees associated with different loan options. Beware of hidden fees that can impact your overall cost.

Loan Type Influence:

The specific purpose of your loan can influence the interest rate.

- Different loan types, such as debt consolidation loans or home improvement loans, may carry different interest rates depending on the lender’s risk assessment for that specific loan purpose.

Your Income and Employment History: Demonstrating Stability

A stable income and consistent employment history are key to loan approval and obtaining favorable interest rates.

Stable Income is Key:

Lenders want reassurance that you can consistently make your monthly loan payments.

- Be prepared to provide documentation of your income, such as pay stubs or tax returns. This verifies your income stability.

- A longer employment history generally improves your chances of approval. Lenders view consistent employment as a positive indicator of financial responsibility.

- Freelancers and gig workers should provide proof of consistent income. Demonstrate a reliable income stream through tax returns, contracts, or bank statements.

Conclusion:

Securing favorable personal loan interest rates today requires a comprehensive understanding of the factors lenders consider. Your credit score, debt-to-income ratio, loan amount, chosen lender, and employment history all significantly impact your approval and the interest rate you’ll receive. By focusing on improving your credit, managing your debt, and carefully comparing offers from various lenders, you can significantly increase your chances of obtaining a personal loan with competitive personal loan interest rates. Start comparing personal loan interest rates today to find the best option for your financial needs. Remember to check your credit report and shop around before applying for a personal loan to ensure you’re getting the best possible rate.

Featured Posts

-

Romes Champion No Time For Complacency

May 28, 2025

Romes Champion No Time For Complacency

May 28, 2025 -

Cbs Announces Jennifer Lopez As Host For 2025 Amas

May 28, 2025

Cbs Announces Jennifer Lopez As Host For 2025 Amas

May 28, 2025 -

Manchester United Outpaces Liverpool For Rayan Cherki Signing

May 28, 2025

Manchester United Outpaces Liverpool For Rayan Cherki Signing

May 28, 2025 -

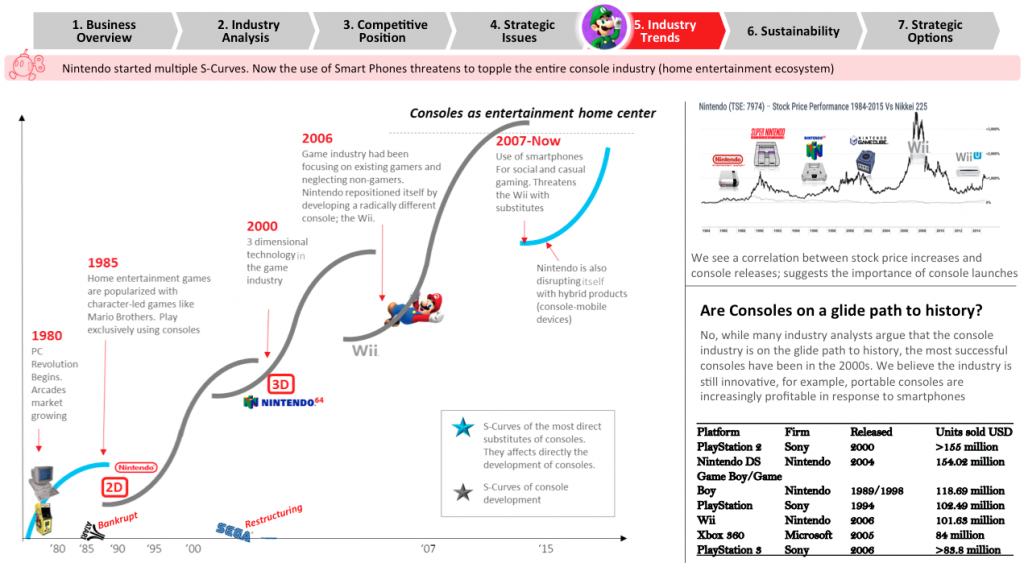

The Calculated Risks Of Nintendos Current Game Strategy

May 28, 2025

The Calculated Risks Of Nintendos Current Game Strategy

May 28, 2025 -

The Kanye West Bianca Censori Relationship Power Dynamics And Public Scrutiny

May 28, 2025

The Kanye West Bianca Censori Relationship Power Dynamics And Public Scrutiny

May 28, 2025