Philippine Economy Faces Headwinds: Top Banker's Dire Prediction

Table of Contents

Inflationary Pressures and the Peso's Weakness

The Philippine economy is grappling with persistent inflationary pressures, significantly impacting consumer spending and overall economic growth. The current inflation rate, hovering above the central bank's target range, is eroding purchasing power and fueling concerns about a potential economic downturn. Simultaneously, the weakening Philippine Peso is exacerbating the situation. A weaker Peso makes imports more expensive, increasing the cost of essential goods and further fueling inflation. It also increases the burden of debt servicing for businesses and the government, hindering investment and economic growth.

- Current inflation rate: [Insert current inflation rate and source]. Projections suggest a further increase in [Month, Year].

- Impact on food prices: The rising cost of food is disproportionately affecting low-income households, reducing their disposable income and dampening consumer demand.

- Factors contributing to Peso weakness: The global economic slowdown, particularly in major trading partners like the US and China, coupled with interest rate differentials between the Philippines and other countries, are significant contributors to the Peso's decline.

- Potential government interventions: The Bangko Sentral ng Pilipinas (BSP) may intervene by adjusting interest rates or implementing other monetary policies to stabilize the Peso and curb inflation. However, these interventions often have trade-offs.

Global Economic Slowdown and its Ripple Effect on the Philippines

The global economic slowdown, marked by recessionary fears in major economies like the US, EU, and China, is casting a long shadow over the Philippine economy. This slowdown is impacting key sectors through reduced demand for Philippine exports, lower remittances from overseas Filipino workers (OFWs), and decreased foreign direct investment (FDI).

- Impact on Philippine exports: Reduced global demand for Philippine goods, particularly electronics and agricultural products, is impacting export revenues and potentially leading to job losses in export-oriented industries.

- Potential decrease in OFW remittances: A global recession may lead to job losses in host countries, resulting in lower remittances from OFWs, a crucial source of income for many Filipino families.

- Reduced FDI due to global uncertainty: Global economic uncertainty is deterring foreign investors from committing capital to the Philippines, hindering investment in crucial infrastructure and economic development projects.

- Government strategies to mitigate the impact: The Philippine government is exploring various strategies to mitigate the effects of the global slowdown, including fiscal stimulus packages and investments in domestic industries.

Rising Interest Rates and Their Impact on Businesses and Consumers

The BSP's efforts to combat inflation have led to rising interest rates, increasing borrowing costs for both businesses and consumers. This has significant implications for investment, consumer spending, and overall economic activity. Higher interest rates make it more expensive for businesses to borrow money for expansion and investment, potentially slowing down economic growth. Consumers also face higher borrowing costs for mortgages, auto loans, and other credit products, leading to reduced consumer spending and potentially impacting overall economic demand.

- Current interest rate levels: [Insert current interest rate levels and source]. Further increases are anticipated in the coming months.

- Impact on business investment: Higher borrowing costs can discourage businesses from investing in new projects and expansion, leading to slower job creation and economic growth.

- Effect on consumer debt and spending power: Higher interest rates increase the cost of servicing existing debt and reduce disposable income, potentially leading to a decrease in consumer spending.

- Potential government measures: The government may consider measures to ease the burden on businesses and consumers, such as targeted tax breaks or subsidies.

The Top Banker's Specific Prediction and Rationale

[Name and Title of Top Banker] recently issued a stark warning about the Philippine economy, predicting [Specific prediction, e.g., a significant slowdown in growth or a potential recession]. Their rationale is based on a confluence of factors, including persistent inflation, a weakening Peso, the global economic slowdown, and rising interest rates.

- Specific prediction: [Clearly state the banker's prediction and the timeframe].

- Key economic indicators supporting the prediction: The banker likely cited indicators such as declining consumer confidence, weakening industrial production, and a persistent current account deficit.

- Comparison with other economic forecasts: [Compare the banker's prediction with other forecasts from reputable institutions].

- Potential risks and uncertainties: The prediction is subject to various uncertainties, including the severity and duration of the global economic slowdown, the effectiveness of government interventions, and unforeseen external shocks.

Navigating the Headwinds: A Look Ahead for the Philippine Economy

The Philippine economy is facing a complex and challenging environment. The confluence of inflationary pressures, a weakening Peso, the global economic slowdown, and rising interest rates, as highlighted by [Top Banker's Name]'s dire prediction, paints a concerning picture for the near future. These headwinds underscore the need for proactive measures from both the government and the private sector to mitigate potential economic hardship. Staying informed about the Philippine economy, monitoring economic indicators closely, and understanding the risks associated with the Philippine economic forecast are crucial for individuals and businesses to prepare for potential economic challenges. Stay informed, monitor economic indicators, and prepare for potential economic challenges. Understanding the risks associated with the Philippine economic forecast is essential for making informed financial decisions.

