PMI Data Drives European Stock Market Movement: Midday Briefing

Table of Contents

Impact of Manufacturing PMI on European Stocks

The Manufacturing PMI, a key component of the broader economic picture, provides valuable insights into the health of the industrial sector. Changes in this index directly influence investor sentiment and, consequently, stock market movements. The relationship between manufacturing data and stock prices is often quite direct.

-

Strong Manufacturing PMI: A robust Manufacturing PMI, indicating strong industrial production and healthy factory orders, signals robust economic growth. This positive outlook typically boosts investor confidence, leading to higher stock prices across various European indices, including the DAX (Germany), CAC 40 (France), and FTSE 100 (UK). This is because increased production translates to higher corporate profits and positive future growth projections.

-

Weak Manufacturing PMI: Conversely, a weak Manufacturing PMI suggests a potential economic slowdown. This might stem from factors such as decreased consumer demand, supply chain disruptions, or rising energy prices. Such negative indicators often lead to market corrections as investors become cautious, potentially selling off assets to mitigate risk. Weakening factory orders are a particularly significant red flag.

-

Recent Data Analysis: For example, a recent decline in the German Manufacturing PMI could be linked to a slowdown in global demand, affecting export-oriented German manufacturers and subsequently impacting the DAX. Analyzing specific sector performances within the manufacturing PMI, such as automotive or technology, provides even more granular insights into market movements.

-

Influencing Factors: External factors like geopolitical instability, changes in global trade policies, and the availability of raw materials also significantly impact the Manufacturing PMI and, in turn, European stock market performance.

Services PMI and its Influence on Market Sentiment

The Services PMI, representing the performance of the service sector – a significant portion of the European economy – plays a crucial role in shaping market sentiment. This sector is closely linked to consumer spending and employment levels, making it a critical indicator of overall economic health.

-

Robust Services PMI: A strong Services PMI reflects healthy consumer spending and strong economic activity. This generally translates into positive market reactions, as it indicates a healthy economy capable of supporting further growth and higher corporate profits. This positive sentiment is often reflected in a rise in stock prices.

-

Weak Services PMI: Conversely, a weak Services PMI can signal declining consumer confidence and a potential economic slowdown. This triggers caution among investors, who may interpret it as a harbinger of lower corporate earnings and reduced future growth prospects, leading to potential market corrections. A decline in employment within the services sector would further contribute to this negative outlook.

-

Recent Data and Market Correlation: For example, a decline in the French Services PMI might reflect weakened consumer confidence, potentially impacting luxury goods companies and other service-oriented businesses listed on the CAC 40, resulting in negative market sentiment.

-

Sectoral Analysis: The influence of the Services PMI is not uniform across all sectors. Specific sub-sectors, like tourism or finance, show greater sensitivity to changes in the index.

Composite PMI and its Overall Market Effect

The Composite PMI, a combined measure of both manufacturing and services PMIs, provides a holistic view of the overall economic health. It serves as a crucial indicator for assessing the overall economic outlook and influencing investor confidence.

-

Strong Composite PMI: A strong Composite PMI reading generally points towards positive economic prospects, bolstering investor confidence and leading to higher stock prices across various sectors. This optimistic view encourages further investment and generally leads to a positive market trend.

-

Weak Composite PMI: A weak Composite PMI raises significant concerns about the overall economic health, potentially causing market volatility and prompting sell-offs. This signals uncertainty about future economic growth, impacting investment decisions.

-

Recent Data and Implications: A consistently weak Composite PMI reading might lead central banks to implement monetary policy adjustments, such as interest rate cuts, in an attempt to stimulate the economy. This, in turn, can affect investor behavior and market trends.

-

Monetary Policy Implications: Central bank decisions are often heavily influenced by Composite PMI readings, with significant implications for interest rates and overall market liquidity.

Conclusion:

In summary, PMI data – encompassing Manufacturing, Services, and the Composite PMI – serves as a powerful predictor of European stock market movements. These indicators provide valuable insights into economic health, directly influencing investor sentiment and market volatility. Understanding these relationships is crucial for effective investment strategies.

Stay informed about crucial PMI data to navigate the European stock market effectively. Regularly check for updates on PMI releases and utilize reputable financial resources to enhance your understanding of market movements and make informed investment decisions.

