Personal Loans For Bad Credit: Up To $5000 With No Credit Check

Table of Contents

Understanding Personal Loans for Bad Credit

Personal loans are sums of money borrowed from a lender, repaid over a set period with interest. They can be used for various purposes, from debt consolidation to covering unexpected expenses like emergency loans or small loans. However, your credit score significantly impacts your loan approval and the interest rate you'll receive.

-

Secured vs. Unsecured Loans: Secured loans require collateral (like a car or house) to back the loan. If you default, the lender can seize the collateral. Unsecured loans don't require collateral, but typically come with higher interest rates for bad credit applicants.

-

The Impact of Bad Credit: A bad credit score (generally below 670) signals higher risk to lenders. This often results in loan rejection or significantly higher interest rates on approved loans. It can also limit the loan amount you qualify for.

-

Key Factors influencing interest rates for bad credit loans:

- Credit score

- Debt-to-income ratio

- Loan amount

- Loan term

Exploring No Credit Check Loan Options

No credit check loans, as the name suggests, don't require a formal credit check during the application process. This can be appealing for those with bad credit, offering a potential pathway to securing a $5000 loan. However, it's crucial to understand the implications.

-

Advantages and Disadvantages: The primary advantage is the increased chance of approval. Disadvantages include significantly higher interest rates than traditional loans and often shorter repayment periods, making the loan more expensive overall.

-

Potential Risks: The higher interest rates can lead to a debt trap if not managed carefully. Borrowers may find themselves struggling to repay the loan.

-

Responsible Borrowing: Even with no credit check loans, responsible borrowing is essential. Only borrow what you can comfortably repay, and carefully review the terms and conditions before signing any agreement.

-

Typical features of No Credit Check Loans:

- Higher interest rates than traditional loans

- Shorter repayment periods

- Potential for higher fees

- Limited loan amounts

Finding Reputable Lenders for $5000 Loans with No Credit Check

Navigating the world of online lenders requires caution. Many illegitimate lenders prey on those desperate for funds. Protecting yourself from scams is crucial.

-

Identifying Trustworthy Lenders: Look for lenders with proper licensing and registration. Check online reviews and testimonials from past borrowers. Reputable lenders are transparent about their fees and terms.

-

Resources for Comparing Lenders: Several websites compare loan offers from various lenders, helping you find competitive interest rates and terms. Utilize these tools to make informed decisions.

-

Key indicators of a reputable lender:

- Valid business license and registration

- Positive customer reviews and testimonials on multiple platforms

- Transparent fees and terms

- Secure website with SSL encryption

Alternatives to No Credit Check Loans

If you're struggling to secure a no credit check loan, several alternatives exist. Consider these options:

-

Secured Loans: Using an asset (like a car or savings account) as collateral can significantly improve your chances of approval and secure a lower interest rate.

-

Credit Union Loans: Credit unions often offer more lenient lending criteria than banks, potentially providing access to loans even with bad credit.

-

Borrowing from Family or Friends: While not always ideal, borrowing from trusted family or friends can offer a more flexible and potentially interest-free option.

-

Debt Consolidation: If you have multiple debts, consolidating them into a single loan might simplify repayments and improve your financial situation.

Improving Your Credit Score

While a no credit check loan might provide immediate relief, focusing on improving your credit score is a long-term solution.

- Practical Steps to Improve Your Credit Score:

- Pay all bills on time, consistently.

- Reduce your credit utilization (keep your credit card balances low).

- Dispute any errors on your credit report.

- Use credit responsibly and avoid opening too many new accounts.

Conclusion: Securing Your Personal Loan for Bad Credit

Securing a personal loan with bad credit can be challenging, but it's not impossible. Understanding the options available, from no credit check loans to alternatives like secured loans or credit union loans, is crucial. Remember, responsible borrowing and careful research are vital, especially when dealing with higher-interest loans. Finding a reputable lender is paramount to avoid scams and ensure fair treatment. Start your search for a personal loan for bad credit today and find the financial solution that's right for you. Explore your options for a $5000 loan with no credit check!

Featured Posts

-

The Shifting Landscape How China Is Reshaping The Fortunes Of Bmw Porsche And The Global Auto Industry

May 28, 2025

The Shifting Landscape How China Is Reshaping The Fortunes Of Bmw Porsche And The Global Auto Industry

May 28, 2025 -

Rumor Mill Hugh Jackmans Potential Return As Wolverine In Avengers Doomsday

May 28, 2025

Rumor Mill Hugh Jackmans Potential Return As Wolverine In Avengers Doomsday

May 28, 2025 -

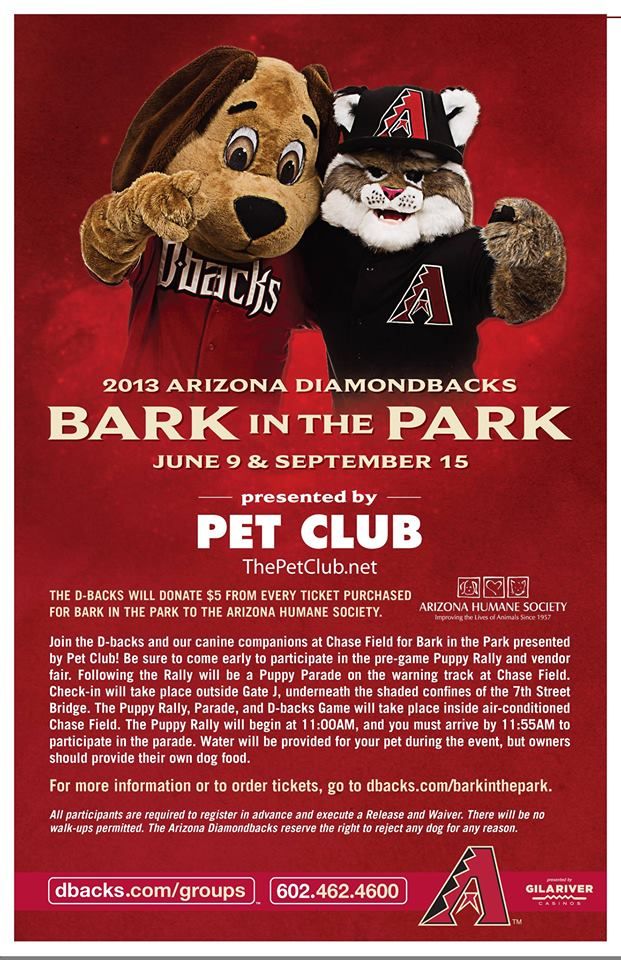

Complete Guide To Arizona Diamondbacks Promotions And Giveaways At Chase Field 2025

May 28, 2025

Complete Guide To Arizona Diamondbacks Promotions And Giveaways At Chase Field 2025

May 28, 2025 -

Ingiliz Devinden Yazin En Bueyuek Transferi Son Guencellemeler

May 28, 2025

Ingiliz Devinden Yazin En Bueyuek Transferi Son Guencellemeler

May 28, 2025 -

Bandung Hujan Hingga Sore Prakiraan Cuaca Besok 23 4 Jawa Barat

May 28, 2025

Bandung Hujan Hingga Sore Prakiraan Cuaca Besok 23 4 Jawa Barat

May 28, 2025