PFC's Action Against Gensol Promoters: EoW On Fake Documents

Table of Contents

Understanding the PFC's Role and Powers

The [Name of Financial Regulatory Body, e.g., SEBI] plays a crucial role in maintaining the integrity and stability of the financial markets. Its mandate includes investigating allegations of financial fraud, market manipulation, and other irregularities. The PFC possesses significant powers to investigate companies and individuals suspected of violating financial regulations. This includes the authority to issue Enforcement of Warrants (EoWs), allowing them to seize documents, assets, and question individuals involved in suspected wrongdoing.

- PFC's Investigative Powers: The PFC has broad investigative powers, including the ability to summon witnesses, demand documents, and conduct on-site inspections.

- Legal Framework: The PFC's actions are underpinned by [mention specific laws and regulations governing their actions, e.g., the Securities and Exchange Act of 1934]. These laws provide the legal basis for investigations, EoWs, and subsequent penalties.

- Previous Actions: The PFC has a history of taking decisive action against financial misconduct. [Cite examples of previous successful investigations and penalties levied by the PFC].

The Gensol Case: Allegations and Evidence

The allegations against Gensol promoters center on the use of fraudulent documents to mislead investors and inflate the company's financial performance. The PFC's investigation uncovered a range of fake documents, suggesting a deliberate attempt to deceive stakeholders.

- Specific Charges: The promoters are facing charges of [list specific charges, e.g., fraud, misrepresentation, insider trading].

- Types of Documents: The fake documents reportedly include [specify types of documents, e.g., falsified financial statements, forged contracts, manipulated audit reports].

- Methods of Falsification: Investigators believe the promoters employed [mention potential methods, e.g., altering existing documents, creating entirely fabricated documents, using sophisticated software to manipulate data].

- Evidence Presented: The PFC has presented [mention the type of evidence presented to support the allegations, e.g., witness testimonies, digital forensic evidence, financial analyses].

The Enforcement of Warrant (EoW) and its Implications

The EoW issued by the PFC in the Gensol case authorizes officials to seize assets and gather further evidence related to the alleged fraud. This is a significant step in the investigation, indicating a strong belief by the PFC that serious wrongdoing has occurred.

- Steps Involved: The EoW process involves [describe the steps, e.g., obtaining a court order, executing the warrant, seizing assets, questioning individuals].

- Asset Seizures: The PFC may seize [mention potential assets that could be seized, e.g., bank accounts, property, company assets].

- Potential Penalties: If found guilty, the Gensol promoters face severe penalties, including [mention potential penalties, e.g., hefty fines, imprisonment, and bans from future involvement in the financial markets].

- Impact on Gensol: The investigation and EoW have already negatively impacted Gensol's share price and operations. The long-term effects remain to be seen.

Impact on Investors and the Market

The PFC's action against Gensol has significant implications for investors who held Gensol shares or invested in related ventures. The case also underscores the broader need for enhanced due diligence and investor protection.

- Advice for Investors: Investors affected by the situation should [give advice, e.g., seek legal counsel, review their investment portfolio, consider reporting potential fraud to authorities].

- Market Reactions: The Gensol case has caused significant share price volatility and may negatively impact investor confidence in the market.

- Due Diligence: Investors should always conduct thorough due diligence before making any investment decision, verifying the authenticity of financial documents and understanding the risks involved.

- Long-Term Effects: The outcome of this case will likely influence future regulatory actions and investor behavior, potentially leading to increased scrutiny and stricter enforcement.

Conclusion

The PFC's investigation into Gensol promoters, triggered by the discovery of fake documents and culminating in an EoW, highlights the serious consequences of financial fraud. The case underscores the importance of robust regulatory oversight and the need for investors to remain vigilant. The potential penalties for the promoters, the impact on investor confidence, and the broader market implications are significant. Stay updated on the PFC Gensol investigation and learn more about detecting fake documents in financial investments to protect yourself. Understanding the implications of EoWs in financial fraud is crucial for making informed investment decisions and mitigating risk. Remember to always conduct thorough due diligence before investing in any company.

Featured Posts

-

Broadcoms Proposed V Mware Price Hike At And T Details A 1 050 Cost Surge

Apr 27, 2025

Broadcoms Proposed V Mware Price Hike At And T Details A 1 050 Cost Surge

Apr 27, 2025 -

Power Finance Corporation Pfc Dividend 2025 4th Cash Reward Announcement On March 12th

Apr 27, 2025

Power Finance Corporation Pfc Dividend 2025 4th Cash Reward Announcement On March 12th