Featured Posts

-

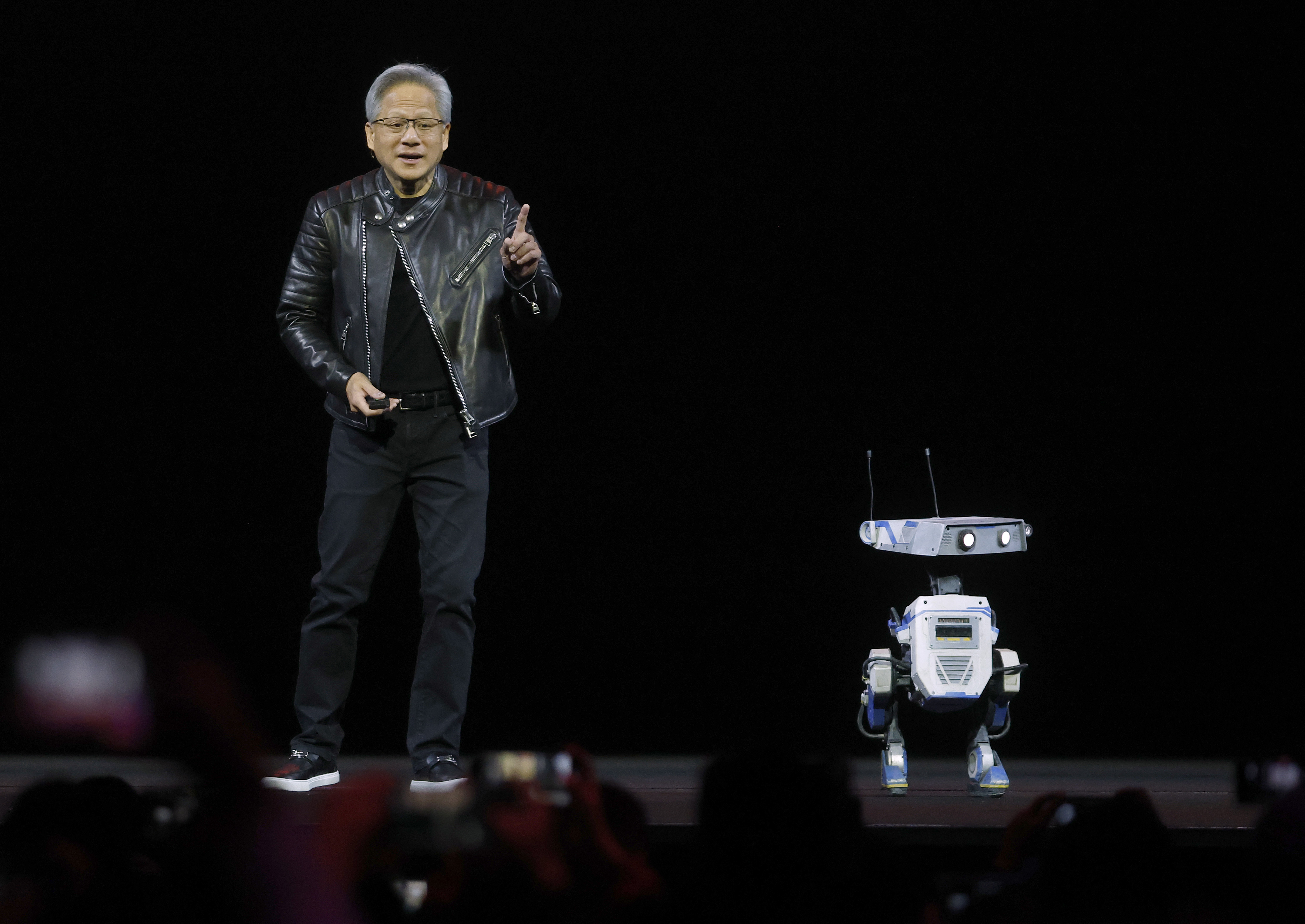

Ai Regulation In Europe The Trump Administrations Opposition

Apr 26, 2025

Ai Regulation In Europe The Trump Administrations Opposition

Apr 26, 2025 -

Nfl Draft Kicks Off In Green Bay Thursdays First Round Preview

Apr 26, 2025

Nfl Draft Kicks Off In Green Bay Thursdays First Round Preview

Apr 26, 2025 -

Victor Osimhen Beyond Manchester Uniteds Budget

Apr 26, 2025

Victor Osimhen Beyond Manchester Uniteds Budget

Apr 26, 2025 -

Phoebe Gates Opens Up Privilege Pressure And Proving Herself

Apr 26, 2025

Phoebe Gates Opens Up Privilege Pressure And Proving Herself

Apr 26, 2025 -

Tom Cruises Death Defying Mission Impossible 8 Biplane Stunt

Apr 26, 2025

Tom Cruises Death Defying Mission Impossible 8 Biplane Stunt

Apr 26, 2025

Latest Posts

-

Ariana Grandes Hair And Tattoo Transformation Expert Opinion And Analysis

Apr 27, 2025

Ariana Grandes Hair And Tattoo Transformation Expert Opinion And Analysis

Apr 27, 2025 -

Exploring Ariana Grandes New Look A Professional Assessment Of Her Tattoos And Hairstyle

Apr 27, 2025

Exploring Ariana Grandes New Look A Professional Assessment Of Her Tattoos And Hairstyle

Apr 27, 2025 -

Understanding Ariana Grandes Latest Transformation A Professionals View

Apr 27, 2025

Understanding Ariana Grandes Latest Transformation A Professionals View

Apr 27, 2025 -

Professional Commentary Ariana Grandes Bold Hair And Tattoo Changes

Apr 27, 2025

Professional Commentary Ariana Grandes Bold Hair And Tattoo Changes

Apr 27, 2025 -

Ariana Grandes Style Evolution Professional Analysis Of Her New Look

Apr 27, 2025

Ariana Grandes Style Evolution Professional Analysis Of Her New Look

Apr 27, 2025