Featured Posts

-

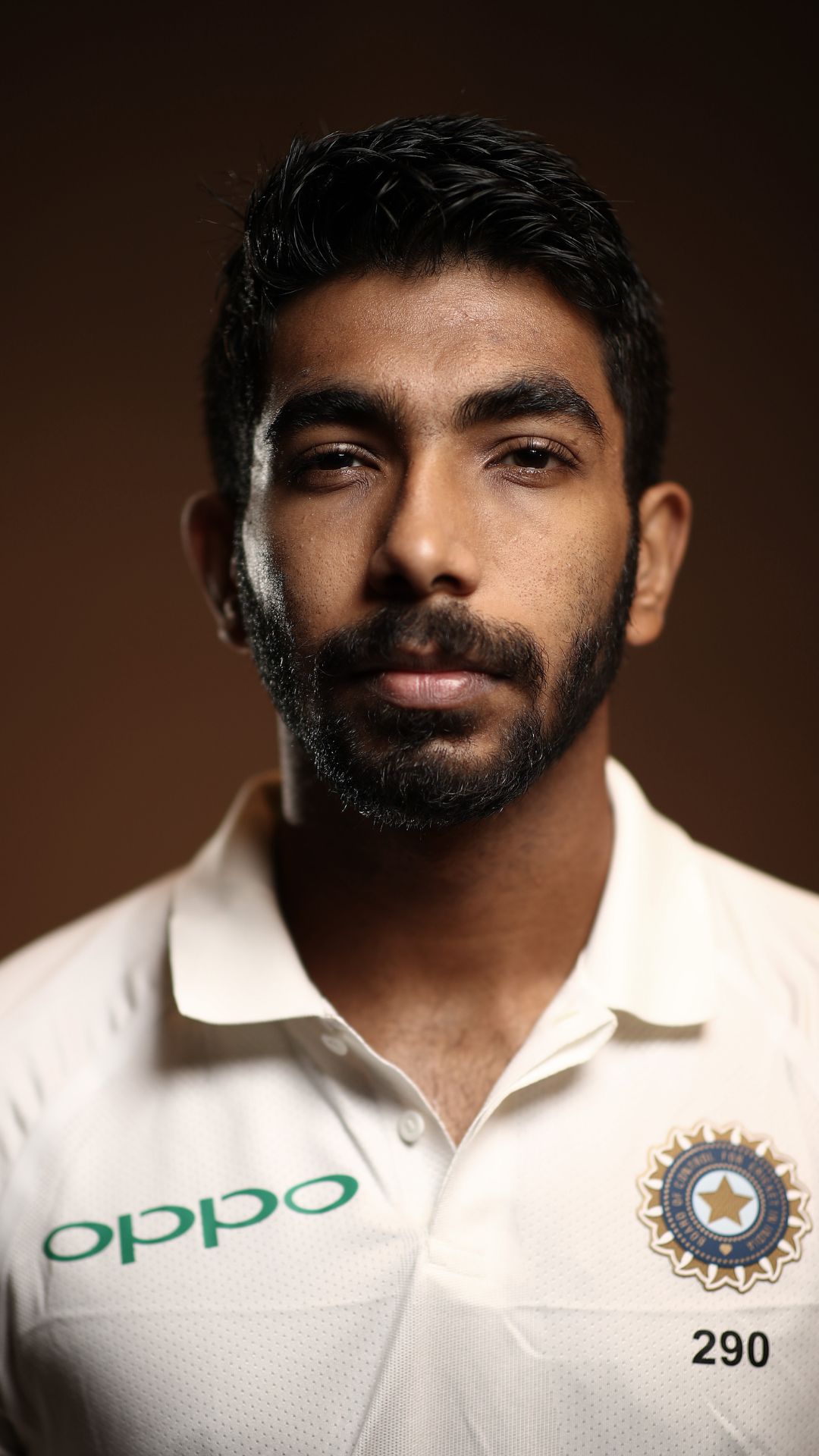

Jasprit Bumrahs Continued Dominance In Icc Test Bowling Rankings

May 23, 2025

Jasprit Bumrahs Continued Dominance In Icc Test Bowling Rankings

May 23, 2025 -

The Whos Roger Daltrey And Pete Townshend Facing Life As Octogenarian Rock Icons

May 23, 2025

The Whos Roger Daltrey And Pete Townshend Facing Life As Octogenarian Rock Icons

May 23, 2025 -

Cobra Kais Karate Kid Connection Showrunner Reveals The Netflix Link

May 23, 2025

Cobra Kais Karate Kid Connection Showrunner Reveals The Netflix Link

May 23, 2025 -

This Morning Cat Deeleys Dress Malfunction Near Disaster Before Live Show

May 23, 2025

This Morning Cat Deeleys Dress Malfunction Near Disaster Before Live Show

May 23, 2025 -

Ln Shpani A Shampion Khrvatska Eliminirana Po Penali

May 23, 2025