Apr 27, 2025 -

Enforcement Of Eo W Pfcs Response To Gensol Promoters False Documentation

Apr 27, 2025

Enforcement Of Eo W Pfcs Response To Gensol Promoters False Documentation

Apr 27, 2025 -

Understanding Ariana Grandes New Look Hair Tattoos And Professional Styling

Apr 27, 2025

Understanding Ariana Grandes New Look Hair Tattoos And Professional Styling

Apr 27, 2025 -

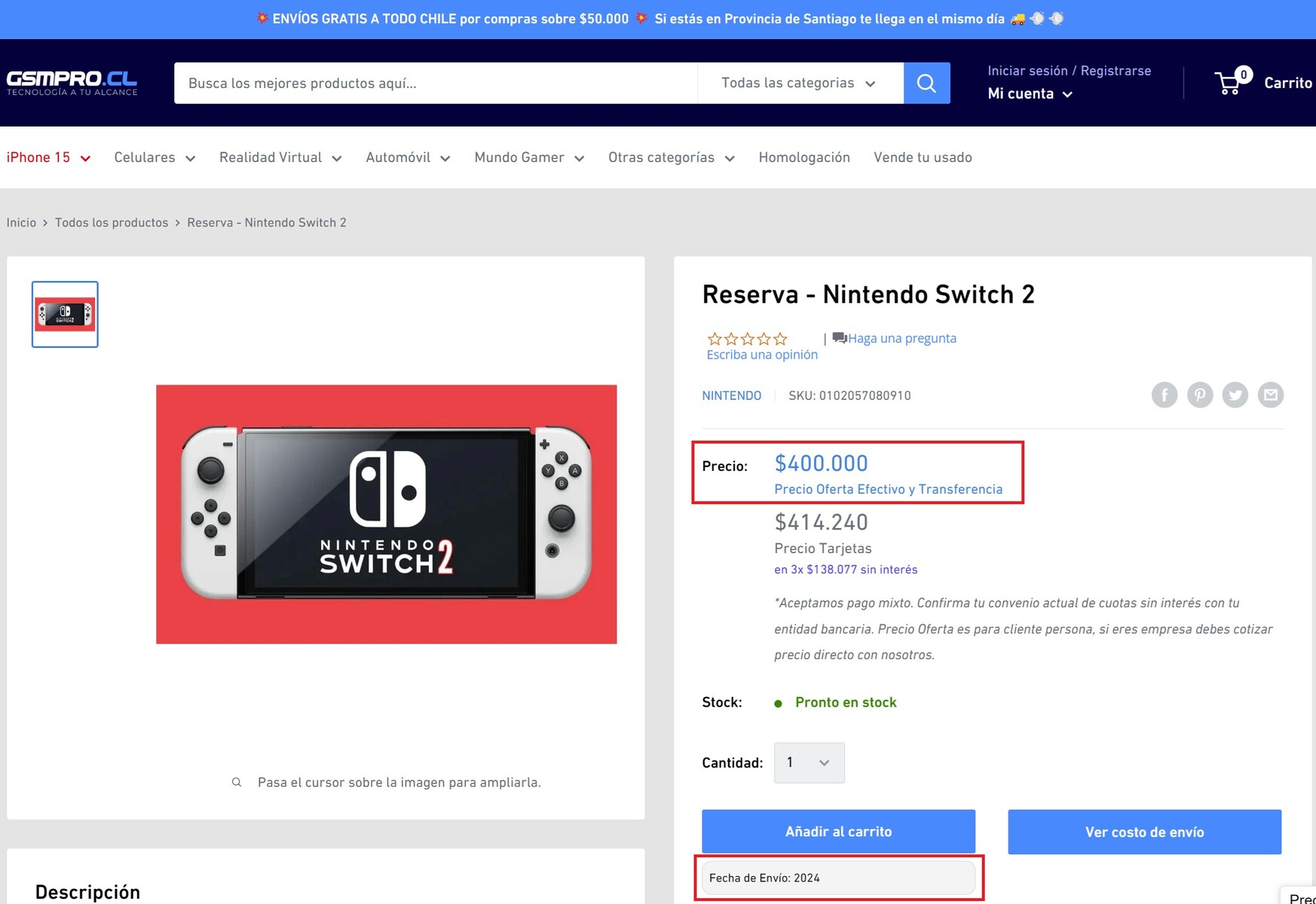

Securing A Nintendo Switch 2 Preorder The Game Stop Queue

Apr 27, 2025

Securing A Nintendo Switch 2 Preorder The Game Stop Queue

Apr 27, 2025

Latest Posts

-

Mine Managers Testimony Refusal Sparks Contempt Threat In Yukon

Apr 28, 2025

Mine Managers Testimony Refusal Sparks Contempt Threat In Yukon

Apr 28, 2025 -

Yukon Legislature Threatens Contempt Action Against Mine Official

Apr 28, 2025

Yukon Legislature Threatens Contempt Action Against Mine Official

Apr 28, 2025 -

Yukon Mine Manager Faces Contempt Charges After Refusal To Testify

Apr 28, 2025

Yukon Mine Manager Faces Contempt Charges After Refusal To Testify

Apr 28, 2025 -

Yukon Politicians Cite Contempt Over Mine Managers Evasive Answers

Apr 28, 2025

Yukon Politicians Cite Contempt Over Mine Managers Evasive Answers

Apr 28, 2025 -

Teslas Rise Leads Tech Driven Us Stock Market Gains

Apr 28, 2025

Teslas Rise Leads Tech Driven Us Stock Market Gains

Apr 28, 2025