Personal Loans: Check Today's Interest Rates & Apply Online

Table of Contents

Understanding Today's Personal Loan Interest Rates

Securing a competitive interest rate on your personal loan is key to managing your finances effectively. Several factors influence the interest rate you'll receive. Understanding these factors allows you to improve your chances of getting a favorable rate and finding the best personal loan interest rates.

Factors Affecting Interest Rates

Several key factors significantly influence the interest rate you'll be offered on a personal loan:

-

Credit Score: Your credit score is the most significant factor. Lenders use your credit history to assess your creditworthiness. A higher credit score (generally above 750, considered excellent) typically translates to lower interest rates. Conversely, a poor credit score (below 600) will likely result in much higher rates, making it harder to secure a loan or requiring a higher interest rate to compensate for the risk. Good credit scores (670-739) generally receive better rates than fair credit (600-669).

-

Loan Amount: Larger loan amounts might come with slightly higher interest rates because they represent a greater risk to the lender.

-

Loan Term: The loan term (the length of time you have to repay the loan) also impacts the interest rate. Shorter-term loans (e.g., 12 months) usually have higher interest rates per month but lower overall interest paid because the loan is repaid faster. Longer-term loans (e.g., 60 months) have lower monthly payments but significantly higher overall interest paid due to the extended repayment period.

-

Income and Debt-to-Income Ratio (DTI): Lenders carefully examine your income and your existing debt (DTI) to determine your ability to repay the loan. A higher DTI (a larger percentage of your income going towards debt payments) might lead to a higher interest rate or even loan denial. A low DTI demonstrates a lower risk to the lender.

-

Type of Lender: Different lenders—banks, credit unions, and online lenders—offer varying interest rates based on their lending policies and risk assessments. Credit unions often offer more favorable terms to their members.

Where to Check Current Rates

Finding the best personal loan interest rates requires comparison shopping. Here are some reliable resources to check current rates:

-

Online Loan Comparison Websites: Websites like LendingTree, Bankrate, and NerdWallet allow you to compare rates from multiple lenders simultaneously, saving you valuable time and effort in your search for quick personal loans.

-

Individual Lender Websites: Visit the websites of major banks and credit unions directly to see their current personal loan interest rate offerings. This allows you to explore different loan options and terms and get a clear understanding of the specific interest rates available.

-

Financial Advisors: A financial advisor can provide personalized guidance based on your financial situation and help you navigate the complexities of different loan options and interest rates.

The Online Personal Loan Application Process

Applying for a personal loan online is often faster and more convenient than the traditional in-person method. Let's explore the steps involved:

Steps to Apply for a Personal Loan Online

Applying for a personal loan online is straightforward:

-

Pre-qualification: Many lenders offer pre-qualification, allowing you to check your potential interest rate and loan amount without impacting your credit score. This is a valuable step to gauge your eligibility before submitting a full application for your online loan.

-

Gather Required Documents: You'll need several documents to complete the application, including government-issued ID, proof of income (pay stubs or tax returns), and bank statements showing sufficient funds and a stable financial history.

-

Complete the Application Form: Fill out the online application form accurately and completely. Inaccurate or incomplete information can delay the approval process.

-

Wait for Approval: The approval process usually takes a few days to a couple of weeks, depending on the lender and the complexity of your application.

-

Review Loan Terms: Carefully review the loan agreement before signing, paying close attention to the interest rate, fees, and repayment terms.

Tips for a Smooth Online Application

-

Choose a Reputable Lender: Research potential lenders and check online reviews and ratings to ensure you're working with a trustworthy and reliable institution offering online loan options.

-

Maintain Accurate Information: Provide accurate and up-to-date information throughout the application process to avoid delays or rejection.

-

Ask Questions: Don't hesitate to contact the lender with any questions or concerns you may have before, during, or after the application process for your online loan.

Choosing the Right Personal Loan for Your Needs

Selecting the right personal loan involves understanding different loan types and carefully considering your financial circumstances.

Types of Personal Loans

-

Secured vs. Unsecured Loans: Secured loans require collateral (like a car or savings account) to guarantee repayment. Unsecured loans don't require collateral but typically come with higher interest rates because they carry more risk for the lender.

-

Fixed vs. Variable Interest Rates: Fixed-rate loans have a consistent interest rate throughout the loan term. Variable-rate loans have an interest rate that fluctuates based on market conditions. Fixed rates offer predictability, while variable rates might offer lower initial rates but could increase over time.

Consider Your Financial Situation

-

Budgeting and Affordability: Before applying, create a realistic budget to ensure you can comfortably afford the monthly loan payments without jeopardizing your financial stability.

-

Long-Term Financial Goals: Consider how the personal loan fits into your broader financial objectives. Will it help you achieve your long-term goals, or could it create additional financial strain?

Conclusion

Securing a personal loan with competitive interest rates requires careful research and planning. By understanding the factors that influence interest rates, following a streamlined online application process, and choosing a loan that aligns with your financial situation, you can successfully navigate the world of personal loans. Start your search today by checking today's personal loan interest rates and applying online for the best personal loan options available! Don't delay – find the perfect personal loan for your needs and secure the best possible interest rates for your quick personal loan.