Ln Shpani A Shampion Khrvatska Eliminirana Po Penali

May 23, 2025

Latest Posts

-

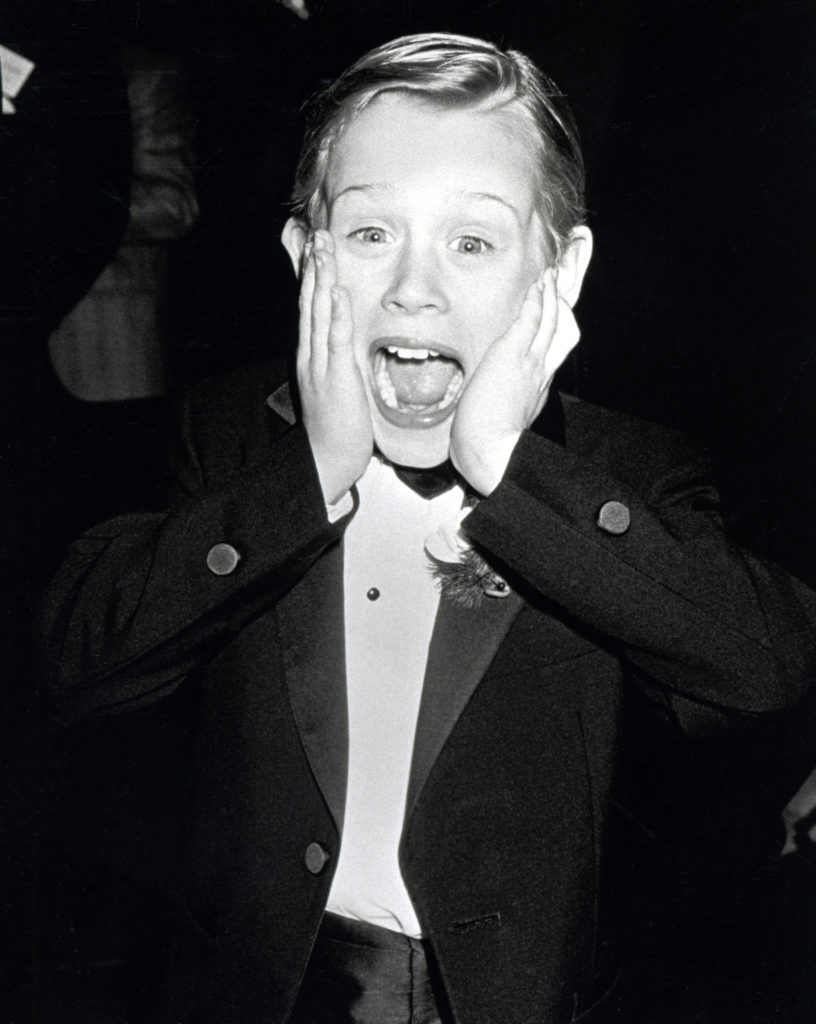

Disney Hosts Hollywood Legends First Film And Award Winning Role

May 23, 2025

Disney Hosts Hollywood Legends First Film And Award Winning Role

May 23, 2025 -

Pivdenniy Mist Remont Fakti Ta Tsifri

May 23, 2025

Pivdenniy Mist Remont Fakti Ta Tsifri

May 23, 2025 -

Stream The Hollywood Legends Film Debut And Oscar Winning Performance On Disney

May 23, 2025

Stream The Hollywood Legends Film Debut And Oscar Winning Performance On Disney

May 23, 2025 -

Analiz Finansuvannya Remontu Pivdennogo Mostu

May 23, 2025

Analiz Finansuvannya Remontu Pivdennogo Mostu

May 23, 2025 -

Hollywood Legends Disney Debut And Oscar Winning Role Now Streaming

May 23, 2025

Hollywood Legends Disney Debut And Oscar Winning Role Now Streaming

May 23, 2025