Featured Posts

-

The Future Of Alejandro Garnacho Staying At Man Utd Or Seeking A Transfer

May 28, 2025

The Future Of Alejandro Garnacho Staying At Man Utd Or Seeking A Transfer

May 28, 2025 -

Arsenal Gyoekeres Atigazolas Szamok Adatok Es Elemzes

May 28, 2025

Arsenal Gyoekeres Atigazolas Szamok Adatok Es Elemzes

May 28, 2025 -

Kapolda Bali Irjen Daniel Resmi Pimpin Serah Terima Jabatan 7 Perwira Menengah

May 28, 2025

Kapolda Bali Irjen Daniel Resmi Pimpin Serah Terima Jabatan 7 Perwira Menengah

May 28, 2025 -

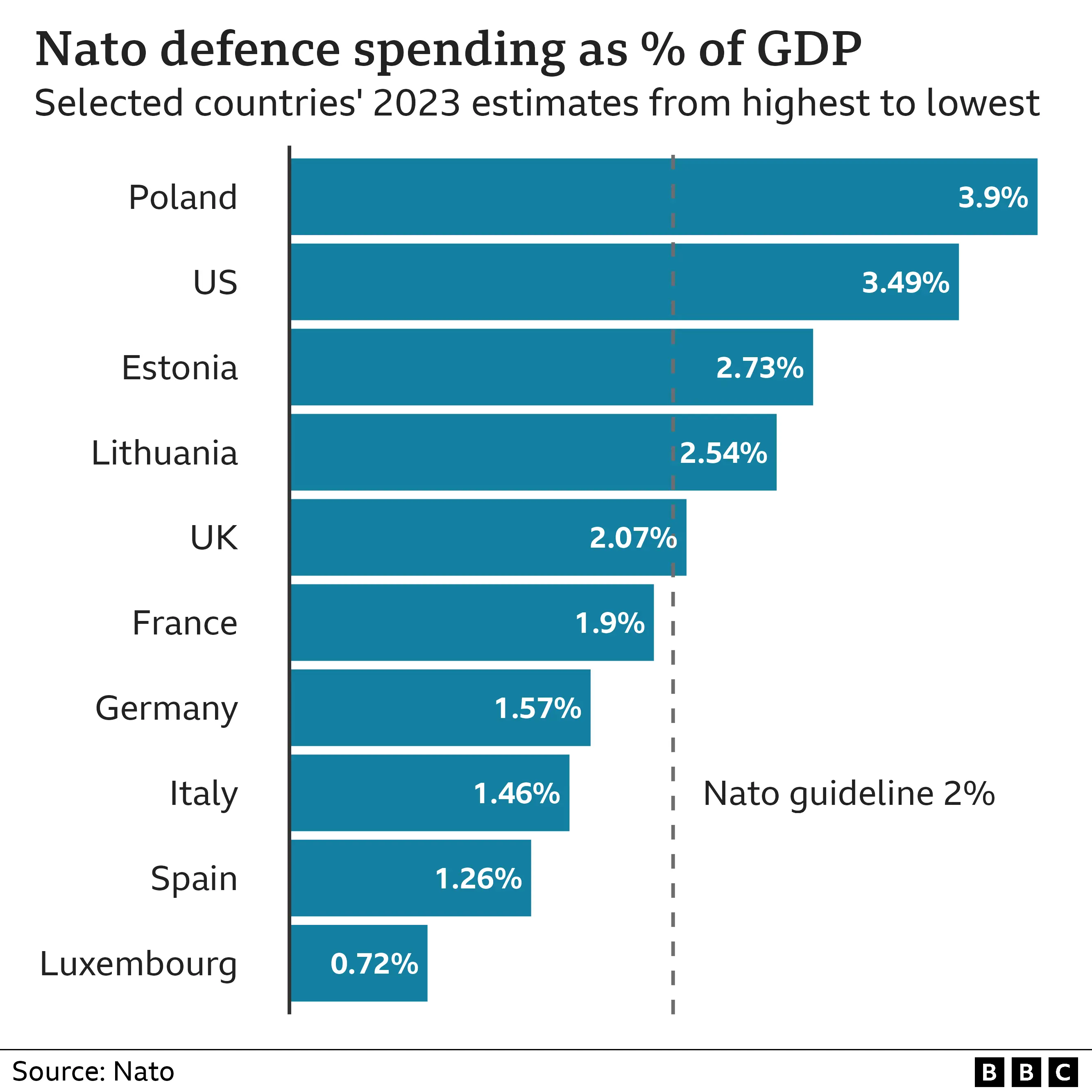

Nato Allies Closer To 5 Defense Spending Goal Stoltenberg

May 28, 2025

Nato Allies Closer To 5 Defense Spending Goal Stoltenberg

May 28, 2025 -

Climate Whiplash Urgent Action Needed To Protect Global Cities

May 28, 2025

Climate Whiplash Urgent Action Needed To Protect Global Cities

May 28, 2025